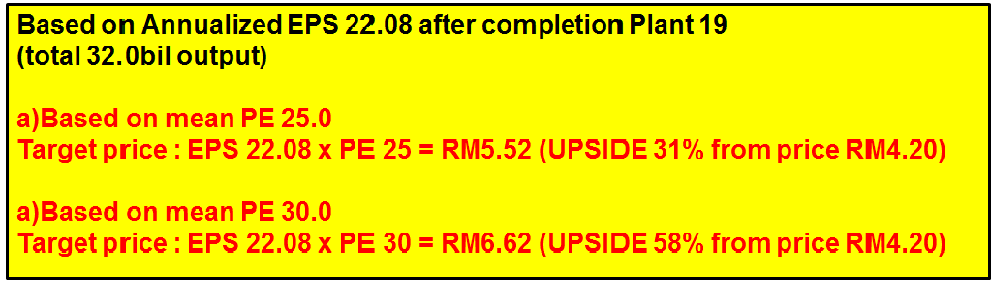

Kossan The Most Undervalue Glove Stock With upside 31% based on PE25 and upside 58% based on PE30

Chelsea

Publish date: Fri, 06 Sep 2019, 08:34 AM

Glove stock has undergo deep correction in early year 2019 due to report IB supply exceed demand. This scenario happen also in early year 2014 and early year 2016. However, it took one year for the share price to recover. This scenario happen because the big four ramp up production in year 2017 and 2018 due to closure pvc glove in china (Enviromental issue). However, China has resume the production in mid year of 2018 and this cause the supply is exceed the actual global demand. Hence, all the big four has take caution action by slow down the expansion to normalize the supply and demand.

I would like to intro Kossan which is the cheapest glove stock with upside 31% based on PE25 and upside 58% based on PE30 based on the reason as per below:

1)The most undevalue glove stock with low PE24 compare with Harta PE40 Top Glove PE31

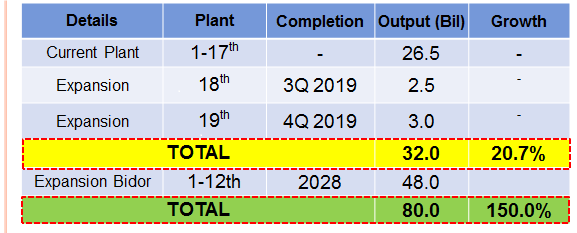

2)Third largest (26.5B) in the world behind Top Glove 60B and Harta 32B. By 2019, it will increase the output from 26.5B to 32B (plant 18 and plant 19) with 20% growth

3)The only glove stock which record double digit growth in year 2019

4)Most IB upgraded the target price after Kossan perform superb result in Q1 and Q2.

Maybank : Target Price RM4.70

Hong Leong : Targer Price RM4.35

Cimb : Target Price RM4.52

Affin : Target Price RM6.00

MIDF : Target Price RM4.64

Kenanga : Target Price RM5.25

Aminvest : Targer Price RM4.80

BIMB : Target Price RM4.60

Rakuten : Target Price RM5.25

AVERAGE TARGET PRICE FROM IB is RM4.90

5)Why i so bullish on the glove stock is trade war whill shift the supply from China to Malaysia.Glove in China are more expensive by 25% and there are no price advantage between PVC and Nitrile. Global demand is 300B and Malaysia dominate the global demand by 63% and China 10%. The shift 10% (30B) demand from China to Malaysia will spur the growth and expansion in Malaysia. Biggest winner is major nitrile glove player which is Harta (90% nitrile) and Kossan (75% nitrile).

Please kindly refer to the projection Kossan as per below:

SLIDE 1

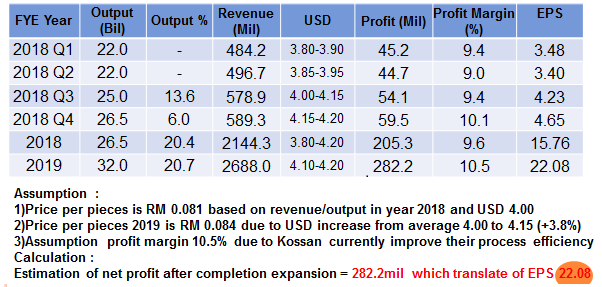

SLIDE 2

SLIDE 3

Remarks : This target price does not include the Bidor expansion which start on year 2020 with additional capacity 48B.

SLIDE 4 (Technical Chart Uptrend)

Disclaimer : This is not buy call and invest based on own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Free here to brainstorm. If look carefull on Supermax, the Q4 always deliver the lowest result which is abnormal. This is because glove produce gloves continuously and earning should be flat or increase if there are expansion.

2019-09-06 09:41

However, need to look into the NP growth. Supermax is constant with single digit growth while Kossan is the only glove stock which record double digit growth in year 2019.

2019-09-06 11:09

Secondly, need to look into the profit margin. Kossan profit margin is keep uptrend due to management look into their process to improve their efficiency and also the OEE.

2019-09-06 11:13

Supermax started thier contact lens div. ,.. this could be a game changer

2019-09-06 11:48

The most confusing thing to me is individuals who sell or refuse to buy excellent companies just because the pe is too high, believing that lower pe stocks will have a chance to run up and have a potential to perform Vs stock that has already "performed".

This is erroneous thinking.

It would be better to use the concept of investing now for a share of the future income of a group of individuals that just graduated university. Do we suddenly sell the rights for the top student in university that was accepted in a big company as management just because he has already performed? Is his future days already over at this point? It may be so, but to transfer our investment to one of the lesser graduates of the group just because he was not accepted in a big company or received a job yet just because of the potential of becoming one is silly.

Cream always rises to the top. Excellent companies that perform usually theme to continue to perform, while the mediocre ones tend to stay mediocre, no matter the potential.

Why not invest in the rubber company with 25% world market share? Or invest in the biggest nitrile glove manufacturer instead? Either topglove or hartalega would outshine kossan any day. In the long term this will be even more clear.

2019-09-07 23:28

Phillip, you are right. Chelsea and the team invested in hartalega 3 years back and sold all their shares at rm7. Harta hit their bottleneck for now, on the other hand, kossan's room to grow is still there.

2019-09-08 17:26

epf is unloading.

you buy they sell.

who win ? think twice before you are trap

2019-09-08 17:47

Phillip, look carefull on topglove. They are biggest in the world in term on volume but thier profit slump this year and thier profit margin keep shrinking to the lowest 6.3%.

Bear in mind largest volume does not mean the best or highest profit margin. This has be proven when looking back in year 2010 when harta output pieces is less twice than topglove but they able to achieve net profit similar to topglove.

Hence biggest does not mean the best. Innovative, able to improve production oee to achieve higher profit margins and strong management is the key of success.

2019-09-08 22:19

Hooi epf selling today and buy next day cannot tell the real story. Selling in left hand and buy back in right hand is to create volume. The most important epf holding is still similar

2019-09-08 22:22

.png)

Airline Bobby

Lol. Supermax cheaper

2019-09-06 09:09