Company Background

The company was incorporated in Malaysia under the Act on 8 February 2021 as a private limited company under the name of SFP Tech Holdings Sdn Bhd and was subsequently converted to a public limited company on 3 September 2021. SFP Tech is an investment holding company and is engaged in the provision of management services to its Subsidiaries.

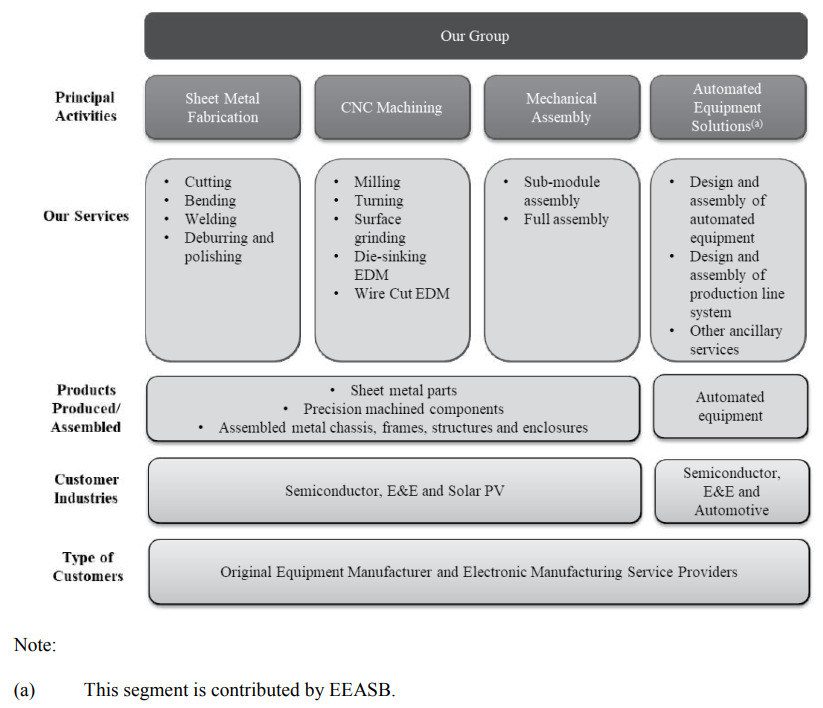

The company is an engineering supporting service provider of sheet metal fabrication, CNC machining, mechanical assembly, and automation equipment solutions

The corporate group structure is as follows:

The company is an engineering supporting service provider, principally involved in the provision of sheet metal fabrication, CNC machining, and mechanical assembly services. Subsequent to the Acquisition of EEASB, they are also involved in the provision of automation equipment solutions. The addition of EEASB enables the Group to become a one-stop automation equipment solutions provider by providing in-house services for the fabrication of component parts up to the assembly of the complete automated equipment.

The company utilizes various fabrication processes working with metal such as cutting, bending, and welding, and machining processes such as milling, turning, surface grinding, EDM cutting, as well as other processes such as deburring and polishing to produce intermediate metal products, ranging from metal piece-parts to precision-machined components. These intermediate metal products that they produce according to the customers’ designs and specifications are then used to produce various machines and/or finished products by the customers in a diverse range of industries, such as, amongst others, semiconductor, E&E, and Solar PV. They also provide mechanical assembly services for sub-module and full assembly, whereby they assemble the intermediate metal products into metal chassis, frames, structures, and enclosures, according to their customers’ designs and specifications.

Further, they provide automated equipment solutions ranging from designing, assembling, and commissioning automated equipment and production line systems (comprising multiple automated types of equipment) for the customers’ manufacturing processes. These types of automated equipment are used in the manufacturing of automotive products, E&E, and semiconductors. They also supply related consumable spare parts, as well as modification and upgrading on automated equipment.

Use of proceeds

-

Purchase of new machinery and equipment - 39.37% (within 36 months)

-

Construction of Manufacturing Plant 3 - 24.10% (within 24 months)

-

Repayment of bank borrowings - 16.07% (within 12 months)

-

Working capital expenditure - 8.25% (within 12 months)

-

Estimated listing expenses - 7.39% (within 3 months)

-

D&D centre - 4.82% (within 12 months)

Purchase of new machinery and equipment - 39.37% (Within 36 months)

