AYS selling lowest PE among all steel stocks - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 03 Nov 2021, 12:30 PM

The table below shows the comparison of all the listed steel stocks in Malaysia. AYS is selling at the lowest PE ratio.

|

Name |

Price |

Latest EPS |

EPS divided by price |

|

AYS |

78.5 sen |

8.5 sen |

10.8 |

|

Leon Fuat |

92.5 sen |

9.76 sen |

10.6 |

|

Prestar (X bonus) |

63.5 |

6 sen |

9.4 |

|

Choo Bee |

Rm 1.99 |

17.15 sen |

8.6 |

|

Mycron |

50.5 sen |

4.13 sen |

8.2 |

|

Hiap Teck |

54.5 sen |

4.26 sen |

7.8 |

|

Leader Steel |

64 sen |

5.01 sen |

7.7 |

|

Ann Joo |

Rm 1.99 |

15.46 sen |

6.8 |

|

Melawar |

41.5 sen |

2.64 sen |

6.4 |

|

CSC Steel |

Rm 1.29 |

4.18 sen |

3.2 |

|

|

|

|

|

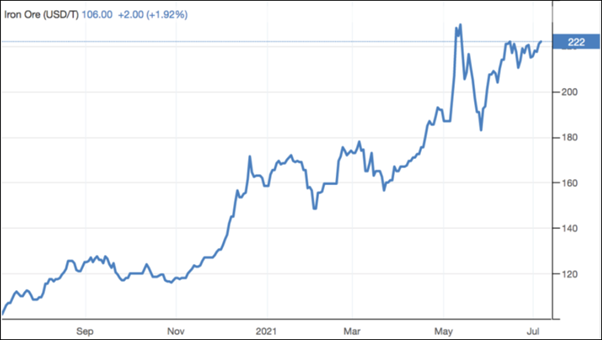

US Iron ore price chart

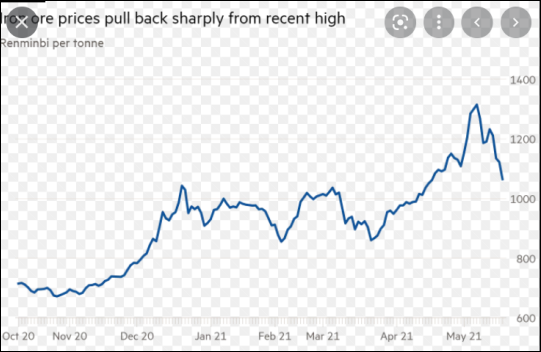

China iron ore price chart

AYS reported its latest EPS of 8.5 sen and its previous quarter EPS was 4.45 sen. The iron ore prices are increasing in US and in China as show on the 2 charts above. Based on the increasing price of iron ore in US and China, AYS should report better profit in the next quarter ending September which should be announced before the end of November.

Even if I assume that AYS EPS remains unchanged in the next few quarters, its annual EPS will be 4 X 8.5 = 34 sen. Its last traded price 78.5 sen divided by 34 sen = 2.3 PE.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024