History of Company

The history of the Group’s business can be traced back to June 2013, when Lim Boon Hua and Lim Siew Fang, the Promoters jointly set up PG Pappajack to venture into the provision of pawnbroking services. After obtaining the pawnbroking license in February 2014, they opened their first pawnbroking outlet in Klang, Selangor. They subsequently acquired 2 operating pawnbroking outlets from third parties in Kuchai Lama, Kuala Lumpur, and Puchong, Selangor in March 2014 and October 2014, respectively, and thereby increased the number of pawnbroking outlets to 3pawnbroking outlets.

In December 2016, they expanded the operations outside the Klang Valley by opening a pawnbroking outlet in Bayan lepas, Pulau Pinang.

They continued to expand the presence in the Klang Valley with the opening of 1 additional pawnbroking outlet in Puchong,m Selangor in March 2017, 1 additional pawnbroking outlet in Klang, Selangor in June 2017, 1 pawnbroking outlet in Pantai Dalam, Kuala Lumpur in September 2017 and 1 pawnbroking outlet in Petaling Jaya, Selangor in November 2018.

Within the experience gained from operating 8 pawnbroking outlets over 5 years, they opened a total of 17 additional pawnbroking outlets in 2019 and 2020. They also successfully penetrated and established the presence in other states within Peninsular Malaysia by opening pawnbroking outlets in Seremban, Negeri Sembilan in September 2019, Johor Bahru, Johor February 2020, and Ipoh, Perak in February 2020.

As at the LPD, they operate 25 pawnbroking outlets in total with 12 located in Selangor, 3 located in Kuala Lumpur, 5 located in Pulau Pinang, 1 located in Negeri Sembilan, 2 located in Johor, and 2 located in Perak.

Use of proceeds

-

Expand of pawnbroking outlets - within 12 months (38.36%)

-

Cash Capital for the existing 20 pawnbroking outlets - within 12 months (54.05%)

-

Estimated listing expenses - Immediate (7.59%)

Expand of pawnbroking outlets - within 12 months (38.36%)

The group has incorporated 5 new companies that intend to utilise a total amount of RM 19.22 million for the initial set up costs and working capital requirements for the 5 new pawnbroking outlets. The company will allocate a total of RM 16.00 million for the 4 new outlets to be operated by their indirect wholly-owned subsidiaries (namely, PPJ Landas Emas, PPJ Maju, PPJ Mandiri, and PPJ Sukses) with RM 4.00 million allocated to each of the new pawnbroking outlets. The balance amounting to RM 3.22 million will be utilized for a new outlet to be operated by a subsidiary that has 80.50% equity interest (namely, PPJ Berkat).

The breakdown of the initial setup cost and working capital for each of the 5 new pawnbroking outlets is set out as follows:

The expected time frame to operationalize the 5 new pawnbroking outlets, subject to the receipt of proceeds raised from the IPO to fund the working capital (e.g. Cash Capital for the issuance of new pawn loans, rental for the outlets as well as salaries for new employees), are as follows:

Cash capital for the existing 20 pawnbroking outlets - within 12 months (54.05%)

