IPO - Cloudpoint Technology Berhad

MQTrader Jesse

Publish date: Fri, 12 May 2023, 10:05 AM

Company Background

The company was incorporated in Malaysia under the Act on 9 June 2021 as a private limited company under the name Cloudpoint Technology Sdn Bhd. On 29 June 2022, The company was converted into a public limited company and adopted the present name.

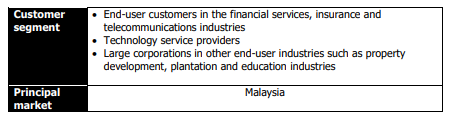

The Company is principally an investment holding company. Through the subsidiary, CSSB, The company is principally engaged in the provision of IT solutions comprising enterprise and data centre networking, cybersecurity solutions, professional IT services as well as cloud services and software applications. At the LPD, they implement solutions and provide services mainly to large enterprises, particularly companies in the financial services, insurance, telecommunications industries, and other technology service providers in Malaysia. The company also provides solutions to multinational companies to cater to their operations based in Malaysia.

Use of proceeds

- Business expansion - 32.9% (within 36 months)

- Relocation of corporate office - 19.3% (within 48 months)

- Working capital requirements - 39.1% (within 24 months)

- Estimated listing expenses - 8.7% (within 1 month)

Business expansion - 32.9% (within 36 months)

