Business Warfare - The Game of Hostile Takeovers

MQTrader Jesse

Publish date: Thu, 05 Oct 2023, 12:13 PM

The phrase "business is like a battlefield" is familiar to everyone, and many companies in similar industries aspire to increase their market share and eliminate their competitors. Apart from relying on product development to maintain competitiveness and gain market share, some financially powerful companies resort to hostile takeovers, absorbing their competitors' companies and market share into their parent company. A hostile takeover, in simpler terms, refers to the acquisition of a company without the approval of the target company's board of directors, regardless of whether the target company agrees or not. If the acquiring company eventually obtains controlling ownership and becomes a significant shareholder, it can integrate the acquired company into its structure.

If a board of directors encounters a hostile takeover, there is no reason for them to passively accept it. Therefore, there are anti-takeover defences in place to protect the target company's control over its operations. In the following discussion, we will briefly explore different anti-takeover defences and examine how companies safeguard their decision-making authority.

Anti-takeover defences

1. Golden Parachute

Golden parachute clauses can be used to provide generous benefits to designated employees after they are terminated. The term "golden parachute" is often used to describe the situation where executives are dismissed due to an acquisition or merger. Examples of golden parachutes include cash severance payments, special bonuses, stock options, or previously granted compensations. The terms for the golden parachute become effective as explicitly outlined in the employment contract. Therefore, when a target company experiences a hostile takeover, a golden parachute can be employed to increase the expected costs and pressure the acquiring party to abandon the acquisition due to escalated expenses. However, this strategy also has some drawbacks, as the target company's management may opt to sell the company at a lower price if they find the prospect of receiving substantial compensation more attractive.

Real Case Scenario: Elon Musk vs Twitter

In 2022, after successfully acquiring Twitter, Musk dismissed several high-level executives, including CEO Parag Agrawal, CFO Ned Segal, Policy Chief Vijaya Gadde, and Chief Customer Officer Sarah Personette. However, under the golden parachute agreement, Musk is still required to provide approximately $141.1 million in additional compensation to these high-level executives.

Among them, CEO Parag Agrawal is expected to receive $57.4 million, CFO Ned Segal is expected to receive $44.5 million, Policy Chief Vijaya Gadde is expected to receive $20 million, and Chief Customer Officer Sarah Personette is also expected to receive approximately $19.2 million.

2. Poison Pill

"A poison pill" is a popular defense mechanism used by target companies, where it employs shareholder rights offerings as a strategy to make hostile takeover transactions costly or less attractive to the attacker. This strategy can also serve as a tool to slow down potential future hostile attempts. It is generally approved by the board of directors without requiring shareholder approval. In companies implementing poison pill plans, a dilution provision is adopted in advance by the board of directors. Once the hostile party acquires a certain percentage of the company's shares (typically 10% to 20% of shares), the provision is triggered, allowing existing shareholders to acquire a significant number of company shares at a lower price, thereby raising the acquirer's costs.

Real Case Scenario: Shanda vs Sina

On May 19, 2005, Shanda announced that it had acquired 19.5% of Sina's shares, naturally becoming Sina's largest shareholder. As both companies were U.S. listed companies, according to legal provisions, when one company holds 20% of another company's equity, the financial statements of both companies must be consolidated, and the party holding 20% equity after the consolidation becomes the actual controller. To prevent becoming a subsidiary of Shanda, Sina adopted a poison pill plan: (1) When Shanda's holdings reach 20%, Sina will automatically issue new stock subscription warrants; (2) Apart from Shanda, shareholders who already hold Sina's stocks will receive subscription warrants at a 1:1 ratio; (3) Original shareholders can exercise the warrants at half the stock price when they are issued, obtaining new stocks. Once the poison pill plan is implemented, Shanda's shareholding will be diluted from 19.5% to 2.28%. In the end, Shanda chose to give up in the face of difficulties.

3. White Knight

When a target company faces a hostile takeover, it may bring in a friendly company as a white knight to rescue the target company and drive out the hostile acquirer. White knights typically offer better acquisition terms, raise the acquisition cost, and make it more expensive for the hostile acquirer to the point where they voluntarily abandon the hostile takeover due to increased costs.

Real Case Scenario: Safeway vs Haft family's Dart Group Corporation

In 1986, the Dart Group, controlled by the Haft family, purchased $145 million worth of Safeway stock.And the Haft family proposed to purchase 61.1 million shares of Safeway at a price of $64 per share. Due to Safeway's awareness that this acquisition was not driven by goodwill (the Haft family's Dart Group Corporation was notorious for hostile takeovers), they sought KKR & Co. Inc as a white knight for rescue. Ultimately, KKR & Co. Inc acquired the company at a price of $69 per share.

4. Scorched Earth Policy

The scorched-earth policy is often used as a final defense measure against a hostile takeover because while it can deter the hostile acquirer, it may also damage the original characteristics of the company. The target company is often subjected to a hostile takeover because the acquirer seeks to obtain its most valuable assets, which are referred to as the "crown jewel." These crown jewels can be subsidiaries, branches, specific departments, assets, business licenses, operations, technologies, patents, or talented individuals. In essence, the crown jewel is the primary reason driving the hostile acquirer to pursue the hostile takeover. Therefore, the target company may sell or use the crown jewel as collateral to thwart the hostile acquirer's initial acquisition purpose.

5. Pac-man Defense

The Pac-Man Defense is a strategy employed by a target company when facing a hostile takeover attempt. It involves the target company actively purchasing shares of the hostile acquirer or enlisting a powerful third-party company to buy a significant amount of the hostile acquirer's shares. This tactic catches the hostile acquirer off guard and aims to reverse the takeover attempt. The Pac-Man Defense is more aggressive in nature, as the target company takes the initiative to counterattack and force the acquirer to abandon their acquisition plans.

Real Case Scenario: Bendix Corporation VS Martin Marietta

In 1982, Bendix Corporation initiated a hostile takeover of Martin Marietta by acquiring the majority of Martin Marietta shares, effectively gaining ownership of the company. Yet, during the brief period between ownership and control, Martin Marietta's management strategically sold non-core businesses and launched its own hostile takeover bid for Bendix. Subsequently, Martin Marietta also attempted a hostile takeover of Bendix Corporation. Eventually, in a bid to prevent being acquired by Martin Marietta, Bendix Corporation sought a 'white knight' in Allied Corporation to acquire their own company. This move allowed them to emerge unscathed from the acquisition battle, and Martin Marietta similarly avoided being acquired.

Overall…

In the business world, companies are willing to go to any lengths to expand their market share, including locking in profitable businesses or conducting hostile takeovers. In the fierce competition, companies sometimes act like warriors, employing various strategies to gain a competitive advantage and defeat their rivals. Among these strategies, hostile takeovers are a powerful tactic that can assimilate the target company into the acquirer's portfolio, eliminate competitors, increase market share, and even acquire new technologies, patents, or talent.

However, when facing a hostile takeover, the target company's board of directors does not remain passive. They employ various anti-takeover defences to protect the company's control and independence. These strategies are designed to make the acquisition process difficult, costly, or to deter the acquiring party altogether. Different anti-takeover defences have distinct characteristics and consequences, and the choice of strategy depends on the specific circumstances and strategic objectives of the target company.

In the intense business competition, companies not only focus on their business development but also need to skillfully use anti-takeover strategies to shield themselves from potential hostile takeover threats. The use of these strategies requires careful consideration to ensure that while protecting their interests, they do not negatively impact the company's long-term development.

Community Feedback

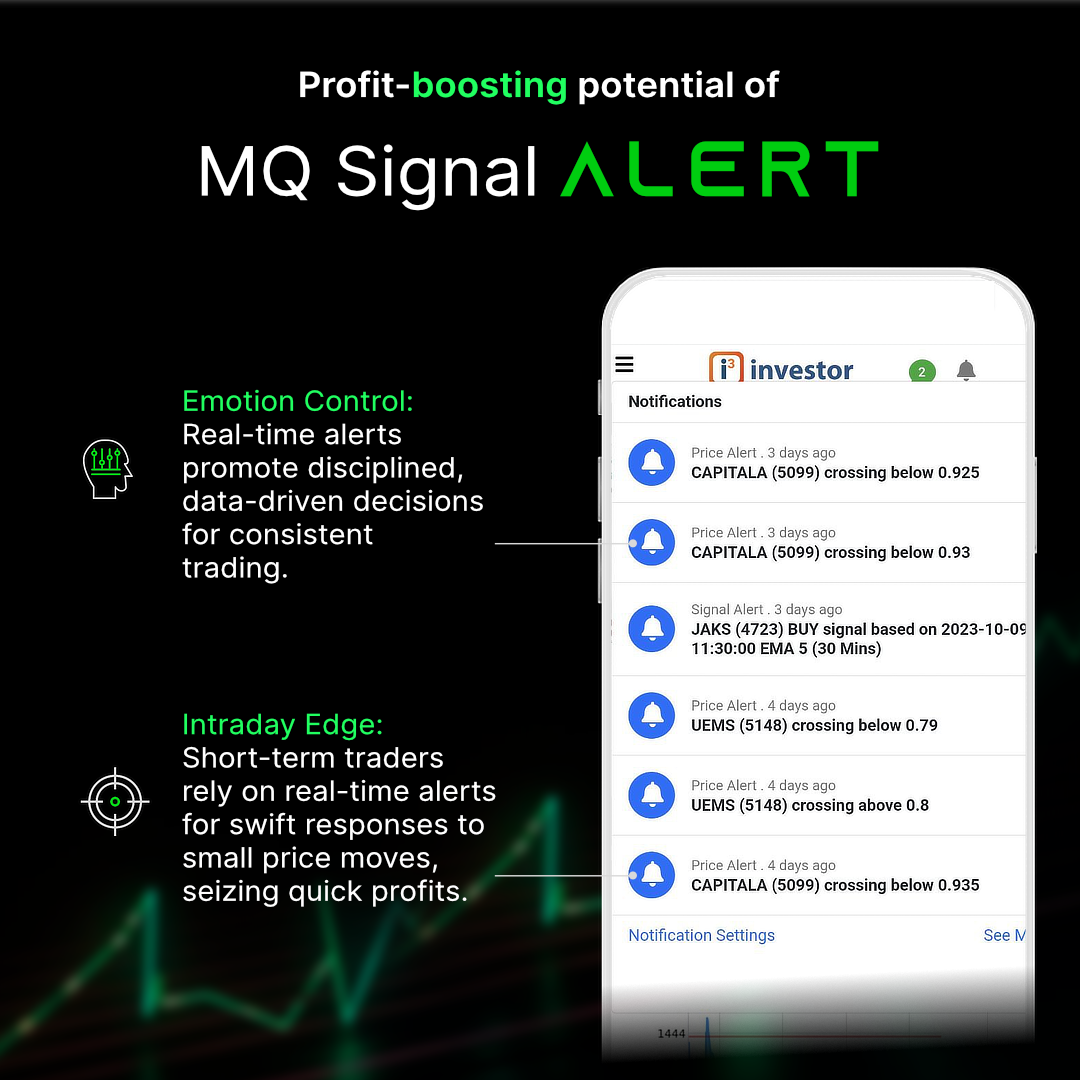

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We would like to develop this system based on community feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered, or initiate a new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023