MQ Expresso

How do people prepare their wealth for retirement ? - [Part 2]

MQTrader Jesse

Publish date: Fri, 24 Jun 2022, 09:28 PM

How to start financial planning for retirement?

To start financial planning, it is better for you to understand the hierarchy of financial planning. This hierarchy allows you to logically plan your financials step by step, so that you won’t find out that you’ve missed out on anything crucial, or even find it impossible to achieve your financial goals later on in your life.

Financial planning is constructed on 4 levels, which are the wealth foundation, wealth accumulation, wealth preservation, and wealth distribution.

First level: Wealth Foundation

The Wealth Foundation is the first and most essential part when building our wealth. It includes wills, emergency funds, and different kinds of insurance.

- Wills: To ensure the wealth is distributed by your own will if there are any unexpected accidents.

- Emergency Funds: To ensure you can survive at least 3-6 months if you do not have any cash inflow.

- Different kinds of insurance: disability insurance, life & health insurance, and auto & homeowners insurance (only needed when you have any car or house). To ensure you don’t need to be worried about the living cost or medical payments when there are any unexpected accidents.

The Wealth Foundation shows us:

- How do we protect ourselves from any accidents which will harm our capital and might cause us to bear debt?

- We need to prepare emergency funds to respond to any emergency scenarios.

Second level: Wealth Accumulation

Now we’ve reached the most difficult part. Wealth Accumulation includes Savings and Investment. It’s simple and straightforward, that we have to start saving first, then only we have the extra money to do investment. This level is where we try to use the money to make extra money, and expanding our wealth is the main target of it.

There are 5 common tools for Wealth Accumulation

- A Fixed Deposit is a financial instrument provided by a bank that provides investors a higher rate of interest than a regular savings account, until the given maturity date.

- Gold is the most popular investment, investors generally buy gold as a way of diversifying risk, investors may buy it as futures contracts, derivatives, or physical gold.

- The stock market consists of exchanges in which stock shares and other financial securities of publicly held companies are bought and sold.

- Foreign currency trade is the trading of one currency for another. For example, one can swap the U.S. dollar for Euro.

- Crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

In Wealth Accumulation, we use extra money to make more money. This part might take a long time, as we have limitations of capital, therefore we have to accumulate the capital first and maintain yearly returns from investments.

In most cases, our wealth doesn’t just grow exponentially overnight. From the graph of famous investor Warren Buffet’s age versus wealth, we can see that it’s like a snowball effect, where we start small and accumulate it step by step. This is why the earlier it starts planning, the sooner and easier you will reach your financial target.

If you would like to learn about the wealth accumulation tools kindly click on this link.

Third level: Wealth Preservation

It’s a strategy that ensures your assets grow while providing a legacy for your family. For this level, there are a variety of investment plans that are all aimed at securing your wealth for the long term.

The main investment plans of Wealth Preservation are:

- Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. Umbrella insurance can provide coverage for injuries, property damage, certain lawsuits, and personal liability situations.

- Long-Term Care Insurance is coverage that provides nursing-home care, home health care, and personal or adult day care for individuals with a chronic or disabling condition that needs constant supervision.

Wealth Preservation is meant to safeguard the wealth, so you don’t lose your money.

Fourth level: Wealth Distribution

After you have a huge amount of capital, you may consider the Wealth Distribution process, which is a good plan for wealth allocation while contributing to society.

There are 3 types of Wealth Distribution which are:

- Gifting is a donation action to return to society if we had earned something from society.

- Estate Planning is the process of preparing for the smooth transfer of a person's assets to the intended beneficiaries when he or she is no longer around.

- Retirement Income, a process to understand your time horizon, determining retired spending to ensure the remaining capital with investment return can maintain your life quality after retire

Verdict

Financial planning requires knowledge, the hierarchy of financial planning is merely a concept for you to be clear on how to build your wealth step by step, with different kinds of investing tools.

And retirement saving requires time to build, so start small and accumulate your wealth to make your retirement dream come true!

Love our content? Follow us closely, as we'll talk about different kinds of investment tools for you in our webinar next week!

Webinar on 29/06/2022

[ 首 300 位免费参与!]

[ 免费 300 MQ 积分! ]

[ 免费 神秘礼物! ]

2022将迎来,有史以来最长的熊市!?

