IPO - Haily Group Berhad

MQTrader Jesse

Publish date: Tue, 06 Jul 2021, 03:39 PM

Haily Group Berhad was incorporated on 21st February 2020 as a private limited company under the name of Haily Group Sdn Bhd. Via an internal reorganisation exercise, Haily Construction Sdn Bhd and Haily Machinery Sdn Bhd (by virtue of it being a wholly owned subsidiary of Haily Construction Sdn Bhd) became wholly owned subsidiaries. Subsequently on 25th August 2020, the company converted to a public limited company to embark on the Listing on the ACE Market of Bursa Securities.

Use of proceeds

Purchase of construction machinery, equipment as well as new contract management and accounting software and office equipment’ – 20.59% (within 24 months)

Working Capital for construction project – 29.41% (Within 24 months)

Repayment of bank borrowings – 34.31% (Within 3 months)

Estimated listing expenses – 15.69% (within 3 months

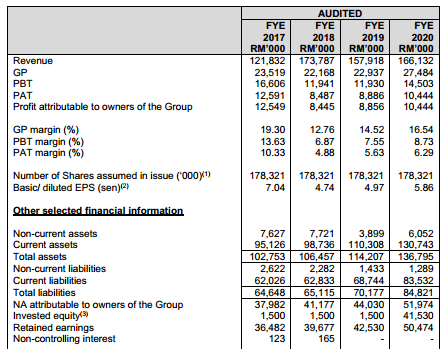

Financial Data

- Revenue new high at FYE 2018 with RM 173 mil and revenue on FYE 2020 is RM 166 mil

- The highest Revenue is at FYE 2018 but due to high-cost impact the GP margin at FYE 2018 only 12.76%.

- PAT margin reach 6.29% at FYE 2020 (Gamuda – 16.60%, IJM – 4.97%, SUNCON – 4.74%, Kerjaya – 11.19%,JAKS - -51.2%, WCT- -10.54%)

- Current ratio is 1.57 times at FYE2020, show that company have good liquidity (good current ratio should between 1.5 – 3.0)

- Gearing ratio is 0.15 mean that company still able to increase their debt and borrowing to maximize the utilise of resources. Low gearing ratio also show that this company management team is conservative. (Good gearing ratio should be between 0.25 – 0.5)

Business segment

-

Building Construction

- Building construction distribute to residential and non-residential. Residential include single-dwelling buildings and multi-dwelling buildings. Non-Residential include commercial buildings, purpose-built buildings, industrial buildings, and institutional buildings.

- Revenue for residential buildings is 87.23% and revenue for non-residential buildings is 11.41%

- Generate 98.64% revenue at FYE 2020

-

Type of buildings.

-

Residential consists of:

- Single-dwelling buildings including terrace, cluster, semi-detached and detached houses.

- Multiple-dwelling buildings, namely high-rise apartments

-

Non-residential consists of:

- Commercial buildings including commercial complex, shop offices, serviced apartments, and terrace villas.

- Purpose-built buildings including workers’ dormitory, sales gallery, and clubhouse.

- Industrial buildings including factories.

- Institutional building namely a school

-

Residential consists of:

-

Others

- Generate revenue from civil engineering construction works and rental of machinery & equipment.

- Generate 1.36% revenue at FYE 2020.

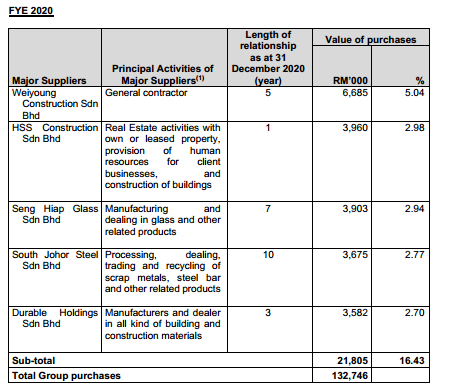

Major customer & suppliers

As the construction sector the revenue is based on contract order book. The company need keep seeking for more contract to improve their revenue in the future. In this situation, we will more concern about the trade receivables amount for Haily group. As trade receivables can reflect whether the customer paid in time. Long overdue of payment have high probability to become bad debt and will cause impairment loss on the financial statement.

Top 5 of suppliers only taken 16.43% on total purchases. Haily Group have strong bargaining power of buyer as this company has many different suppliers.

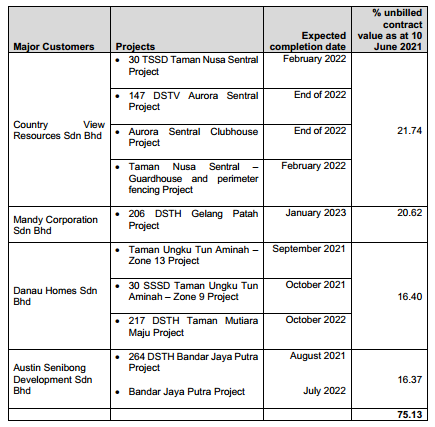

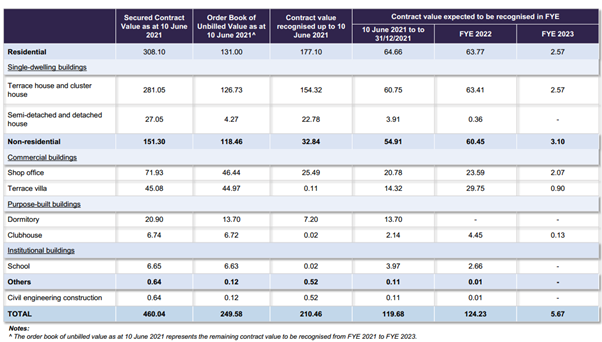

Order book

- Order book of unbilled value with RM 249.58 mil, (Residential – RM 131 mil, Non-residential RM 118.46 mil, Other – RM 0.12 mil)

- Management predict that unbilled order book will contribute RM 119.68 mil at FYE2021, RM 124.23 at FYE 2022 mil and RM 5.67 mil at FYE 2023.

- According to this information, the order book for this company can only last till FYE 2023, company must find more contracts to ensure the stability of revenue after FYE 2023.

Future plans and strategies for Haily

- Continue to focus on building construction in Johor.

- Expansion into other districts in Johor (Current principal market is on Kulai and Johor Bahru).

- Purchase new construction machinery and equipment, as well as contract management and accounting software and office equipment.

MQ Trader Views

Opportunities

- Reasonable PAT margin compares with competitors.

- Above 50% of use of proceeds on operation and expand company.

- Low debt company.

Risk

- Current order books only last to FYE 2023.

- Non-diversify on business segment.

- All the projects currently concentrated at southern region of Johor.

- Slowdown in projects due to MCO.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)

me073194

Huat huat

2021-07-20 22:57