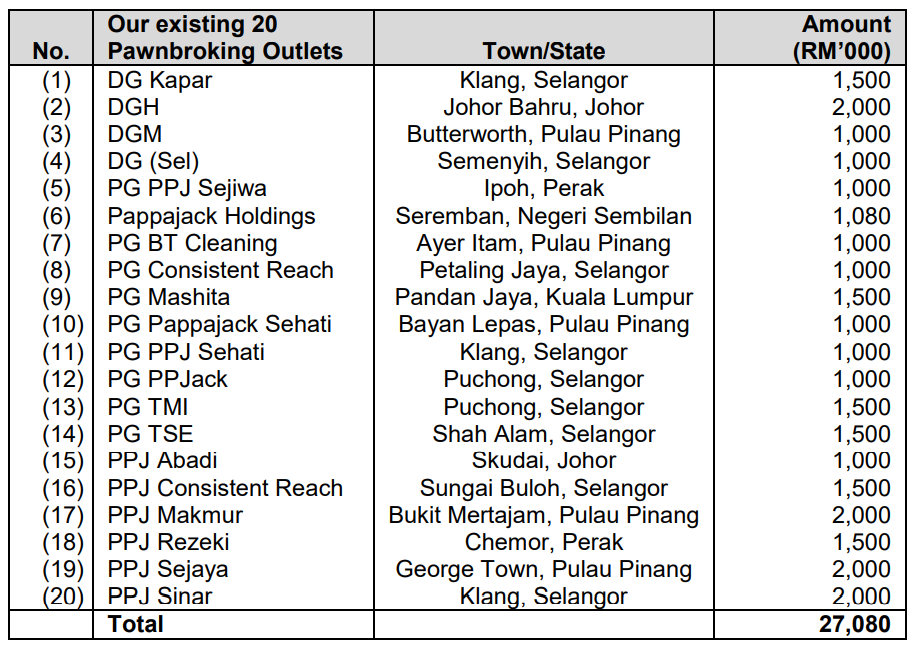

The proceeds from the Public Issue were earmarked for a Cash Capital of RM 27.08 million will be allocated to the 20 existing pawnbroking outlets which have been identified as pawnbroking outlets with higher growth rates, in the following proportion:

Business model

Pappajack operate pawnbroking outlets that are licensed by the KPKT and as such, they adhere to the regulations under Pawnbrokers Act1972 and guidelines issued by the KPKT, amongst others, prescribed interest rate, administrative fees chargeable to customers, and all administrative procedures set by the KPKT including procedures to sell the unredeemed or bid pledges and obligations to the customer.

The chart below illustrates the revenue streams:

The following are the key data for the Group’s pawnbroking service for the FYE 2018, FYE 2019, FYE 2020, FYE 2021:

A summary of the business model is illustrated in the chart below:

Financial Highlights

The following table sets out a summary of our combined statements of profit or loss and other comprehensive income for the Period Under Review as well as the historical unaudited combined statement of profit or loss and other comprehensive income of our Group for the FPE 2020.

-

Revenue reached a new high at FYE 2020 with RM 30 million, this also shows that the company is expanding its market share in this sector

-

The gross profit margin is within the range between 30%-40%. (Generally GP margin 20% is considered high/ good).

-

PAT margin decreased from 15.69% (FYE 2018) to 10.22% (FYE 2019) and broke a new high with 26.67% in FYE 2020. As per check the recorded decrease in PAT margin from 15.69% in FYE 2018 to 10.22% in FYE 201. This was mainly due to the expenses incurred for the additional 9 new pawnbroking outlets set up in the FYE 2019 as well as the professional fees incurred for identifying and opening new pawnbroking outlets.

Revenue Segmentation

-

Revenue Segmentation by Business Segment

The breakdown of the Group’s revenue segmentation by business segment is as follows:

According to the revenue segmentation, we realized that the majority of the revenue is from the sale of unredeemed or bid pledges from FYE 2018 to FYE 2020. The company will sell the unredeemed pledges to jewellery or gold bullion traders.

-

Revenue Segmentation by Geographical Region

The breakdown of the Group’s revenue segmentation by geographical location is as follows:

Over 80% of the revenue is from Selangor and Kuala Lumpur because the total of 15 outlets is located in Selangor and Kuala Lumpur.

Major customer and Supplier

Major customers

Pappajack’s customers are the general public aged 18 years and above who seek micro-loans. The target customers are a population who may be financially unserved or underserved by conventional financial institutions.

For the unredeemed or bid pledges, the customers who purchase the unredeemed or bid pledges comprise mainly scrap collectors. Based on the data, we know that the majority of the revenue for Pappajacks is selling the unredeemed or bid pledges to different customers. Customer A is a gold bullion trader based in Selangor and it is not listed on any stock exchange. Customer B is a gold bullion trader based in Selangor, Customer B is a subsidiary of a publicly tested company that is listed on the LEAP Market of Bursa Securities. Customer C, a retailer, and wholesaler of jewelry and gold bullion trader based in Kuala Lumpur, Customer C did not list on any stock exchange. Customer D, a gold bullion trader based in Pulau Pinang, Customer D is not listed on any stock exchange.

