China Today - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 04 Jul 2022, 12:30 PM

There are countless number of books written about China and I also know most people do not want to read a book. So, I did some research and pick up all the most useful information for you.

About 160 years ago, my Grand Father and his younger brother came from a village in Quandong, China to Kuala Lumpur to work as carpenters. Gradually they saved enough of money they started their own timber sawmill and invited more people from their home village to come to work for them. In those day, there was no electric saw. Their business of hand sawing timber grew rapidly because there was a big demand for wooden railway sleepers. Their sawmill was located at the corner of the cross between Jalan Inbi and Jalan Pudu, diagonally opposite the Pudu Jail. Traditionally Chinese are very good businessmen. Like my Grand father, most of Chinese migrated to countries around the world to work and when they have saved enough of money they start to do business.

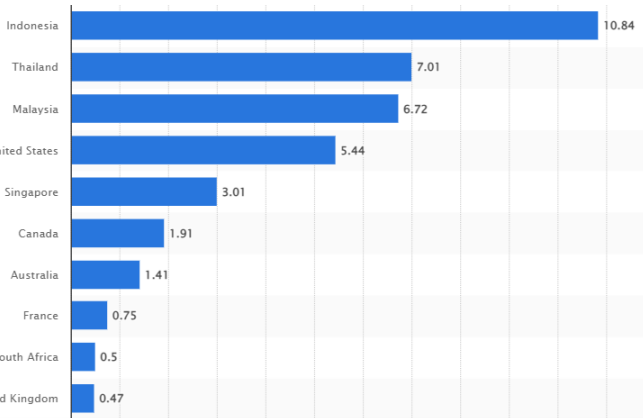

The above graph shows the numbers in millions of overseas Chinese. Indonesia has the most ethnic Chinese. Malaysia has 6.72 million ethnic Chinese. I think all of them are born in Malaysia. There are about 46 million Chinese living overseas and practically all of them are born locally.

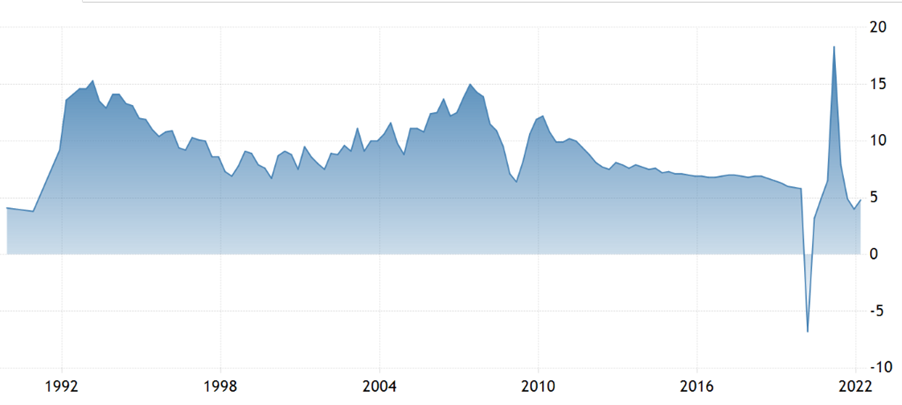

China GDP average annual growth rate is about 6.5% in the last 40 years as shown below:

BEIJING, April 1, 2022— Over the past 40 years, the number of people in China with incomes below $1.90 per day – the International Poverty Line as defined by the World Bank to track global extreme poverty– has fallen by close to 800 million. With this, China has contributed close to three-quarters of the global reduction in the number of people living in extreme poverty. At China’s current national poverty line, the number of poor fell by 770 million over the same period.