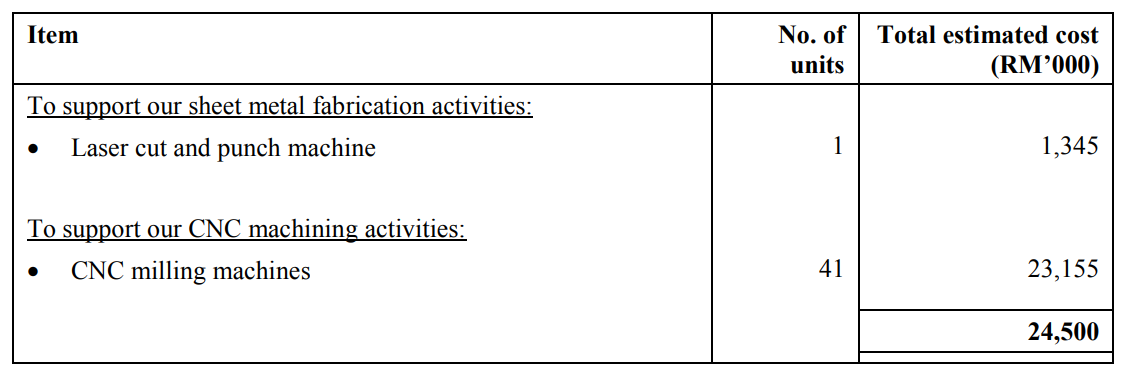

The company intends to allocate RM 24.50 million of the gross proceeds from the Public Issue for the following:

The estimated cost for the purchase of machinery and equipment is inclusive of the installation cost and was derived based on suppliers’ quotations. If the actual cost exceeds the amount budgeted above, the deficit will be funded out of the portion allocated for the general working capital requirements and/or internally generated funds.

The new machines will increase the number of laser cut and punch machines from 6 units to 7 units and CNC milling machines from 93 units to 134 units. These machines are expected to increase the overall estimated maximum manufacturing capacity from 520,410 hours per annum to 652,080 hours per annum, or approximately 25.30%, which is in line with the company’s plan to grow its customer base and serve more local and international customers. Further, the additional capacity would allow them to cater to increase orders from both existing and new customers

Construction of Manufacturing Plant 3 - 24.10% (within 24 months)

The total estimated construction cost for Manufacturing Plant 3 is approximately RM50.00 million. As at the LPD, the company has secured RM30.00 million of bank borrowings for the construction. For the remaining estimated construction cost of RM20.00 million, they intend to allocate RM15.00 million of the gross proceeds from the Public Issue for the construction of Manufacturing Plant 3 whilst the remaining balance of RM5.00 million will be funded internally generated funds. The construction of Manufacturing Plant 3 is expected to be completed by the end of the second quarter of 2022 and fully operational by the fourth quarter of 2022.

The construction of Manufacturing Plant 3 is part of the business expansion plans and efforts to increase the production capacity to cater to the increasing demand for the engineering supporting services, mainly the company's CNC machining activities. In addition, Manufacturing Plant 3 will house the D&D center which will be used for the venture into the vision inspection industry.

Details of the estimated construction costs are as set out below:

If the actual construction expenses are higher than budgeted, the deficit will be funded by internally generated funds. Conversely, if the actual construction expenses are lower than budgeted, the excess will be used for working capital purposes.

Repayment of bank borrowings - 16.07% (within 12 months)

The company intends to allocate RM10.00 million of the gross proceeds from the Public Issue for the partial repayment of the borrowings as follows:

Based on the above, upon reducing the Group’s total borrowing of RM39.32 million as of 31 December 2021 by the proposed repayment as set out above, the company expects to achieve an annual interest savings of approximately RM0.35 million. However, the actual interest savings amount may vary depending on the applicable interest rate at that point in time. Notwithstanding the expected annual cost savings of RM0.35 million, the company is estimated to incur a one-off prepayment penalty of RM0.18 million in the event they repay the above banking facility by December 2022. The prepayment penalty cost of RM0.18 million will be paid via internally generated funds.

Working capital expenditure - 8.25% (within 12 months)

The company intends to set aside RM5.13 million of the gross proceeds from the Public Issue for the working capital purposes over 12 months from the Listing. The working capital requirements are expected to increase in tandem with the expected growth in their business. The following is a breakdown of the expected utilization of the working capital:

Raw materials are one of the largest components of the cost of sales, consistently constituting more than 25.00% of the total cost of sales for the Financial Years Under Review. The purchase of raw materials for the Financial Years Under Review was made using bank borrowings (i.e., bankers’ acceptances for imported raw materials) and internally generated funds.

With the additional working capital of RM5.13 million, the company intends to reduce its usage of bankers’ acceptances to finance their purchase of aluminum, steel, and fabricated parts, which in turn will reduce our interest expenses and improve the profitability.

General working capital includes payment of the administration and operating expenses for 12 months. This includes payment of wages and salaries of the employees, utility expenses, and office-related expenses.

