Porsche VS Volkswagen: Family Acquisition Battle

MQTrader Jesse

Publish date: Mon, 25 Mar 2024, 03:48 PM

In January 1951, the world-renowned automotive maestro Ferdinand Porsche passed away due to a stroke, marking the beginning of an inevitable family feud in the future.

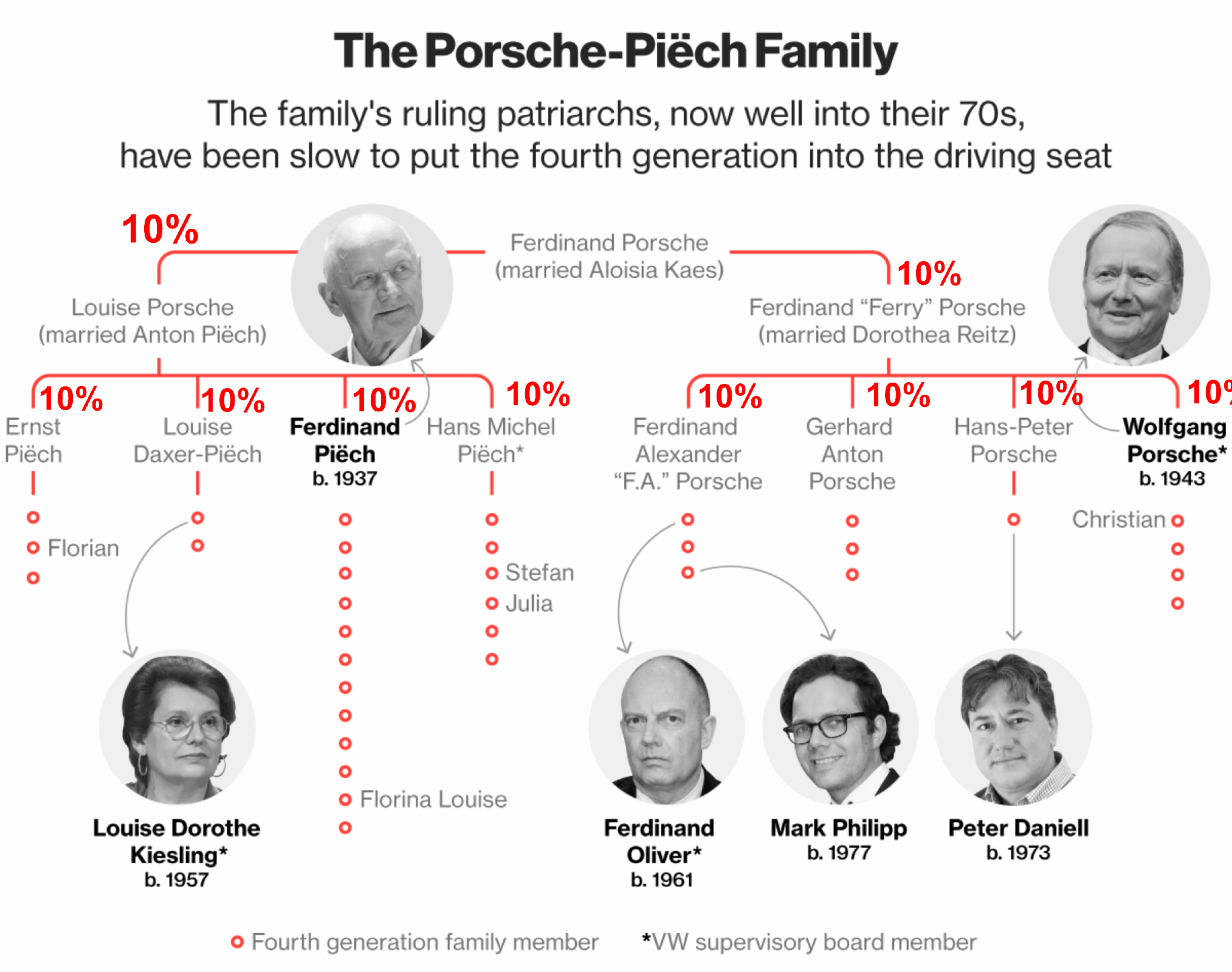

Before we delve into the story, let's discuss Ferdinand Porsche's background and gather some information about his direct descendants to better immerse ourselves in the context of the narrative.

