How Budget 2024 impact various sectors in Malaysia

MQTrader Jesse

Publish date: Fri, 20 Oct 2023, 11:48 AM

The basic summary of the budget

On October 13, 2024, at 4 PM, Malaysia's Prime Minister, Anwar, announced the fiscal budget for the year 2024. Prime Minister Anwar mentioned three main strategies to build a prosperous nation: (1) Adjust economic structure and promote economic growth; (2) Improve people’s living standards; and (3) Improve government good governance.

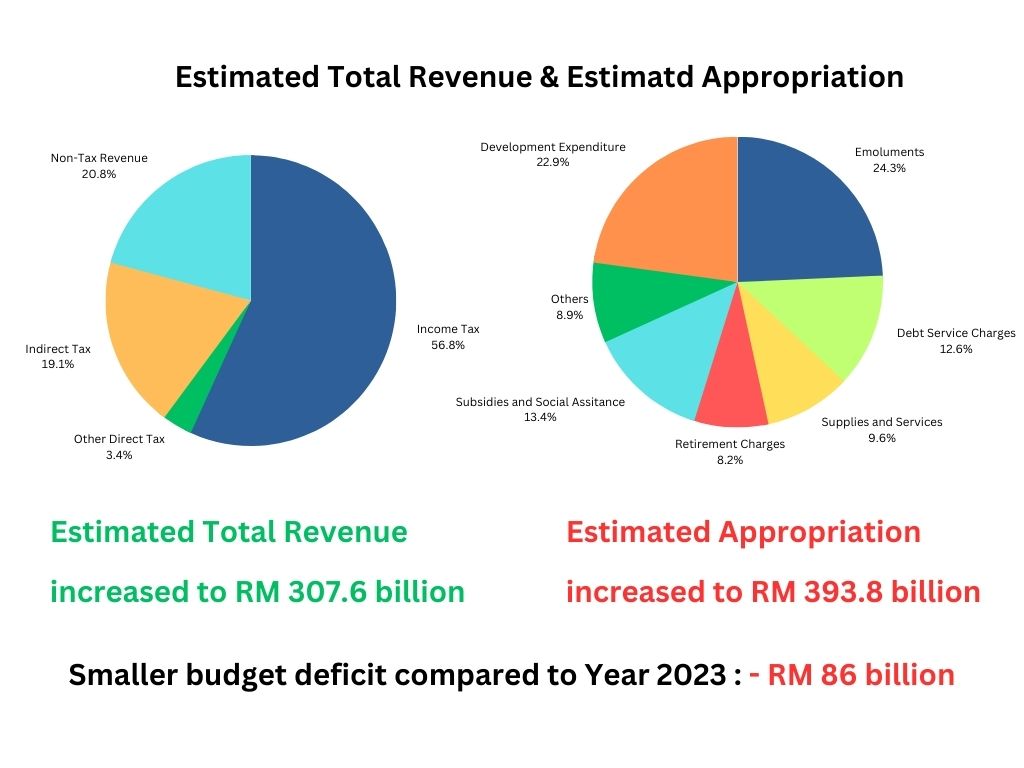

Source: Ministry of Finance

The projected revenue for this year has increased from RM 303.2 billion in 2023 to RM 307.6 billion, and the allocation for this year has also risen from last year's RM 386.1 billion to a high of RM 393.8 billion, making this budget the largest in Malaysian history. Therefore, the expected fiscal deficit for this year is estimated to reach RM 86 billion. However, the fiscal deficit for 2024 is expected to decrease to 4.3% of the Gross Domestic Product (GDP).

To influence the economic activities of the country, there are typically two primary tools. The first is monetary policy, where the central bank adjusts interest rates to impact the liquidity of currency in the market and consequently alter people's attitudes towards consumption. The other is fiscal policy, where the government allocates funds to various projects through policies, thereby increasing the liquidity of money in the market and stimulating economic activities. As investors, it's important for us to pay attention to the aspects of these policies that may have positive or negative impacts on companies, guiding our observation and investment decisions.

Impact of Policies: Pros and Cons for Companies

Consumer

Impact: Positive

Company: Consumer Sectors, LHI, TEOSENG, QL, LAYHONG

Highlight:

- The EPF's third account (flexible withdrawals), incentive payment to government pensioners and assistance grants from the STR can both increase monetary liquidity, and smaller amounts of funds are more likely to stimulate the consumer industry.

- The likely removal of price caps on eggs and chicken is expected to lead to price increases, which would benefit chicken farming and egg production companies.

