Jaya Tiasa price correction is good for investors - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 17 Mar 2022, 12:33 PM

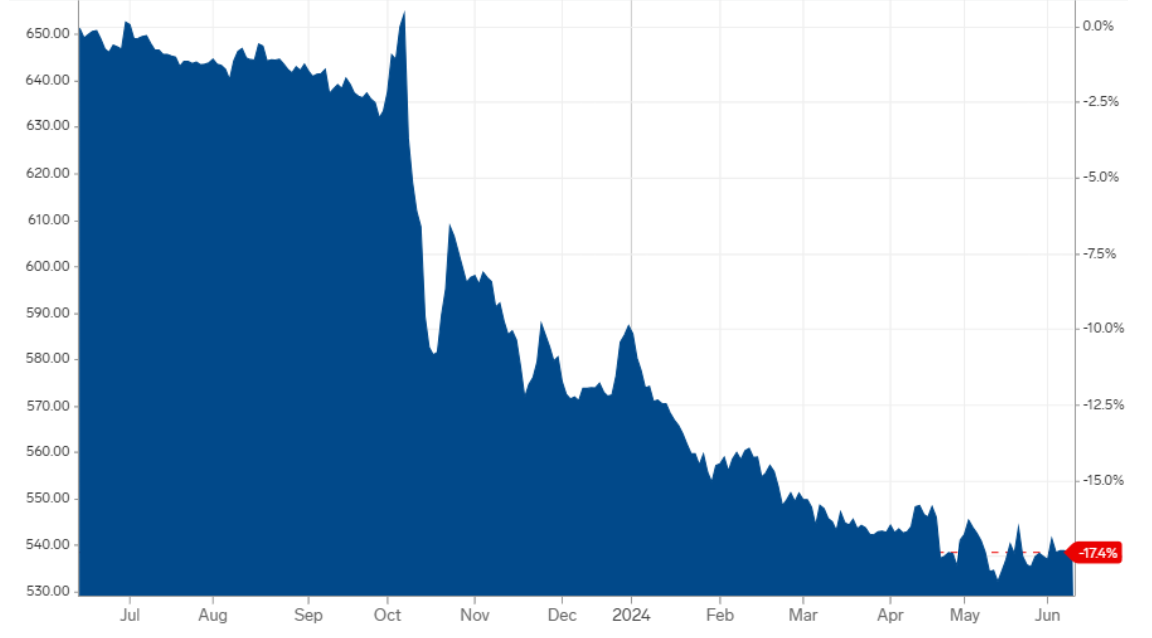

The Jaya Tiasa price chart below shows that it was 61.5 sen on 27 January and it shot up to peak at Rm 1.23 28 February, an increase of 61.5 sen or 100% in about 5 weeks. As a result, many short-sighted investors are selling to pocket some profit. Short term price correction is expected and is a healthy sign. It is good for serious long-term investors to buy at lower prices.

KUALA LUMPUR (Feb 18): Malaysian crude palm oil (CPO) futures prices rose past RM6,000 a tonne for the first time to their all-time high on Thursday evening (Feb 17) after climbing as much as RM87 to RM6,054 in Bursa Malaysia’s extended trading session between 9pm and 11:30pm in what analysts describe as a palm oil industry super cycle amid supply constraints during seasonal low production in the first half of the year when demand is also expected to grow ahead of Hari Raya Aidilfitri in May 2022.

At 10:55am on Friday, March 2022 CPO price rose RM33 to RM6,000 a tonne after the commodity was traded at between RM5,986 and RM6,054 so far on Friday.

March 2022 CPO, which opened at RM6,000 a tonne at 9am, registered bid and ask prices of RM6,000 and RM6,002 respectively.

Public Investment Bank Bhd analyst Chong Hoe Leong wrote in a note on Friday that the palm oil industry witnessed an unprecedented super cycle with CPO futures topping RM6,000 a tonne on Thursday for the first time.

"We turn bullish on the sector as we expect a strong earnings trajectory for the plantation companies. We think CPO prices will remain strong in the first half of 2022 given the tight global vegetable oil supplies and also supply constraints for palm oil in the top two producing countries.

Unfortunately, there are a few less informed investors who are thinking that my object of posting so many buy-recommendations of Jaya Tiasa is to encourage them to buy to push up the share price to make me richer. They cannot do it because the daily traded volume is tens of million shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Discussions

If his objective is not to influence less informed investors to push up the shares to make him rich, then what's his objective?......to make less informed investors rich???

2022-03-17 19:36

Dr Neoh Soon Kean of Dynaquest is in Top 30 holders of Jtiasa for many years

Jtiasa is a stock whose time has come

Do not miss the coming Superbull ahead

2022-03-17 20:51

4086

I see Dr Neoh has SOP, Subur Tiasa, Jtiasa (same boss of Subur) and Thplant

Dr. Neoh in Top 30 holders and all doing excellent

also Cold Eye aka Fong Siling

He is in Top 30 of Hs Plant and Innoplant (Tsh also has 21.95% of inno)

2022-03-18 11:56

Calvin u must have made a lot of $$ from Oil Palm counters, why not take over TalamT, the ICBC stock, and shake it up??

2022-03-18 13:22

Posted by king36 > 53 minutes ago | Report Abuse

Calvin u must have made a lot of $$ from Oil Palm counters, why not take over TalamT, the ICBC stock, and shake it up??

Tyvm

Calvin still got Talam shares & Tan Sri Datuk Chan is in charge of Talam

As for now CPO Over Rm6,000 we enjoy Palm oil Super Bull first (others Kiv ok)

2022-03-18 14:17

King36

Now we are in Palm oil Superbull due to Cpo over Rm6,000 a ton (Just focus on Palm on Theme now)

2022-03-18 14:18

calvin, how about kmloong? i see nobody mention about kmloong, but neoh choo ee and dynaquest is top 30.

2022-03-18 14:25

No price correction is good for investors !!!

Onli price rally is good for investors.

2022-03-18 15:35

4086

Kmloong people already said that when Cpo prices were low their milling business will do well and if Cpo prices are high then their milling business will earn less as they have to pay more for Ffb (fresh fruit bunches)

As such it is better to go for palm oil co with pure upstream

Also compared to others Kmloong has lesser palm oil estates

That is so clear

That is why go for Pure upstream palm oil co with large palm oil acreage best

2022-03-19 00:58

When CPO price is high Kmloong should gain more instead because it gains more by processing from FFB to crude palm oil. Kmloong people may have provided wrong information or the one who received the information has misunderstood it.

I maybe wrong.

2022-03-19 11:36

Thank you Calvin for your sharing. Jtiasa is more favourable than Kmloong, as for me this is fair enough.

The confused part is the keywords, CPO and fresh fruit bunches.

The intake of palm oil mill is FFB, not CPO. Only higher cost of FFB can increase the production cost but not CPO.

Possibly typo errors by The Edge Malaysia?

----------------------------------------------------

Higher CPO price actually means higher cost for our milling operations

Fresh Fruit Bunches was Rm350 per ton & now over Rm800 a ton - up by over 100%!!)

2022-03-19 15:16

vcinvestor

"Unfortunately, there are a few less informed investors who are thinking that my object of posting so many buy-recommendations of Jaya Tiasa is to encourage them to buy to push up the share price to make me richer. They cannot do it because the daily traded volume is tens of million shares." - so basically this is your admission that you're using less-informed readers to jack up the share price to your profit la

2022-03-17 14:09