IPO - Edeltqe Holdings Berhad

MQTrader Jesse

Publish date: Mon, 15 May 2023, 11:10 AM

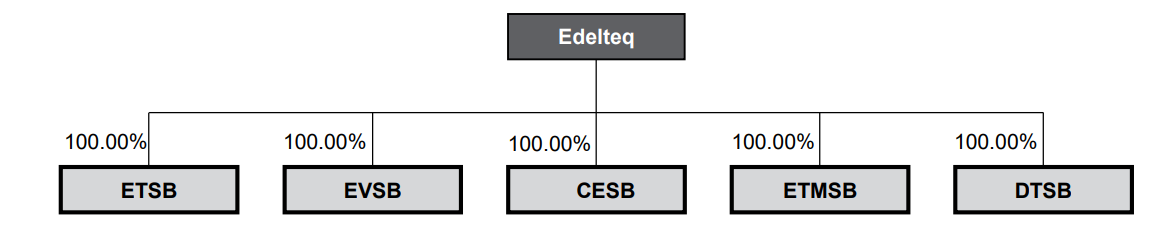

Company Background

The Company was incorporated in Malaysia under the Act on 18 September 2019 as a private limited company under the name of Edelteq Holdings Sdn Bhd. On 20 September 2022, the Company was converted into a public limited company for the Listing. The Group commenced operations through the incorporation of Dysteq Technology (M) Sdn Bhd (which changed its name to ETMSB on 8 October 2019) on 24 June 2004. At the LPD, our group structure is as follows:

The Company is an investment holding company and through the Subsidiaries, the company is principally involved in the provision of engineering support for IC assembly (a process that involves the attaching of an IC to a die attach pad i.e. a metallic device used to connect the IC to a circuit board) and test processes (test carried out in the process of manufacturing semiconductors) in the semiconductor industry.

Use of proceeds

- Construction of Proposed Batu Kawan Factory - 15.33% (within 12 months)

- Repayment of bank borrowings (Proposed Batu Kawan Factory) - 42.71% (within 24 months)

- R&D - 12.90% (within 30 months)

- Working capital - 14.06% (within 24 months)

- Estimated listing expenses - 15.00 (within 3 months)

Construction of Proposed Batu Kawan Factory - 15.33% (within 12 months)

The total estimated cost for the construction of the Proposed Batu Kawan Factory is RM15.24 million (comprising the acquisition of Batu Kawan Land of RM3.31 million and construction costs of RM11.93 million), further details of which are set out in the table below:

Based on the above, the Group intends to allocate RM3.68 million representing approximately 15.33% of the gross proceeds from the Public Issue to partially finance the estimated cost for the construction of the Proposed Batu Kawan Factory of RM11.93 million. The initial payment of RM0.33 million for the acquisition of the Batu Kawan Land was paid initially through internally generated funds and the remaining estimated cost of RM2.98 million for the acquisition of the Batu Kawan Land will be funded by bank borrowings.

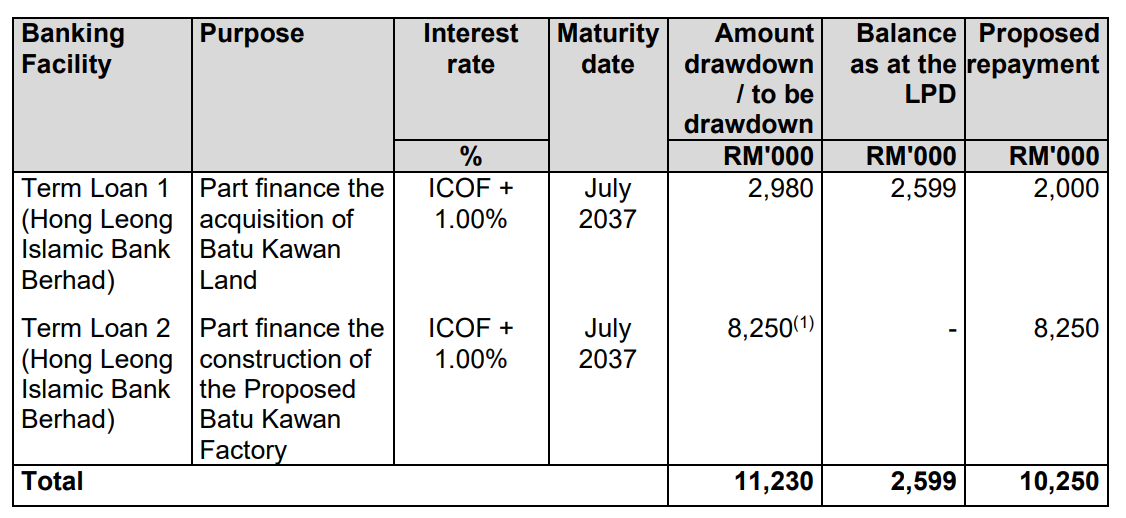

Repayment of bank borrowings (Proposed Batu Kawan Factory) - 42.71% (within 24 months)

The Group intends to allocate RM10.25 million representing approximately 42.71% of the gross proceeds from the Public Issue for the repayment of the aforementioned 2 term loans which are utilized for part financing the construction of the Proposed Batu Kawan Factory, further details of which are set out in the table below:

The proposed repayment of bank borrowings above will reduce our Group's overall gearing levels from 0.17 times to 0.03 times based on the pro forma consolidated statement of financial position as of 31 December 2022 and after taking into consideration the proposed repayment of bank borrowings above.

R&D - 12.90% (within 30 months)

Prior to FYE 2022, the Group did not undertake any R&D activities. The company commenced the R&D efforts during FYE 2022 and as part of the continuing R&D efforts, the Group intends to allocate RM3.10 million representing approximately 12.90% of the gross proceeds from the Public Issue for the development of new ATE and refurbishment methods as well as enhancement of factory automation solutions.

1. Development of new ATE and refurbishment methods

The company intends to expand its product and service portfolio for ATE and IC assembly and test consumables. The new product and service portfolio will also complement the existing products and services, which they can cross-sell to existing and potential customers.

2. Enhancement of factory automation solutions

The company currently provides factory automation customization for ATE which allows remote management and monitoring, data-driven visualization, and analysis during the production process. The company intends to further enhance the factory automation solutions which involves R&D activities to design, develop and integrate hardware and software, as well as prototyping, testing, and commissioning of the factory automation solutions.

The company intends to allocate RM1.34 million of the gross proceeds from the Public Issue to fund the purchase of R&D tools which will be used for the R&D activities and development of prototypes.

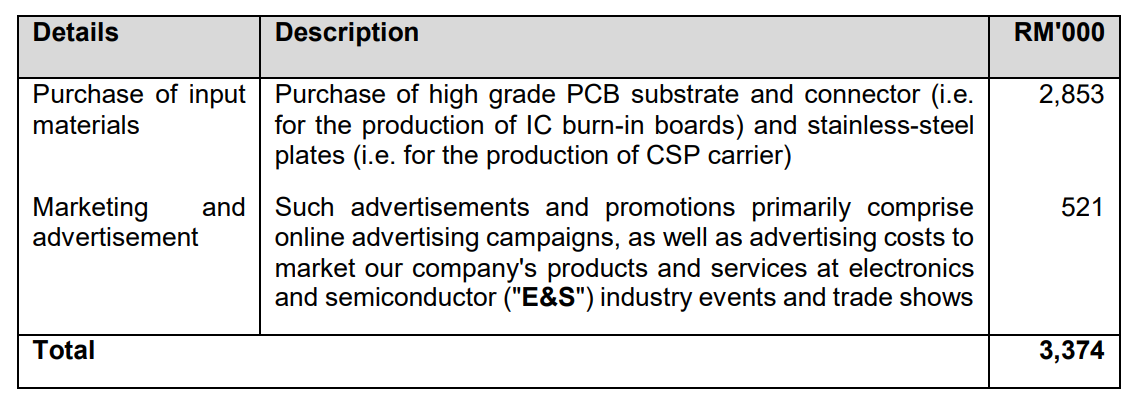

Working capital - 14.06% (within 24 months)

The Group's working capital requirements are expected to increase in tandem with the expected growth in the business. The company intends to allocate RM3.37 million representing approximately 14.06% of the gross proceeds from the Public Issue to finance the Group's expected future working capital requirements (based upon the anticipated growth in the business operations) in the following manner:

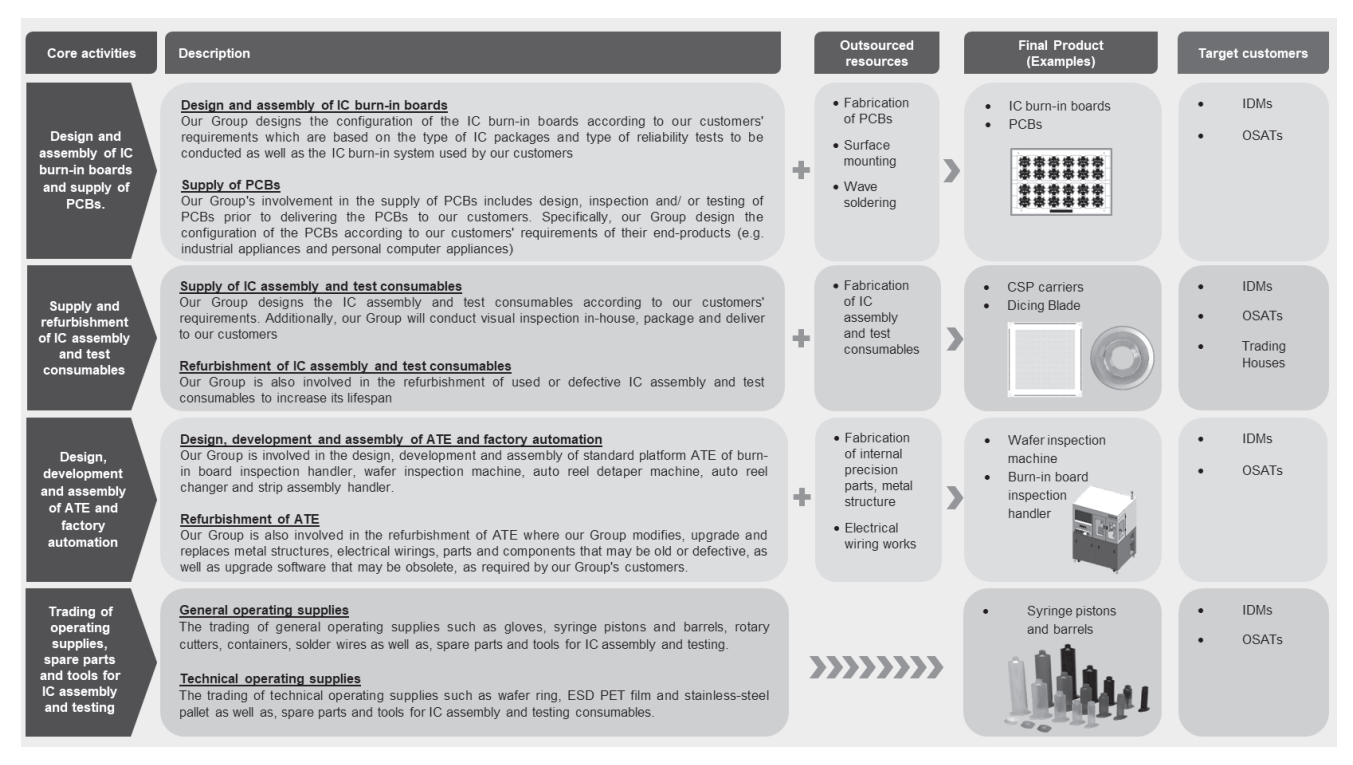

Business model

A snapshot of the Group’s business model is illustrated as follows:

The company is principally involved in the provision of engineering support for IC assembly and test processes in the semiconductor industry.

Details of core principal activities are as follows:

- Design and assembly of IC burn-in boards and supply of PCBs.

- Supply and refurbishment of IC assembly and test consumables.

- Design, development, and assembly of ATE and factory automation.

- Trading of operating supplies, spare parts, and tools for IC assembly and testing.

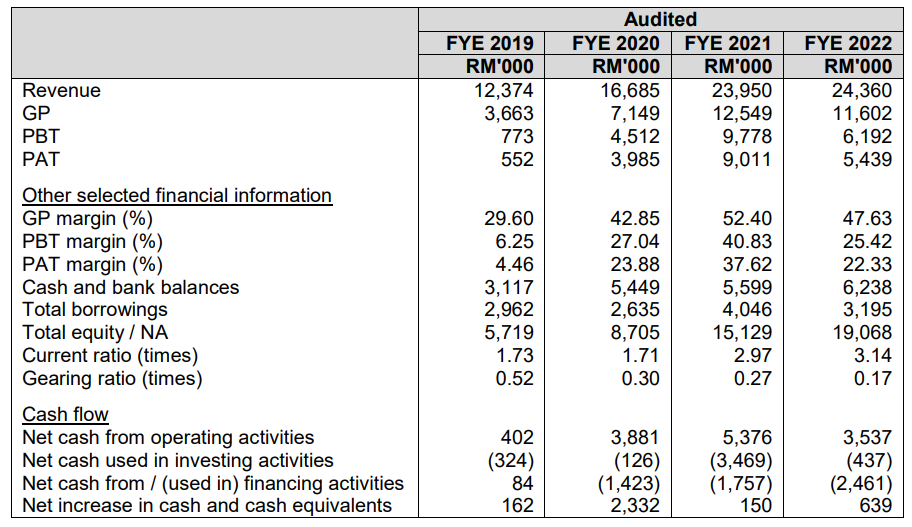

Financial Highlights

The table below sets out a summary of our historical financial information based on the combined financial statements of the Group for the Financial Years Under Review:

- The revenue increased from RM 12.374 mil (FYE 2019) to RM 24.36 mil (FYE 2022), this shows that the company is expanding its market.

- The gross profit margin is 29.60% in FYE 2019, and consistently above 40% from FYE 2020 to FYE 2022 which is above the average benchmark of 20%. (Generally, a GP margin of 20% is considered high/ good). [

- PAT margin increased from 4.46% (FYE 2019) to 37.62% (FYE 2021) and decreased to 22.33% (FYE 2022).

- The gearing ratio is 0.17 times. This also indicates that the company is not over-leveraged, which means it is better equipped to handle crises. (A good gearing ratio should be between 0.25 – 0.5).

Major customer and Supplier

Major Customers

The top 5 major customers and their respective revenue contribution for the Financial Years Under Review is as follows

According to the details, we know that the top 5 customers contribute 82.43% of the revenue to the company. The top 2 customers’ revenue contribution is over 50%. The company mentioned they are dependent on the top 2 major customers. In this case, the company is involved in high-concentration customer risk, if the top 2 customers terminate the service provided by the company. It will have a serious impact on the company’s revenue.

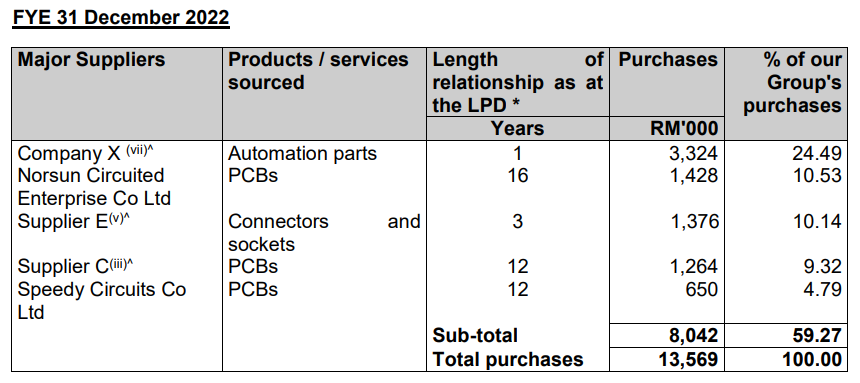

Major Suppliers

The top 5 major suppliers for the purchase of materials and services for the Financial Years Under Review is as follows:

According to the details, the top 5 suppliers are 59.27%. The company mentioned they are not dependent on any of the top 5 major suppliers as the company can source the same supplies from alternative suppliers at similar prices. The products and services supplied by the top 5 major suppliers are commonly available electronic products such as PCBs, connectors, and sockets that can be sourced locally or overseas, as well as fabrication works readily available in Malaysia.

Industry Overview

As per the research report from Smith Zander, The growth of the semiconductor industry, measured in terms of global semiconductor sales, increased from USD 412.2 billion (RM1.77 trillion) in 2017 to an estimated USD 580.13 billion (RM2.55 trillion) in 2022, at CAGR of 7.07%. In 2019, global semiconductor sales decreased by 12.05% YOY, from USD 468.78 billion (RM1.89 trillion) in 2018 to USD 412.31 billion (RM1.71 trillion) mainly resulting from uncertainties arising from the escalation of the US-China trade war. Nevertheless, driven by continuous technological advancements which have led to the increased usage of semiconductors in various end-user applications, global semiconductor sales recovered by 6.81% YOY to USD 440.39 billion (RM1.85 trillion) in 2020. Despite the recovery, global semiconductor sales recorded in 2020 were lower than in 2018, resulting from global chip shortages. WSTS expects global semiconductor sales to decrease from USD 580.13 billion (RM2.55 trillion) in 2022 to USD 556.57 billion (RM2.45 trillion) in 2023, at a YOY decline of 4.06%, due to oversupply conditions in some semiconductor segments which had resulted from manufacturers increasing production to address the global chip shortage situation. The future outlook of the semiconductor industry is expected to be driven by rapid technological advancements in electronic products, increasing global demand for E&E, increased adoption of IoT, technological advancement of automotive electronics, and Government initiatives.

As different equipment and tools are required at each stage of the semiconductor value chain, semiconductor industry players are supported by engineering support companies that supply equipment and/or tools that are required in the manufacturing of semiconductors. The manufacturing sales value of PCBs, which is used to represent the industry size of IC BIBs and PCBs in Malaysia, increased from RM66.46 billion in 2017 to RM128.54 billion in 2022 at a CAGR of 14.10%. The manufacturing sales value of specialized machinery and equipment, which is used to represent the industry size for the manufacturing of ATEs in Malaysia, increased

from RM5.26 billion in 2017 to RM8.32 billion in 2022 at a CAGR of 9.60%. Due to the fragmented nature of the industry segments related to the supply and refurbishment of IC assembly and test consumables; and the trading of operating supplies, spare parts, and tools for IC assembly and testing, as well as the wide range of products available in these industry segments, the industry size for these industry segments cannot be determined. The future outlook of the semiconductor engineering support industry is expected to grow in tandem with the growth of the semiconductor industry, and will similarly be driven by rapid technological advancements in electronic products, increasing global demand for E&E, increased adoption of IoT, technological advancement of automotive electronics and Government initiatives.

Source: Smith Zander

Business strategies and prospects for EDELTEQ HOLDINGS BERHAD.

The following are the business strategies:

- The company intends to expand the premises through the construction of the Proposed Batu Kawan Factory.

- The company intends to expand its product and service portfolio through the development of new products and refurbishment methods as well as the enhancement of factory automation solutions.

- Development of new ATE and refurbishment methods

- Enhancement of factory automation solutions

MQ Trader View

Opportunities

- The company has a strong portfolio of multinational customers in the semiconductor industry with established long-standing relationships through repeat orders. The customers are primarily multinational IDMs and OSATs located in Malaysia and overseas such as Singapore, Thailand, China, and the United States.

Risk

- The company is dependent on the top 2 major customers who contribute substantially to the revenue.

- The financial performance may be materially affected in the event of revocation or expiry of the pioneer status granted by MIDA.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedback so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)