SG Bank QR Results - Despite negative market, the CEOs remains positive on SG bank's future

MQTrader Jesse

Publish date: Fri, 26 Aug 2022, 04:57 PM

Singapore’s three local banks, namely DBS Group, United Overseas Bank Ltd (UOB), and OCBC Ltd stand as Straits Times Index (STI) pillar as three of these banks make up over 30% of the market cap in STI. UOB was the first bank to report its earnings in the second quarter (2Q2022) and the first half of 2022 (1H2022). This was followed by OCBC Ltd which announced a record net profit for 1H2022. Lastly, Singapore’s largest bank DBS Group weighed in with its result and outlook for the remainder of the year. Therefore, let's have an overview of the quarterly & first half-year report to look at the performance of the bank sector in Singapore.

How have Singapore banks fared in the first six months of global interest rate hikes?

Source: STRAIT TIMES GRAPHICS

According to the financial results of local banks in Singapore, net interest income increased by 16% to 18% year-on-year. This shows that local banks in Singapore continue to expand their business.

Although DBS's non-interest income declined by 11% y-o-y, net profit still increased by 7% y-o-y, driven by the 17% increase in net interest income. OCBC's net income performed well in the 2nd quarter of FY2002, rising 28% to $1.48 billion.

In addition, net interest margin is a profitability indicator used to measure the financial company's income from credit products such as loans and mortgages against the outgoing interest it pays to holders of savings accounts and certificates of deposit (CDs). UOB experienced the fastest growth in net interest margin, increasing 0.07 percentage points in the first half of 2022 compared to the first half of 2021. However, with OCBC growing by 0.06 pts and DBS by 0.05 pts, the growth gap between the three banks is not too large.

In addition, DBS has the strongest earnings per share, which is $2.8, although it decreased by $0.08 compared to H1 FY21. UOB's earnings per share are $2.37, up $0.01 from H1 FY21. OCBC has the weakest earnings per share, which is $1.26, but up $0.07 from H1 FY21. Although OCBC has the lowest earnings per share among the banks, it is the fastest growth compared to the other banks.

Finally, dividend payout is the most important sign that a mature company rewards its shareholders. Based on the table, we can see that DBS and OCBC increased the dividend payout compared to the first half of FY21, while UOB maintained the dividend payout by $0.60.

Based on this financial report, it is easy to see that the banking sector in Singapore itself still has a strong demand space. Moreover, Singapore is a world-renowned financial centre, which is a natural advantage for financial institutions such as Singapore banks. Compared to other Southeast Asian countries, Singapore is also easier to attract and retain foreign capital. This has also led to foreign money contributing a lot to the growth of local banks in Singapore, in addition to the flow of local money.

Bank’s CEO views toward the current market…

DBS CEO Piyush Gupta mentioned that if the interest rate in the United States reaches a peak of 3.5% to 4%, there could be a slowdown in economic growth and a mild recession to curb the rise in inflation. He also mentioned that in this baseline scenario, the flow to Asia remains relatively limited, so we are not facing a recession in our part of the world and the currency depreciation is also manageable.

However, he is also concerned that some uncertainties such as the Russia-Ukraine war will affect energy and food prices, leading to "stubborn inflation." In the meantime, central banks will have to be more aggressive in raising interest rates, which could lead to a significant slowdown and deeper recession in the West, which in turn will have a greater impact on Asia. Mr. Gupta also said that uncertainty over China's reopening and systemic risks from the real estate debt crisis are other issues to watch out for.

OCBC Chief Executive Officer Helen Wong said overall economic growth in her key market is expected to remain positive this year, but at a slower pace due to increased headwinds in the operating environment. She also told reporters that the Russia-Ukraine war is exacerbating tensions in the global supply chain. This is also fueling inflationary pressures, which are having a negative impact on the global economy as a whole. Ms. Wong also mentioned the increasing recession risks caused by monetary tightening in major developed countries. However, Ms. Wong said that recession will not happen in Singapore at this stage, but rising interest rates and slowing economic growth may put pressure on the debt servicing capacity of businesses and consumers.

UOB Managing Director Wee Ee Cheong said they do not expect a recession in their key markets, although growth may slow down. Mr. Wee also mentioned that although the market is slowing down and inflation is picking up, customers are also repaying their loans, so the bank still needs to generate more loans. He added that the bank will continue to benefit from rising interest rates through higher net interest income in the next 12 to 18 months.

