Steel stocks comparison update - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 17 Nov 2022, 09:07 AM

All the steel stocks have been going up higher and higher since my last update on 28 Oct, especially yesterday. After the Covid 19 pandemic lockdown, people are free to go to work. There are more construction activities in every town and cities in Malaysia. As a result, the demand for steel and steel products have increased. Due to the increased demand, all the prices of steel and steel products have also increased.

All the steel traders and steel product manufacturers should report higher profit in the next few quarters.

Steel stocks comparison update

| Name | Price | Q ending June EPS |

| Ann Joo | Rm 1.09 | 6.11 sen |

| AYS | 48 sen | 5.24 sen |

| CSC Steel | Rm 1.24 | 4.62 sen |

| Leon Fuat | 53 sen | 4.11 sen |

| Pantech | 70.5 sen | 3.78 sen |

| Prestar | 46 sen | 3.27 sen |

| Hiap Teck | 26.5 sen | 1.41 sen |

AYS is the best steel stock to buy. Yesterday AYS went up 1.5 sen.

AYS Ventures Bhd is an investment holding principally involved in the trading and manufacturing of steel related products. The company is organized into three segments namely trading, manufacturing and others. The trading division trades and markets a diverse range of steel products and construction materials whilst the manufacturing division manufactures and trades pressed steel and fiberglass reinforced polyester sectional water tanks, steel purlin, and wire products. Other segment includes investment holding, warehousing and storage services and dormant. The products serve customers in the construction, engineering for heavy steel industries, fabrication, oil and gas, power plant and shipbuilding sectors. The group principally operates within Malaysia.

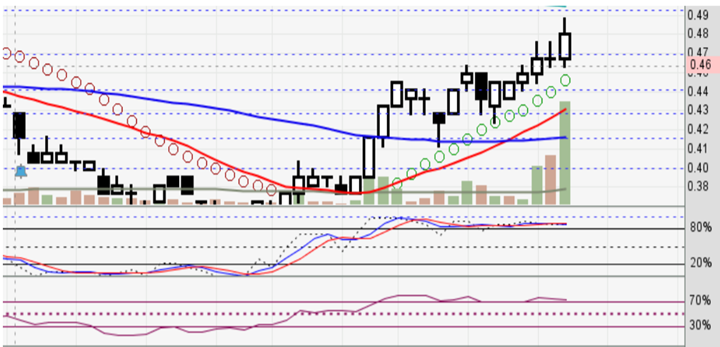

AYS moving average up trend chart update

I am obliged to tell you that I have AYS shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

AYS2024-11-21

ANNJOO2024-11-21

ANNJOO2024-11-21

HIAPTEK2024-11-20

PANTECH2024-11-18

PANTECH2024-11-15

HIAPTEK2024-11-15

HIAPTEK2024-11-14

HIAPTEK2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOO2024-11-12

ANNJOOMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.