Ferdinand Porsche was a highly renowned automotive design master of his time and designed Volkswagen's first model: the Beetle. Moreover, he is the founder of Porsche. It wasn't until his final moments that he distributed the shares of Porsche among his two children and eight grandchildren, with each receiving 10%.

Although Ferdinand Porsche served as a leader in the Volkswagen company, the actual controlling party at that time was the Nazi government. Due to the historical context of that period and the fact that automotive companies were not solely producing cars, as there was a need for military production during World War II, Volkswagen had intricate ties with the government of that time.

However, the Porsche family always believed that Volkswagen was part of the assets owned by Porsche and its family, but due to the circumstances of World War II, they were unable to reclaim it. What's more, it's not only the Porsche family that holds this belief; the general public also considers Volkswagen to be owned by the Porsche family.

In the timeline reaching the year 2005, when Porsche SE enthusiastically started acquiring shares of Volkswagen, the majority of Germans were supportive. This laid the foundation for the subsequent repeal of the "Volkswagen Law."

But the question is, what is the “Volkswagen Law”? In simple terms, according to the "Volkswagen Law," any company needed to acquire 80% of the shares to gain complete control of Volkswagen. However, at that time, the German government already held 20.1% of the shares. So, under the "Volkswagen Law," Porsche SE had no way of obtaining control over Volkswagen. The law was established to safeguard the interests of German state governments and prevent the acquisition of Volkswagen by foreign companies. However, under continuous lobbying by Porsche SE and pressure from the European Union, the German government eventually abolished the "Volkswagen Law."

From this timeline of Porsche acquiring Volkswagen shares, it is evident that this takeover was a long-planned strategy:

- 2005: Porsche acquires 18.5% of Volkswagen's shares.

- 2006: Porsche increases its shares to 27.3% of Volkswagen's shares.

- March 2007: Porsche holds 31% of Volkswagen's shares.

- November 2007: Porsche actively promotes and successfully achieves the repeal of the "Volkswagen Law."

However, at this time, Volkswagen had already existed as an independent company with no direct connection to Porsche. Therefore, after the repeal of the "Volkswagen Law," most people believed that Porsche SE's series of actions, such as accumulating Volkswagen shares and actively lobbying for the law's repeal, were aimed at strengthening the collaboration between the two companies in the future. No one anticipated that one of the reasons for Porsche SE's intentions was to acquire Volkswagen. This was partly because Volkswagen was significantly larger in scale than Porsche SE, approximately 15 times its size.

How did Porsche go from being a minnow to swallowing a whale?

Wolfgang Porsche initially secured financing by forming a syndicated loan with 15 banks, aiming to raise over 10 billion euros. At that time, Porsche SE was considered one of the most profitable companies in the automotive industry, boasting high per-vehicle profits. This made Porsche SE an attractive borrower for banks, leading to a competitive environment where numerous banks were eager to lend money to the company.

To navigate around German securities laws, which require disclosure for shareholdings exceeding 5%, Porsche collaborated with entities such as Merrill Lynch and Deutsche Bank to strategically execute the acquisition. Through various accounts and a network of financial institutions, Porsche discreetly purchased significant volumes of Volkswagen shares that were publicly traded on the open market. This covert approach allowed Porsche to accumulate substantial shares in Volkswagen without triggering mandatory public disclosures under the 5% threshold.

In March 2008, Porsche announced its goal to increase its shares in Volkswagen to 50%, revealing their ambitions to take over Volkswagen completely.

Short or Long ?!

