IPO - MST Golf Group Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 03 Jul 2023, 09:07 AM

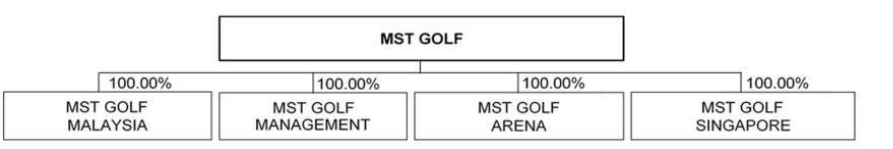

Company Background

The Company was incorporated in Malaysia under the Companies Act, 1965 on 13 May 1993 as a private limited company under the name of Adat Semarak Sdn Bhd and is deemed registered under the Act. On 31 December 1998, they changed the name to Planet Golf Sdn Bhd and subsequently on 2 May 2001, they further changed the name to MST Golf (Asia) Sdn Bhd. On 4 November 2022, they changed the name to MST Golf Group Sdn Bhd. On 23 November 2022, they were converted into a public limited company and assumed its present name.

The company is a specialty retailer and wholesaler of golf equipment comprising golf clubs, golf balls and accessories, and golf apparel in Malaysia and Singapore.

Use of proceeds

- Expansion in Malaysia and Singapore - 45.61% (within 36 months)

- Expansion into new geographical markets - 38.92% (within 36 months)

- Upgrade of digital technology facilities - 2.18% (within 36 months)

- Working capital requirements - 8.06% (within 24 months)

- Estimated listing expense - 5.23% (within 1 month)

Expansion in Malaysia and Singapore - 45.61% (within 36 months)

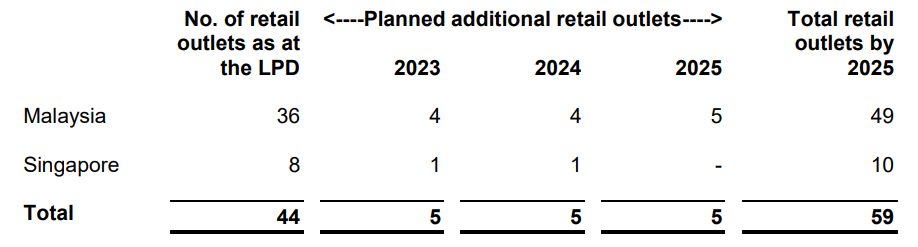

The Group intends to utilise approximately RM62.76 million, representing approximately 45.61% of the gross proceeds to be raised from the Public Issue, to fund the Group's expansion in Malaysia and Singapore, and to upgrade and refurbish the Group's existing golf retail outlets in Malaysia as well as the head office and warehouse at Subang Jaya, Selangor.

The process in identifying new retail outlet locations takes into consideration the factors as set out below:

- identifying the golfer catchment areas including new areas for potential growth

- opportunities and areas that are underserved by them;

- urban and major suburban locations with golf courses in the surrounding areas;

- premises including shopping malls, commercial buildings as well as golf and country clubs and driving ranges; and

- number of golf courses in the respective countries, where Malaysia has 243 golf courses and Singapore has 28 golf courses in 2020 (based on the latest available data) (Source: IMR Report), as the number of golf courses is potentially a driver of demand for golf equipment.

The Group intends to utilise RM59.76 million out of RM62.76 million to set up an additional 10 retail outlets and 5 retail outlets with indoor golf centres by 2025. The details of the planned additional retail outlets are set out below:

Expansion into new geographical markets - 38.92% (within 36 months)

