A Debt Storm is Coming: Which country will potentially be the next Sri Lanka?

MQTrader Jesse

Publish date: Fri, 14 Oct 2022, 03:13 PM

Sri Lanka is 'bankrupt,' Prime Minister says

This news was published by CNN on July 6, 2022. It makes people think that besides the current Russian-Ukrainian crisis, there is also a gray rhino, namely the debt crisis. Since globalization, the link between nations is stronger than ever, which means that the bankruptcy of one country might trigger a domino effect and affect the whole world.

With unbridled borrowing during the pandemic, the world's debt has once again reached a new record. According to the IMF, the rate of increase in the budget deficit and debt accumulation is the highest compared to previous recessions, including the most severe economic recession, the Great Depression, and the 2008 financial crisis. Only the two world wars in the 20th century can be compared to this.

Therefore, people have to be concerned about what will cause a country to go bankrupt and which country might be involved in a dangerous zone.

How did Sri Lanka end up bankrupt?

Due to a complicated historical issue, Sri Lanka ended its 26-year civil war in 2009. As an underdeveloped agricultural country, Sri Lanka has always depended on the exports of tea, rubber, and coconuts to secure its foreign exchange earnings. The textile industry is the most important sector contributing to foreign exchange earnings.

However, with the rapid growth of production levels among the world's developed countries. Sri Lanka's market share in textiles was damaged by India and Vietnam. And the tea market is damaged by India. As a result, Sri Lanka's orders decreased and affected the country's revenue. In addition, due to geographical factors, Sri Lanka has to import many necessities such as crude oil, wheat, raw sugar, etc. from abroad.

Tourism is also one of Sri Lanka’s important economic contributors. At its peak, Sri Lanka's tourism revenue accounts for about 12% of GDP and 14% of foreign exchange reserves. But things started to change after the country faced a horrific terrorist incident in April 2019, when the Easter Sunday Bombings in the national capital of Colombo, resulted in the deaths of 250 people, of which 42 were foreign nationals traveling to Sri Lanka. And with the emergence of Covid-19, caused Sri Lanka to face its worst foreign exchange crisis. This year, tourism accounts for around 5% of Sri Lanka's GDP, with the U.K., India, and China as the most important markets.

The three pillar industries that procure foreign exchange are affected to different degrees and from different aspects. This is the reason for the reduced inflow of funds to Sri Lanka’s foreign exchange reserves. The war between Russia and Ukraine has also led to an increase in crude oil and food prices. As mentioned earlier, Sri Lanka is dependent on necessary products from abroad, and the price increase will increase the outflow of funds from foreign exchange reserves. In the end, Sri Lanka couldn’t afford to make payments on imports, which would lead to bankruptcy as foreign exchange reserves are depleted.

(Source: usnews.com) People waiting to buy fuel at a fuel station in Colombo, Sri Lanka, June 27, 2022.

Government Policy

In addition to the factors mentioned above, there are also some internal factors, such as government policies. Sri Lanka has lost about 10 lakh taxpayers in the last two years after Gotabaya Rajapaksa's government announced sweeping tax cuts in 2019 to boost growth. In addition, the Sri Lankan government printed 1.2 trillion rupees in 2021 and 588 billion rupees in the first quarters of 2022 alone, and Sri Lanka's money supply has increased by 42% in the last four years. Overprinting money will eventually lead to inflation.

The Sri Lankan government's chemical fertilizer ban has left more than two million farmers, or about 27% of the country's labor force, scrambling for natural fertilizer. The government has failed to increase domestic production of organic pesticides and fertilizers, or provide subsidies to farmers to purchase them.

This sudden policy change led to a decline in crop yields. For rice, Sri Lanka's staple food, which the country used to produce in sufficient quantities and even export, average yields fell by about 30%. For the first time in decades, Sri Lanka had to import rice. Production of tea, the country's most important export, fell by 18%, reducing the country's foreign exchange earnings. Following protests by farmers, the ban on imports of chemical fertilizers was eased in November 2021, but the economic damages done by this policy change are already done and irreversible…

To sum things up, various internal and external factors are destroying Sri Lanka's economy.

- Long-standing civil war leads to insufficient national strength

- The wrong policies of the government make the country uncompetitive.

- Core industries have a low barrier to entry, and a lack of technical skills to remain competitive

- Excessive dependence on foreign imports for necessary products.

- Foreign exchange reserves are chronically inadequate.

- The national currency remains unstable for a long time.

- Stubbornly high inflation.

(Source: Politico.com) Protestors burn an effigy of acting President and Prime Minister Ranil Wickremesinghe as they demand his resignation in Colombo, Sri Lanka.

Which country will potentially be the next Sri Lanka?

The whole world is currently experiencing high inflation, which makes an already indebted country even worse. This is because when inflation is high and reaches a dangerous range, the Federal Reserve will raise the interest rate, which will cause the USD to flow into the US and appreciate against other countries' currencies. Since settlement is done through SWIFT, all trade must be done in USD. This increases the cost of imports for one country, and once the country's foreign exchange reserves are no longer sufficient to make the payments, it will go bankrupt.

Let’s not dive too deep into what awaits if one country goes bankrupt. Instead, let’s observe and evaluate different countries that may go down the same as Sri Lanka...

Turkey

Before the Covid 19 pandemic, foreign tourist visits to Turkey were increasing by about 14% per year. According to Turkey's official data, Turkey received 51.9 million tourists in 2019, an increase of 13.7% from the previous year, of which 80% were foreign tourists. Turkey's tourism revenue amounted to $34.5 billion in 2019, an increase of nearly 20% compared to 2018 and a record high.

During the epidemic, the number of tourists visiting the country directly decreased by 78%. As a result, one of the most important ways for Turkey to generate foreign exchange reserves has been lost. The long-term trade deficit is also one of the reasons affecting foreign exchange reserves (current foreign exchange reserves are around USD 60 billion). In addition, the Turkish economy is already riddled with holes. The CPI is over 70% and the trend is still rising. The value of the lira has fallen by 44% against the dollar in 2021, which will lead to high inflation, and in addition, the country will need more lira to import goods, which in turn will affect foreign exchange reserves.

Egypt

The price increase in food, fertilizer, and energy prices caused by the conflict between Russia and Ukraine has led to a drastic deterioration of Egypt's economic situation and has severely affected the normal life of the population. Egypt is the largest importer of wheat in the world, with 59.7% coming from Russia and 22.3% from Ukraine. The rise in wheat prices caused the price of unsubsidized food in Egypt to increase by 50% in the short term, and inflation also jumped to 15.3% in May from 4.8% a year earlier.

On April 4, 2022, the Egyptian government announced that current wheat stocks would last only 2 months and 18 days. The U.S. Federal Reserve's unstoppable rate hike expectations have led to massive outflows of foreign capital from Egypt, further straining the country's unhealthy economic structure. Egypt's net foreign exchange reserves have fallen from $40.9 billion in February to $37 billion at the end of March 2022, while the country's total external debt stands at $137 billion at the end of the 2020-2021 fiscal year, up threefold from $33.7 billion in 2010. This means that Egypt now spends one-third of its national budget on debt repayment and interest. Egypt's currency, the Egyptian pound, fell to 18.71 against the dollar on June 9, its lowest level in five years, according to Refinitiv statistics.

Lebanon

Like Sri Lanka, Lebanon faces many challenges, such as the collapse of its currency, shortages of goods, severe inflation, increasing hunger, lack of gasoline buyers, and a sharp decline in the middle class. In addition, the country has endured a long civil war, with government incompetence and terrorist attacks hampering the recovery. Longstanding anger against the ruling class erupted in late 2019 when the government proposed new taxes, triggering months of demonstrations.

As a result, Lebanon's currency began to lose value as it was unable to repay debts of around $90 billion, which account for 170 percent of gross domestic product (GDP). Lebanon is one of the most indebted countries in the world. In June 2021, when the Lebanese pound had lost almost 90% of its value, the World Bank declared that the country was in the worst crisis in the world in more than 150 years. On April 04, 2022, the Deputy Prime Minister of the Lebanese government, Saadeh Al-Shami, "declared the bankruptcy of the state and the Lebanese Central Bank on Monday."

