Bullwhip effect, which might cause the US face deflationary

MQTrader Jesse

Publish date: Fri, 25 Nov 2022, 11:41 AM

Big Short Investor - Michael Burry mentioned Bullwhip Effect

The big short investor, Michael Burry, who successfully predicted the 2008 Subprime Mortgage Crisis, posted a statement on Twitter mentioning the bullwhip effect. In this statement, Michael Burry believes that the current CPI is a false manifestation of the bullwhip effect. At the end of the bullwhip effect, deflation will occur and cause disinflation in CPI this year. In the end, the Fed will have to start lowering the interest rate and easing monetary policy again.

So let’s begin to understand the logic from its fundamentals.

What is the bullwhip effect?

In 1961, the bullwhip effect was described by J. Forrester in Industrial Dynamics. The basic theory is that customer demand is volatile in the normal course of business, so the supplier must always predict customer demand to optimise the inventory. However, the prediction depends on the statistical basis, usually, it is not quite accurate. Therefore, the company will order additional stock to serve as safety stock for unexpected orders received from customers.

According to the figure, the actual customer demand is 9 units, but retailers forecast customer demand of 10 units and order a total of 15 units (10 units for customer demand + 5 units of safety stock) from the distributor. Meanwhile, the distributors also increase their order to 20 units (15 units for retailer demand + 5 units of safety stock), and the distributors intentionally increase their order quantity to get a volume discount from the manufacturer. If several distributors want to increase the order quantity, the manufacturer will also produce more products, namely 40 units. In the end, the actual customer demand is only 9 units, but the manufacturer will produce 40 units of the product.

This is also the main reason why Michael Burry thinks deflation is likely due to excessive inventories. This action will push inflation down and cause deflation in the economy.

Why does Michael Burry believe that the high CPI is not persistent over time?

Let's explain the story from the beginning of the timeline.

In 2020, the Covid-19 pandemic swept around the world, the Federal Reserve decided to lower the interest rate to 0-0.25% (the lowest in history) and implement the largest quantitative easing in history, which is indefinitely quantitative. The goal of this decision is to save the economy while laying the foundation for high inflation in the future.

When the money supply in the economy increases, people will have more money to spend, which will increase people's willingness to spend money, and eventually, retail sales will increase continuously. In response, retailers will order more goods and build more safety stock to ensure their business is doing well. When retailers order more inventory from distributors, the distributors will also increase the order quantity from the manufacturer.

At the same time, several countries/states started to implement lockdowns, due to the Covid-19 pandemic. This has disrupted the supply chains that countries have built over the years. As a result, the manufacturer will produce more products than in the order book, so distributors will always have spot goods when they place orders. The sellers at all levels feel that inventories are insufficient and orders are increasing, leading to excessive accumulation of goods.

As inventories build up, so does the side effect of money printing, namely runaway inflation, and the Fed will implement quantitative tightening and raise interest rates to try to curb demand, which indirectly affects inflation. Michael Burry believes that our economy is in a period of high inflation that only appears to be. He believes that deflation will occur as soon as inventories are made available to the public when the supply of products exceeds the supply of money. Deflation will cause the economy to slow down and fall into recession, and the Fed will begin the QE and lower interest rates.

Did the US Fed make the right decision to plan?

The Fed's recent drastic rate hike is not only to curb inflation but also to create enough room to cut rates in a future recession to stimulate the economy. The Fed is aware that 0-0.25% interest rates will be insufficient to deal with the coming recession.

Does the Fed realize that a recession will inevitably come, and therefore plan ahead, i.e., increase the scope for rate cuts so that it has enough room to cut rates later? Perhaps only time will give us the most accurate answer on this point.

It is worth noting that the founder of ARK Invest, Cathie Wood, has mentioned that we will face a cyclical deflation since last year. She believes under the Covid-19 pandemic, consumption behaviour changed from service consumption to product consumption, coupled with the businesses shut down. This causes an imbalance in demand and supply. Therefore, people will probably double - and triple-ordering beyond their needs. As a result, once Covid-19 passes and companies face excess supplies, prices should unwind.

MQ View

According to the theory of the bullwhip effect, we believe that there is a high possibility for deflation to happen when an excessive supply of products occurs. However, the inflation has been prolonged unexpectedly due to several factors such as the expanded Ukraine-Russia War that have deteriorated the supply chain issue. If inflation continues to surge, the U.S. will face a recession eventually before deflation occurs. Therefore, we also believe that the Fed will raise interest rates at any cost to bring down inflation. In addition, U.S. economic data remains very strong, which also gives the Fed enough confidence to continue raising rates. If the Fed takes the opportunity to raise interest rates to comfortable levels, it can also use lower rates to stimulate the economy when deflation occurs in the future.

According to the theory of the bullwhip effect, we believe that there is a high possibility for deflation to happen when excessive supply of products occurs. However, the inflation has been prolonged unexpectedly due to several factors such as the expanded Ukraine-Russia War that deteriorate the supply chain issue, the U.S. will face a recession eventually before deflation occurs. Therefore, we also believe that the Fed will raise interest rates at any cost to bring down inflation. In addition, U.S. economic data remains very strong, which also gives the Fed enough confidence to continue raising rates. If the Fed takes the opportunity to raise interest rates to comfortable levels, it can also use lower rates to stimulate the economy when deflation occurs in the future.

Community Feedback

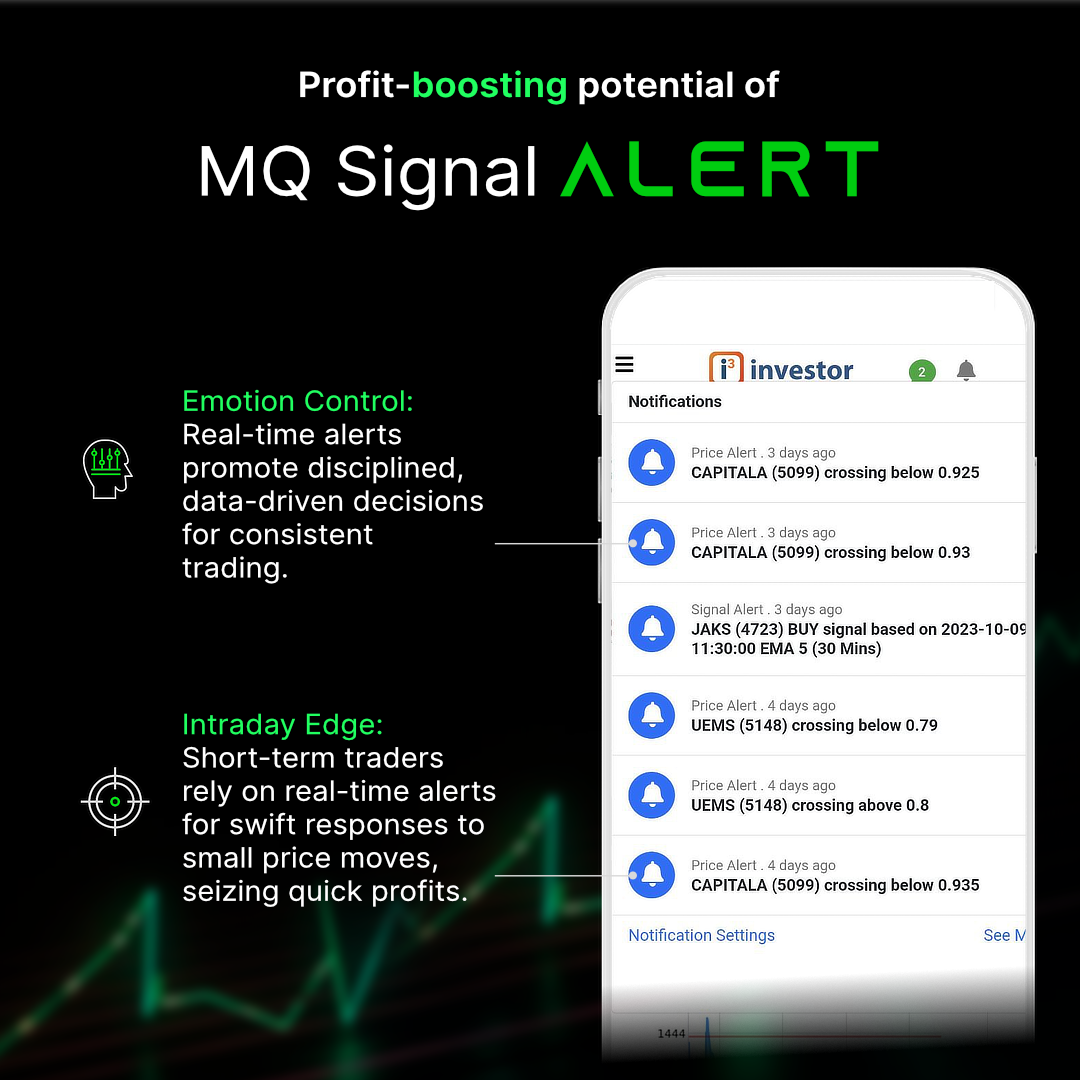

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023