Topic / 标题 : 洞察全球局势 战胜熊市交易法

Date / 日期: 29/06/2022

Time / 时间: 8.30 pm - 10:00 pm

Speaker / 演讲者: Vernon Tee

Language / 语言: 中文 (Mandarin)

Register Now / 立即注册:https://bit.ly/3y83PdS

Learn More / 更多详情:https://bit.ly/3OeZYRV

Community Feedback

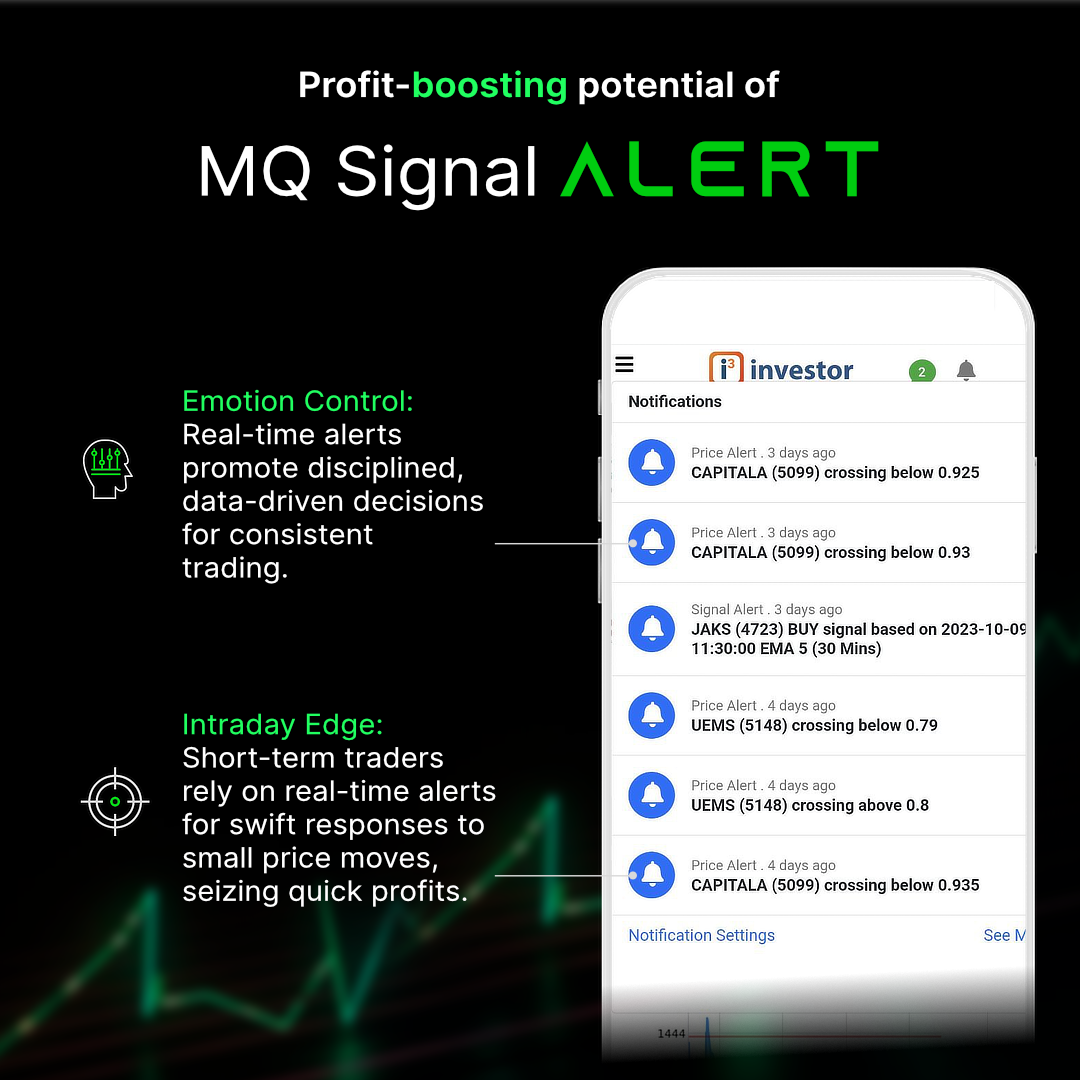

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

Email: admin@mqtrader.com

More articles on MQ Expresso

Don't let your busy lifestyle be a barrier to successful trading

Created by MQTrader Jesse | Oct 26, 2023

The Revival of Construction and Real Estate: Government Plans to Revitalize the Economy

Created by MQTrader Jesse | Oct 12, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments