UK biggest tax cuts in 50 years is bad - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 26 Sep 2022, 09:48 AM

Liz Truss' tax cut election slogan has helped her to win the election to become the new UK Prime Minister. 2 days ago, she has unveiled the biggest package of tax cuts in 50 years as she gambles her premiership on boosting growth at all costs.

The Prime Minister and Kwasi Kwarteng, the chancellor, announced £45 billion of tax cuts as part of a “new era” for Britain. They include scrapping the 45p rate of income tax, bringing forward a 1p cut in the basic rate to next year and reducing stamp duty. Corporation tax will be frozen and the rise in national insurance contributions reversed.

The tax cuts, combined with the energy support package, will fuel a £72 billion rise in government borrowing this year. Kwarteng said they were “central to solving the riddle of growth”.

Cutting so much of taxes, where is the government going to find money to manage the country?

Taxes are needed for the provision of basic services, general administrative purposes, and finance capital projects within the country.

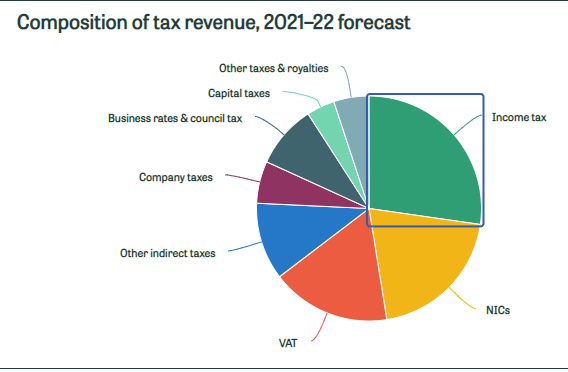

This was the previous government’s tax proposal: The government raises around £800 billion in revenue each year. Most comes from the three biggest taxes: income tax, National Insurance contributions (NICs) and VAT.

Although I am not concerned as a Malaysian, I would like to point out that cutting so much of taxes is not a good strategy. These are the reasons for imposing taxes.

1. To raise revenue: Taxes are used to raise income for the government of the country. Through the collection of tax, the finances that are needed for the provision of basic services, general administrative purposes, and finance capital projects within the country are made available to the government.

2. To redistribute income: Through the Pay As You Earn (P.A.Y.E) system, the government can narrow or almost bridge the gap between the rich and the poor by introducing a system of progressive taxation.

3. Discouragement of production and consumption of harmful goods: It is through the collection of taxes that the fervent discouragement of the production, as well as consumption of harmful goods and services, are discouraged. This is done through Indirect taxes imposed and usually leads to higher prices which ultimately discourages the consumption of some harmful goods within the country.

4. To control inflation: Without taxation in some cases, inflation will be quite impossible to control. Taxes are sometimes used as a tool to stop inflation and this is done by the increase in direct tax by the government so that expenditures are not increased.

5. To protect new industries: Sometimes, the government takes advantage of taxation to protect the newly established industries from competition with firms in foreign countries.

6. For the correction of adverse balance of payment: Taxes are used to correct an unfavorable balance of payment. When there is so much importation of foreign goods, the government can decide to increase the tax rate on these goods so that the importation rate will be reduced to the minimum.

This is because when there is a high rate of importation into the country, the currency of the country usually declines in value and the effects will usually be seen on the balance of payment.

7. Prevention of dumping: Some companies love to export their goods to other countries where they sell at cheaper prices compared to how much they sell these goods in the countries where the goods were originally produced.

This has a detrimental effect on the economy as such, the government introduces taxes to further curb the situation so that when goods are produced, they can be sold at an affordable rate even in the countries where they are produced because ‘dumping’ as it is called, ruins the local industries.

8. Promotion of economic growth: One of the reasons why the government imposes the tax is that it is with tax that a lot of projects are done for the ultimate benefit of the economy. Without the tax, the growth of the economy will be static most times with little or no development seen around.

The profits made from the tax are sometimes reinvested into the economy through the empowerment of small and medium scale enterprises for adequate productivity in order to foster stability and expansion.

9. Retaliatory measure: Taxation can also be used as a measure of retaliation in the international trading market.

10. Employment purposes: When there is an increase in the tax rate, the government can then do they can to achieve the desired employment level.

11. Savings: Taxation can be used in many countries to instill the rate of savings and investments.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024