SGX Market Update: The top 5 industrial sector-related companies with the best stock performance!

MQTrader Jesse

Publish date: Tue, 30 May 2023, 09:17 AM

- The Industrial Sector has ranked among the five strongest performing global Sectors in the YTD, with gains extending to the Asia Pacific. Total returns of Singapore’s 20 most traded Industrial Stocks for the 20 weeks have seen three gainers for every one decliner, with asymmetrical returns producing average & median total returns of 16% & 3%.

- Last week, these 20 stocks were led by Marco Polo Marine, Yangzijiang Shipbuilding and Singapore Airlines, with the trio averaging 11% price gains on combined net institutional inflow of S$16 million. Last week the 20 stocks booked S$34 million of net institutional inflow, reducing their combined YTD net institutional outflow to S$55 million.

- On 11 May, Marco Polo Marine reported 102% YoY revenue growth for its 1HFY23 (ended 31 Mar), while on 16 May, Singapore Airlines reported FY22/23 (ended 31 Mar) revenue growth of 133%. Yangzijiang Shipbuilding’s share price gain from S$1.18 to S$1.27, coincided with the USD/CNY returning to Dec 2022 levels, above the 7.00 threshold.

Company Highlight

MarcoPolo Marine [Stock Code: 5LY] is an integrated marine logistics company that primarily operates in Singapore, Indonesia, Australia, Myanmar, Taiwan, and Malaysia. The adjusted net profit attributable to owners has surged more than fourfold to S$8.5 million in 1HFY2023, driven by growth in both the shipyard and ship-chartering segments. The company's shipyard segment has secured new build contracts, ensuring revenue visibility until 1HFY2024. The management anticipates increased demand for OSVs (Offshore Support Vessels) as oil and gas activities rebound, along with ongoing support for Taiwan's offshore wind farm through the Oceanic Crown Offshore Marine Services joint venture.

YZJ Shipbldg SGD [Stock Code: BS6] is a large enterprise group primarily engaged in shipbuilding and marine engineering manufacturing, with supplementary operations in shipping leasing, trade logistics, and real estate. It operates primarily in China, Canada, Japan, Bulgaria, and other Asian and European countries. In FY2022, the group achieved year-on-year revenue growth of 37% to reach RMB 20.71 billion, driven by a record-high number of vessel deliveries to customers. In a press release issued this February, the group recommended a final dividend of S$0.05 per ordinary share for FY2022, representing a payout ratio of 36%. Furthermore, the group has raised its order-win target for FY2023 by 50% from the initial US$2 billion to US$3 billion.

SIA [Stock Code: C6L] is a world-leading airline and the flag carrier of Singapore, providing passenger and cargo air transportation services under the Singapore Airlines and Scoot brands across East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa. For FY2022/2023, the group has announced a record operating profit of S$2,629.1 million, representing a reversal of S$3,301.8 million from the previous year. This significant improvement is primarily attributed to the increase in passenger revenue, which reached $10,559.7 million, driven by record Passenger Load Factor (PLF) and Revenue per Available Seat Kilometer (RASK). The group has also reported a net profit of S$2,156.8 million for FY2022/2023, marking a substantial turnaround from the net loss of $962.0 million reported last year. As part of their financial announcements, the group has proposed a final dividend of S$0.28 per share.

Dyna-Mac [Stock Code: NO4] is a global leader in the design and construction of modules for the hydrocarbons industry. In 1Q2023, the group achieved year-on-year revenue growth of 29.3% to reach S$87.3 million, primarily driven by higher progressive recognition for projects carried out during the quarter. The earnings per share for 1Q2023 stand at S$0.37, marking a 95% YoY increase. Furthermore, the group has successfully secured several firm contracts, totaling a provisional sum of S$270 million, from its repeat customers. This brings the net order book to a value of S$608.1 million.

SIA Engineering [Stock Code: S59] is the leading provider of maintenance, repair, and overhaul (MRO) services to airline carriers and aerospace equipment manufacturers in Asia and globally. For FY2022/2023, the Group has reported revenue of S$796.0 million, representing a significant year-on-year increase of 40.6%. This growth can be attributed to the resurgence in demand for maintenance and overhaul services in line with the recovery of flight activities. Regarding the group's financial position, the Equity attributable to owners of the parent reached S$1,666.1 million at the end of FY2022/2023, indicating a year-on-year increase of $55.4 million (+3.4%). This increase was primarily driven by the profits earned during the financial year. Notably, the board is recommending a final ordinary dividend of S$0.055 per share for FY2022/2023, which marks the first dividend since the onset of the Covid pandemic.

Want to stay up-to-date in the Singapore market?

Click hereto get the latest update of upcoming events and highlights of opportunities to invest in the Singapore stock market. Various attractive rewards like check-in rewards, mysterious gifts and promotions will be given away during the campaign period.

Don’t miss out on the latest news, trends in the market and rewards - check out our campaign today!

Community Feedback

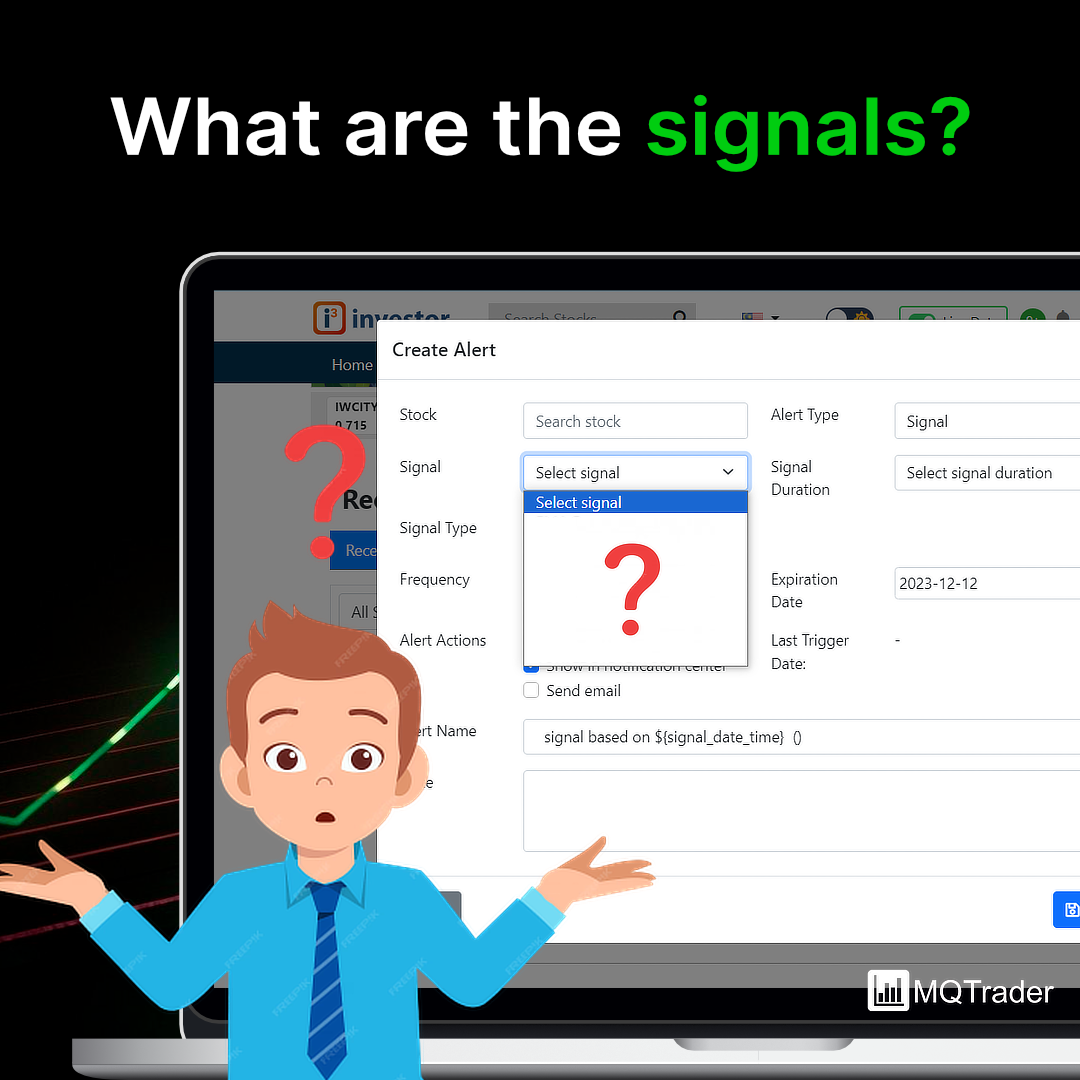

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We would like to develop this system based on community feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered, or initiate a new position in the stock within the next 7 days.

Join us now!

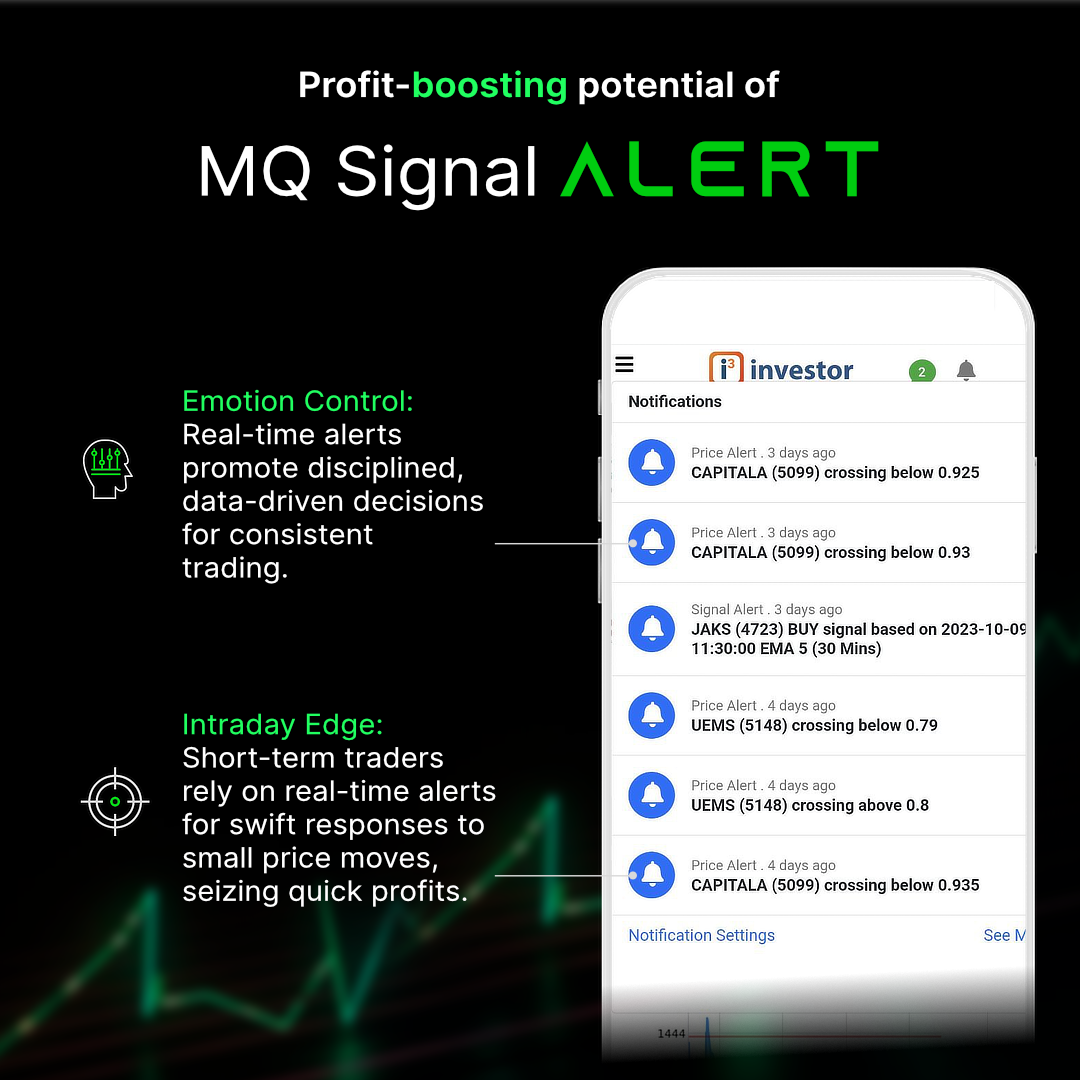

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023