The Verdict…

Aside from other uncontrollable factors such as the Russian-Ukrainian war, monetary tightening, high inflation, and future black swan events, the three bank CEOs have roughly the same views on the current market. They believe that current factors will lead to a slowdown at best, not a recession. Moreover, reasonable interest rate increases will also bring some benefits to the banking sector. Besides, the bank itself has strong fundamentals. Therefore, the three CEOs generally believe that the bank's future prospects will continue to grow as long as no extraordinary events in the market disrupt the economy.

Click here if you would want to know more on Singapore Banks!

Community Feedback

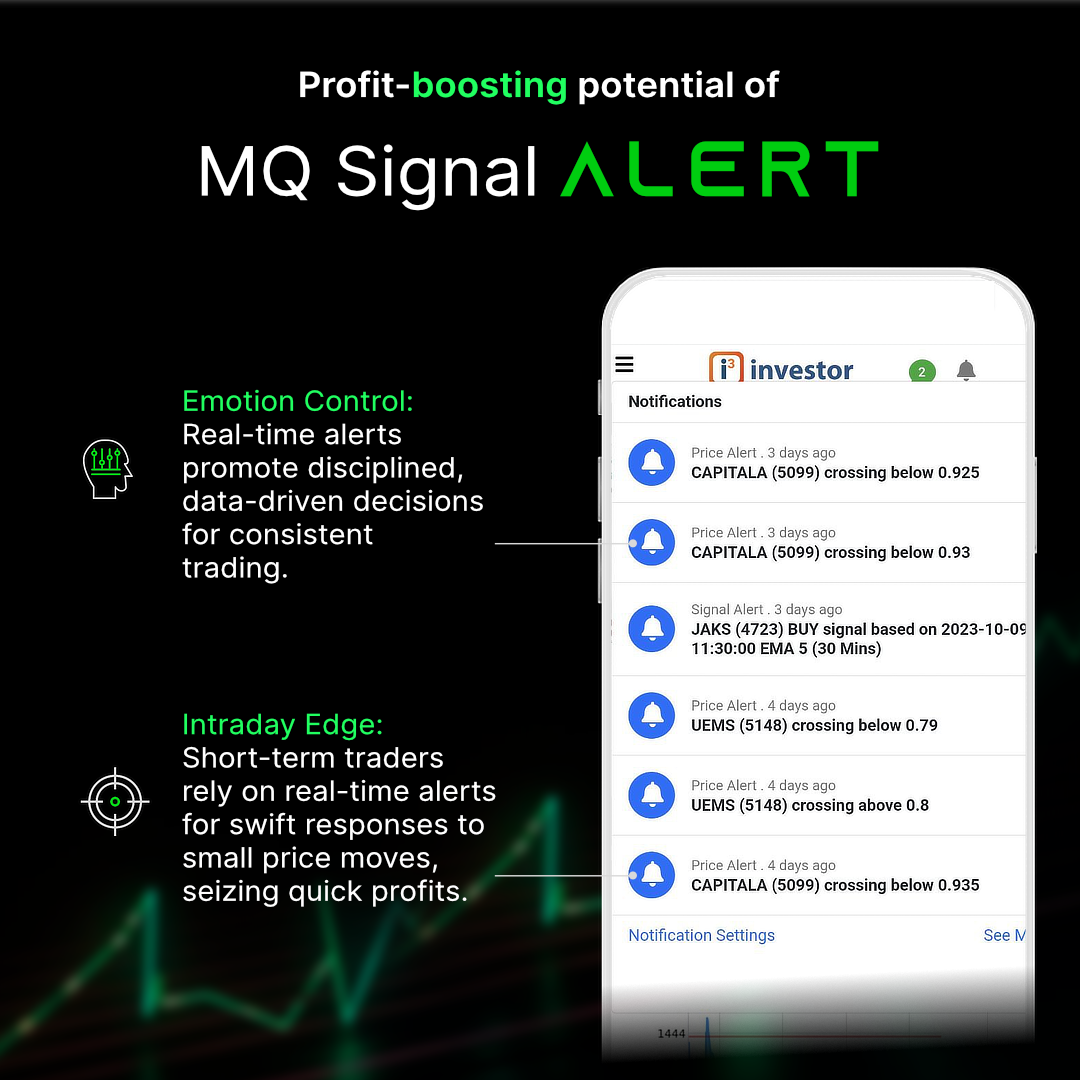

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023