IPO - Minox International Group Berhad (Part 2)

MQTrader Jesse

Publish date: Mon, 25 Sep 2023, 02:29 PM

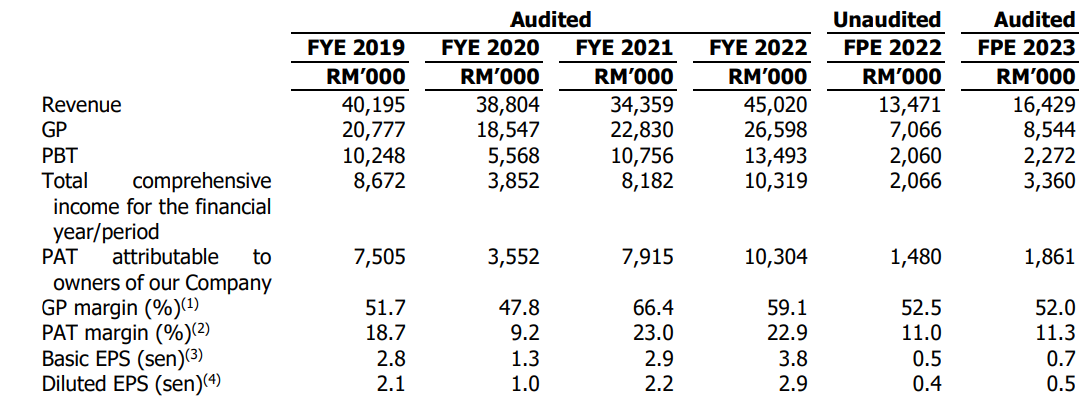

Financial Highlights

The following table sets out the financial highlights based on the combined statements of profit or loss and other comprehensive income for FYE 2019 to 2022 and FPE 2022 to 2023:

- The revenue increased from RM 40 million (FYE 2019) to RM 45 mil (FYE 2022). However, the company's revenue does not consistently increase year by year.

- The GP margin remains between 44% to 66%, but in most cases, it is higher than 50%. This also demonstrates the company's strong bargaining power with customers. (Generally, a GP margin of 20% is considered high/ good).

- In most cases, the PAT margin is above 15%. However, the PAT margin for FYE 2020 was 9.2% due to a decline in GP and GP margin.

- The gearing ratio is 0.40 times, which falls within the healthy range. However, the gearing ratio is close to the maximum limit of 0.5; therefore, we will need to be concerned about the company's liquidity in the future. (A good gearing ratio should be between 0.25 – 0.5).

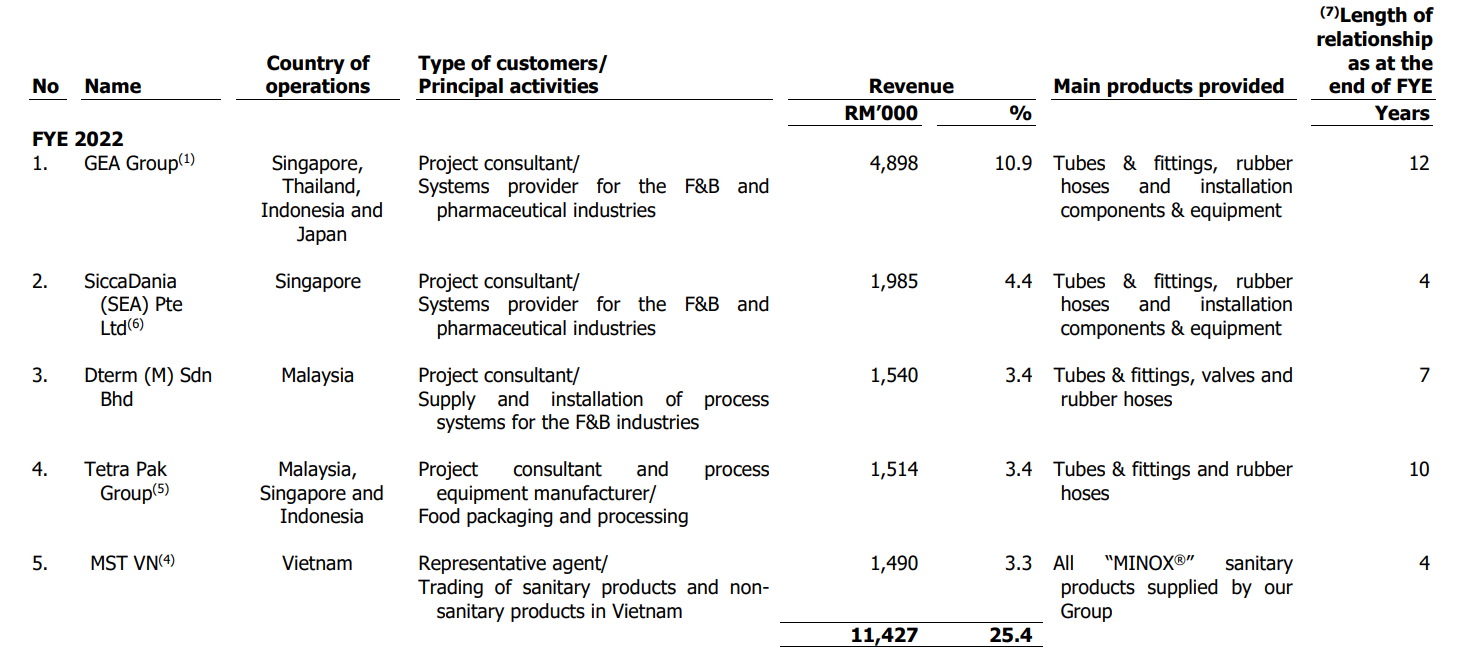

Major customers and supplier

Major Clients

The top 5 customers according to the revenue contribution for FYE 2022 is as follow:

According to the table, the top 5 customers contribute a total of 25.4% of revenue to the company. This shows that the company is not involved in high customer concentration risk. The management also mentioned that they are not dependent on any single customer due to their large customer base of approximately 1,700 active and recurring customers.

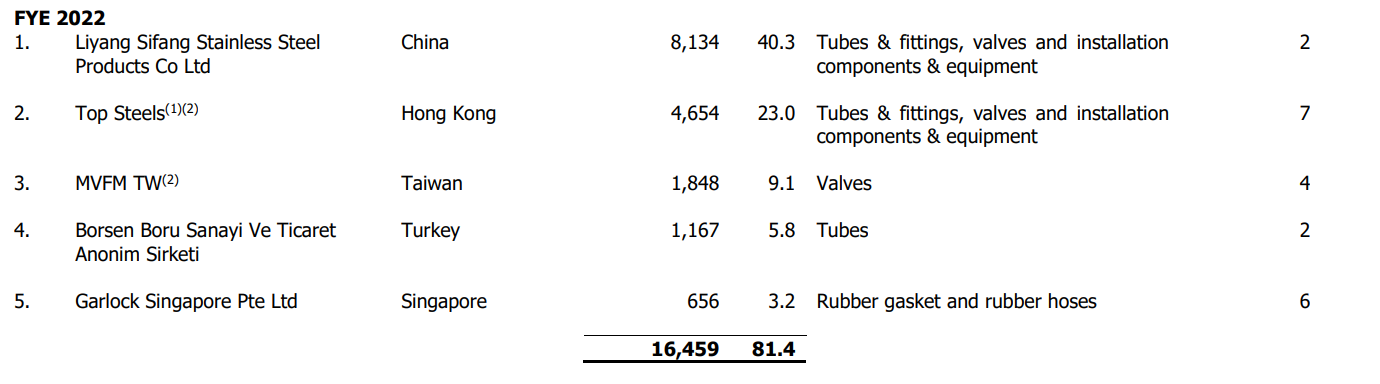

Major Suppliers

The company’s suppliers are based in China, Denmark, Italy, South Korea, Taiwan, Thailand, Turkey, and Hong Kong. They are selected based on the pricing, lead time for delivery, credible market reputation, creditworthiness and adherence to quality standards for QC procedures as well as possessing the necessary industry certifications and reliability of products.

The Group’s top 5 suppliers according to the total purchase for FYE 2022 is as follows:

The total purchases from the top 5 suppliers account for 81.4% of the procurement. The company's management will evaluate suppliers based on pricing, delivery lead time, credible market reputation, creditworthiness, adherence to quality standards for QC procedures, and possession of necessary industry certifications, including 3-A and SME BPE, as well as the reliability of their products.

Industry Overview

According to the research report from “Protégé Associates, the Asia Pacific sanitary valves and fittings industry has dominated the global industry with its 49.2% share valued at USD 615.28 million in 2022. Growth in Asia Pacific is expected to be bolstered by emerging economies such as China and India expanding their pharmaceutical and F&B industries coupled with growing hygiene awareness in these industries, as well as growing requirements for water treatment in various Asia Pacific countries. Moving forward, the sanitary valves and fittings industry in Asia Pacific is expected to reach USD 642.97 million in 2023 and expand by a CAGR of 6.1% to reach USD 825.60 million in 2027.

From a local perspective, factors boosting growth within the Malaysian sanitary valves and fittings industry are likely to come from the expansion in the local F&B manufacturing industry, a prevalence of chronic lifestyle disease boosted demand for pharmaceutical products, as well as technological advancement spurring demand for semiconductors. At the same time, the growing affluence of Malaysians also indicates higher spending power by the population for the consumption of food and pharmaceutical products, as well as consumer electronics.

