Kerjaya Prospek Group and KP Property comparison - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 08 Sep 2023, 10:14 AM

I cannot understand why RHB strongly recommend buy for Kerjaya Prospek Group (7161) and not KP Property (7077).

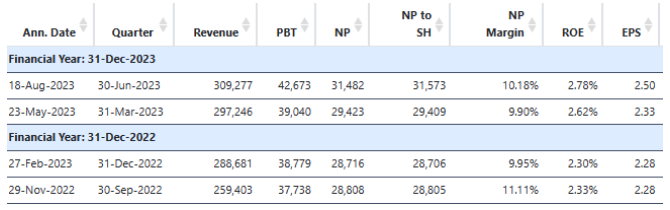

Kerjaya Prospek Group selling Rm 1.14. Its total EPS for the last 4 quarters is 9.39 sen as shown below:

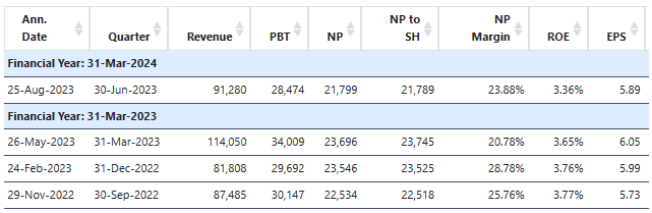

KP Property selling 84 sen. Its total EPS for the last 4 quarters is 23.6 sen as shown below:

KP Property 4 quarters EPS is 23.6 sen and it is selling cheaper than Kerjaya Prospek Group with 4 quarters EPS of 9.39 sen.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024