IPO - Panda Eco System Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 10 Nov 2023, 02:31 PM

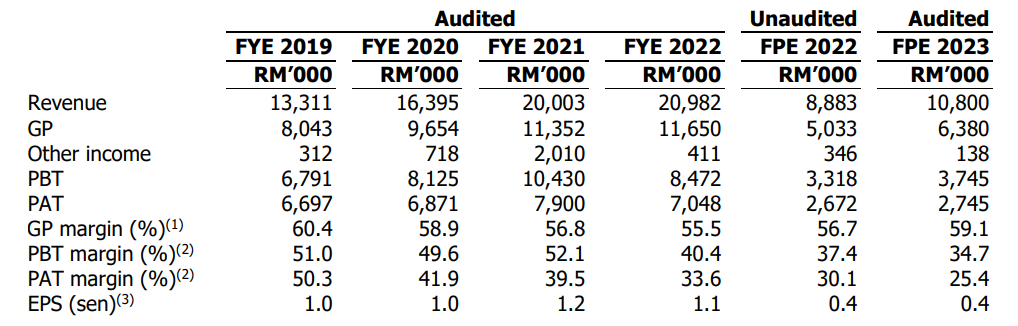

Financial Highlights

The following table sets out the financial highlights based on the combined statements of comprehensive income for FYE 2019 to 2022 and FPE 2022 to 2023.

- The revenue increased from RM 13.3 million (FYE 2019) to RM 20.9 million (FYE 2022). However, the revenue growth slowed down from FYE 2021 to FYE 2022 due to a deceleration in the grocery retail store sector segment.

- The GP margin declined from 60.4% (FYE 2019) to 55.5% (FYE 2022). Although the GP margin is still significantly high, this continuous decrease may indicate that the company is losing its pricing bargaining power in the market, which, in turn, suggests a decline in competitiveness. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin declined from 50.3 (FYE 2019) to 33.6% (FYE 2022)

- The gearing ratio is 0, which means the company has almost no debt. This will provide the company with good liquidity to avoid any unexpected systematic risk in the future. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Clients

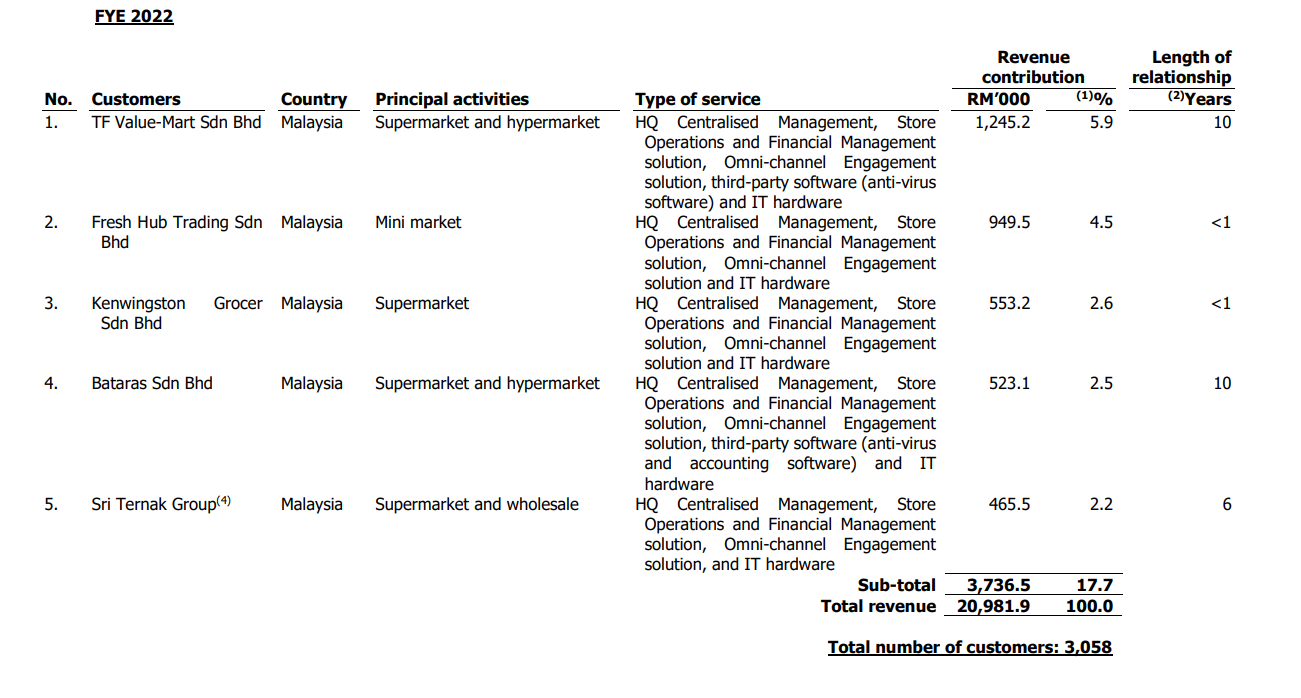

The table below sets out the Group’s top five customers for FYE 2022:

According to the table, the top 5 customers contribute 17.7% of revenue to the company, and the total number of customers is 3,058. Therefore, the company has good customer diversification, with revenue not concentrated on a few top clients, and they have a sufficiently large customer base to diversify the risk.

Major Suppliers

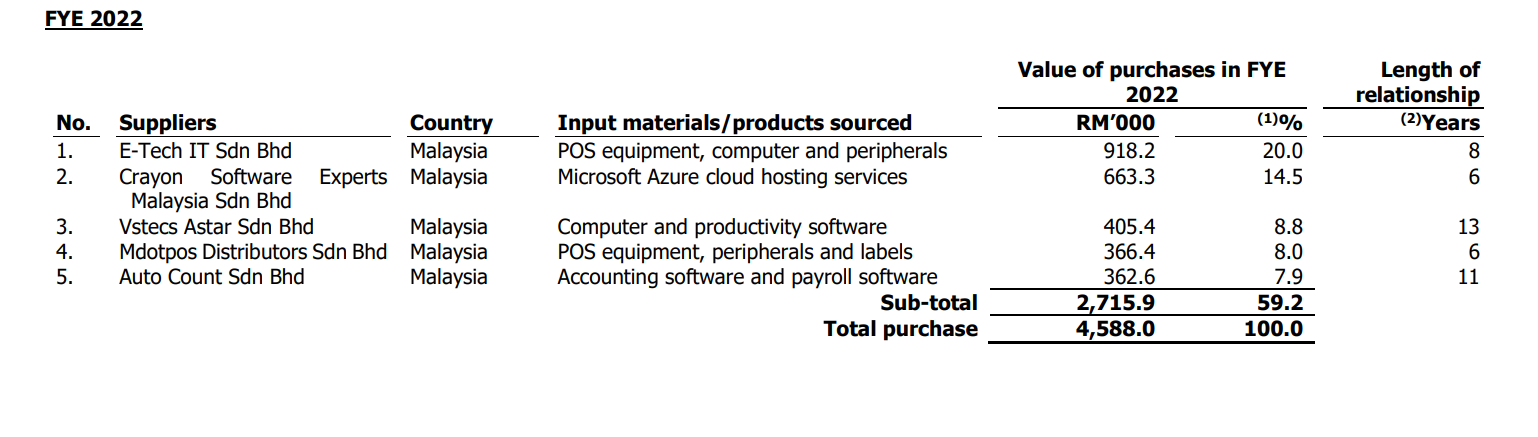

The table below sets out the Group’s top five suppliers for FYE 2022:

The total purchases from the top 5 suppliers account for 59.2% of the purchases. The management has mentioned that the company is not dependent on any single major supplier as there are other suppliers available in the market that can provide similar IT hardware and software as well as services.

Industry Overview

According to the research report from Providence Stretegic Partners, the retail management solutions industry in Malaysia has been growing at a CAGR of 18.8% between 2018 and 2022. Moving forward, PROVIDENCE forecasts the retail management solutions industry size in Malaysia to recover and register a CAGR of 18.4% between 2023 and 2025. The growth of the retail management solutions industry in Malaysia is expected to be driven by the following:

- Growth of the retail industry in Malaysia which will drive demand for retail management solutions;

- Introduction of new retail management solutions to keep up with the latest retail industry trends will create new revenue streams for retail management solutions industry players;

- The growing preference for cloud-based retail management solutions; and

- Government initiatives to promote digitalisation.

The growing retail industry in Malaysia is expected to lead to retailers expanding their network of retail stores and/or e-commerce activities. There is thus a constant need for retail management solutions to not only manage existing physical retail stores and online retail stores but also new physical and online stores that will be set up. In addition, the growth in the retail industries in neighboring countries such as in Indonesia and the Philippines could benefit the local retail management solutions industry. Retail management solutions industry players in Malaysia could expand their reach into other countries to tap into the growing retail industries in these countries. At present, the competitive landscapes in Indonesia and the Philippines primarily comprise international retail management solution providers who have set up operations in these countries. Panda Group stands to benefit from the positive outlook of the retail management solutions industry in Malaysia, as a key industry player in the local retail management solutions industry. Panda Group also stands to benefit from the growing retail industries in Indonesia and the Philippines as the Group intends to expand into these markets.

Source: Providence Strategic Partners

Future plans and strategies for PANDA ECO SYSTEM BERHAD.

- The company intends to develop cloud-based modules under its HQ Centralised Management, Store Operations and Financial Management solution, and expand the solution offerings under its Retail Management Eco-system.

- Development of cloud-based modules for the Retail Management Ecosystem

- Expansion of solution offerings

- The company intends to expand the workforce and operational facilities to facilitate its business expansion in Malaysia

- Expansion of its CTS department in Melaka

- Expansion of its HQ

- Establishing additional service hubs and expanding the workforce in existing service hubs in Malaysia

- The company plans to regionally expand its geographical footprint in other countries within the ASEAN region.

MQ Trader View

Opportunities

- The company has a diversified customer base. This helps to mitigate the risk of customer concentration, which could significantly impact the company's revenue in its financial reports.

- The company's gearing ratio is 0, greatly enhancing its ability to withstand risks and increasing its chances of survival in the face of unexpected events.

Risk

- The slowdown in the company's GP margin indicates weaker profitability. The company has faced cost control issues from FYE 2019 to FYE 2022, potentially making it less attractive to investors.

Click here to refer the IPO - Panda Eco System Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)