More construction activities - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 26 Dec 2021, 10:38 PM

Ever since the Covid 19 pandemic began about 2 years ago, almost all the listed companies have been affected. Due to MCO lockdown, workers could not go to work. As a result, there is less construction activities and the requirement of building materials especially steel.

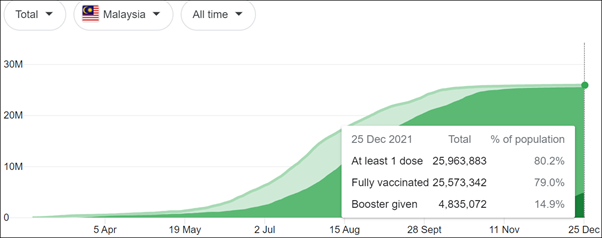

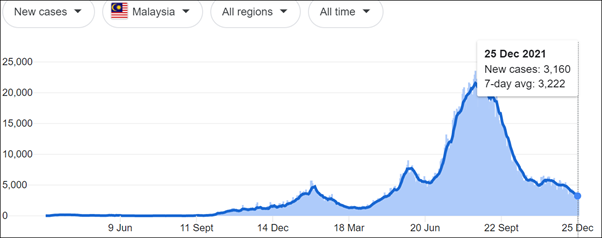

As shown on the above 2 graphs, 80% of our populations are fully vaccinated with 2 doses and the 7-day average of new cases is only 3,222. As a result, there are no more MCO lockdown. Currently there are more building construction activities as you can see more construction tower cranes movements in every town and city.

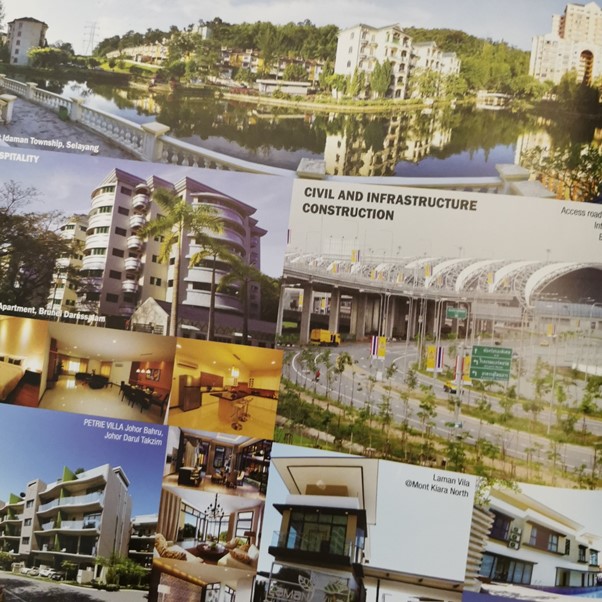

The President Dato Foo Chek Lee and Secretary General Mr Denis Tan of the Master Builders Association just told me there are more construction activities than before the MCO lockdown. All the construction workers are free to go to work and the requirement of building materials especially steel has increased.

By the way, I am proud to mention that all the infrastructures and buildings in Malaysia are constructed by Members of the Master Builder Association.

I was the Secretary General for 9 years between 1972-1980 when Tan Sri Low Keng Huat and Tan Sri Yeoh Tiong Lay were the Presidents.

My aim for writing this article is to point out that there is no more MCO lockdown. People especially workers are free to go to work. As a result, there are more construction activities in every town and city and the requirement of building materials especially steel has increased. This information is useful for investors of building materials especially AYS.

My target price for AYS

Its 2nd quarter ending Sept EPS was 6.51 sen and its 1st quarter ending June EPS was 8.5 sen, totalling 15 sen for 1st half year. All these profits were achieved during the Covid 19 pandemic MCO lockdown. Currently there is no more MCO lockdown and AYS should be able to make better profit in its 2nd half year than its 1st half year.

Assuming its 2nd half year performance is the same as its 1st half year, its annual profit EPS will be 30 sen per share.

Based on PE 3, AYS should be 90 sen.

Based on PE 4, AYS should be Rm 1.20.

Based on PE 5, AYS should be Rm 1.50.

The last traded price was 66 sen.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Koon everyday talk about AYS only as if this is the only stock to buy

2021-12-27 01:34

不要以为管有缘不会华文,因为我看他的英文用词,非常生硬。

这可能说明,管有缘的华语其实很好的,但他天天用英文发文,从来不用华语,难道有什么秘密?

如果有什么秘密,我认为,这个秘密就是,他和中共有着密切的关系。

2021-12-27 14:23

For Construction sector, choose AZRB cheaper, more vibrant construction activities and better future than AYS.

2021-12-27 15:50

For the benefit of long term share holder, I think it is good that the price maintain at this level for few months. Let those thinking of fast money and bought on margin pay the penalty of interest. Or else AYS will turn into a goreng stock oni.

2021-12-27 19:02

construction sector talk about construction stocks la...every excuse get talk AYS again

2021-12-27 19:12

for construction, better go for Suncon or OKA. Steel related counters have nothing to do with construction unless you are building a 100% steel building. Stay away from those garbage steel counters..

I like OKA because it a proxy to the construction sector and could be one of the biggest beneficiaries of public infrastructure spending..

2021-12-28 17:05

abang_misai

Koon, ada saham lain? Ays hardware shop ada banyak competitor

2021-12-26 23:32