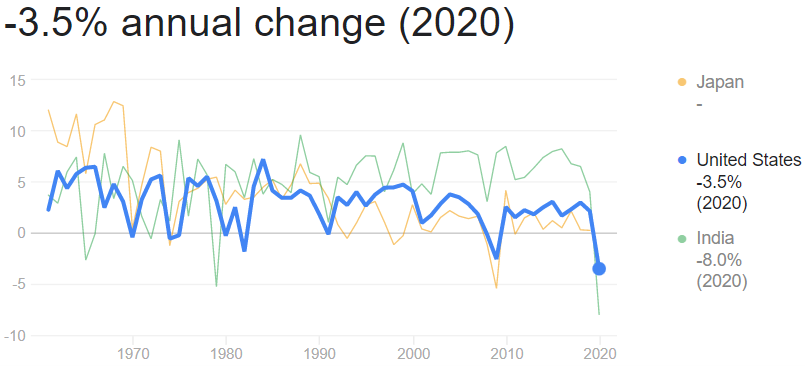

You may like to see US GDP in the last 40 years as shown below:

In 2020 did badly -3.5% due to Covid 19 pandemic and many other issues.

China's foreign trade:

China was the first to recover from the pandemic and able to transport products from daily necessities to electronics and medicines to marketplaces around the world.

China has many advantages in producing products with favorable prices. China is rich in labor resources. Chinese people are hard working. China has a good manufacturing industries system. China has invested a lot in technology and innovation. China acts in accordance with international rules and regulations.

China’s foreign trade exceeded 6 trillion U.S. dollars for the first time in 2021, despite the impacts of the COVID-19 pandemic.

Official data shows the total trade in goods amounted to 6.05 trillion U.S. dollars, up 1.4 trillion U.S. dollars from a year ago. ASEAN, the European Union and the United States are China's three major trading partners.

China's imports and exports expanded 13.3 percent year on year to 6.2 trillion yuan in the first two months of 2022. Both exports and imports continued double-digit growth during the period, surging 13.6 percent and 12.9 percent from the same period of last year, respectively.

Top 10 Largest Banks in the World by 2020

· Industrial & Commercial Bank of China.

· China Construction Bank Corporation.

· Agricultural Bank of China.

· Bank of China.

· HSBC Holdings (HSBC)

· JPMorgan Chase & Co. (JPM)

· BNP Paribas.

· Mitsubishi UFJ Financial Group (MUFG)

Fortune 500

In 2021, Fortune's Global 500 list of the world's largest corporations included 135 Chinese companies in total. Over the same year, Forbes reported that four of the world's ten largest public companies were Chinese, including the world's largest bank by total assets, the Industrial and Commercial Bank of China.

Visited China

In May 1974 Malaysia established diplomatic ties with China. Before that time Malaysians were not allowed to visit China. My wife and I first visited China early 1980s. Subsequently we visited China more than 10 times and on every occasion, we see so many new high rise buildings, high ways and high speed rails which I am most impressed.

China High Speed Rail:

We travelled from Beijing to Shanghai by the high-speed Rail. The journey of 1,300 kilo-metres took us 3 hours and 15 minutes. China has world’s largest high speed railway network as long as 40,000 km (24,855 mi) and capable of accommodating high speed trains running at 250-350 km/hr(186-217 mph).ray k

China will extend its high-speed rail network nearly 32 per cent by 2025, roughly equal to the combined length of the next five largest countries by network size, amid an emerging consensus that Beijing is again leaning on infrastructure investment to curb an economic slowdown.

Of course, we saw the great wall. The first-ever section of the 'Great Wall' was first built in the Chu State over a period of 24 years (680–656 BC). Afterward, new 'Great Wall' sections were built or rebuilt on their old sites to resist the invasion from neighbouring states and later the northern nomads and nations, lasting over 2,300 years. The total length of the Great Wall is 21,196 kilometres (13,170 miles)

Forbidden City, Imperial Palace complex in Beijing, containing hundreds of buildings and some 9,000 rooms. It served the 24 emperors of China from 1421 to 1911. No commoner or foreigner was allowed to enter it without special permission. The moated palaces, with their golden tiled roofs and red pillars, are surrounded by high walls with a tower on each corner. The palaces consist of the outer throne halls and an inner courtyard, each palace forming an architectural whole. North of the front gate, a great courtyard lies beyond five marble bridges. Farther north, raised on a marble terrace, is the massive, double-tiered Hall of Supreme Harmony, once the throne hall, one of the largest wooden structures in China. The palaces and buildings are now public museums.

When we visited the Forbidden City, there was no flush toilets. Fifty years ago, a flush toilet in China was a luxury. Currently China Astronauts are flying to outer space and has established observatory space station. This is only a tiny example of China’s progress which is unstoppable.

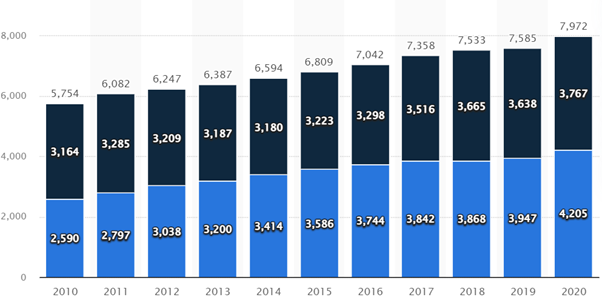

The graph below shows the number of graduates from public colleges and universities in China between 2010 and 2020.

In 2020 around 32.9 million students were enrolled in public colleges and universities in China.

China is the most brilliant, most industrious, most ambitious, most educated, meritocratic and technocratic, most modern, sophisticated, and civilised, and best-governed by far. It is the first non-white, non-Western country to reach this status since the 1600s. The determination of this country is indescribable. It looks like China’s progress is unstoppable. By comparison, all the countries in the world have stagnated or progressed very little. In fact, USA has gone downward. Currently US inflation rate is the highest in 40 years.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Yes, China progress has been impressive! But don't take credit for China success while hitting at malays are home as if you have contributed to homeland success just like that shake leg Qqq3! Don't rock the 'sampan' in Malaysia!

2022-07-04 13:06

Qqq3! You and Grandpa Koon love to bash malays in Malaysia and taking credit for China success!

It's okay to acknowledge China success but not to extend creating racial divide in Malaysia! It's a very dangerous thing to do!

Back in the 80s and 90s, we were very proud of been so called nation that maintain racial harmony! Until the chauvinists and 'tuan melayu' Umno and Pas fake holymen wheck havoc everything!

2022-07-04 14:54

China Chinese has nothing to do with Malaysia Chinese. You can go back to China if you think this country is so great

2022-07-04 20:06

I feel KYY should be fair when downplaying the USA.. Dont forget that PRC is about 4.2 times the size of the US in terms of population...so it does have some advantages when calculating the gdp and market size.....What should really matters is the per capita income ..for which the US ranks 8 while the PRC ranks 64. It is great that PRC is progressing well..but i feel it has nothing geat to gloat about.. It has played the role of a low cost producer of american, japanese and korean products ..but the companies from these countries are moving out...While i understand KYY's sentiments, I see not see why it has to be done at the expense of the US..which we all know is way ahead on many issues that matters to ordinary citizens..Going ahead of oneself..could cause one to fall flat on the face..like what happened on all the hype on vaccines

2022-07-05 15:50

KYY has been dreaming on a kind of dream ..... what all little pinkies & chinese rubbers have been dreaming on ... "China dream " ... and keep dreaming , all chinese rubbers of Malaysia !

2022-07-05 16:10

listening to an old man who had never worked a day in global hedge fund. why not listening to George Soros, Ray Dalio and Warren Buffett?

why so many people wasting time reading his worthless pieces. ?

2022-07-05 17:50

USA is not a nation but it is an enterprise formed by various groups of violators/criminals from various parts of Europe that against their kings, governments or churches so settled in the new world founded by certain voyagers. The natives suffered and killed by these settlers. The slavery was introduced into the lands as human resources to cultivate the lands robbed or occupied through force and wars. Having managed to run away from their authorities back home, so the word FREEDOM was just being introduced to delete their names that were blacklisted by their kings/churches/queens.

2022-07-05 21:54

There was no person/nationalist like in China, India, Indonesia, ...that fighting for their land of birth against any invasion from external force. To do that/to be nationalist, mean they will fight for cause of the red Indians. They got the idea of "democracy", a form of governing/ruling the land without a king unlike the Europeans during that period of time. Other nations have the own/respective nationalist like Tunku Abdul Rahman, Sun Yat Sen, Mahatma Gandhi, Sukarno or Chulalongkorn. Then, the got the idea of capitalism where funds/money being raised/created to move the market/economy...control the market or the whole market in the world.

2022-07-05 22:07

China is very near to bankrupt...they could avoid bank runs by messing with people's cellphones but economy inevitably collapsing. Now 90% of SME dead, 80% of big corporation in trouble, we shall witness the biggest collapse of an economy.

2022-07-06 05:55

China is already comfirmed bankrupt...they could avoid bank runs by messing with people's braims but economy inevitably collapsing. Now 100% of SME dead, 100% of big corporation in trouble, we now witnessing the biggest collapse of an economy. USA IS STILL STRONK

2022-07-06 10:14

supersaiyan3=AlsvinChangan=Gordon Chang

China already bankrupt since 1990!!

2022-07-06 11:21

the rest of the world can not accept the rise of china and that's a fact! communism with chinese characteristic beats the hell out of democracy and that's also a fact!

2022-07-06 11:25

Chairman Xi is killing China with his zero Covid policy! And also his war monger agenda! If Chairman Xi successfully purge Premier Li, then that will be the end of China!

2022-07-06 11:49

America is the only GOD and the great Guardian of the World,,,,..american dream...and deserve to be World Police

2022-07-06 12:27

Weird. What is the purpose of discuss China and US. They not even care about small country like Malaysia. Sometimes I wonder where those supporter and hater coming from. Hilarious, if China bankruptcy then how about Malaysia, bankruptcy talk have been continuous for so many years and see what happen

2022-07-06 13:41

A country which does not have capital flight and huge external borrowings will go bankrupt ? Wistful thinking at most.

2022-07-06 16:09

The Myth of Chinese Efficiency

https://www.youtube.com/watch?v=kUpnOl66Cyk

2022-07-07 13:08

China spends almost 1% of its GDP on all rail. It seems hard to believe that high speed rail by itself is a profitable dollar per dollar investment, given that a lot of the economic benefits of rail seem to be cargo on slow rail. It could be true, but with costs that high, it seems like alternative investments could be worth a higher ROI.

Overbuilding is definitely a sign of inefficiency though (unless you're going to argue that every mile they build is worth it dollar per dollar), especially since they clearly know that these new lines are going to be unprofitable. Some of the new lines definitely smell like politics and prestige projects.

2022-07-07 13:10

Laos gets a HSR and Its debt to China is 45% of its GDP/Beijing's dream in Southeast Asia

https://www.youtube.com/watch?v=fh0ZZP9BibY

China Insights

220K subscribers

With the cost of $5.9 billion USD, the HSR took six years to complete. It is a crucial "One Belt, One Road" project for Beijing. What will it bring to China, Laos, and South East Asia? Will it bring wealth or debt?

It looks like Beijing will continue to push forward with its high-speed railroad to Southeast Asia.

But amidst the grave economic downturn in China, Beijing will have to face the question of whether this will trigger a financial crisis of its own in turn.

2022-07-07 13:39

China's High Speed Railway DEBT CRISIS: The Cause Of The Next Global Recession

https://www.youtube.com/watch?v=bbPBpcBZ_zE

Ben - Mr. Business

China's high speed railway system will unfortunately be the country's downfall, and will plunge global economies into deep recessions. China's high speed railways systems necessitated huge amounts of debt, to the tune of $850 billion. And with a decline in travel to-and-fro smaller provincial towns, small municipality governments in China are not able to bear the huge debt burden and looming interest payments.

Just over a decade ago, in 2009, China’s first long-distance high-speed rail (HSR) service covered the 968 kilometers between Wuhan and Guangzhou at an average speed of around 350 kilometers per hour. The feat was recognized as the Communist Party of China’s “debt-fueled” response to the global financial crisis. It was a sort of a “Railway Keynesianism,” where China re-engineered its railway infrastructure to drive the demand for concrete and steel and create millions of jobs. In the decade that followed, China’s HSR network spanned over a track length of 38,000 kilometers, the highest in the world. Bagging a share of 26 percent of the country’s total railway network, HSR today connects almost every major city in China, with travel time just a couple of hours more than air travel, but with the comfort that only trains can provide.

In the mad rush to gain the rich economic dividends that the HSR delivered on several profitable lines, especially the Beijing-Shanghai and Beijing-Guangzhou lines, provincial governments across the country have blindly tried to emulate the feat. However, most of such provincial construction has ignored the low- to zero- potential of the expensive routes to attract similar volumes of passenger traffic and are running at high idle capacity. Most new HSR lines in China have witnessed a sharp decline in their “transportation density”. Measured in passenger-kilometers, it is an indicator that projects the line’s operating efficiency in terms of annual average transport volume per kilometer. For example, while the 1,318-kilometer Beijing-Shanghai HSR corridor’s transportation density was 48 million passenger-kilometers in 2015 and continues to be high, the 1,776-kilometer Lanzhou-Urumqi line has only 2.3 million passenger-kilometers of transportation density. China’s overall transportation density of HSR was 17 million passenger-kilometers in 2015, while it was 34 million passenger-kilometers for Japan’s Shinkansen in the same year.

HSR construction costs nearly three times more than a conventional rail line. Given the absence of freight tariffs, its operational viability is hinged solely on passenger fares to cover the capital expenditure and operating costs. The craze for HSR has made China neglect the construction of conventional systems, adversely affecting the balance of the country’s logistics mix. As a result, rail has consistently trailed road and water freight transport for the past several years. This has led to growing investments in polluting freight road trucks and trailers, offsetting the environmental gains resulting from HSR. But for the China Rail Corporation (CRC) that owns the HSR network, that is the least of its worries.

In the past few years, mega borrowings by provincial governments to monetize its HSR lines have created a debt trap, which is now pinching the coffers of the state-owned CRC. CRC’s financial woes started nearly four years ago when more than 60 percent of the HSR operators each lost a minimum of US $100 million in 2018. That year, the least profitable operator in Chengdu reported net loss of US $1.8 billion. In the same year, transport economists in China had predicted an impending debt crisis for the country’s HSR that was dependent on “unsustainable government subsidies with many lines incapable of repaying the interest on their debt, let alone principal”, and were caught in a vicious cycle of “raising new debt to pay off old debt”. Consequently, since 2015, CRC’s interest payments have been significantly higher than its operating profits, shrinking its bottom line.

Four years later, in March 2021, China’s State Council, the highest organ of state power, has waved a red flag to curtail investments in HSR to prevent the slide into a deepening debt trap. The new guidelines have stopped the construction of new HSR corridors, primarily on underutilized routes that are operating at less than 80 percent of prescribed capacity. For China, which has seen the length of its high-speed railway network increase by 91 percent between 2015 and 2020, the new guidelines indicate that the country’s pursuit for speed has come at a high price.

2022-07-07 13:41

The Myth of the Chinese Debt Trap in Africa

Bloomberg Quicktake

https://www.youtube.com/watch?v=_-QDEWwSkP0

2022-07-08 08:38

OneStand

3 months ago

As African, the changes we have in the last years of China collaboration in term of development have never been seen with centuries of ties with the West

2022-07-08 08:40

Francisco Galárraga

Francisco Galárraga

3 months ago

"Whenever China visits your country, a new hospital is built. Whenever a western country visits Africa, you get a lecture." - Kenyan diplomat.

2022-07-08 08:43

"Whenever China visits your country, a new high speed train is built." Like a Robbin Hood robbed the poor & give to the rich...hahahahaha

2022-07-14 12:41

sherlockman

Dear Mr Koon, AYS how??

2022-07-04 12:42