Why must we invest in Singapore market?

MQTrader Jesse

Publish date: Fri, 28 Oct 2022, 10:06 AM

Singapore, as a neighboring country of Malaysia, thought it was just an inconspicuous small country, but with its own excellent management, it has used limited resources to become a financial giant. According to the World Competitiveness Ranking 2022 Results, Singapore ranked 3rd place, Malaysia ranked 25th, and Thailand ranked 28th. Through the ranking, we can know Singapore is really performing well to develop its country.

Here is the reason why you should definitely invest in the Singapore market: -

The currency is stronger than other neighboring countries

The Singapore currency is often considered a safe haven compared to other currencies in Southeast Asia. The Singapore currency has held up well despite a stronger dollar. The Singapore currency is also often seen as a relatively "safe" currency. Especially in Southeast Asia, the decline against the USD is simply not worth mentioning, even though the SGD has lost almost 6% so far. So, investing in the stock market denominated in a Singapore currency is equivalent to owning a Singapore currency, and you do not have to worry about exchange rate losses when investing.

Asian financial center, favored by foreign investors

Benefiting from the government's open trade policy, Singapore has successfully attracted foreign direct investment and welcomed foreign companies to the local market. This policy has cemented Singapore's status as one of Asia's top financial centers, and many multinational companies have also set up stores in the region. Singapore is the fourth largest financial center in the world and the third richest country in the world. It is the largest foreign exchange trading center in the Asia-Pacific region and the third largest in the world, after New York and London. Therefore, the world-famous Singapore is also known as a recognized financial center in Southeast Asia.

The stock market is stable, suitable for long-term investment

The securities market in Singapore has a history of over 60 years, and the derivatives market has a history of over 30 years. As an international capital market in the Asia-Pacific region, the Singapore market has a very high degree of internationalization and an excellent market supervision system. The main investors are also international institutional investors who focus on long-term values and sustainability.

According to the Singapore Exchange, as of the end of September this year, there were 734 listed companies on the Singapore Exchange with a total market value of USD661 billion, with the market value of non-Singapore companies accounting for 43%, including many high-quality listed companies in Southeast Asia, South Asia, and other Asia-Pacific regions, as well as more than 100 multinational companies from mainland China.

Over the ten years from 2008 to 2018, the Straits Times Index (STI), Singapore's market benchmark, delivered an annualized return of 9.2%, with a cumulative return of more than 140%. It outperformed the Hang Seng Index's annualized return of 9.1% over the same period and significantly outperformed the CSI 300 Index's annualized return of 6.6%. High corporate dividends are an important factor in the return of the Straits Times Index. The current average indicative dividend yield of the 30 companies included in the Straits Times Index is 3.8%, almost the highest in Asia. In addition, Singapore's very distinctive REITs and REITs with an average high dividend payout ratio of 6.4% and low volatility also provide long-term cash flow for stable investors.

The world's second-largest REITs market

Singapore introduced its first REIT back in 2002 (before that, only a few countries in the United States, Australia, and Japan introduced REITs, and China has yet to do so). The second largest, most international and most mature REITs market. Currently, Japan has 58 REITs projects with a total market value of S$141.2 billion; Singapore has 42 REITs projects with a total market value of S$84.8 billion; Hong Kong has 13 REITs projects with a total market value of S$48.2 billion. Most of the listed REITs in Singapore invest not only in local properties but also in overseas properties throughout Australia, the United States, China, Malaysia and Europe. According to data released by the Singapore Exchange in July 2018, the average annual dividend yield of 34 S-REITs and 6 stacked stocks is around 6.7%, and historical data in recent years shows that the average annual dividend yield is also around 6%. From 2010 to 2017, the dividend yield of the Singapore REITs Index was among the highest in the world for a long time.

Limited time benefits (Free to join)

There are 2 campaigns to win up to 6,000 SGD, which is

- RM 100 Cashback Campaign

- Trade SGX & Win Campaign

RM 100 Cashback Campaign (Duration: 1 Oct 2022 to 31 Dec 2022)

Open a free trading account with MQ Trader’s advertiser, the account is under the AmEquities LYH group.

After your account is created, you can buy any 3x Singapore stocks and you will receive RM 100 guaranteed cashback.

Trade SGX & Win Campaign (Duration: 1 Oct 2022 to 31 Mar 2023)

This campaign has 2 types of rewards, and the reward is in Singapore dollars!

First Reward: Monthly Reward

3 winners will be selected to win up to 1,000 SGD every month by being in AmEquities’ top 3 highest-traded clients for Singapore stocks

Second Reward: Final Prize

Top 5 highest traded clients for Singapore stocks, within the duration 1 Oct 2022 to 31 March 2023 able to win the prize pool of 10,000 SGD!

If you really want to invest in the Singapore market, this is a good opportunity for you. You can earn different rewards while starting your investment journey.

Please click here to sign up for an account to start your SGX trading or you can contact us to know more details!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

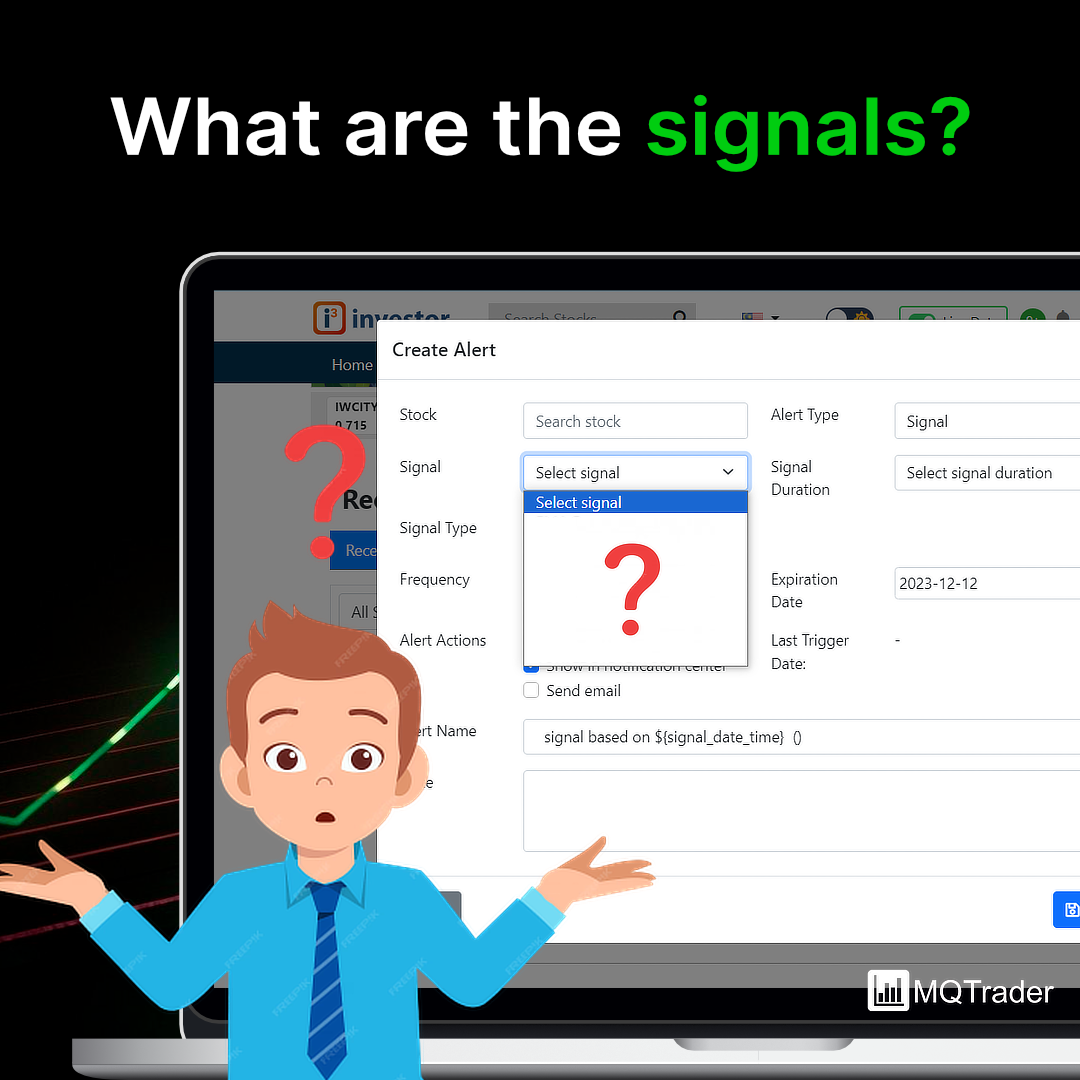

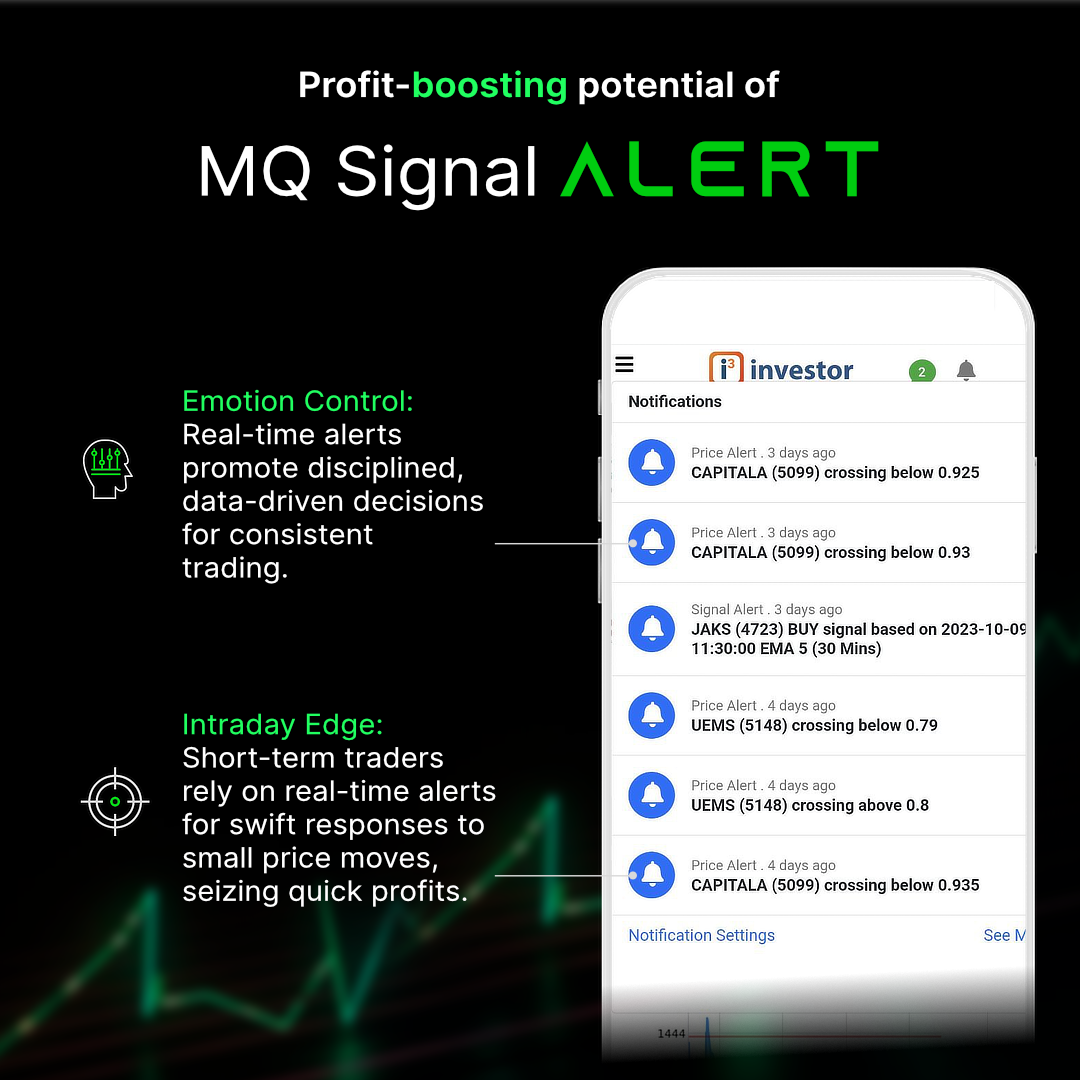

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023