CTOS – The largest IPO in 2021

MQTrader Jesse

Publish date: Fri, 02 Jul 2021, 06:33 PM

CTOS are a regional market leader for credit bureaux in the ASEAN region, with presence in Malaysia

and Thailand. They provide credit information and analytics digital solutions on companies, businesses, and consumers for use by banks and businesses at each stage of the customer lifecycle and provide credit information and analysis to consumers. They serve three types of customers: Key Accounts, Commercial and Direct-to-Consumer. As at the LPD, we provide digital solutions to approximately 430 Key Accounts customers in Malaysia, including Malaysian banks and corporates, and approximately 17,000 Commercial customers primarily in Malaysia, including SMEs in industries such as financial services, telecommunications, wholesale and retail trade, manufacturing, construction, professional services, and insurance.

Use of proceeds

Repayment of bank borrowing – 70.5% (within three months)

Defray fees and expenses for IPO and Listing – 2.8% (Within six months)

Acquisitions to be identified – 26.7% (Within 36 months)

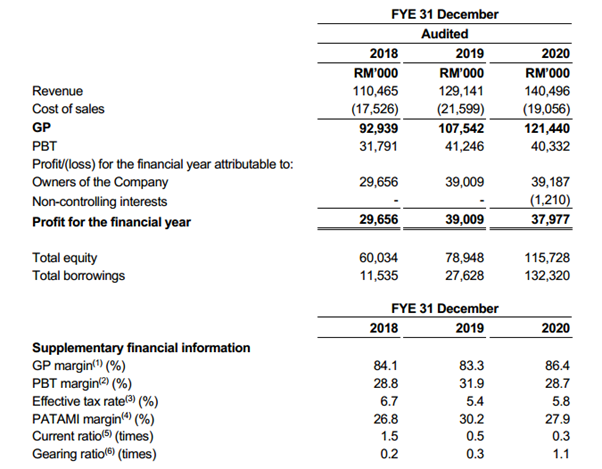

Financial Analysis

- Revenue keeps increasing also show that the market still having develop potential.

- Debt increases over RM 100 mil, (main purpose for the IPO - to settle the bank borrowing and debt)

- GP margin increase due to revenue increase and cost decrease.

- PATAMI margin decrease on FYE 2020 due to increase of expenses on selling & marketing, administrative and finance cost.

- Current ratio only 0.3 not a healthy signal due to the increase on debt. (Good current ratio should between 1.5 – 3.0)

- Gearing ratio also increase due to the increase on debt. (Good gearing ratio should be between 0.25 – 0.5)

Business segment

- Key Account

- customise these digital solutions to meet customers’ specific requirements, contracts are generally for a fixed term, typically one to three years, and renewed upon expiry.

- Key Accounts customers are all located in Malaysia and include commercial banks, other established financial institutions, telecommunication companies, insurance companies, fintech companies such as P2P lenders and e-commerce platforms, and business organisations.

- generate 33.7% revenue at FYE 2020.

- Commercial

-

generate revenue from Commercial customers primarily through subscription fees

that customers pay for access to CTOS Credit Manager and to utilise customer

management modules as well as from sales of additional digital solutions and services that

our customers purchase from CTOS Credit Manager and CTOS Basis (formerly

BASISNET) -

To serve Commercial customers, aim to provide easy-to-use, ready off the shelf,

and effective credit insights and risk management tools to help businesses make credit or

trade decisions, facilitating broad access and affordable credit for both business-to-business and business-to-consumers. - generate 56.7% revenue at FYE 2020.

- Direct to Consumers

-

generate revenue from our Direct-to-Consumer customers primarily from the sale of

MyCTOS Score Reports through our website and through authorised reseller agents.

Consumers who purchase MyCTOS Score Reports receive their CTOS Consumer Score

and other information regarding their credit history and financial health, such as CCRIS

information, directorship and business interests, litigation cases and trade reference

information. - promote financial literacy and credit awareness by helping Malaysians understand their own creditworthiness and educating them of the value of maintaining good credit health, leading to greater access to credit.

-

generate 4.5% revenue at FYE 2020.

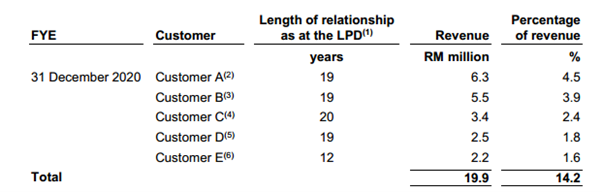

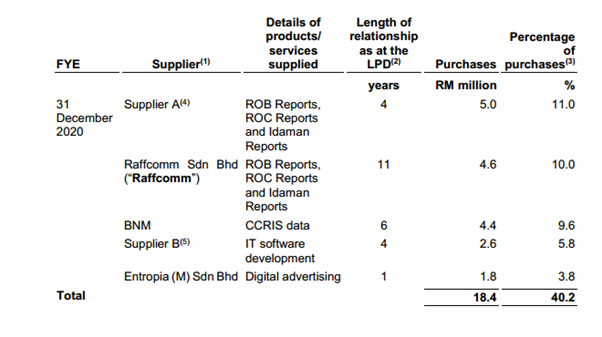

Customer & Supplier

Top 5 customers only take 14.2% of revenue, which mean that CTOS had strong bargaining power of supplier. 80% of the customer already cooperate above 15 years with CTOS this also show the stability relationship between CTOS and his customer.

Top 5 suppliers had taken around 40.2 % of total purchase. The bargaining power of buyer for CTOS is only normal.

Future plans and strategies for CTOS

- Invest in further developing and extending ecosystem of end-to-end credit management solutions.

- Continue to deepen and broaden data sources.

- Expand into new verticals including the automotive, real estate and insurance sectors.

- Maintain and grow the market share leadership for CRA service in Malaysia.

- Selectively pursue acquisitions and investments in companies as part of growth strategy.

MQ Views

Opportunities

- Largest IPO of 2021 attracts high profile institutional investors such as EPF, PNB, Aberdeen, AIA, JP Morgan and others retail investors.

- Steady growth track record as extract from the Financial Statements alongside with good future growth prospect.

- One of the top grossing IPO of 2021 - will create strong trading momentum in the near term.

- Clear roadmap on expansion plan.

Risk

- Relatively high PE in Malaysia market around 63 times. However, it is common to see fintech company (overseas) has relatively high PE than traditional business e.g., manufacturing etc.

- Most of the funds raised are to pay debts instead of expansion plan.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)