While Volkswagen and the German government believed that Porsche SE's acquisition of shares was aimed at promoting future collaboration, astute speculators sensed an opportunity. Therefore, after the repeal of the "Volkswagen Law," these speculators anticipated that it was only a matter of time before Porsche SE would take control of Volkswagen. As expected, Porsche SE initiated a relentless buying spree that drove the stock price to a peak, soaring from 30 euros to 240 euros.

However, the company's preferred shares remained at 40 euros. Some hedge funds believed that once Porsche completed the acquisition, the stock would eventually return to the level of the preferred shares. With this assumption, they started shorting Volkswagen stocks.

During this period, a battle between long and short positions unfolded. One day, Porsche SE announced that they held controlling shares of 74.1% in Volkswagen, comprising common shares (42.6%) and call options (31.5%). This left only 5.8% of freely traded shares in the market (recall that the German government held 20.1% of the shares). However, simultaneously, the short position on Volkswagen was at a high of 10.4%, indicating a 4.6% short squeeze (when the 5.8% freely traded shares are exhausted, there would be 4.6% with outstanding short positions).

Short sellers in the market quickly covered their positions in Volkswagen stocks to avoid being part of the 4.6% shortfall, providing further upward momentum. The stock price surged from 200 euros to 1005 euros. During this period, several funds faced margin calls and started liquidating their positions. The saga concluded when Porsche SE announced the release of 5% of Volkswagen shares, causing the stock price to plummet by 48% and bringing an end to the farce. In the end, the short sellers suffered a resounding defeat in this market battle!

Porsche is one move away from success, but...

