What's wrong with the bank sector ?

MQTrader Jesse

Publish date: Fri, 24 Mar 2023, 05:35 PM

Shares of SVB Financial Fall 60% as tech-focused bank looks to raise more cash, announced by CNBC on 9 March 2023

Source: CNBC

On March 9, news of liquidity risks faced by Silicon Valley banks hit the market like a black rhinoceros, shattering investor confidence and disrupting the Federal Reserve's pace of raising interest rates. Investors had enjoyed relative stability throughout 2022, but this "expected surprise" finally materialized in early 2023. Unfortunately, the long-term high-interest rate environment had plunged the 16th-largest bank in the United States, Silicon Valley Bank, into deep liquidity risks, ultimately resulting in its bankruptcy. Soon after, Signature Bank, the 19th largest bank in the US, also declared bankruptcy. In less than three days, two consecutive banks, with market capitalizations of over 100 billion, were wiped out. The media even reported that Silicon Valley Bank's collapse was the second-largest bank crash in US history.

But why did this happen?

Silicon Valley Bank, as its name suggests, serves venture capital funds and start-up companies in Silicon Valley. Due to its customer base, its main source of funds comes from venture capital financing in the market, including cash from start-up companies. However, after the Federal Reserve started raising interest rates, financing became difficult, resulting in stagnant deposits. Additionally, start-ups have a high burn rate and need to withdraw funds from bank accounts frequently.

As Silicon Valley Bank struggled to remain financially stable, liquidity risks gradually emerged. Eventually, they had to sell their Treasury bonds, which led to actual losses from book losses. The bank sold a total of 21 billion dollars in Treasury bonds, resulting in an estimated loss of 1.8 billion dollars. To make up for this loss, the CEO announced plans to raise funds from the market to deal with potential liquidity risks in the future.

However, this move prompted various institutions to call on the public to withdraw their funds from Silicon Valley Bank, triggering a run on the bank. This wave of withdrawals gradually spread from Silicon Valley Bank to all small and medium-sized banks in the United States. Two main factors contributed to the liquidity risks faced by Silicon Valley Bank: the tightening of the macro environment and the nature of its clients.

The actions have been taken by the Department of the Treasury, Federal Reserve, and FDIC.

Source: U.S. Department of The Treasury

On the weekend of the incident, the three major U.S. institutions jointly issued a statement, including the Department of Treasury, the Federal Reserve, and the FDIC. The statement primarily conveyed to the public that, in order to protect the US economy, they had decided to endorse the incident and boost market confidence in the US banking system. They also re-emphasized that all depositors will have access to all of their money starting Monday. However, investors and some unsecured creditors were not included in the protection and would have to bear any losses themselves.

At the same time, the Federal Reserve announced the BTFP plan, which explains how it will help banks face liquidity problems. While most banks have assets, they may struggle to convert them into cash quickly, particularly in a tightening environment. However, the Federal Reserve allows banks to mortgage their assets to the Federal Reserve in exchange for cash, including US Treasuries, agency debt, MBS, and other qualifying assets. The Fed charges a reasonable interest rate for this service.

For more information, click here to view the report details (BTFP plan)

The market reaction toward the incident

Source: CNBC

While the risk of bank runs has been temporarily eased, the market is still reacting to potential risks among small and medium-sized banks. On the first day, many banks triggered the circuit breaker in turn, resulting in declines ranging from 20% to 60%.

This incident led the market to believe that the Fed's attitude will turn dovish and they will start cutting interest rates and start QE again within the year, as economic stability is believed to be more important than inflation.

MQ Trader’s View

The collapses of Silicon Valley Bank (a subsidiary of SVB Financial) and Signature Bank caused a widespread sell-off across the banking sector. These two bank failures have brought fear to investors who are concerned about whether there are still more problematic banks being uncovered. There will be challenges ahead for the sector in terms of earnings this year and tightened regulation in the future. However, we believe that most banks will survive this, as they are having healthy financial positions with deposit bases that are much more diversified than SVB. Many banks are observed to be oversold and poised to rebound, forming attractive entry points for many of these stocks.

As Warren Buffett once said, "Be greedy when others are fearful, and be fearful when others are greedy." When uncertainty is at an all-time high is often when the best opportunities emerge themselves. Therefore, investors must remain vigilant and ready to take advantage of any irrational sell-off by accumulating shares of companies with sound fundamentals.

Always be ready with your foreign investment account!

If you do not have an account to invest in the US stock market, you can click the link below to pre-register for an M+ global investment account.

Competitive Brokerage rates

- US Market: 0.2% (min USD 3.00)

- HK Market: 0.2% (min HKD 18.00)

Additionally, you can also enjoy additional benefits by registering early from the exclusive pre-registration campaign. By clicking the link to pre-register and depositing RM 10,000 within the first month, you will receive:

- 5 units of Grab shares

- HK live quotes LV1

- US market live quotes LV1

The validity of Pre-registration from 06/03/2023 to 31/03/2023

Register link: https://m.global.mplusonline.com/activitiesr/question?drCode=R313

Community Feedback

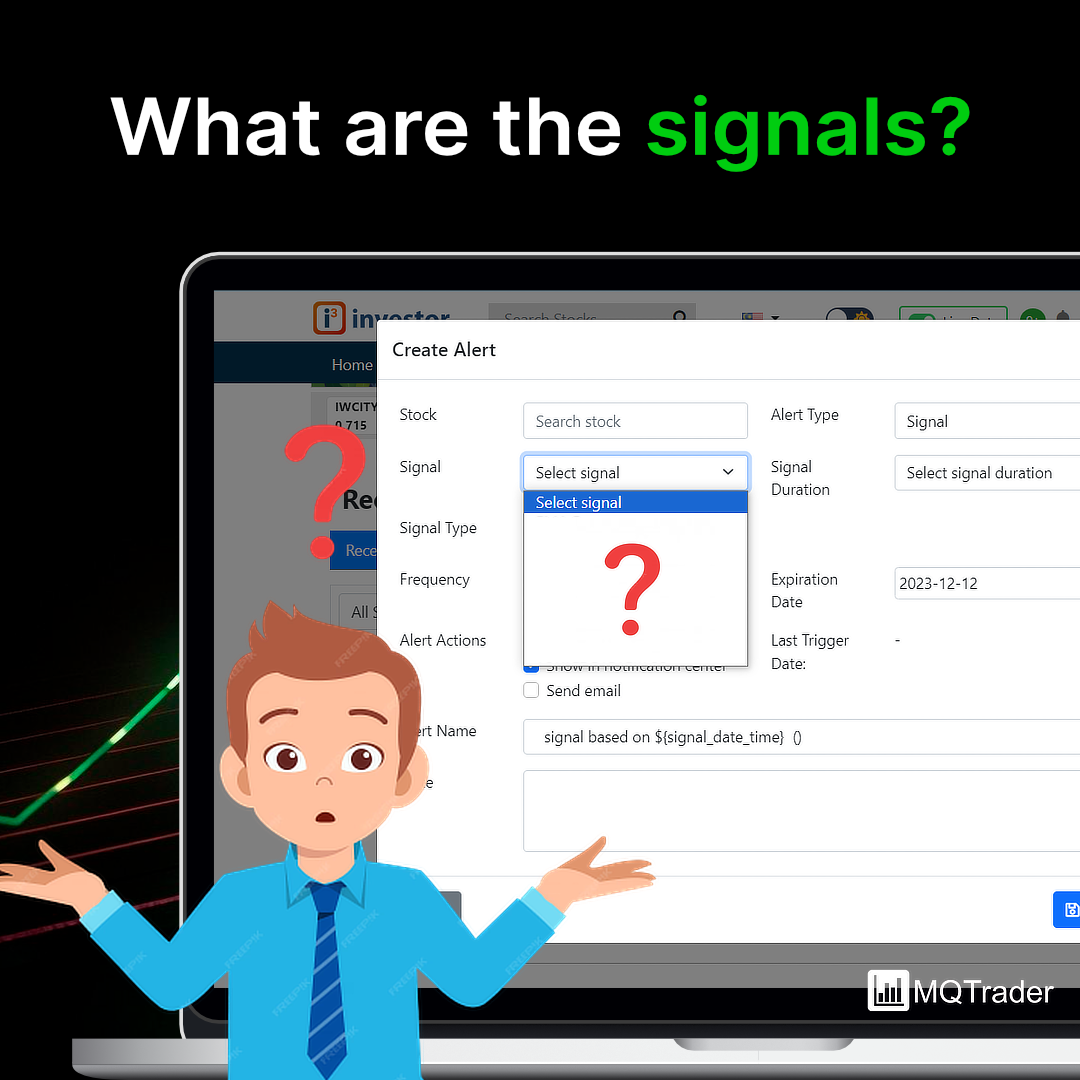

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We would like to develop this system based on community feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered, or initiate a new position in the stock within the next 7 days.

Join us now!

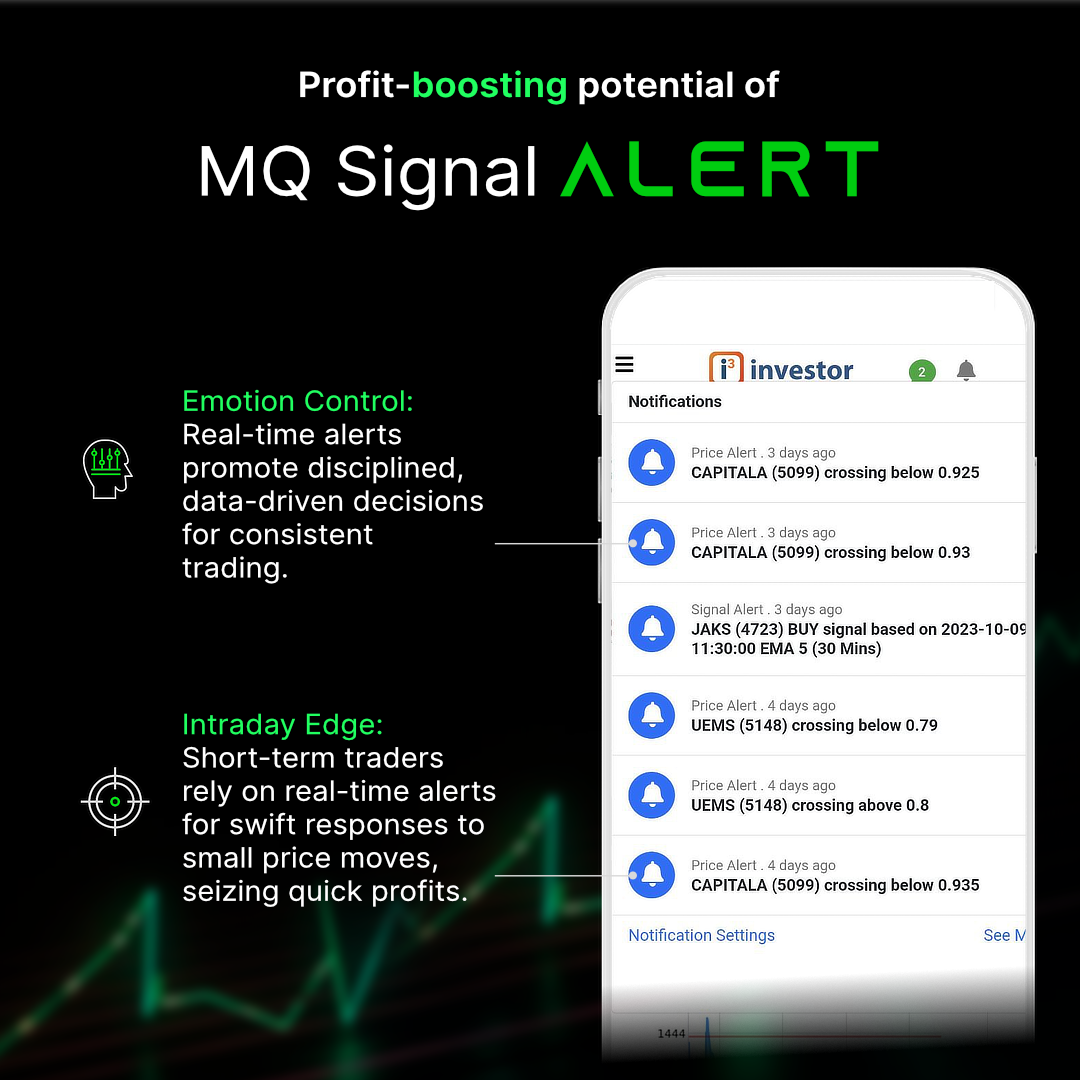

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023