IPO - Synergy House Berhad

MQTrader Jesse

Publish date: Wed, 17 May 2023, 10:42 AM

Company Background

The company was incorporated in Malaysia on 3 August 2021 under the Act as a private company limited by shares under the name of Synergy House Sdn Bhd and was subsequently converted into a public company on 21 December 2021.

The company is an investment holding company and through the Subsidiaries, it is principally involved in the design, development, and sale of RTA home furniture.

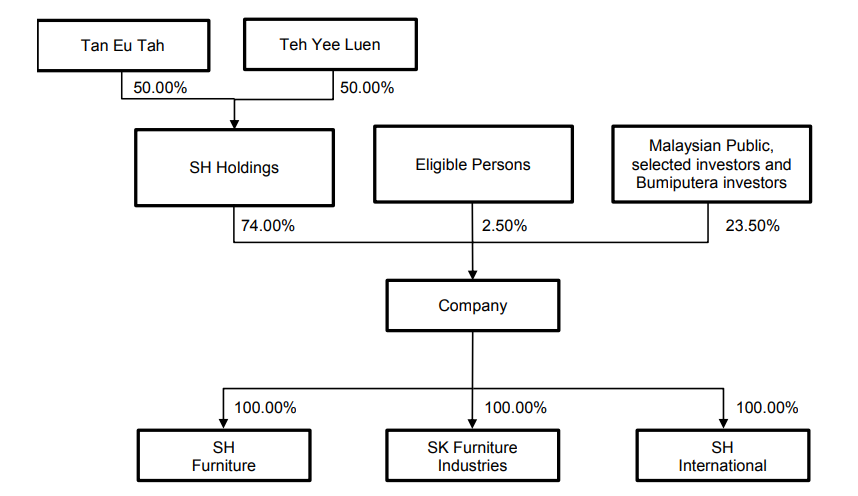

The Group structure upon Listing is as follows:

Use of proceeds

- E-commerce fulfillment centers in Muar, Johor, and overseas countries - Purchase of inventories - 29.07% (within 18 months)

- E-commerce fulfillment center in Muar, Johor - Purchase of racking system and forklifts - 4.36% (within 18 months)

- E-commerce advertising and promotions - 2.91% (within 18 months)

- Repayment of borrowings - 29.07% (within 6 months)

- Working capital - 22.38% (within 12 months)

- Estimated listing expenses - 12.21% (within 1 month)

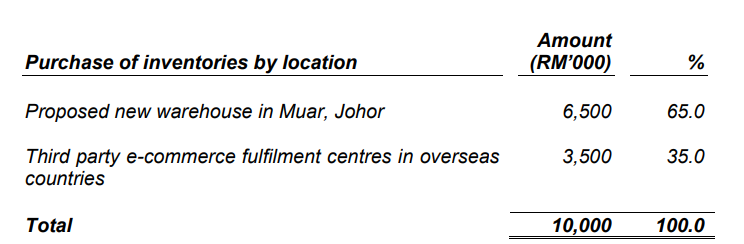

E-commerce fulfillment centers in Muar, Johor, and overseas countries - Purchase of inventories - 29.07% (within 18 months)

Purchase of inventories for the proposed new warehouse in Muar, Johor and third-party e-commerce fulfillment centers in overseas countries

The Group plans to use RM10.0 million of the proceeds raised from the Public. The issue for the purchase of inventories for the proposed new warehouse in Muar, Johor and third-party e-commerce fulfillment centers in overseas countries as follows:

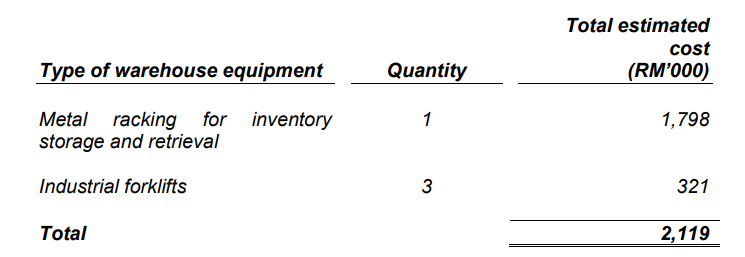

E-commerce fulfillment center in Muar, Johor - Purchase of racking system and forklifts - 4.36% (within 18 months)

Purchase of a racking system and forklifts for the proposed new warehouse in Muar, Johor

The Group plans to use RM1.5 million of the proceeds raised from the Public. The issue with the purchase of the following warehouse equipment for the proposed new warehouse in Muar, Johor:

E-commerce advertising and promotions - 2.91% (within 18 months)

The Group plans to use RM1.0 million of the proceeds raised from the Public Issue to implement advertising and promotion strategies to promote the products on third-party e-commerce platforms. In the Financial Years Under Review, the Group incurred costs amounting to RM0.14 million, RM0.07 million, RM0.31 million and RM1.07 million respectively for the e-commerce-related advertising and promotion activities

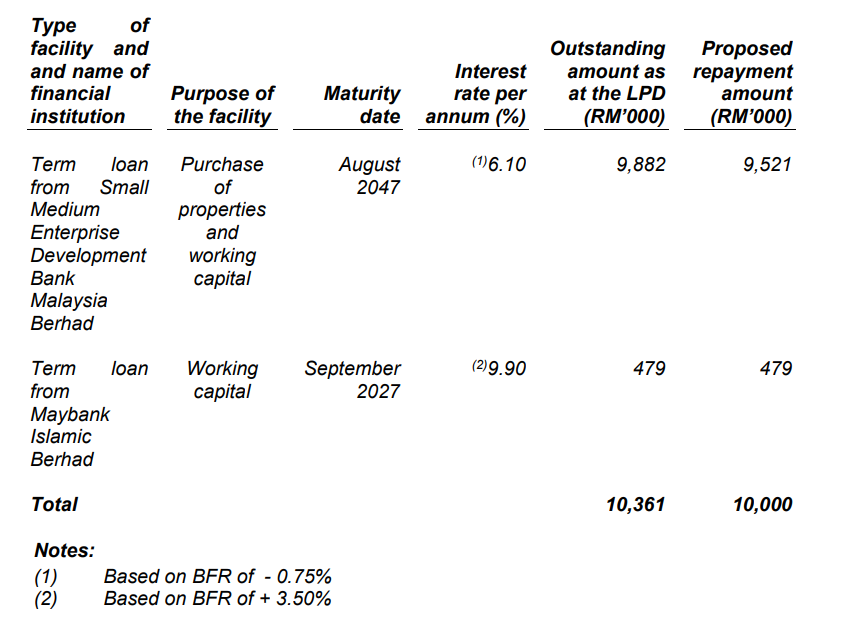

Repayment of borrowings - 29.07% (within 6 months)

As at the LPD, the total outstanding amount of the Group's borrowings (including lease liabilities) stood at RM69.66 million. We plan to use RM10.0 million of the proceeds raised from the Public Issue to partially repay the loan facilities as follows:

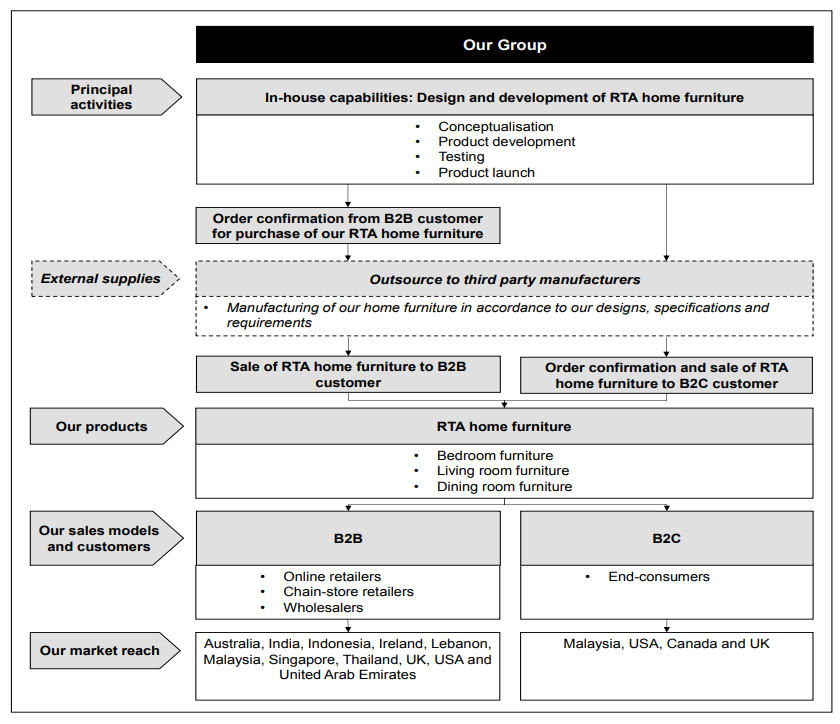

Business model

The principal activities can be summarized in the business model below:

The company is principally involved in the design, development and sale of RTA home furniture. RTA home furniture is a form of furniture where furniture parts are in flat-packed form for ease of storage and transportation. RTA home furniture requires customers to assemble themselves upon purchase.

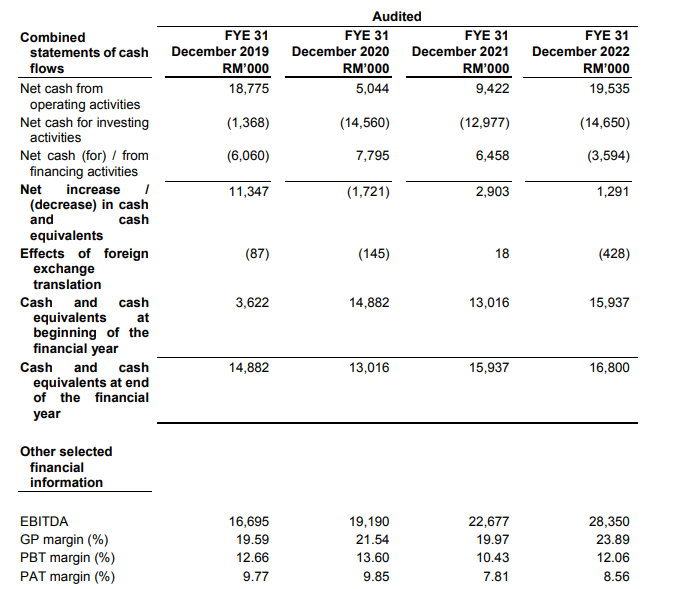

Financial Highlights

The following table sets out a summary of the combined financial information of the Group for the Financial Years Under Review.

- The revenue increased from RM 111.482 mil (FYE 2019) to RM 194.093mil (FYE 2022), this shows that the company is expanding its market.

- The gross profit margin is 23.89%. Although the gross profit margin is not consistently over 20%, it is always near 20% when it doesn't reach that threshold.

- PAT margin decreased from 9.77% (FYE 2019) to 8.56% (FYE 2022).

- The gearing ratio is 1.38 times. This shows that the company has over-leveraged its equity, which might cause them to lose the capability to handle any crisis. (A good gearing ratio should be between 0.25 – 0.5).

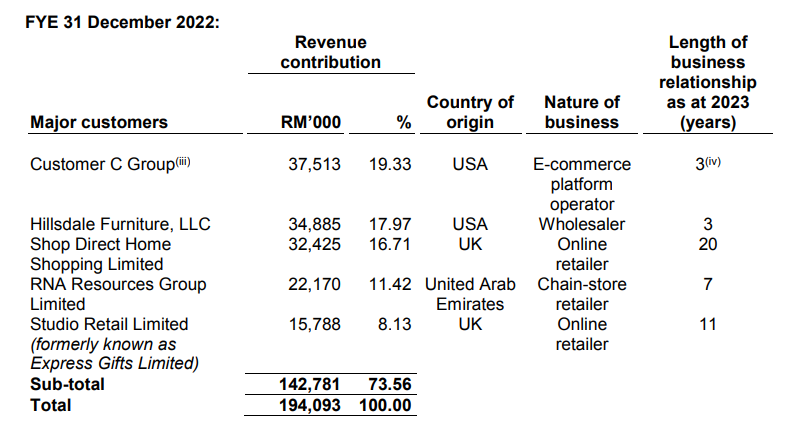

Major customer and Supplier

Major Customers

The Group’s top 5 major customers for the Financial Years Under Review are as follows:

According to the details, we know that the top 5 customers contribute 73.56% of the revenue to the company. The company mentioned that they are only dependent on Shop Direct Home Shopping and Hillsdale Furniture but not dependent on Customer C Group as Customer C Group is not a B2B customer and they utilize Customer C Group’s e-commerce platforms to sell their home furniture directly to B2C customers in the USA. In this case, the company is involved in high-concentration customer risk, if any of the second or third major customers terminate the service provided by the company. It will have a serious impact on the company’s revenue.

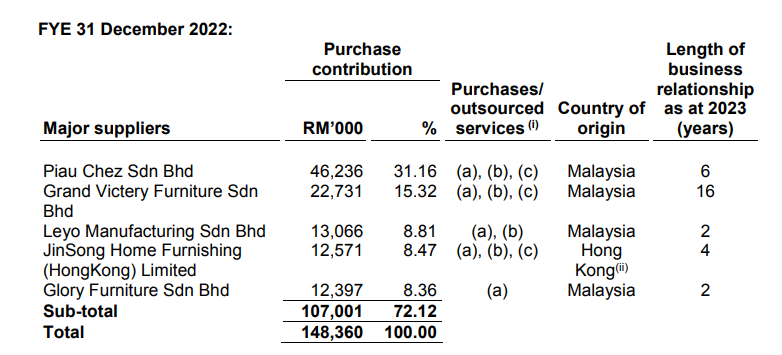

Major Suppliers

The Group’s top 5 major suppliers for the Financial Years Under Review are as follows:

According to the details, the top 5 suppliers are 72.12%. The company mentioned they were dependent on 2 of their major suppliers, namely Piau Chez Sdn Bhd and Grand Victery Furniture Sdn Bhd. However, for the Financial Years Under Review up until the LPD, the company has engaged approximately 57 third-party manufacturers cumulatively and hence they are able to source manufacturing services from alternative third-party manufacturers when required to reduce dependency on its major suppliers.

Industry Overview

In 2022, furniture manufactured in Malaysia was exported globally to 174 countries. Based on the latest data available, in 2021, Malaysia was the 12th largest furniture-exporting country globally, accounting for 1.46% of total global furniture exports of USD 206.85 billion (RM857.48 billion). Between 2019 and 2022, Malaysia's furniture export grew from RM11 .10 billion to RM13.84 billion at a CAGR of 7.63%; and

Malaysia's wood-based home furniture export grew from RM8.71 billion to RM10.71 billion at a CAGR of 7.13%. This was mainly attributed to the US-China trade war which boosted the exports of Malaysia's furniture in 2020; the rise in global furniture e-commerce sales amidst the COVID-19 pandemic in 2020 and 2021, where the global furniture e-commerce increased at a CAGR of 17.76% from USD59.43 billion (RM 246.20 billion) in 2019 to USD 82.41 billion (RM341 .62 billion) in 2021; and the recovery of Malaysia furniture industry following the transition into the COVID-19 endemic phase in April 2022 which have since allowed all business activities to resume operations fully.

Consumers were driven to purchase furniture online during the movement restriction and lockdown periods, and furniture retailers also increasingly adopted e-commerce as an additional distribution channel to expand their customer reach during the pandemic. From 2019 to 2021, global furniture consumption increased at a CAGR of 9.64%, from USD 490.82 billion (RM2.03 trillion) to USD 590.01 billion (RM2.45 trillion). During the same period, global wood-based home furniture consumption also increased from USD199.08 billion (RMO.82 trillion) to USD 247.67 billion (RM1 .03 trillion), at a CAGR of 11 .54%. Moving forward, the furniture e-commerce market is expected to continue to grow with the continuous adoption of online shopping amongst consumers.

Further, the global demand for furniture is expected to remain strong over the long term as furniture are essential items to support daily activities. The global demand for furniture will continue to be supported by the recovery and growth in global economic conditions, growth in global population and urbanization, growing popularity of furniture e-commerce, and increasing consumer preference for RTA furniture. SMITH ZANDER forecasts global furniture consumption to grow at a CAGR of 2.88% from USD590.01 billion (RM2.45 trillion) in 2021 to USD 642.46 billion (RM2.83 trillion), in 2024, and global wood-based home furniture consumption to grow at a CAGR of 3.10% from USD 247.67 billion (RM1 .03 trillion) to USD 271.43 billion (RM1 .19 trillion) over the same period. The forecast growth is expected to benefit furniture export industry players in Malaysia as these industry players will be able to leverage the growth in global demand for furniture to continue expanding their business. As such, SMITH ZANDER forecasts Malaysia's furniture exports to grow at a CAGR of 4.07% from RM13.84 billion in 2022 to RM14.99 billion in 2024, and Malaysia's wood-based home furniture exports to grow at a CAGR of 4.79% from RM10.71 billion in 2022 to RM11 .76 billion in 2024.

Source: Smith Zander

Business strategies and prospects for SYNERGY HOUSE BERHAD.

The following are the business strategies:

- The company intends to continue growing the B2C sales segment:

- Expansion of the customer reach through listing and selling its products on more third-party e-commerce platforms with a new market focus.

- Enhancement of the revenue through advertising and promotions

- Establishment of new warehouses in Muar, Johor in 2023 and Port Klang, Selangor in 2027 respectively as the e-commerce fulfillment centers

- Purchase of inventories for third-party e-commerce fulfillment centers in overseas countries and Proposed New Muar Warehouse in anticipation of increasing B2C sales.

- The company will continue to expand the range of home furniture through continuous D&D efforts

MQ Trader View

Opportunities

- The company operates a B2C sales model as one of the sales channels, making us well-positioned to capitalize on the growing global furniture e-commerce market

Risk

- The company is dependent on 2 of the major customers who contribute substantially to the revenue.

- The company is dependent on third-party manufacturers for the manufacturing of home furniture. The Group focuses on the design, development and sale of home furniture. They outsource all manufacturing work for the home furniture to third-party manufacturers who are responsible for the purchasing of raw materials, manufacturing and packaging of the home furniture by the designs, specifications and requirements.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedback so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)