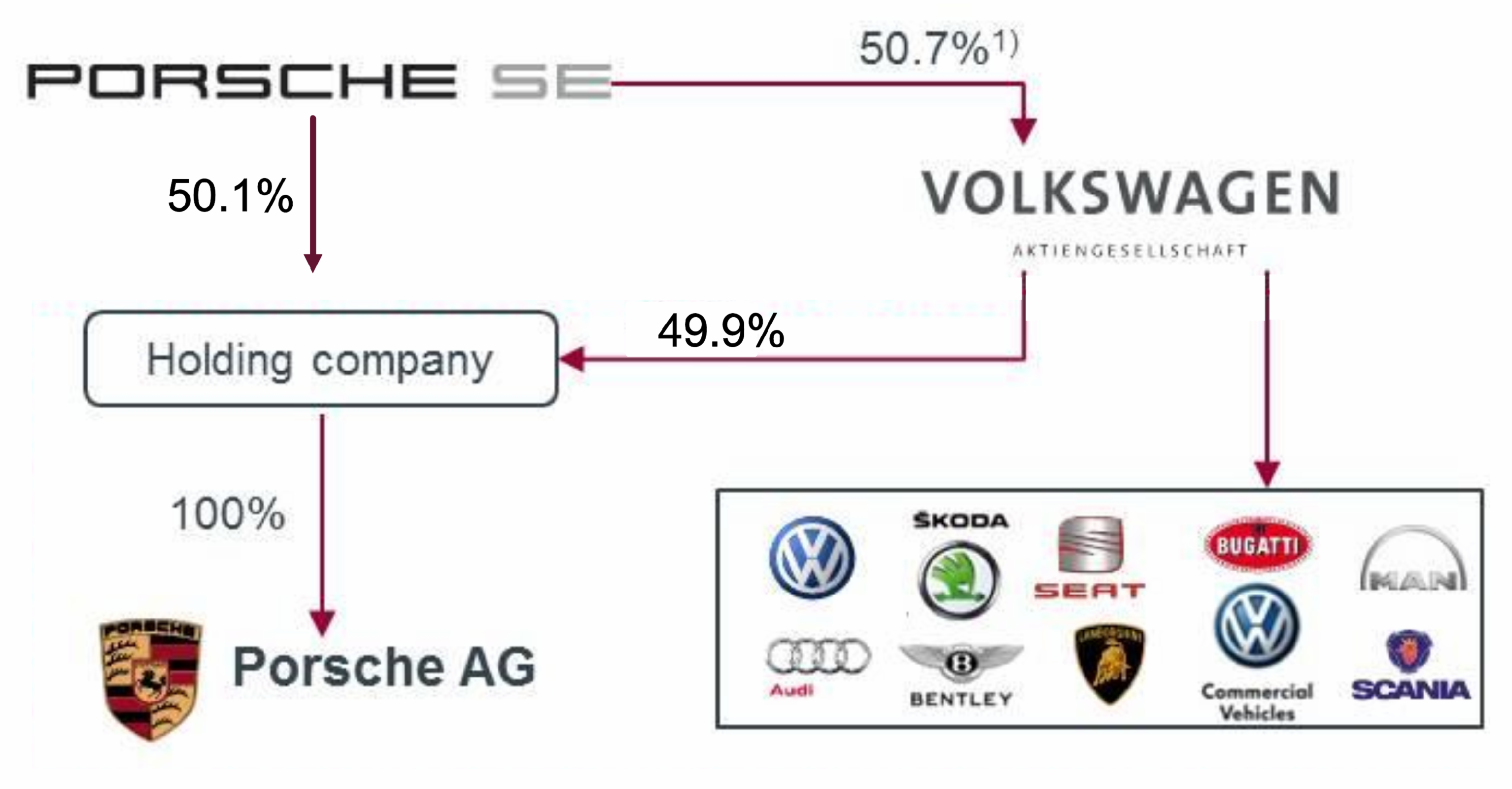

As the entire acquisition plan approached its conclusion, prolonged credit tightening finally burst the real estate bubble, triggering the most severe financial crisis of the 21st century - the subprime mortgage storm. In order to implement the "minnow to swallow a whale" acquisition method, Porsche had borrowed a considerable amount of loans from the market. The financial crisis caused Porsche SE's sales to decline, severely impacting cash flow. For companies like Porsche SE, relying on low sales and high profits, a decline in sales is undoubtedly a fatal blow. In the end, unable to make ends meet, Porsche SE had to terminate the acquisition plan, and control of Volkswagen's shares remained at 50.7%.

