DNEX plunged - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 25 Feb 2022, 09:02 AM

DNEX reported 1.4 sen EPS for the quarter ending December and its previous quarter ending Sept. EPS was 9.81, a drop of 8.4 sen. It dropped like coconut.

Many investors are caught with their pants down.

I must say God works in mysterious way. Fortunately, on 16 Feb I sold all my DNEX shares and I posted the following article on DNEX forum on i3investors.com:

Why did I sell DNEX?

Koon Yew Yin 16 Feb 2022

My niece who is a very clever investor recommended me to buy DNEX about 2 months ago when it was selling about 75 sen. It reported 9.81 sen EPS for its latest quarter ending Sept and 4.93 sen EPS for its previous quarter, total 14.7 sen. I bought some shares to diversify because I have only Prestar, Leon Fuat and AYS.

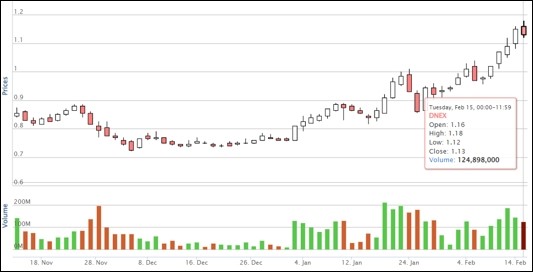

As you can see from the chart below, DNEX has been shooting up from 75 sen to peak at Rm 1.16 at Rm 1.16 yesterday, an increase of 41 sen or 55% within 2 months.

Yesterday I sold all my DNEX at Rm 1.16 to make 55% profit within 2 months. I am very satisfied with the profit although it might still go up higher as its price chart is up-trending.

My reason for selling DNEX is because Prestar, Leon Fuat and AYS are cheaper in terms of PE ratio as shown on the table below.

|

Name |

Price |

Latest EPS |

Previous EPS |

Total |

|

DNEX |

Rm1.16 |

9.81 sen |

4.93 sen |

14.7 sen |

|

Prestar |

67 sen |

7.21 sen |

9.59 sen |

16.8 sen |

|

Leon Fuat |

99 sen |

11.34 sen |

9.76 sen |

21.1 sen |

|

AYS |

68 sen |

5.61 sen |

8.5 sen |

14.1sen |

You may like to know that Prestar reported its profit shot up from 7.21 sen to 10.03 sen, an increase of 40% for the quarter ending December. Its EPS for the year is 10.03sen + 7.21 sen + 9.59sen +9.45sen = 36.28 sen. The last traded price is 70 sen. It is selling at PE less than 2.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

wow. conman sold 1.16. went up to 1.30. now still at 1.16. conman so hebat la wow. my pants drop down already la. haha. big round of applause for old man conman.

2022-02-25 12:43

halo, did you read the financial report properly? how can you compare eps with last two quarter's exceptional one off gain?

You compare PE of dnex with steel industry for what??

Why dont you compare dnex PE with D&O, Inari, Vitrox, Greatech?

2022-02-25 12:50

Actually Dnex latest result is very good! Revenue doubled! Its very common to see reduce EPS! This is growth stock by the way!

2022-02-25 12:51

I don't have a stake in Dnex, but this KYY must have read the chart upside down.

Pity him lar, 80 something. Don't know which way is up, which way is down.

2022-02-25 12:54

DNEX 2QFY22 ZOOM Briefing key take away

Key takeaway

- Core businesses: DagangNet, SealNet (Cloud based single platform similar to DNT but on the private sector B2B), DNex solutions, GenaXis, DNex Telco (subsea Telco), OGPC (Equipment, serving upstream and downstream) and Ping (E&P), Silterra (completed 60% stake acquisition)

- Enlarged group expected to have combined revenue >RM1b

Silterra

- Operational improvement: 97,146 wafer fab out in 2QFY22 – 2nd highest. 37,461 wafers fab out in Dec21 – highest monthly wafer out. Fab yield performance at 98.95% - highest ever

- Capex investment – approved USD153m (RM640m) which will expand annual capacity to 10m mask layers. More capacity to be allocated for Silicon Photonics, MEMS. Emerging technology per mask layer ASP would be USD80-100 vs current’s at USD20-25.

- Emerging technology BRCM & Gorilla products started risk run, anticipate to complete qualification by 2H22. Core tech improvements on target, highest yield of 99% for C18F process for ChipOne. Increase of BCD shipment from 15% in 1QFY22 to 25% in 2QFy22.

- Secured two LT wafer supply agreements with Chipone USD 400m and Illitek USD173m. Anticipate to complete 2 more in 2HFY22 to fulfil LTA UR to 80%.

- Growth revenue from ChipOne, 1Q 15%, 2Q 22% and Illitek 1Q 7%, 2Q 11%. Average net ASP from 1Q USD20.8 to USD23.6 in 2Q.

- New management – Dr Albert Pang as Officer In Charge.

- In 2021, the market attrition was at 13%, Silterra overall cumulative attrition was at 10.6% - announced multiple benefits improvements to employees.

- Quality: 996 wafers scraped; first time achieved total wafer scrap <1000 wafers per quarter.

- Net wafers USD527 in 2Q, 1Q-488, 4Q-434. Masks layer – 23.6 vs 18 in 4Q

- Current capacity 8.5m mask layers per year, after approved capex of USD68m till Nov21 – 8.8m mast layer and with approved capex of USD85 in Jan22, it will be 10m mask layers – to start production in 2023.

- Benefits enhancement to attract talents.

- 2 more LTA customer is in progress of negotiation.

- Plant expansion and product mix optimisation with completion of LTA.

- Focused expansion on new technologies – SiPh + MEMS

- Gearing of Silterra in 12M21 at 0.3x vs 1.04x in 7M21

- In summary: Excellent operational improvements achieved – higher production, yield and lower cost. Future plant expansion – higher capacity and SiPh and MEMS which command higher ASP. Product mix optimisation, 2 additional LTA to bring UR to 80%. Financial performance to strengthen both BS and IS. Continue to explore and improve benefits to employees to be comparable to market.

Anasuria

- Brent has reached >USD100/bbl – strategy is to accelerate production to take advantage of current high prices. Taken some hedging position.

- Net volume hope to secure Kbopd to about 10k (to be driven by Avalon, to deliver first oil in Jul24), now is at 2k. Partnering with Hibiscus with Anasuria.

- Anasuria: Profit enhancement strategies via increase in production rate/additional reserves, optimise OPEX, better tax management and extend Cessation of production to add reserves. Capacity enhancement work programs – infill drilling and facility debottlenecking

- Avalon – to deliver first oil in Jul24. FDI and FDP approval expected at FY22.

- Others – acquisition of brownfield assets, embarking in developing a Net Zero framework to achieve ESG, low cost operator.

IT

- National single window (deployment of new services NPCO, cross border trade exchange eCert, Air Manifest for aviation, and potentially Air Cargo System). International front: Increasing pipeline – new initiative with PAA and ASEC, ADB World bank and USAID.

- Trade Facilitation – B2B: Optimising overhead and BPO – Seal Net products – Petronas, Dell & Intel.

- System integration & consultancy – securing funnels with a TCV of RM15-20m

2Q results

- Revenue of RM353m all time high, EBITDA RM130m – Tech – stronger performance on higher ASP, wafer shipment.

2022-02-25 12:55

Have lodge report to SC on this sly fox and his 2 stipid personal assistant James Ong and Alan Gan for manipulative reports.

2022-02-25 15:39

Manipulators wanted list:

1. Frail and senile Chairman - Uncle K

2. Chief Manipulator Officer - James Ong

3. Chief Manipulator Assistant - Alan Gan

This 3 tag team write nonsense on i3 to con investors

2022-02-25 16:03

Very sad, at this age still talk nonsense disgrace to himself. Hope those poor guys not swallow his lies and run with pant down.

2022-02-26 13:49

Very disrespectful almost like MM ..destroying their hard earn reputation at their late ending life.

2022-02-26 13:51

kyy kyy... hahaha u cunning fox, wanna whack also whack with some sense la

2022-02-26 22:02

yeah misleading to compare with the preceding quarter without excluding the exceptional gain in the preceding quarter.

What is interesting about Dnex are

1. it is in Technology and Oil & Gas sectors, high growth sectors

2. it has started paying dividend

2022-02-27 15:58

DindingJalan

waa, really old sly fox

2022-02-25 12:11