Major Supplier

The company does not have any major suppliers due to the nature of the pawnbroking business as they do not purchase or require any supplies for the operation of the business. The unredeemed or bid pledges that they sell to scrap collectors and watch purchasers through an online luxury watch trading platform are received from their customers who are individuals who pawn these pledges for pawn loans.

Industry Overview

According to the source from Smith Zander, the pawnbroking industry in Johor, Kuala Lumpur, Negeri Sembilan, Perak, Pulau Pinang, and Selangor is computed based on the revenues of the licensed pawnbroking industry players in these states. The pawnbroking industry in these 6 states grew from RM 0.71 billion in 2017 to RM0.85 billion in 2019 but declined slightly to RM0.84 billion in 2020, thereby registering an overall Compound Annual Growth Rate (“CAGR”) of 5.76% during the period. In 2020, the pawnbroking industry in these 6 states represented approximately 79% of the pawnbroking industry in Malaysia. The pawnbroking industry in Malaysia grew from RM0.93 billion in 2017 to RM1.11 billion in 2019, but declined slightly to RM 1.07 billion in 2020, thereby registering an overall CAGR of 4.79% during the period.

The Ar-Rahnu industry (Islamic pawnbroking service) in Malaysia is computed based on the revenues of the banks and non-bank financial institutions that offer Ar-Rahnu services. The Ar-Rahnu industry in Malaysia declined from RM0.49 billion in 2017 to RM 0.36 billion in 2020, recording a CAGR of -9.77%.

Based on the latest available information, in 2020, the size of the pawnbroking industry in the 6 states in which Pappajack Group operates, namely Johor, Kuala Lumpur, Negeri Sembilan, Perak, Pulau Pinang, and Selangor, was recorded at RM 0.84 billion. For the year ended 31 December 2020, the revenue for Pappajack Group (comprising interest from pawnbroking and sale of unredeemed or bid pledges) was recorded at RM 30.77 million and thereby, Pappajack Group captured a market share of 3.66% in the 6 states which it operates.

Based on the latest available information, in 2020, the size of the pawnbroking industry in Malaysia was recorded at RM 1.07 billion. For the year ended 31 December 2020, the revenue for Pappajack Group (comprising interest from pawnbroking and sale of unredeemed or bid pledges) was recorded at RM 30.77 million, and thereby, Pappajack Group captured a market share of 2.88% in Malaysia.

Based on the latest available information, in 2020, the size of the pawnbroking industry in Malaysia, inclusive of the Ar-Rahnu industry, was recorded at RM 1.43 billion. For the year ended 31 December 2020, the revenue for Pappajack Group (comprising interest from pawnbroking and sale of unredeemed or bid pledges) was recorded at RM 30.77 million, and thereby, Pappajack Group captured a market share of 2.15% in the pawnbroking industry in Malaysia inclusive of the Ar-Rahnu industry.

Future plans and strategies for Pappajack

-

The company plan to expand the network of pawnbroking outlets to increase the market presence in Malaysia

-

Expansion of 5 new pawnbroking outlets

-

Future expansion of pawnbroking outlets

MQ Trader Views

Opportunities

-

This company has low debt and it can avoid paying debt with high-interest after the BNM decides to increase the OPR rate.

-

The pledge value is under protection and not diluted easily, as the gold price increases during high inflation era.

-

The tremendous growth of revenue and net profit shows that the company has a healthy financial position.

Risk

-

Pledge value is susceptible to gold price volatility.

-

Under the Pawnbrokers Act 1972, a pawnbroking licence is mandatory for opening and operating a pawnbroking outlet. Any changes in legislation, regulations and/or policies governing the pawnbroking industry can cause the business operations being restricted or incurred with higher operating costs.

-

Exposed to physical security risk (i.e. burglary, theft, fraud or misappropriation of cash or pledges by third parties or by their employees, etc) due to high value of physical items.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

SureWin1Woh

Nice and fancy company name

2022-03-18 20:37