D&D centre - 4.82% (within 12 months)

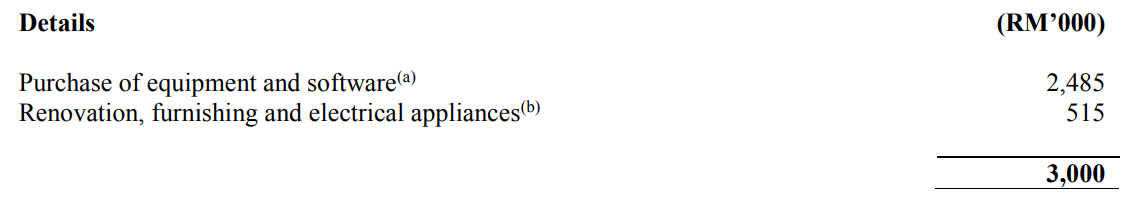

The company has earmarked RM3.00 million of the gross proceeds from the Public Issue for setting up their D&D center. Approximately 2,000 sq ft of built-up area in Manufacturing Plant 3 is intended to be allocated for the D&D center. Details of setting up the D&D center expenditure are as set out below:

As the construction of the D&D center was not part of Manufacturing Plant 3’s building plan, renovations are required to enable the functionality of the D&D center. The construction of the D&D center is expected to commence in the third quarter of 2022 and be completed by the end of the fourth quarter of 2022.

The estimated construction cost of the D&D center is RM3.00 million, which will be fully funded by the IPO proceeds. The deficit will be funded by internally generated funds if the actual D&D center expenditure is higher than budgeted. Conversely, if the actual D&D center expenditure is lower than budgeted, the excess will be used for working capital purposes.

Pending the eventual utilization of proceeds from the Public Issue for the abovementioned purposes, the funds will be placed in short-term deposits with licensed financial institutions or short-term money market instruments.

Business model

The products and services are as follows:

The company is an engineering support services provider, principally involved in the provision of sheet metal fabrication, CNC machining, and mechanical assembly services. They utilize various fabrication processes working with metal such as cutting, bending, and welding; machining processes such as milling, turning, surface grinding, EDM cutting, as well as other processes such as deburring and polishing to produce intermediate metal products, ranging from metal piece-parts to precision-machined components. These intermediate metal products that produce according to the customers’ designs and specifications are then used to produce various machines and/or finished products by the customers in a diverse range of industries, such as, amongst others, semiconductor, E&E, and Solar PV.

They also provide mechanical assembly services for sub-module and full assembly, whereby they assemble the intermediate metal products into metal chassis, frames, structures, and enclosures, according to the customers’ designs and specifications.

Subsequent to the Acquisition of EEASB, the company is also involved in the provision of automation equipment solutions. They provide automated equipment solutions ranging from designing, assembling, and commissioning automated equipment and production line systems (comprising multiple automated types of equipment) for its customers’ manufacturing processes. These types of automated equipment are customized according to the customers’ specifications and are used in the manufacturing of amongst others, automotive products, E&E, and semiconductors. The company also supplies related consumable spare parts, as well as modification and upgrading on automated equipment.

The addition of EEASB enables the Group to become a one-stop automation equipment solutions provider by providing in-house services for the fabrication of component parts up to the assembly of the complete automated equipment.

STSB is involved in the provision of the engineering supporting services consisting of sheet metal fabrication, CNC machining, and mechanical assembly services, whilst EEASB is involved in the provision of automated equipment solutions. The Acquisition of EEASB enabled the Group to enjoy synergic opportunities such as being able to cross-sell both engineering supporting services and automated equipment solutions to both existing and prospective customers, provide a wider range of services to the customers’ manufacturing needs, as well as become a one-stop automated equipment solution from the production of in-house component parts up to the assembly of the complete automated equipment.

Financial Highlights

The following table sets out the key financial highlights based on the historical audited combined financial statements for the Financial Years Under Review:

-

Revenue reached a new high in FYE 2021 with RM 50 million. Through the financial statement, we realize the revenue growth is because the demand for CNC machining mechanical keeps increasing.

-

The gross profit margin is consistently over 50% from FYE 2018 to FYE 2021. This also shows the company has high bargaining power toward its customers by adjusting the price and the company also has a strong moat to protect its margin. (Generally, a GP margin of 20% is considered high/ good).

-

PAT margin is consistently over 30 %, is because of the tax incentive on Pioneer Income.

-

The gearing ratio is 0.42 after Public Issued and uses of proceeding. The gearing ratio is still in a healthy range (A good gearing ratio should be between 0.25 – 0.5)

Major customer and Supplier

Major Customers

The Group’s top 5 major customers for FYE 2021

According to the details, the top 5 customers are over 90% of all the customers, this shows that the company highly relies on the top 5 customers, the top 1 customer - Customer S reached 61% revenue of all the customers, this will cause the company to involve in high customer concentration risk. Furthermore, the management also disclose that their customers typically do not enter into long-term contracts with them and the sales are based on purchase orders that they receive from time to time, therefore this will increase the risk as the customer can easily swap to other companies when SEP Tech lost their competitive advantage.

Major Suppliers

The Group’s top 5 major suppliers for FYE 2021

According to the details, the top 5 suppliers are over 30 % of all the suppliers. The management mentioned they are not dependent on any of the major suppliers as their raw materials are common and can be sourced from other supplies. This also reflects that SFP Tech can easily swap the suppliers to maintain the quality of the raw material

Industry Overview

According to the research from Protégé Associates Sdn Bhd, in 2020 the market size of the ESI in Malaysia is valued at RM6.23 billion, a sharp decline of 21.4% from 2019. Weak consumer sentiment caused by the COVID-19 pandemic has led to the falling demand from end-user markets. However, the industry rebounded in 2021 along with a recovery in global economic activities supporting demand for various products, particularly E&E parts, components, and products. Going forward, the ESI in Malaysia is projected to undergo cyclical growth in tandem with a fluctuation in global economic growth and uncertainties in the foreign currency exchange.

Nonetheless, the ESI in Malaysia is supported by technological advancement arising from the invention of new technologies, advancements in telecommunication technologies, and IoT that spur demand from the end-user markets particularly in the semiconductor and solar PV industries. Despite substantial headwinds caused by the COVID-19 pandemic, the global semiconductor sales were USD440.39 billion in 2020, which was an increase of 6.8% over the previous year. The global semiconductor industry grew to USD552.96 billion in 2021 and is expected to reach USD601.49 billion in 2022.

In terms of installed capacity, the size of the solar PV industry in Malaysia stood at 1,493MW in 2020. Whilst 2020 was a challenging year for the local solar PV industry, as COVID-19 disrupted operations within the industry, projects were continuously deployed throughout the year. Solar projects implemented are expected to be gradually rolled out and implemented in 2022. The solar PV industry will be mainly supported by government-led tariff selling programs. These tariff selling programs, namely the NEM and the LSS programs are expected to bolster the growth of the solar PV industry, and in turn, drive demand for ESI.

From the supply side, strong government support is expected to boost the growth of the local ESI, whereby supportive government incentives including the Industry4WRD-related financial facility support and incentives are expected to provide the impetus for growth. Additionally, technological advancements such as enhanced automation, greater versatility, and better reliability are also expected to support the growth of the Malaysian ESI. Industry players are increasingly expanding their technical capabilities to further strengthen their competitive edges. However, the trade protectionism trend, if prolongs, is set to pose further uncertainties to the global economy as well as to the ESI in Malaysia The ESI in Malaysia was estimated at RM7.62 billion in 2021 and is projected to expand from RM8.36 billion in 2022 to RM11.67 billion in 2026 at a CAGR of 8.9% for the period.

Source: Protégé Associates

Plans and strategies for SFP Tech Holdings Berhad

-

Expansion of product and service offerings in the automated equipment solutions segment;

-

Expansion of the production capacity and capabilities of the engineering support services segment;

-

Local market expansion; and

-

In-house D&D expansion.

MQ Trader View

Opportunities

-

The management team has a full plan for expanding the business. For example, expansion of products and services, construction of manufacturing plant 3, purchase of new machinery and equipment to increase the capacity, etc.

-

Strong financial statement. The company's high gross profit margin maintain at over 50%, a high net profit margin maintain at over 30%, and a healthy gearing ratio in the past few years’ financial statements.

Risk

-

High customer concentration risk. the top 5 customers are over 90% of all the customers, this shows that the company highly relies on the top 5 customers, the top 1 customer - Customer S reached 61% revenue of all the customers, this will cause the company to involve in high customer concentration risk. Furthermore, the management also disclose that their customers typically do not enter into long-term contracts with them and the sales are based on purchase orders that they receive from time to time, therefore this will increase the risk as the customer can easily swap to other companies when SEP Tech Holdings Berhad lost their competitive advantage.

-

The government increase in the minimum wage might affect the profit of the company. According to the IPO report, most of the employees in SFP Tech Holdings Berhad are under production line, and the adjustment of the minimum wage to RM 1,500 which is effective on 1 May 2022 will affect the cost of the workforce.

-

The financial performance may be materially affected in the event of revocation or expiry of the pioneer status of the subsidiaries. The company does not have the tax incentive once the pioneer status is unable to extend after 21 January 2025.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry: