IPO - CPE Technology Berhad (Part 1)

MQTrader Jesse

Publish date: Wed, 22 Nov 2023, 04:17 PM

Company Background

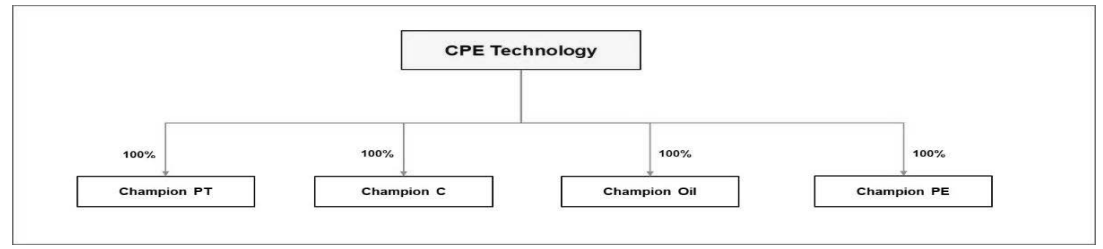

The Company was incorporated on 26 April 2021 in Malaysia under the Act as a private limited company under the name of CPE Technology Sdn. Bhd. On 13 April 2022, the Company was converted into a public limited company and assumed its present name. The Company is a holding company based in Malaysia and its Subsidiary Companies are based in Malaysia and Singapore. The Group structure is as illustrated in the diagram below.

The Group is an engineering supporting services provider principally involved in manufacturing precision-machined parts and components and providing CNC machining services.

Use of proceeds

- Acquisition of the New Industrial Lands and construction of the New Plants - 38.76% (within 36 months)

- Purchase of new machinery and equipment and relocation of existing machinery and equipment - 18.31% (within 36 months)

- Repayment of bank borrowings - 9.72% (within 36 months)

- Part-financing working capital expenditure requirements - 26.12% (within 24 months)

- Part financing other capital expenditure requirements - 0.79% (within 12 months)

- Estimated listing expenses - 6.30% (Within 3 months)

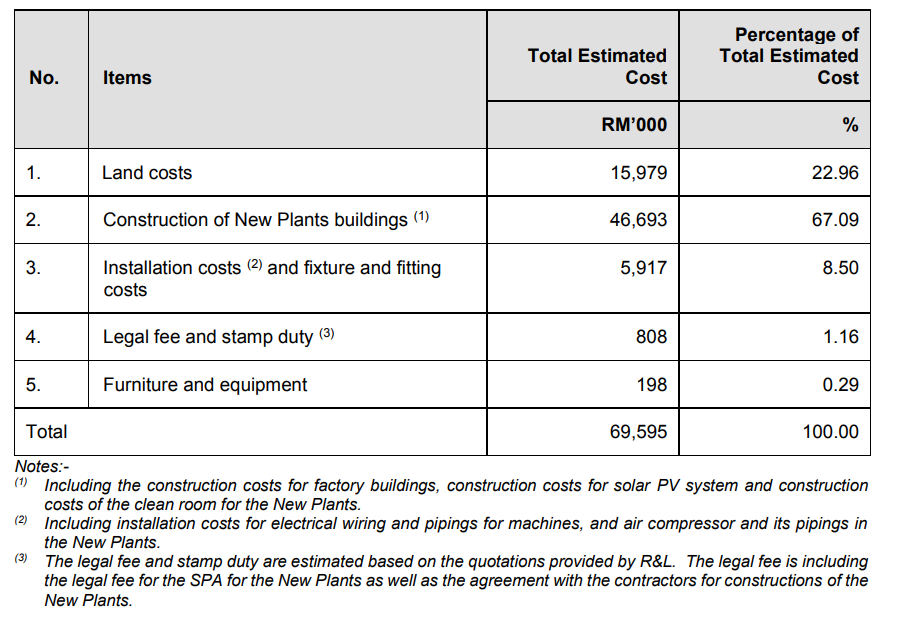

Acquisition of the New Industrial Lands and construction of the New Plants - 38.76% (within 36 months)

The company intends to allocate approximately RM69.60 million of the gross proceeds from the Public Issue for the Acquisition of the New Industrial Lands and construction of the New Plants.

The total estimated land costs for the New Industrial Lands and estimated construction costs for the New Plants are approximately RM62.67 million.

The estimated breakdown of the land costs for the New Industrial Lands and construction costs for the New Plants are as set out in the table below:

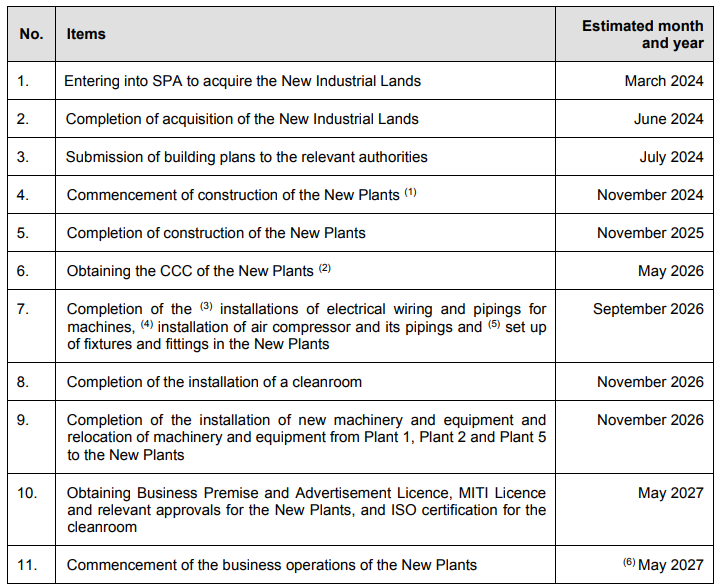

The estimated timeline about the acquisition of New Industrial Lands and construction of the New Plants is as set out in the table below

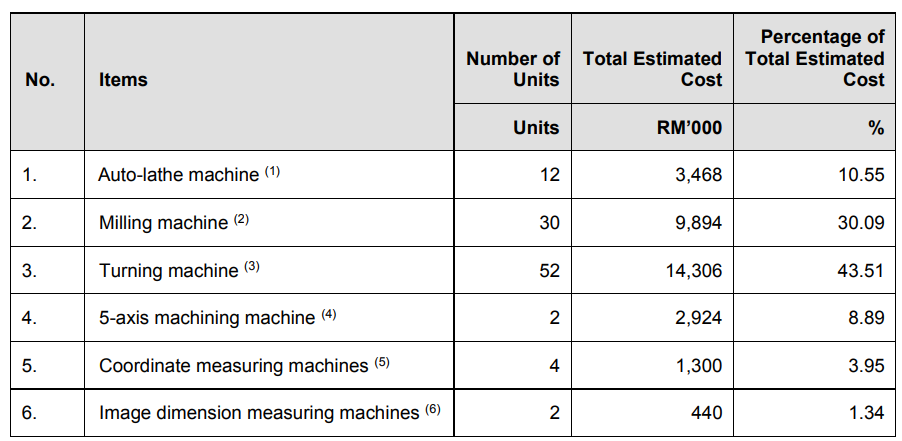

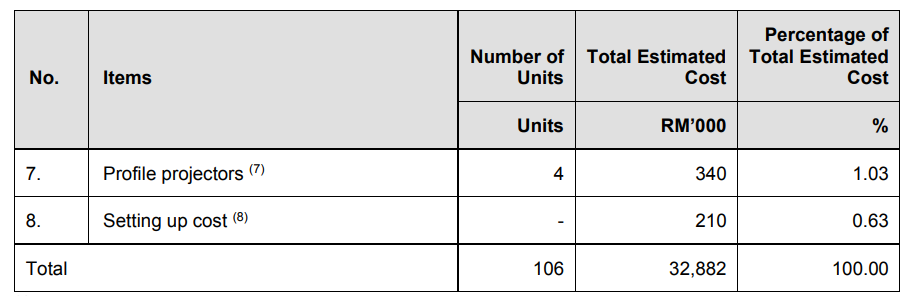

Purchase of new machinery and equipment and relocation of existing machinery and equipment - 18.31% (within 36 months)

The company intends to allocate approximately RM32.88 million of the gross proceeds from the Public Issue for the purchase of new machinery and equipment and relocation of existing machinery and equipment as stated in the table below.

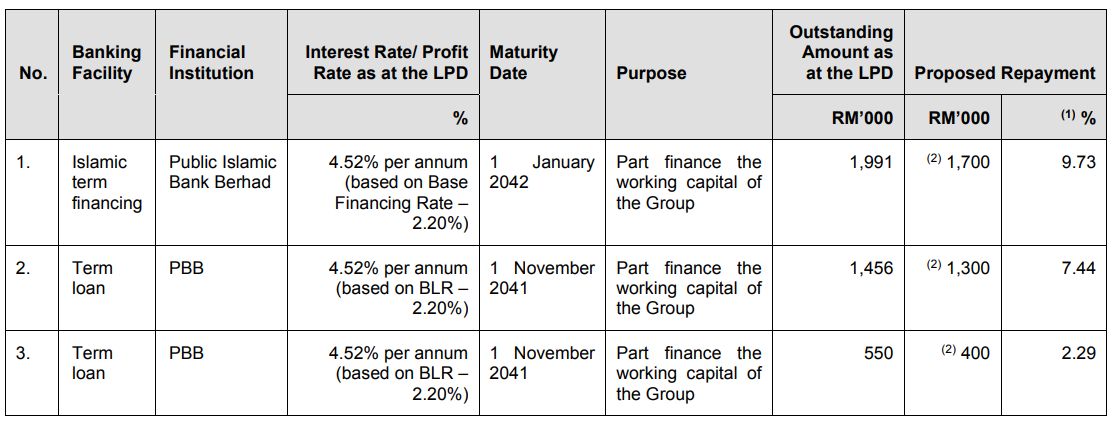

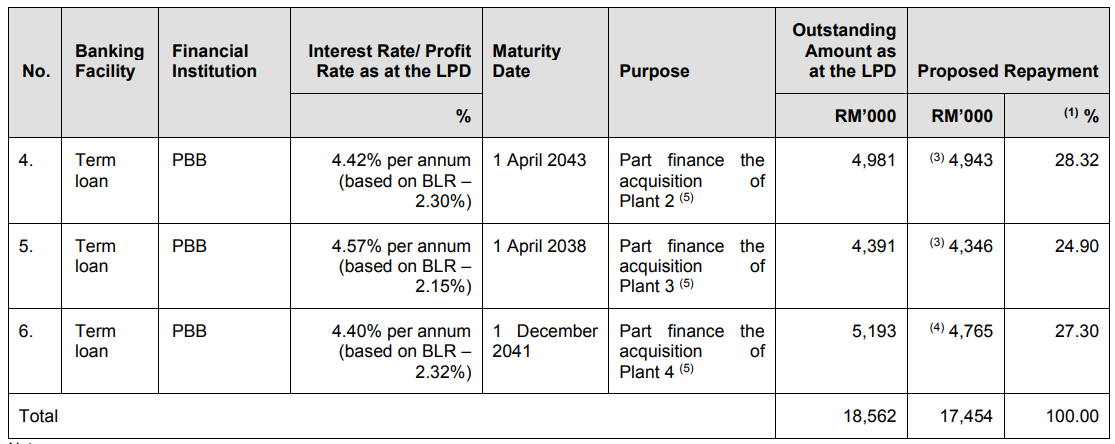

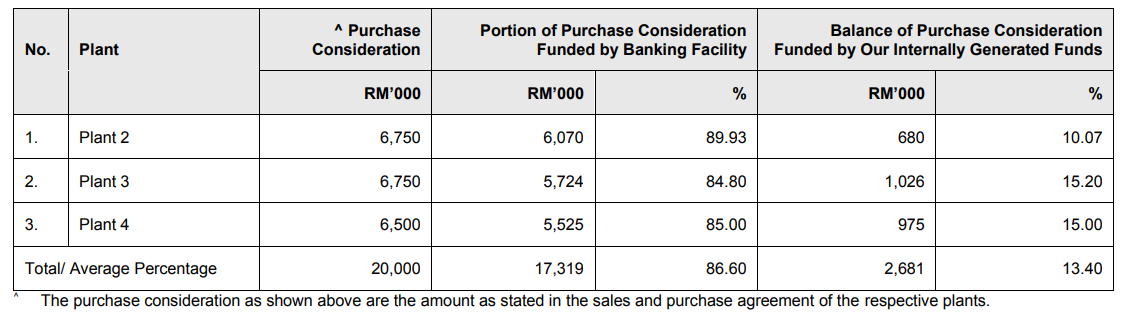

Repayment of bank borrowings - 9.72% (within 36 months)

The company has allocated approximately RM17.45 million of the gross proceeds from the Public Issue to partially repay the existing bank borrowings as stated in the table below.

Upon reducing the total borrowings by the proposed repayment as set out in this section, the company expects to achieve an annual interest savings of approximately RM0.78 million based on its computation using the applicable interest rates as at the LPD. However, the actual interest savings amount may vary depending on the applicable interest rates at that point in time.

Part-financing working capital expenditure requirements - 26.12% (within 24 months)

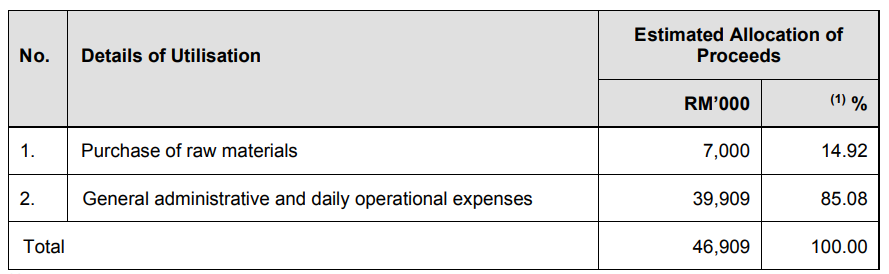

The company has allocated approximately RM46.91 million of the gross proceeds of the Public Issue to fund its working capital requirements, which include, but are not limited to, the purchase of raw materials and general administrative and daily operational expenses such as staff-related costs, utilities, statutory payments and any other overhead expenditures.

The breakdown of such utilisation has not been determined at this juncture and will be dependent on the operating and funding requirements at the time of utilisation. Notwithstanding that, and on best estimate basis, the percentage of the allocation of the proceeds to be utilised for each component of its working capital are as stated in the table below

Part financing other capital expenditure requirements - 0.79% (within 12 months)

The company intends to use up to approximately RM1.42 million of the gross proceeds from the Public Issue to part-finance the other capital expenditure requirements which include, but are not limited to, the purchase of new laptops/desktops, replacement of existing laptops/desktops, and upgrade of IT system/server.

Business model

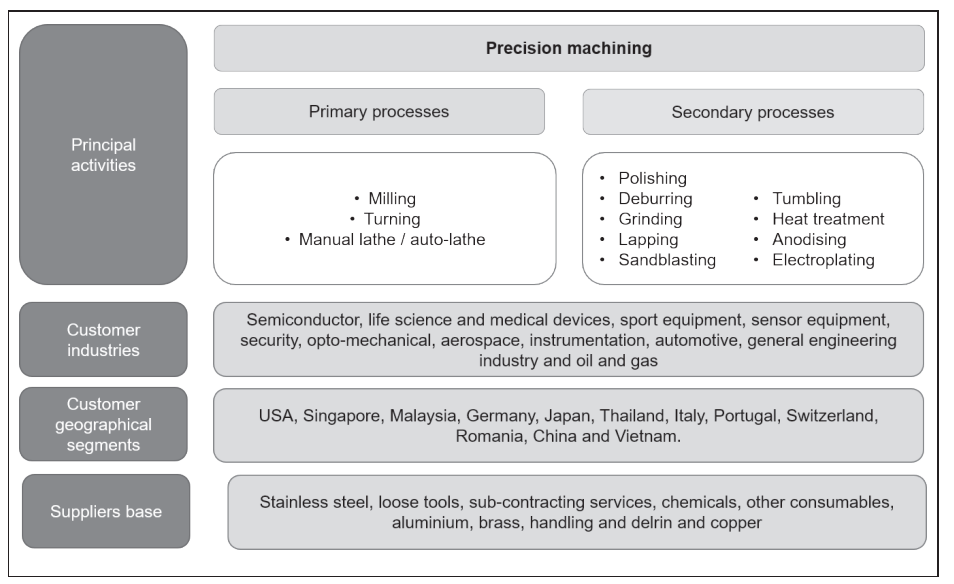

The Group is an engineering support services provider principally involved in the manufacturing of precision-machined parts and components and the provision of CNC machining services. The precision-machined parts and components are then used by customers in different industries which include but are not limited to, semiconductors, life science and medical devices, sports equipment, sensor equipment and security industries in Malaysia and overseas. The company utilises CNC machining as its primary process such as milling, turning and lathing before going through associated secondary processes which include, but are not limited to, polishing, grinding and sandblasting to produce precision-machined parts and components from metal rods and blocks. The company can provide different services depending on the needs and requirements of the customers and can source the raw materials for the customers and manufacture the precision-machined parts and components for the customers.

For customers that engage the company to procure raw materials as well as to manufacture precision machined parts and components, the company will classify them under ‘sales of goods’. On the other hand, some of the customers would prefer to provide them with the raw materials after which the company will manufacture the precision-machined parts and components for them. Under such circumstances, the company classifies them under ‘rendering of services’.

The principal activities, customer industries, customer geographical segments and supplier base are summarised in the diagram below

The production process is as illustrated in the diagram below.

Click here to continue the IPO - CPE Technology Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)

Dav Yau

Kena Jail House Rock......0.90 only.....Adoooiiiii

2023-12-07 13:19