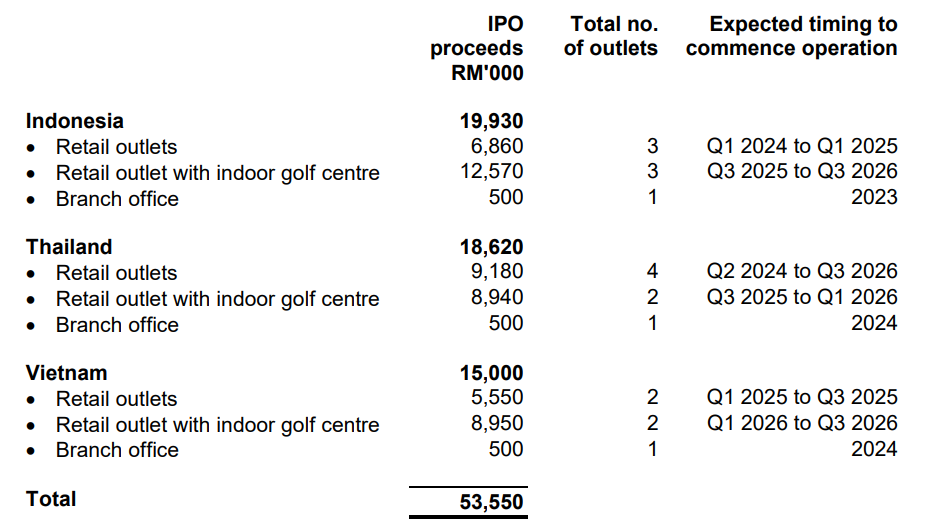

The Group intends to utilise RM53.55 million, representing approximately 38.92% of the gross proceeds to be raised from the Public Issue, to fund the Group's expansion into new geographical markets to establish golf retail outlets and retail outlets with indoor golf centres, namely in Indonesia, Thailand and Vietnam. The Group plans to establish new retail outlets within the region through joint venture arrangements with local partners in the respective countries. The rationale for expansion into new geographical markets via joint venture arrangements with local partners is to tap into their business track record, financial strengths, resources and their existing network within the retail industry in the respective geographical markets.

The basis for expanding into Indonesia, Thailand and Vietnam has taken into consideration the following key factors in assessing the opening of new retail outlets and indoor golf centres:

- location focusing on the major cities (such as Jakarta in Indonesia, Bangkok in Thailand and Ho Chi Minh City in Vietnam) in areas that have golf course facilities;

- premises including shopping malls, departmental stores, commercial buildings and golf and country clubs; and

- industry observations such as the number of golf courses in the respective countries where Thailand has 317 golf courses in comparison to 243 golf courses in Malaysia in 2020 (based on the latest available data). In addition, Indonesia has 170 golf courses and Vietnam has 86 courses in 2020 (based on the latest available data). The number of golf courses is potentially a driver of demand for golf equipment. Golf is often perceived to be an expensive sport compared to other sports, partly due to its exclusive nature, cost of equipment, as well as fees for golf club membership or fees to play on public and private golf courses. As such, growth in the economies, population, household income and consumer sentiment index (CSI) are factors of demand for golf equipment. Growing economies will serve as the platform for sustainability and growth for the golf industry.

The details on the utilisation of RM53.55 million from the IPO proceeds for the expansion into new geographical markets are set out below:

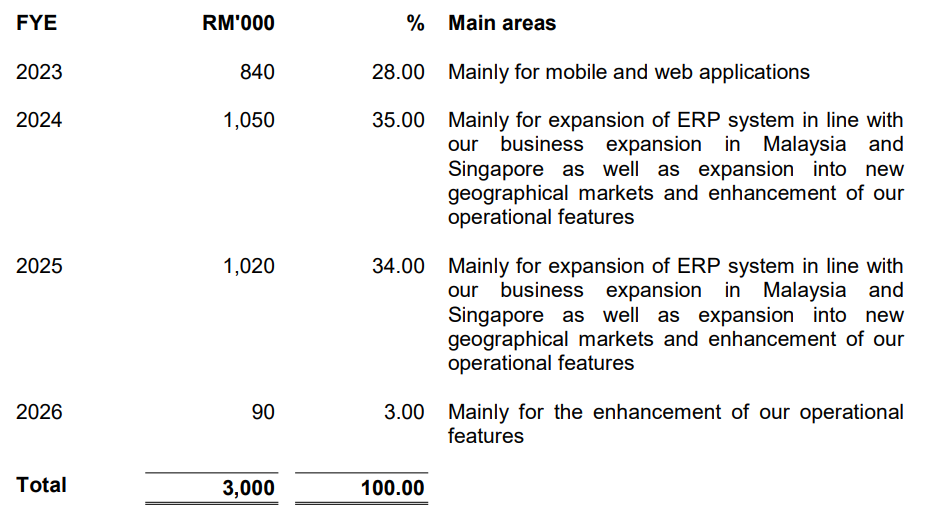

Upgrade of digital technology facilities - 2.18% (within 36 months)

The Group intends to utilise RM3.00 million, representing approximately 2.18% of the gross proceeds to be raised from the Public Issue, to upgrade its digital technology facilities including ERP and IT-related systems. This includes the development of mobile and web portal applications, expansion of ERP systems such as retail point of sales and accounting systems as well as integration of operations enhancement features such as data analytics to keep up with the Group's business expansion mainly to support the retail business expansion in Malaysia and Singapore as well as the new foreign countries including Indonesia, Thailand and Vietnam.

The upgrade of the digital technology facilities will focus on the following areas:

- mobile and web portal applications with the incorporation of new applications for golf-related services such as tee-time booking, golf coaching lessons, and corporate and wholesale sales, as well as online expansion in Singapore and the new foreign countries;

- expansion of ERP system including additional point-of-sales terminals and accounting system as part of the retail management system for its expansion in Malaysia and Singapore as well as the new foreign countries; and

- enhancement of operational features incorporating new data analytics.

The IPO proceeds will be allocated in the proportions as set out below:

Working capital requirements - 8.06% (within 24 months)

The company anticipates the need for more inventory and to utilise more operational and manpower resources to support its existing and future growth. Pursuant thereto and in tandem with the anticipated growth in line with the business expansion, they have earmarked RM3.26 million, representing approximately 8.06% of the gross proceeds to be raised from the Public Issue, for the working capital requirement purposes.

Business model

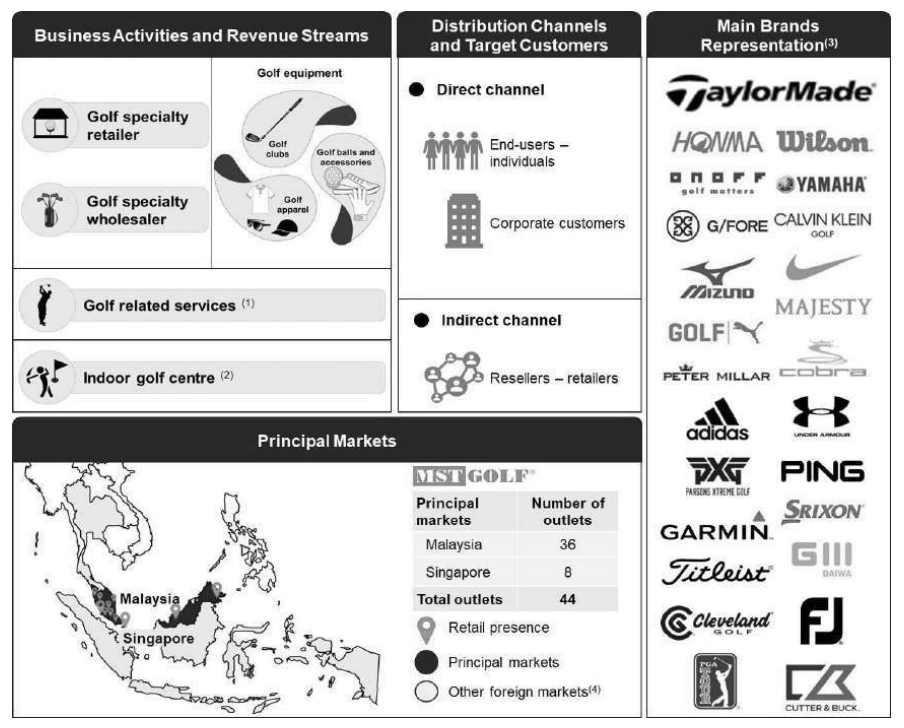

Business activities and revenue streams

The company is a specialty retailer and wholesaler of golf equipment comprising golf clubs, golf balls and accessories and golf apparel in Malaysia and Singapore. It is a multi-brand operator covering approximately 97 brands of golf equipment as at the LPD. For the FYE 2021 and FYE 2022, the top 25 brands accounted for 87.96% and 87.48% of the total revenue of RM206.52 million and RM300.88 million respectively, which include, among others, adidas, Calvin Klein Golf, Cleveland GOLF, Cobra, Cutter & Buck, Footjoy, Garmin, G/FORE, GIII, Honma, Majesty, Mizuno, Nike Golf, ONOFF, Peter Millar, PGA Tour, PING, Puma Golf, PXG, Srixon, TaylorMade, Titleist, Under Armour, Wilson and Yamaha.

Here are the details of the company’s business activities

- Retailer - the company has a total of 42 retail outlets in Malaysia and Singapore comprising 21 specialty stores, 19 pro shops and 2 departmental counters.

- Wholesaler - the company is also a wholesaler of gold equipment comprising golf clubs, golf balls and accessories and golf apparel to retailers operating in Malaysia and Singapore, as well as selling to other foreign countries, mainly Indonesia.

- Golf-related services - The company offers golf-related services including providing golf coaching at its golf academy to the general public located at the KLGCC, rental of golf equipment mainly golf clubs and golf accessories at its pro shops at the golf and country clubs and supply of range balls for use at the driving range that they operate, as well as event management and planning mainly for golf tournament-related events.

- Indoor golf centre - In February 2022, the company opened its first indoor golf centre under the "MST GOLF ARENA" brand located at The Gardens Mall in Kuala Lumpur with a GFA of approximately 27,140 sq. ft. which houses 20 golf simulation bays. a simulation putting green as well as dining areas serving food. and alcoholic and non-alcoholic beverages.

Click here to continue the IPO - MST Golf Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)