However, the ongoing geopolitical tension across the globe as well as economic slowdown is expected to result in dampened demand for various products including food, pharmaceutical products as well as consumer electronics. In addition, as part of the manufacturing sector that is often labour intensive, the labour shortage issues faced by Malaysia may hinder the growth of the end-user markets of the local sanitary valves and fittings industry, which may dampen the development of the industry.

On the supply side, the Malaysian sanitary valves and fittings industry is expected to benefit from the advancement in technostructure facilities and resources in the country. Furthermore, support from the Malaysian Government in growing the local manufacturing sector in the country has also served to bolster growth of the local sanitary valves and fittings industry. In particular, the National Food Security Policy Action Plan 2021-2025 by the Ministry of Agriculture and Food Industries as well as tax incentives for pharmaceutical manufacturers is expected to boost the development of these industries. On the flipside,the higher cost of raw materials such as chromium and nickel which are essential in the manufacture of stainless steel is expected to hinder the expansion of the local sanitary valves and fittings industry.

In 2022, growth in the sanitary valves and fittings industry in Malaysia was supported by the pickup in local economic activities, whereby the Malaysian Government had announced the transition of COVID-19 into an endemic phase starting 1 April 2022. The Ministry of Health had also announced further relaxation of COVID-19 restrictions from 1 May 2022 and that all economic sectors are allowed to operate from 15 May 2022 onwards. On the global front, vaccination efforts and more relaxed COVID-19 measures are expected to boost economic activities, thus resulting in an increase in demand for various goods and services. During the year, the industry expanded by 13.0% to reach RM213.57 million. Going forward, the Malaysian sanitary valves and fittings industry is expected to grow at a CAGR of 11.2% from RM234.93 million in 2023 to RM 363.09 million in 2027.

Source: Protégé Associates

Business strategies for MINOX INTERNATIONAL GROUP BERHAD.

The business objectives are to maintain sustainable growth in its business and create long-term shareholder value. To achieve the business objectives, the company will implement the following business strategies over the period of 36 months from the date of the Listing

- Expansion of the product range

- Construction of Warehouse 4

- Expansion of the market coverage in Singapore

MQ Trader View

Opportunities

- The company's business presence across the globe ensures customer diversification and also helps mitigate certain regional risks. The company is able to distribute the products in Malaysia, across various SEA countries and neighboring countries through the headquarters in Malaysia and regional offices in Indonesia, Singapore and Thailand. The regional office and warehouse in Singapore aim to better serve overseas markets such as Bahrain, Cambodia, Denmark, Germany, India, Japan, South Korea, Myanmar, Sri Lanka, Spain and the United Arab Emirates.

- The company has a large customer base, so it is excluded from the high-concentration customer risk. This also helps the company maintain its ability to negotiate prices and protect its GP margin. The Group has a customer base of approximately 1,700 active and recurring customers, including project consultants, contractors, and industrial end-customers. The major customers have been doing business with them for between 5 to 13 years.

Risk

- The company is exposed to fluctuations in foreign exchange rates, which may impact the profitability of the Group. The company faces foreign exchange fluctuation risk because the company purchases from various overseas third-party manufacturers/suppliers, including those in China, Denmark, Italy, South Korea, Taiwan, Thailand, Turkey, and Hong Kong. The majority of these purchases are denominated in USD. Therefore, the company is primarily exposed to fluctuations in the USD.

- The company is exposed to the risk of unexpected freight disruptions and fluctuations in freight rates. Since the products are imported from third-party manufacturers/suppliers and exported to overseas customers, the company relies on sea/air freight. Therefore, the company may be vulnerable to unexpected freight disruptions due to factors, including but not limited to adverse weather conditions, political turmoil, social unrest, port strikes, or delayed or lost shipments, which could adversely impact its business operations. Additionally, any significant fluctuation in freight rates could have a substantial effect on costs and, ultimately, profit margins if the company is unable to pass on these cost increases to customers through higher selling prices. Here are the freight charges from FYE 2019 to 2022: RM 0.82 million (FYE 2019), RM 0.98 million (FYE 2020), RM 0.68 million (FYE 2021), and RM 1.24 million (FYE 2022).

- The company is subject to fluctuations in the cost of purchases due to fluctuations in raw material prices. The company currently engages third-party manufacturers to produce the 'MINOX®' brand of sanitary products. These third-party manufacturers are also responsible for sourcing and purchasing raw materials, such as stainless steel. Therefore, any significant increase in manufacturing costs charged by the suppliers because of rising raw material prices will result in an increase in its purchase price.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)