Investing with Confidence: Singapore Airlines' Unyielding Dominance in the Airline Industry

MQTrader Jesse

Publish date: Fri, 09 Jun 2023, 05:01 PM

The airline industry was hit badly when countries around the world implemented containment measures to contain the spread of Covid-19 in the year 2020. However, amidst the turbulence, one airline company has stood tall as a beacon of stability and success: Singapore Airlines (SIA). After the pandemic, SIA also managed to recover much faster than its peers in the industry as the world re-opens.

SIA's track record further solidifies its position as an appealing investment option for individuals seeking reliable returns and long-term growth. In this article, we will delve into each of the key points that contribute to SIA's attractiveness as an investment opportunity.

Striving through excellence

SIA is one of the largest airline businesses in Asia, with direct flights to destinations in North America, the Middle East, Europe, Africa, and Asia. It is ranked as a 5-star airline by Skytrax for the past 2 decades and has also been ranked as the world's best airline several times.

Service Excellence

One of the key factors that set SIA apart from its competitors is its unwavering commitment to excellence as a service provider. Throughout its history, SIA has maintained an unparalleled reputation for providing world-class service and hospitality. The company managed to achieve these records by investing heavily in training its employees.

For instance, SIA trains its new employees for four months, which is twice as long as the industry average of eight weeks. The company allocates millions of dollars to retrain its employees each year. Its training course includes operation training, deportment, etiquette, wine appreciation, cultural sensitivity, etc. By investing in training programs, SIA is able to enhance productivity, minimize errors, and improve overall operational efficiency. In turn, it also enhances customer satisfaction and fosters customer loyalty.

Cost Management Excellence

Other than training their employees, SIA has also implemented several strategies to manage their operational costs effectively. These strategies have contributed to the airline's ability to maintain financial stability and navigate the highly competitive aviation industry.

For example, SIA employs fuel hedging strategies to mitigate the impact of volatile fuel prices. By entering into contracts and financial instruments, SIA can secure fuel at predetermined prices, reducing its exposure to price fluctuations and providing greater cost predictability.

Besides, SIA consistently invests in fleet modernization, by ensuring that its group’s fleet is always young. The average age of the group’s fleet was just around 7 years, compared to the market average age of 10 years, making it one of the youngest in the airline industry. Newer aircraft are equipped with advanced technologies that contribute to improved fuel efficiency, reducing fuel consumption and associated maintenance costs. Newer planes are also less prone to mechanical failures, which leads to fewer delays or cancellations. And, of course, customers like newer planes. All these facilitate higher customer satisfaction

Pandemic Management Excellence

SIA’s excellency is also seen in how the company strives through the pandemic. This is due to the company’s strategic management during the pandemic period.

During the early stage of the pandemic, Singapore Airlines (SIA) implemented cost-cutting measures, reducing its staff by 20%.To navigate through the challenging times, SIA secured unprecedented financing of S$22.4 billion (US$17 billion), surpassing all other airlines globally. This substantial financial support enabled the airline to preserve its operational capacity and retain a significant portion of its workforce, preparing for the eventual reopening. As a result, SIA successfully averted the ground staff shortages that plagued European and American airlines, leading to massive delays and long queues.

While other regional airlines have to cut their fleets and strike deals with creditors to avert bankruptcy, SIA did some house cleaning and invest in new planes during the pandemic. This included merging SilkAir into the main SIA brand and equipping its low-cost carrier, Scoot, with new Airbus planes. Simultaneously, SIA retired older aircraft ahead of schedule, while acquiring brand-new A350s and renovating the remaining A380s with upgraded cabins.

Thanks to its forward-thinking and well-calculated management, SIA enjoyed the rewards in 2022, achieving a passenger capacity that reached 80% of pre-COVID levels by December. This accomplishment exceeded the average of 51% for airlines in the Asia-Pacific region, as reported by the Association of Asia-Pacific Airlines.

SIA's operating profit in the third quarter of FY2023 reached an impressive S$755 million, marking a significant increase compared to the S$76 million profit recorded in the same period of FY2022. The company's revenue for the third quarter of FY2023 also more than doubled year on year, reaching S$4.8 billion. This remarkable financial performance can be attributed to SIA's ability to sustain robust demand for air travel, demonstrating the company's continued success in capturing market opportunities.

Moving forward

Looking ahead, Singapore Airlines (SIA) has ambitious plans to expand its network as global travel activities gradually resume. The airline has already increased flights to several destinations, including Hong Kong, Seoul, Taipei, and Japan. Although the number of destinations served in China has decreased from pre-pandemic levels, SIA and its low-cost carrier Scoot currently serve 14 destinations in China. As of the end of 2022, SIA's network covered a total of 111 destinations across 36 countries.

In addition to expanding its network, SIA actively seeks collaborations with other airlines to broaden its reach. The company has recently signed multiple agreements with airlines in India, Australia, Thailand, and Vietnam to explore codeshare arrangements. These collaborations allow SIA to tap into additional destinations worldwide and enhance its connectivity.

The gradual easing of COVID-related travel restrictions in Hong Kong, China, and other countries in the region since January has provided a positive outlook for SIA. The airline plans to operate at approximately 77% of its capacity compared to four years ago in the March quarter, indicating a progressive recovery in passenger demand.

These strategic initiatives, coupled with the easing of travel restrictions, position SIA to capture opportunities as the aviation industry recovers and international travel gradually resumes.

Challenges ahead

In the coming months, the airline industry may encounter hurdles due to geopolitical and macroeconomic uncertainties, along with the persistent issue of high-cost inflation. Despite a recent moderation in fuel prices, they still remain relatively high. Additionally, there is an anticipated rise in competition, while cargo demand is expected to remain sluggish in the near term. Inflation and potential global recession can affect consumer demand and trade, further impacting the industry's outlook.

In short…

SIA's commitment to excellence and unwavering dedication to delivering exceptional service have established it as an appealing investment opportunity for those seeking consistent returns and long-term growth. However, it is important for investors to exercise caution in light of the anticipated challenging market conditions ahead.

Want more Singapore market trends?

Click here for an overview of upcoming events of opportunities to invest in the Singapore stock market. This website is the go-to resource for investors looking to stay informed and make intelligent investment decisions in the Singapore stock market.

Don’t miss the latest SGX trends - check out the website today!

Want to start trading in the Singapore market? Click here to enjoy a FREE sign-up for an account that allows you to trade in Singapore and 11 other countries!

Join us now!

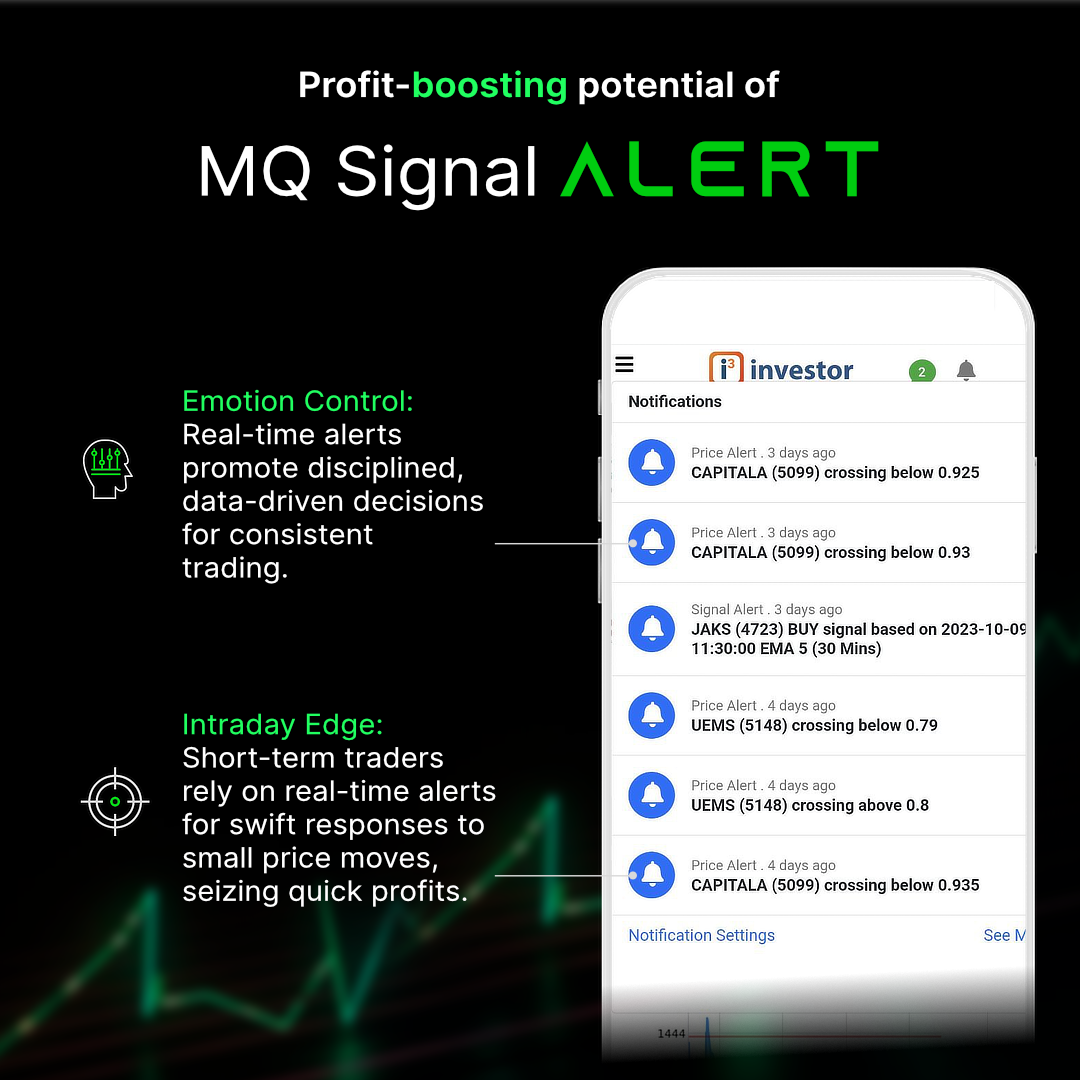

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators, and quantitative data to generate accurate trading signals without the interference of human emotions and bias against any particular stock. It comprises trading strategies that are very popular among fund managers for analyzing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. Sign up for a free trial now, no credit card information is needed.

Contact us

Please do not hesitate to contact us if you have any inquiries:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion in the next release of the system.

We want to develop this system based on feedback to cater to community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties on the Internet. We may or may not hold the position in the stock covered or initiate a new position within the next 7 days.

More articles on MQ Expresso

Created by MQTrader Jesse | Oct 26, 2023

Created by MQTrader Jesse | Oct 12, 2023