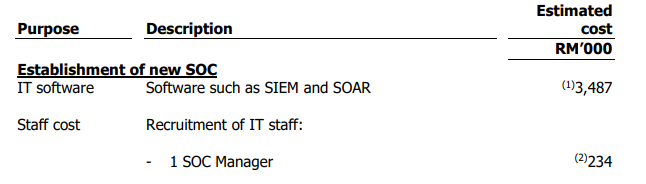

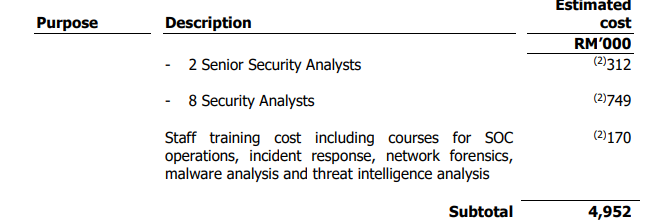

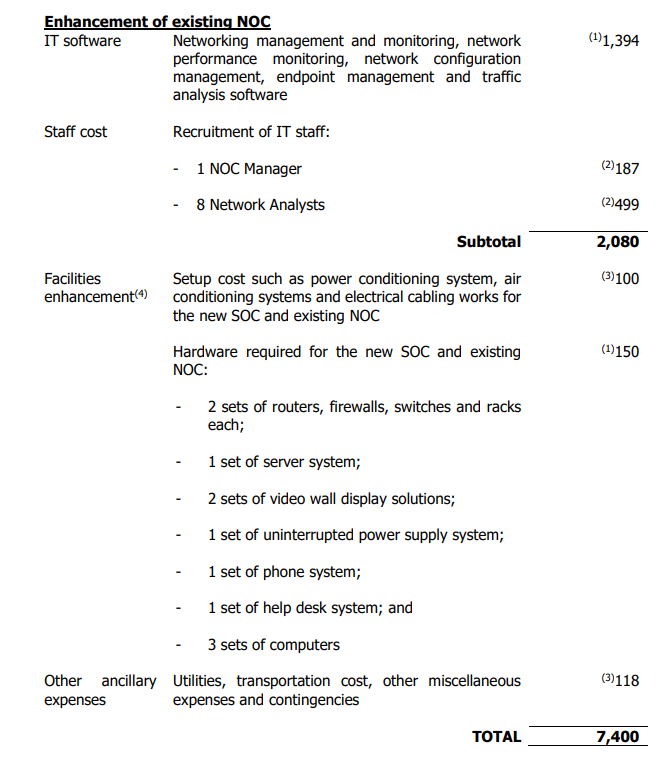

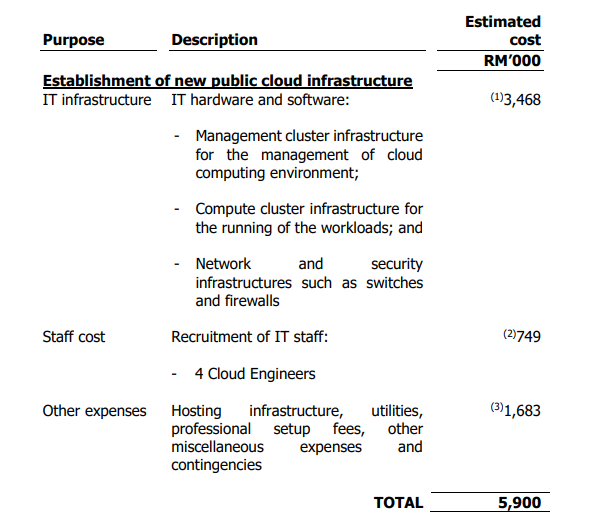

The Group intends to expand its IT solution offerings to increase its competitiveness and enhance the comprehensiveness and quality of enterprise and data centre networking solutions, cybersecurity solutions, and cloud services. The Group intends to allocate RM13.30 million, representing 32.9% of the proceeds from the Public Issue for the business expansion by establishing a new SOC in the corporate office located at Solaris Mont’ Kiara, Kuala Lumpur, Wilayah Persekutuan, enhancing the existing NOC and establishing a new public cloud infrastructure.

1. Establishment of new SOC

2. Enhancement of existing NOC

3. Establishment of new public cloud infrastructure

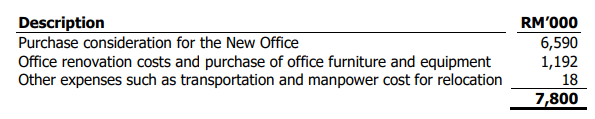

Relocation of corporate office - 19.3% (within 48 months)

The Group intends to allocate RM7.80 million, representing 19.3% of the proceedsfrom the Public Issue, for relocation of the existing corporate office

The Group currently operates from its rented corporate office located at Solaris Mont’ Kiara, Kuala Lumpur, Wilayah Persekutuan with a total built-up area of approximately 6,000 square feet (“Existing Office”). They had entered into a sale and purchase agreement on 12 April 2022 to acquire 2 units of corporate offices with a total built-up area of 4,768 square feet located at Pavilion Damansara Heights, Kuala Lumpur, Wilayah Persekutuan (“New Office”) for a total purchase consideration of RM7.32 million. Upon relocation of the corporate office to the New Office, the company will discontinue the rental of Existing Office.

The proposed allocations of the proceeds for the relocation of the corporate office are set out as follows:

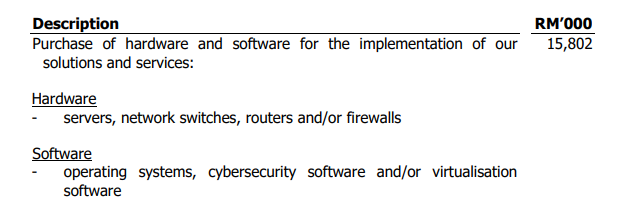

Working capital requirements - 39.1% (within 24 months)

The Group has allocated RM15.80 million, representing 39.1% of the proceeds from the Public Issue, to supplement the working capital requirements of the Group to finance its new projects which is expected to increase in line with the growth in the Group’s business operations.

The proceeds will be allocated in the following manners:

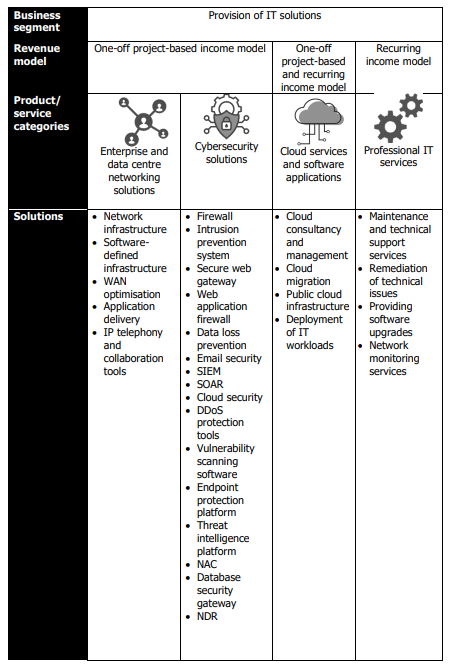

Business model

The Group’s business model is summarized in the diagram below:

