Steel price rises due to global supply shortage - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 07 Jul 2022, 10:36 AM

Due to the Ukraine war, the price of everything has been going up rapidly. The recent rise in steel bar prices was due to strong demand resulting from global economic recovery and a hike in raw material prices, particularly scrap, iron ore and coking coal, due to supply tightness and global supply chain disruptions.

The Malaysian Iron & Steel Industry Federation, together with the Malaysia Steel Association stated that rising raw material costs and the cost of doing business (such as utilities, transportation, etc.) have a significant impact on steel prices.

“The trajectory of domestic steel prices tracks the international price trend. Hence, domestic steel bar manufacturers have no control over steel prices as domestic steel prices are subject to global supply and demand dynamics,” the associations said in a joint statement last Friday.

“Steel bar users, such as contractors and housing developers, are able to import steel bars at zero import duty without the need for an AP (Authorisation Permit). Aside from that, steel products only account for approximately 2%–4% of total housing project costs.”

The statement was made in response to the Real Estate and Housing Developers Association’s (Rehda) report on the impact of rising building material prices.

According to the Rehda Property Industry Survey for the Second Half of 2021 and Market Outlook 2022, the overall costs of business operations of the respondents have increased by 18%.

In terms of the average percentage increase in the price of building materials, the survey found that aluminium ranked first with 55%, followed by timber with 52% and steel with 38%.

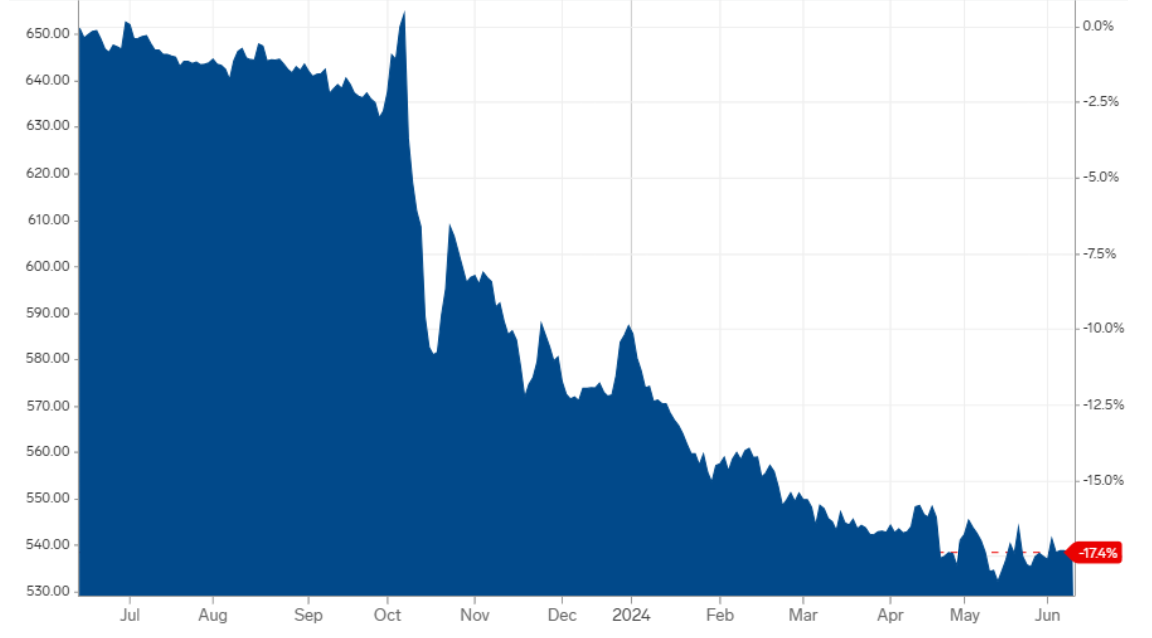

If steel price has gone up 38%, all the prices of steel stocks such as Leon Fuat, AYS and Prestar should recover.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

China’s steel mill owners are in a bad mood as demand takes a hit

“There’s negative energy all round. The steel industry is just not making any profit,” Wu said.

A lot of steel — a key raw material in the manufacturing powerhouse — is sitting idle around the country amid a stop-and-start economy which is forcing down demand and prices.

https://www.cnbc.com/2022/06/24/chinas-steel-mill-owners-are-in-a-bad-mood-as-demand-takes-a-hit.html

2022-07-08 00:39

Grandpa Koon has lost his golden touch! Best to retire! Seems 10 out of 10 stock pick turn turd lately!

2022-07-08 12:26

Penipu Uncle ini,

World Steel price dropped lah. You think we can Google world steel prices. Penipu Besar.

2022-07-08 17:42

AYS and LeonFB are down trending stocks, they are hopeless as well.

More than 90% of stocks listed in KLSE are down trending stocks, cut loss loh.

No more value investing, all cut loss.

This irresponsible person will lose his wealth in this downtrend.

All previous gains are evaporated in thin air.

Nothing to boast as super investor anymore.

If you do not want to invest like Warren Buffet, please keep your mouth shut.

Do not cause more damage to other value investors here.

Be more greedy when others are more fearful.

Not one winning formula in share investment.

Accept other views, just keep your mouth shut.

Stop attacking other value investors.

2022-07-17 10:25

emsvsi

DEAR KOON,

STEEL PRICES IN MALAYSIA LIKE REBAR ARE DROPPING

ARE YOU PROMOTING SO YOU CAN SELL

2022-07-07 18:24