Verdict

The main causes of defaulters and country bankruptcies are instability, and damaged domestic economy. These will cause a slowdown in foreign exchange earnings and a depletion of foreign exchange reserves. If the Fed continues to raise interest rates now, it will devalue the currency, increase the country's import costs, and further damage foreign exchange reserves. Due to insufficient foreign exchange reserves, the country will be unable to stabilize its currency, which is a vicious cycle that will eventually lead to the country's bankruptcy.

Community Feedback

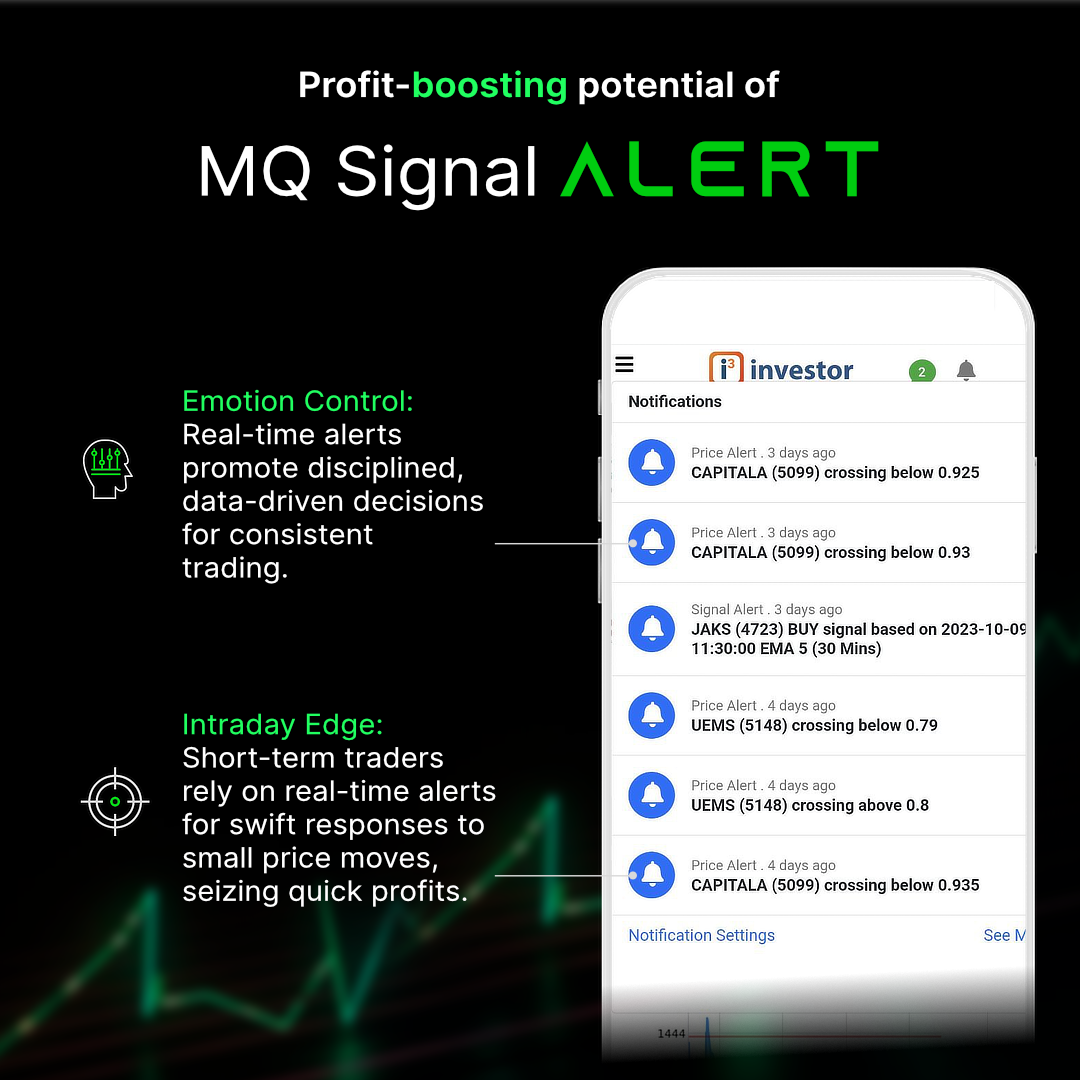

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023