The group is principally involved in the provision of IT solutions, with a focus on the following products and services:

- Enterprise and data centre networking solutions

- Cybersecurity solutions

- Provision of professional IT services

- Cloud services and software applications

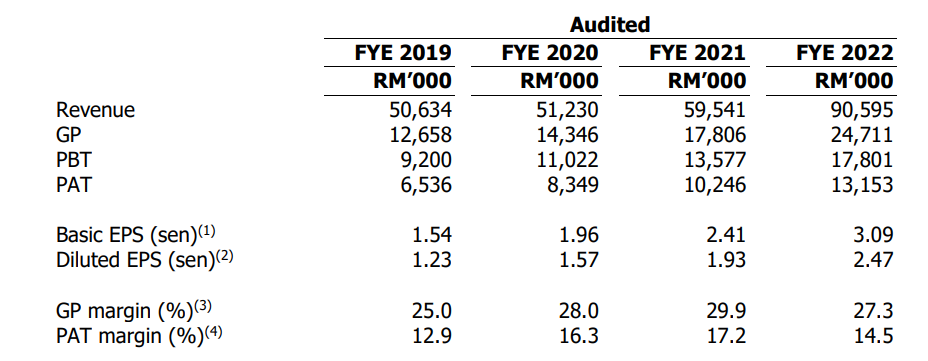

Financial Highlights

The following table sets out the financial highlights based on the combined statements of profit or loss and other comprehensive income for FYE 2019 to FYE 2022:

- The revenue increased from RM 50 mil (FYE 2019) to RM 90 mil (FYE 2022).

- The gross profit margin is consistently above 25% which is above the average benchmark of 20%. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 25% (FYE 2019) to 27.3% (FYE 2022).

- The gearing ratio is 0.01 times, which is nearly 0. This also indicates that the company is not highly leveraged, which means it is better equipped to handle crises. However, the company should consider acquiring some debt within a healthy range to leverage its resources. (A good gearing ratio should be between 0.25 – 0.5).

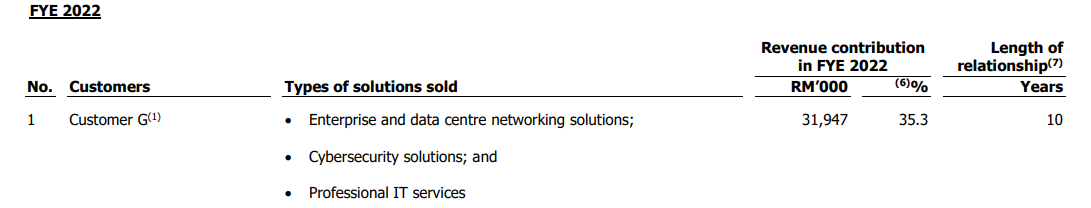

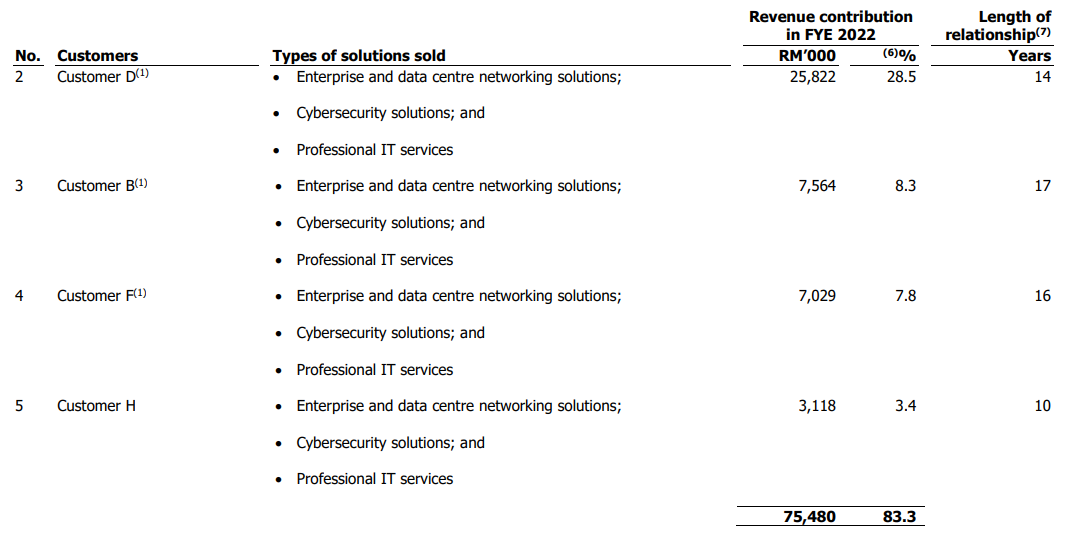

Major customer and Supplier

Major Customers

The Group’s revenue from customers varies depending on the types and quantity of products sold. The top 5 major customers for each of FYE 2022 are as follows:

According to the details, we know that the top 5 customers contribute 83.3% of the revenue to the company. The top 2 customers’ revenue contribution is over 50%. In this case, the company is involved in high-concentration customer risk, if the top 2 customers terminate the service provided by the company. It will have a serious impact on the company’s revenue. However, from the details, we can see that the length of the relationship between the company and the customer is long, which also means that the customer is satisfied with the company's products/services.

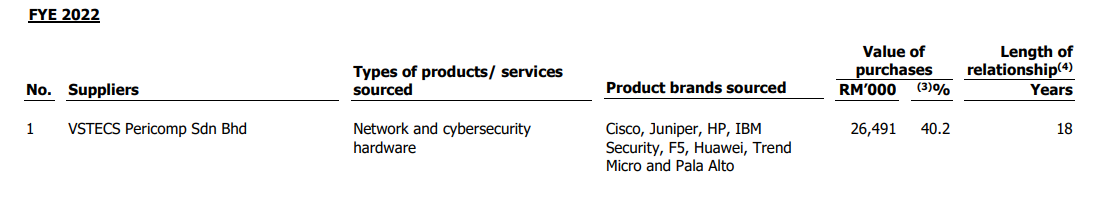

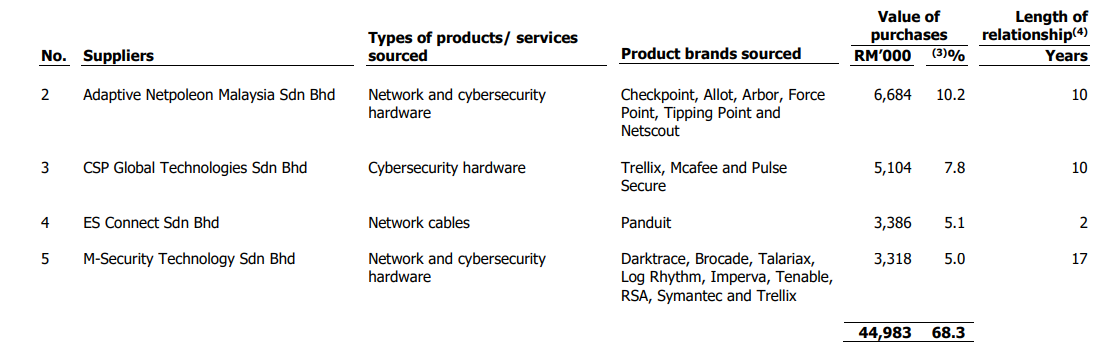

Major Suppliers

The Group’s top 5 suppliers for FYE 2022 are as follows:

According to the details, the top 5 suppliers are 68.30%. The company mentioned they are not dependent on any individual Technology Vendors or their distributors for its business operation.

Industry Overview

As per the research report from Providence Strategic Partners, cloud solutions refer to computing services and/or resources that are delivered through the internet,typically on a subscription or on-demand basis. Cloud solutions can be used by organizations of all sizes ranging from enterprises to government agencies, across a wide range of applications such as data storage, data backup, disaster recovery, software development, and testing, as well as big data analytics.

Meanwhile, cloud services refer to the services involved in the implementation of these cloud solutions. This includes consultancy and management to propose suitable cloud-based solutions, and cloud migration services that aim to assist enterprises to migrate their software applications and data from on-premises

IT infrastructure to cloud-based infrastructure as well as deployment of cloud solutions.

All cloud solutions can be hosted on a public cloud or private cloud infrastructure. Public cloud infrastructure refers to the hosting of data and software applications in a data centre where the infrastructure is shared amongst numerous organizations, whilst private cloud infrastructure is the hosting of data and software applications on infrastructure in a data centre that is sectioned for a single organization. Cloud solutions offer various benefits, including scalability and elasticity, as resources can be scaled according to changing demand based on factors such as organizational size and workload. This leads to reduced operating costs as an enterprise or organization is only required to pay for what they use. Further, there is no need for upfront capital expenditure to purchase and run hardware and

software, allowing funds to be used for other critical business operations. Cloud service providers typically deploy the latest hardware to ensure efficient performance, reliability, and reduced downtime.

The cloud solution industry size in Malaysia, as indicated by the expenditure on public cloud infrastructure, grew from USD 558.9 million (RM2.3 billion) in 2019 to an estimated USD860.0 million (RM3.8 billion) in 2022 at a CAGR of 15.4%. Moving forward, the cloud solution industry size in Malaysia in terms of spending on public cloud infrastructure is forecast to grow to USD2.1 billion (RM9.2 billion) in 2026.In 2022, there are approximately 50 cloud service providers in Malaysia.

Apart from the benefits it offers, as elaborated above, the cloud solution industry in Malaysia is expected to be driven by government initiatives to encourage the adoption of cloud solutions and grow the industry. In February 2021, the Government of Malaysia announced conditional approvals to 4 cloud service providers, namely Microsoft, Google, Amazon, and Telekom Malaysia, to build and manage hyper-scale

data centres and cloud services, thus improving digital infrastructure in the country. These cloud service providers are expected to invest between RM12.0 and RM15.0 billion over the next 5 years.

The Government of Malaysia launched MyDIGITAL, a national initiative that aims to transform Malaysia into a digitally-driven, high-income nation and a regional leader in the digital economy. One of the strategic thrusts is to drive digital transformation in the public sector, to optimize government resources, improve accessibility to data and information, as well as improve the remote work approach among civil servants. To this end, the Government of Malaysia announced MyGovCloud in May 2022, an upgrade of the Public Sector Data Centre into a hybrid cloud solution for the use of all government agencies. The growth of the cloud solution industry in Malaysia is expected to give rise to cloud services in the country, as this would increase demand for services relating to the consultation and implementation of cloud solutions.

Source: Providence Strategic Partners

Business strategies and prospects for CLOUDPOINT TECHNOLOGY BERHAD.

The following are the business strategies:

- The company intends to venture into providing managed cybersecurity services by setting up a SOC.

- The company intends to enhance the existing NOC to enable the offering of managed network services.

- The company intends to expand the cloud services and software applications segment.

MQ Trader View

Opportunities

- The company has established a relationship with a well-established network of technology vendors. Based on the details provided by the major suppliers, the company has observed that the length of the relationship between the company and its suppliers is over 10 years.

- The company provides a wide and complementary range of solutions. Under IT solutions, the company presently provides enterprise and data centre networking solutions and cybersecurity solutions, as well as professional IT services. These solutions are complementary to one another.

Risk

- The company is dependent on the performance of the financial services industry and its customers in the financial services industry.

- The company depends on its ability to secure new projects and customers. Projects related to the provision of enterprise and data centre networking solutions, cybersecurity solutions as well as cloud services and software applications (which the company has recently begun offering) secured by the Group are generally on a purchase order basis and last for a period of 1 to 12 months, depending on the complexity of the project. Upon completion of the projects, the company typically enters into professional IT service contracts with some of these customers, ranging between 1 and 3 years.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedback so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)