Company Background

Cengild Medical Berhad was incorporated in Malaysia under the Act on 3 February 2021 as a private limited company under the name Cengild Medical Sdn Bhd and subsequently converted into a public limited company in July 2021. The company was incorporated to facilitate the Listing.

As at the LPD, the group structure is as follows:

Cengild Medical Berhad is a healthcare service provider operating a medical center, specialising in the diagnosis and treatment of gastrointestinal, liver diseases, and obesity. The medical center is located at Nexus @ Bangsar South, Kuala Lumpur. The business activities are set out below:

Use of proceeds

Expansion of existing medical center - 18.00% (Within 36 months)

Establishing new medical centers - 51.38% (Within 36 months)

Working Capital - 24.11% (Within 24 months)

Defraying the listing expenses - 6.51% (Within 1 month)

Expansion of existing medical center - 18.00% (Within 36 months)

The company intends to expand the existing medical center, which is currently operating from rented premises in Nexus @ Bangsar South, Kuala Lumpur, to meet the current and future demand for diagnosis and treatment of gastrointestinal and liver diseases, and obesity.

The company has earmarked RM 13.00 million or approximately 18.00% of the proceeds to expand and renovate the existing medical center. The plan will involve the expansion of the existing medical center by leasing additional space of approximately 12,000 to 15,000 sq ft at Nexus @ Bangsar South, Kuala Lumpur to cater to current and future demand for medical services, especially endoscopic procedures to strengthen the company's position in the segment.

The breakdown of utilization for the expansion of the existing medical center is as follows:

The management disclosure of any shortfall will be funded through internally generated funds and/or bank borrowings. The management assumes it will take up to 12 months from completion of the renovation for them to obtain MOH’s approval/license before the expanded area of the existing medical center can be operational.

Establishing new medical centers - 51.38% (Within 36 months)

The company intends to expand the medical center by establishing 2 new full-fledged medical centers specializing in gastrointestinal and liver diseases, and obesity in other major cities in Malaysia such as Johor Bahru, Penang, or Ipoh.

The company has earmarked RM 37.10 million or approximately 51.38% of the proceeds for the establishment of 2 new full-fledged medical centers to facilitate the provision of medical services.

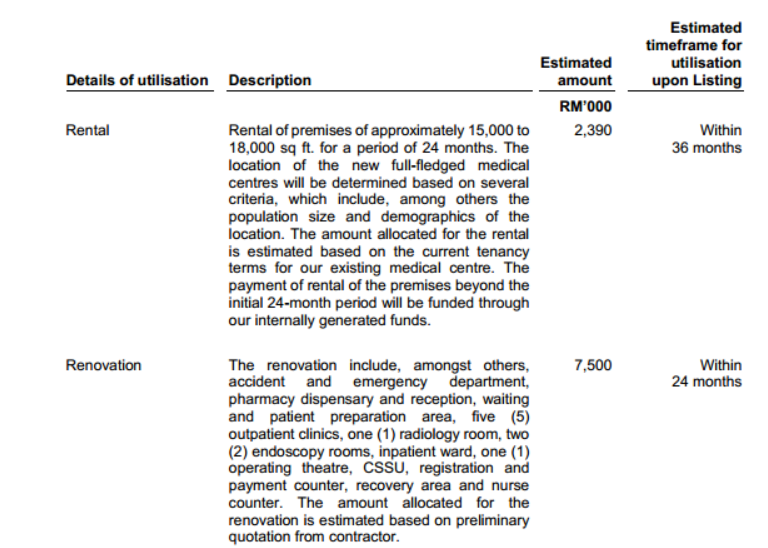

The estimated cost to set up 1 full-fledged medical center is as follows:

Same as above, the management mentioned that any shortfall will be funded through internally generated funds and/or bank borrowings. The management assumes it will take up to 12 months from completion of the renovation for them to obtain MOH’s approval/license before each of the 2 new full-fledged medical centers can be operational.

The company operates an asset-light business model whereby they plan to rent or lease instead of purchase the business premises. This enables them to generate recurring cash flows allowing them to fund their future expansion plans and/or dividend payments, and increase their return on equity. However, it will have a tenancy agreement list when the company chooses to rent or lease the business premises.

This is also one of the plans “Geographical expansion of the services” mentioned by the company as the company wants to expand their services under different areas. The Middle region is based in Kuala Lumpur, the Northern region is based in Ipoh or Penang, the Southern region in Johor.

Working capital - 24.11% within 1 month

The company has earmarked RM 17.40 million or approximately 24.11% of the proceeds as working capital to support the expansion of the existing medical center as well as into other major cities in Malaysia such as Johor Bahru, Penang, and Ipoh.

The breakdown of the allocation is in the manner set out below:

Management mentioned if the actual cost of the above-planned utilization exceeds the earmarked amount, the shortfall will be funded through internally generated funds and/or bank borrowings. Conversely, if the actual cost of the above-planned utilization is lower than earmarked amount, the surplus will be used for general working capital purposes.

Business model

Cengild Medical Berhad is a healthcare service provider operating a medical center specializing in the diagnosis and treatment of gastrointestinal and liver diseases, and obesity. Their medical center is located at Nexus @ Bangsar South, Kuala Lumpur. The business activities are set out below:

Currently, the medical center has 10 clinics, 3 endoscopy rooms, 28 beds (including 8 day-care beds), 2 operating theatres, a radiology department, accident and emergency department, pharmacy, laboratory, and central sterile supply department. The team of consultants provides tertiary care subspecialised advanced endoscopic services, gastrointestinal and general surgeries, gynaecological and urological endoscopy services, and surgeries, supported by a cardiologist. Tertiary care sub specialised service refers to the level of healthcare services provided to patients which typically involves specialist consultative care, advanced treatment or complex surgery, and inpatient care, within a medical specialty.

As at the LPD, the company has 6 employee consultants, 5 resident consultants, 17 visiting consultants, and 4 medical officers, of which 3 employee consultants and 4 visiting consultants are consultants specializing in gastrointestinal and liver diseases, and obesity.

Consultant services

The medical center focuses on gastrointestinal and liver diseases, and obesity. Gastroenterology is the study of the diseases of the gastrointestinal system including the oesophagus, stomach, small intestine, large intestine, rectum pancreas, gallbladder, bile ducts, and liver. Common gastrointestinal diseases include gastroesophageal reflux disease (GERD), functional dyspepsia, Helicobacter pylori infection, peptic ulcer disease, irritable bowel disease, gallbladder stones, colorectal cancer, esophageal and gastric cancers, pancreatic cancers and morbid obesity. Hepatology is the study of the diseases of the liver. Common hepatology diseases include viral hepatitis B and C, fatty liver, liver cirrhosis, and liver cancers.

The medical center offers a comprehensive and diverse range of care and treatment services for gastrointestinal and liver diseases and obesity. Our services extend to include diagnosis and treatment of gastrointestinal oncology, urology, and gynaecology-related conditions. We also provide general cardiology assessment as part of our treatment of gastrointestinal and liver diseases and obesity.

Medical Management services

The medical management services support our consultant services with facilities available at the medical center to provide care and comprehensive medical treatments for our patients. This includes the operating theatres which are fully equipped to perform procedures ranging from keyhole surgery to open surgery, a radiology department equipped with diagnostic scans, a clinical laboratory where pathology tests are carried out on clinical specimens and a 24- hour blood testing service, a pharmacy department which prepares and dispenses medication and a 24-hour accident and emergency department and inpatient ward. The medical management services are supported by our nursing services and clinical support services.

Financial Highlights

-

Revenue reached a new high in FYE 2021 with RM 63 million, CAGR around 76% from FYE 2018 to FYE 2021. This also shows that the company is expanding its market share in this sector

-

The gross profit margin is consistently over 40% from FYE 2018 to FYE 2021. This also shows the company has high bargaining power toward its customers (Generally GP margin 20% is considered high/ good).

-

PAT margin growth from 5.2% (FYE 2018) to 15.8% (FYE 2021). As per check the recorded decrease in PAT margin from 15.69% in FYE 2018 to 10.22% in FYE 201.

-

The gearing ratio is 1.43 including lease liability; 0.06 excluded lease liability. The lease liabilities are 10 years remaining tenure with a 4.50 interest rate per annum. (Good gearing ratio should be between 0.25 – 0.5)

Major customer and Supplier

Major Customers

Due to the nature of the business, the customers mainly comprise individual patients and corporate clients and thus, the company is not dependent on any single individual patient or corporate client. They provide healthcare services to employees of certain companies. These companies are their corporate clients. Therefore the company can avoid the risk of concentration on a few customers which will affect the company's business if the main customer leaves the company.

Major Suppliers

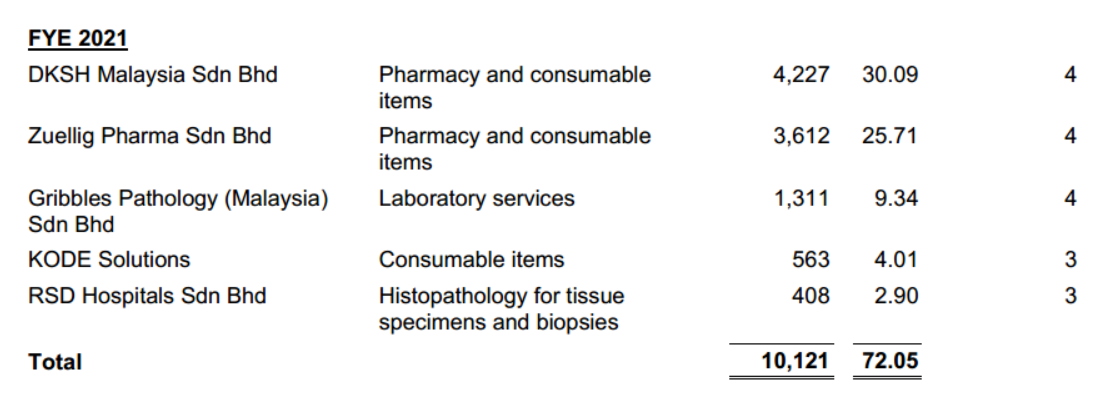

The suppliers consist of private laboratory diagnostic companies, manufacturers, and distributors of pharmaceutical products and medical supplies, and consumables. The top 5 suppliers are as follows:

According to the details, the top 5 suppliers are over 70% of all the suppliers, this shows that the company highly relies on the top 5 suppliers, therefore they can bargain with the suppliers to get a better offer price of the material/service. However, highly relies upon several suppliers will face supply chain issues if the supplier's side meet has an unexpected issue.

Industry Overview

According to the research from Protege Associates, Malaysia’s population stood at 32.7 million in 2021, supported by a large productive labour force of 15 years to 64 years old that accounted for 69.6% or 22.7 million of the population. The Malaysian population grew at an average of 1.1% over the last 5 years, mainly due to a relatively low to moderate crude birth rate of 15.5 per 1,000 people as well as a low crude death rate of 4.7 per 1,000 people. The principal causes of death in Malaysia are old age, heart diseases, respiratory diseases, infectious and parasitic diseases, and car accidents.

Malaysia is on track moving into an ageing population, where the elderly population aged 65 years and above accounts for 7.4% in 2021 and is projected to reach 14.50% by 2040. The growing elderly population number is anticipated to increase the demand for age-related medical care.

Furthermore, lifestyle factors such as diet and smoking, and a sedentary and stressful lifestyle have also contributed to diseases such as diabetes, hypertension, and obesity. Between 2011 and 2019, the prevalence of diabetes among those 18 years old has been increasing from 11.2% to 18.30%. In 2019, 30% of the population aged 18 and above are having hypertension. Obesity is one of the factors that would increase the risk of a person developing gastrointestinal diseases and disorders. Common gastrointestinal issues included acid reflux or gastroesophageal reflux disease (“GERD”), indigestion or dyspepsia, irritable bowel syndrome (“IBS”), and haemorrhoids. The prevalence of obesity in Malaysia has been on an increasing trend for people aged 18 years and above from 15.20% in 2011 to 19.70% in 2019. The general increase in these non-communicable diseases over the years undoubtedly increased the need for healthcare services.

In 2019, the Malaysian private healthcare service market was valued at RM 14.89 billion, a growth of 10.8% from 2018 mainly due to an increase in patient volume as consumer demand for quality healthcare services remained high. Healthcare service providers are also reaching out to healthcare travellers, leveraging on the Malaysia Year of Healthcare Travel campaigns that seek to reinforce Malaysia as a preferred healthcare travel destination. In 2020, the Coronavirus Diseases (“COVID-19”) pandemic and the subsequent movement control orders (“MCO”) and border closures had caused a reduction in inpatient volumes as patients opted to postpone non-urgent and non-essential treatments and deferred visits to hospitals. The healthcare services market in Malaysia contracted by 2.3% from RM14.89 billion in 2019 to RM14.55 billion in 2020, due to the widespread economic slowdown caused by the COVID-19 pandemic. The private healthcare services market is estimated to value at RM15.44 billion for the year 2021.

Protege Associates' research team assumes that the healthcare industry will grow in the short term (2022-2023) is likely to be affected by continued economic recovery and reopening of borders as Malaysia moves to its endemic phase. The ongoing and continuous COVID-19 vaccination effort should further facilitate the recovery of the healthcare services market in Malaysia. In the medium to long term (2024- 2026), the healthcare services market in Malaysia is anticipated to restore to its pre-COVID level as economic activity including the healthcare travel industry continues to recover. Malaysia’s growing ageing population and increasing affluence are anticipated to drive demand for private healthcare as life expectancy, chronic disease, and comorbidity rise. The Malaysian healthcare services market is projected to remain resilient in the long term and register a CAGR of 9.6% from RM15.44 billion in 2021 to RM24.46 billion in 2026.

Plans and strategies for Cenglid Medical Berhad

-

Expansion of existing medical center

-

Geographical expansion of the services

-

Expansion of the medical team

MQ Trader View

Opportunities

-

Hospital businesses have strong cash flow as the business runs on cash terms / insurance claims.

-

Business easy to expand as the company is using light asset model (leasing) to carry out their business

-

According to Protege Associates research, the population structure in Malaysia benefits the hospital business. (Refer to Industry overview)

-

Professional team and modern medical equipment and facilities. The company has a reputable and experienced team of consultants supported by nursing staff and clinical support staff. Besides, the company has invested in modern medical equipment and facilities at the medical center that includes 3 endoscopy rooms and 2 operating theatres.

Risk

-

Inflation will affect the price of pharmaceutical products, when the price of pharmaceutical products increases people might prefer to choose other private hospitals or government hospitals.

-

There is a lease risk if the lessee does not want to continue to rent the shop lot, the company has to spend extra expenditure to seek for a new location and transfer their equipment.

-

The business is subject to or reliant on approvals, licences, permits, or certificates issued by the relevant Malaysian authorities. If the company is unable to comply with the terms and conditions imposed by the relevant authorities, the approvals, licences, permits, or certificates may be revoked, suspended, or not renewed, which could have a material adverse effect on our business operation, financial condition and prospects, as well as penalties, fines, potential criminal prosecution being imposed/initiated against us and/or our directors.

-

High reliance on relevant professionals. Doctors are the main assets towards the business model, where doctors are responsible to provide advice and surgery to their customers. Therefore hiring reputable and qualified doctors could be challenging. It will be costly in both monetary and time to seek for relevant professionals.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

paperplane

a clinic earning 62mil a year, net profit near 20mil.....

2022-04-05 09:44