Impact: Negative

Company: TOMEI, POHKONG, FFB, DLADY, F&N, NESTLE

Highlight:

- An increase in luxury goods taxes by 5-10% may have a negative impact on the sales of jewelry-related companies.

- The increase in the domestic tax on sugary drinks will reduce the preference for sugary beverages among some of the population.

Utilities

Impact: Positive

Company: TENAGA

Highlight: The government's continued provision of electricity subsidies to impoverished households will benefit electricity companies.

Tourism & Entertainment

Impact: Positive

Company: CAPITALA, GENM, GENTING, SHANG, BERJAYA, AAX, AIRPORT, ASTRO

Highlight:

- The government will allocate funds to promote and advertise Malaysia's tourism industry.

- The tax exemptions for local artists, theme parks, and film production companies will boost the entertainment industry.

Housing

Impact: Positive

Company:

- Forest City-related companies - UEMS, SUNWAY, SPSETIA, ECOWLD, EKOVEST

- Property Sectors

Highlight:

- The main beneficiaries of the Malaysia My Second Home (MM2H) program will be the recently emphasized Iskandar Malaysia, also known as the Forest City, in Johor, where the government has been focusing on creating a financial hub.

- The expansion of the housing credit guarantee scheme will also enhance people's eligibility to buy homes, thereby driving the real estate-related industry.

Healthcare

Impact: Positive

Company: UMC

Highlight: The government's allocation for the purchase of medical equipment will boost the sales of medical equipment distributors.

Infrastructure / Public projects

Impact: Positive

Company: Infrastructure Related Sectors (raw material suppliers, contractors, construction, and others).

Highlight: The government's restart or implementation of large-scale projects such as the Sabah Pan Borneo Project (Phase 1B), the Sarawak-Sabah Link Road Project (Phase 2), the expansion of the North-South Highway (PLUS) to 6 lanes, the LRT3 project, and the resolution of water supply issues will require the participation of infrastructure-related companies.

Electric Vehicle

Impact: Positive

Company: SUNWAY, MRCB, GAMUDA, PENTA, GENETEC

Highlight:

- The government's subsidies for electric motorcycles, tax exemptions for electric vehicles, and investment in electric buses all demonstrate the government's encouragement of people to purchase electric vehicles. The primary goal is to reduce the public's dependence on gasoline and, in turn, lower the government's subsidies on gasoline.

- The federal government plans to use electric vehicles as official vehicles, as TNB, Gentari, and Tesla are investing over RM 1.7 billion to establish electric vehicle charging stations.

Solar Energy

Impact: Positive

Company: SUNWAY, MRCB, GAMUDA, SLVEST, SUNVIEW, TNB

Highlight: Build a transmission line network in Sabah to support solar power generation and transform Putrajaya into a low-carbon city, while promoting the installation of solar panels. This will benefit construction companies and businesses in the solar industry.

Others

Impact: Positive

Company: IFAMSC, ADB, CENSOF, CUSCAPI

Highlight:

- The promotion of e-invoicing will drive companies to upgrade their accounting systems, benefiting software providers.

- Government funding allows businesses to secure loans for enhancing their sales, inventory, and digital accounting systems.

Impact: Positive

Company: CEB, INARI, NATGATE, MPI, UNISEM, PENTA, VITROX

Highlight:

- The funding for the New Industrial Master Plan (NIMP) 2023 will indirectly boost the electrical and electronics (E&E) industry.

- To establish an ecosystem-zone for the northern E&E sector, a high-tech industrial zone is being set up in Kerian, northern Perak.

Verdict…

From this year's budget, we can see that the government has abandoned short-term welfare measures. They have ceased giving money to the people to boost consumption and allowing withdrawals from the Employees Provident Fund (KWSP) accounts. Instead, they are focusing on longer-term development, such as:

- Restarting some infrastructure projects, as the improvement of national infrastructure will naturally attract more foreign investment.

- Gradually implementing e-invoicing to prevent tax evasion and the proliferation of the underground economy, thereby recovering government revenue.

- Developing the electric vehicle industry, with the promotion of electric cars helping to reduce gasoline subsidies and alleviate fiscal pressure.

- Avoid large-scale subsidies that could lead to an increase in national debt.

It can be said that this budget lacks some short-term surprises and may not be well-received by the market in the short term. However, taking a long-term perspective, if everything can be executed according to plan, it will be beneficial for Malaysia's future economy.

MQ Trader has also identified potential beneficiary companies of certain policies. Since this budget only provides a broad blueprint, many details, such as the execution of policies and any conditions, remain unknown. We will need to wait for further announcements over time. As investors, what we can do is prepare in advance, identify companies with the potential for significant benefits, gradually position ourselves, and then reap the rewards at some point in the future.

[Disclaimer: This message is for information purposes only and is not intended to be distributed to any third party. It does not construe as an offer/a solicitation/a recommendation to buy/sell any stocks. Please consult your own independent adviser(s) before investing in any stocks and no responsibility or liability can be accepted for any loss or damage that may arise from the reliance of this message. The information herein constitutes our findings as of this date and is subject to change without notice.]

Community Feedback

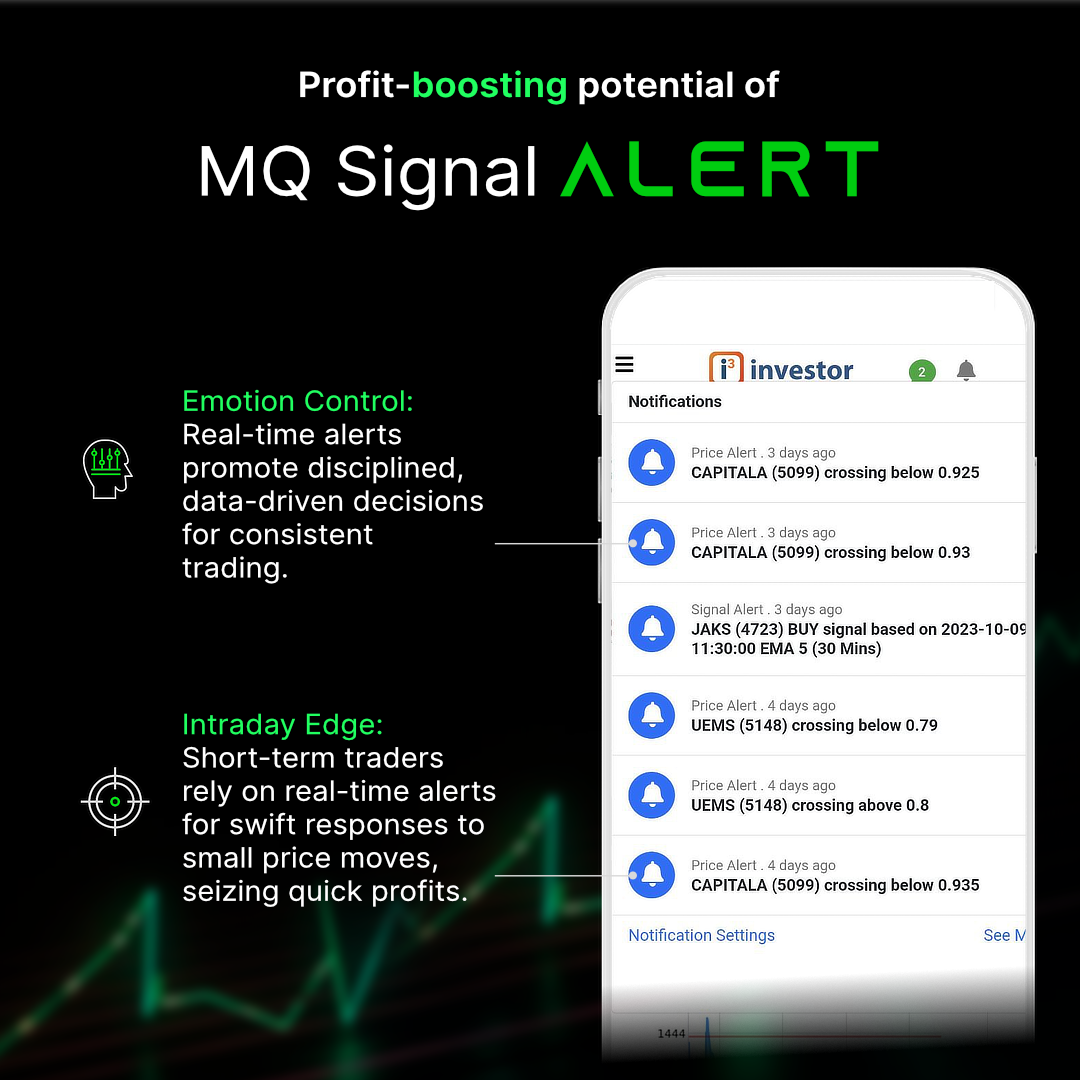

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We would like to develop this system based on community feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered, or initiate a new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023