Whale's Counterattack

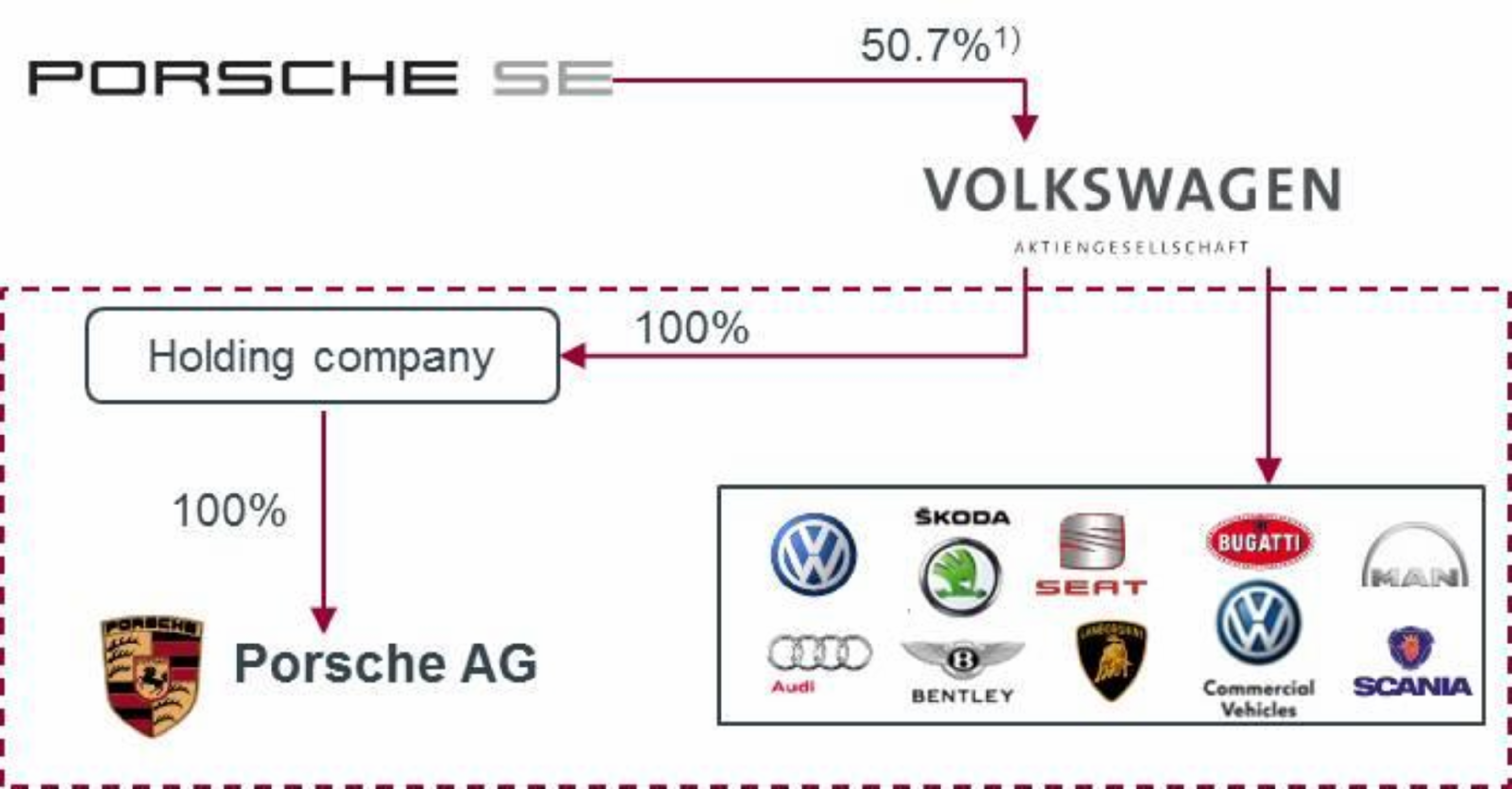

At this moment, Ferdinand Piëch is well aware that this is a once-in-a-lifetime opportunity. If they allow Porsche SE a moment to catch its breath, there is a risk that hostile takeovers will persist. Therefore, he decides to launch a counterattack. The financial crisis has also indeed affected Volkswagen, but due to its large-scale sales model, the impact is relatively minimal. Furthermore, Volkswagen possesses substantial assets that can be leveraged to secure a significant amount of funds. Subsequently, Volkswagen acquires Porsche SE's most profitable subsidiary, Porsche AG, through loans, effectively cutting off Porsche SE's source of funds. This move shatters Porsche SE's dreams of acquisition.

The acquisition of Porsche AG took place in two phases. The first phase occurred in 2009 when Volkswagen acquired 49.9% of the shares for 3.9 billion euros.

The second phase involved Volkswagen acquiring the remaining 50.1% shares for 4.46 billion euros.

In the end, this acquisition battle has once again concluded, and Porsche SE no longer possesses the capability to initiate further acquisition proceedings against Volkswagen.

Conclusion

From the case above, we can observe that despite the 15-fold difference in scale between Porsche and Volkswagen, it is still possible for Porsche, relying on certain strategies, to completely acquire Volkswagen. Porsche SE came very close to accomplishing this feat. The main reason for Porsche SE's failure is closely related to the overall environment. As financial policies began to tighten, smaller and medium-sized enterprises were more suitable for adopting defensive strategies to ensure they would not fall into any liquidity risks. Finally, Ferdinand Piëch demonstrated how competent management can seize opportunities for a counterattack. This not only protected Volkswagen but also prevented Ferdinand Porsche from acquiring more Volkswagen shares and gaining higher control.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We would like to develop this system based on community feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered, or initiate a new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023