Jaya Tiasa monthly CPO and Logs production - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 20 Oct 2022, 03:31 PM

I do not have any Jaya Tiasa share. Investors should consider this useful information.

I have extracted the following useful information from Jaya Tiasa’s monthly announcements.

| Month | CPO (Tons) | Logs (Cu Meters) |

| Sept | 18,760 | 7,510 |

| Aug | 17,650 | 6,890 |

| July | 12,488 | 7,591 |

| Total for 3 months | 44,898 | 21,991 |

| June | 11,723 | 8,230 |

| May | 11,500 | 8,134 |

| April | 9,964 | 7,433 |

| Total | 33,187 | 23,797 |

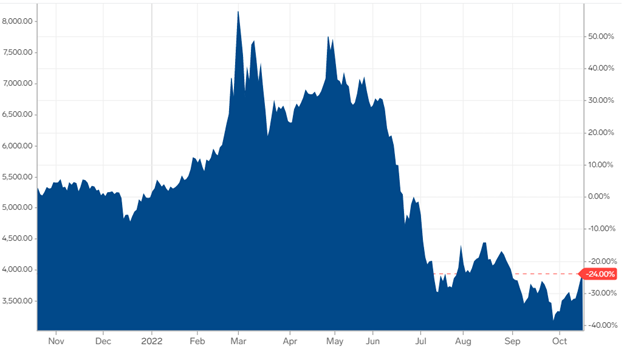

Based on CPO price chart as shown above:

Average CPO price for July, Aug and Sept is Rm 3,700 per ton.

Revenue 44,898 tons X Rm 3,700 = Rm 166 million

Average CPO price for April, May and June is Rm 6,700 per ton.

Revenue 33,187 tons X Rm 6,700 = Rm 222 million

Since the production of logs for the 2 quarters are about the same, the profit from logs should be about the same for the 2 quarters.

Jaya Tiasa will most likely report reduced profit for the quarter ending September.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

incomplete info

Jtiasa number 1 is Ffb (fresh fruit bunches) production

Sept : 100,131 metric tonnes

Aug: 91,936 metric tonnes

July: 71,881 metric tonnes

total for 3 months : 263,948 tonnes

June: 70,266 metric tonnes

May: 61,834 metric tonnes

April: 56,299 metric tonnes

total for 3 months: 188,399 metric tonnes

so Sept qtr is up by a whopping 40.1%

Ffb current price is Rm700 per ton so in Sept alone the revenue from Ffb alone is Rm70 millions

This Jtiasa should report a better qtr or at least remain status quo

2022-10-21 07:12

more facts

from last qtr results (refer Bursa)

profit is 4.36 sen

annualised is 4.36 x 4 or 17.44 sen

at current price of 58 sen Jtiasa has a forward p/e of 3.32

which translates to only 3.32 years Jtiasa will double your money

17.44 sen divides by 58 sen is a yield of 30%

tell us what industries could give us a yield of 30% today?

bank Fd only give a small yield of 2.25% which will not keep up with inflation

Low p/e means Jtiasa is too undervalue and price should rise

on the other hand tech stocks have p/e of 50 to 60 which means prices will go lower in times of high interest rates

we can expect Jtiasa and all palm oil stocks to go higher as Cpo rebounded above Rm4000

2022-10-21 07:20

further note

high interest rate will be good for palm oil co and bad for tech shares

tech has little profit so when interest rate goes up it's cost of funds to pay bank loans will be tough

it is also hard to get funding for new start up and that is why the faang stocks of nasdaq are all down as Fed raise rates

palm oil also got borrowings but as Cpo prices surged up the cash inflow from palm oil now bring in copious cash

they can then pay off bank loans like Jtiasa already pared down loan from above Rm800 millions to a mere Rm330 millions

last qtr revenue alone was Rm214.799 millions and in a year will be Rm859 millions

so revenue is 2.6 times debt

in no time Jtiasa will be a debt free entity and surplus cash can then enjoy high interest income

plus Jtiasa is able to give good dividend once again

we just received a nice 2.8 sen dividend and certainly can expect good times to return for all happy Jtiasa investors

2022-10-21 07:30

Kyy ask you to buy when the prices at the mountain ask you to sell when the prices at the bottom. That is his new golden rule of investment buy high sell low. Follow his rule and you will make big big profit in shares.

2022-10-21 09:41

Make big profits ?

Kyy first .appeared in i3 forum year 2014 promoted Jtiasa at lofty peak prices of Rm2.60 to Rm2.70

today Jtiasa is below 60 sen and a huge Rm2.00 discount to Kyy buy call of Rm2.60

He should be buying now that the good turnaround fundamental prospects of Jtiasa is improving

Jtiasa just gave a nice 2.8 sen dividend

a healthy co give dividend just like a healthy tree bears fruit

2022-10-21 09:56

Just a standard 1 addition:

18,769 + 17,650 + 12,488 = 48,907

Just wonder is KYY miscalculate the sum as 44,898 unintentionally or with his hidden agenda?

Why also no taken in the PK total of 11,312 for month july, aug and sept?

2022-10-21 17:03

hatersgonnahate

when the prices at the mountain we see you, when the prices at the bottom also we see you.

2022-10-20 17:11