IPO - CPE Technology Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 22 Nov 2023, 04:17 PM

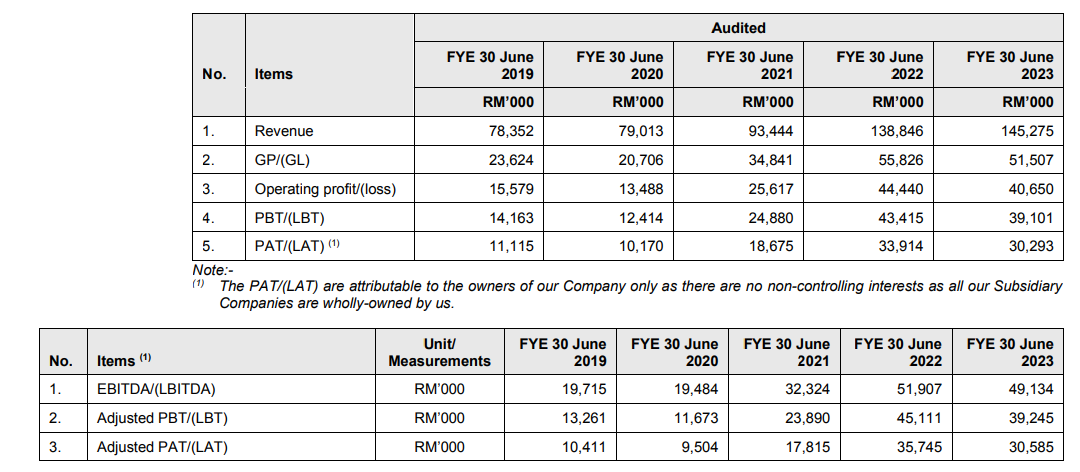

Financial Highlights

The tables below set out financial highlights based on the audited consolidated financial statements for the Period Under Review.

- The revenue increased from RM 78 million (FYE 2019) to RM 145 million (FYE 2023), indicating that the company's market share in its sector is continuing to grow.

- The GP margin was highest at 40.21% in FYE 2022 and lowest at 26.21% in FYE 2020. However, the GP margin has mostly remained above 30%. Considering the company's scale, this consistent performance above 30% also reflects the competency of the company's management. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin reached its highest point at 24.43% in FYE 2022 and its lowest at 12.87% in FYE 2020. Over the span of 5 years, the average PAT margin has been around 18%.

- The gearing ratio is currently 0.23 and is expected to decrease to 0.05 after the IPO. This ratio falls within a healthy range, indicating that the company maintains a higher risk tolerance. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

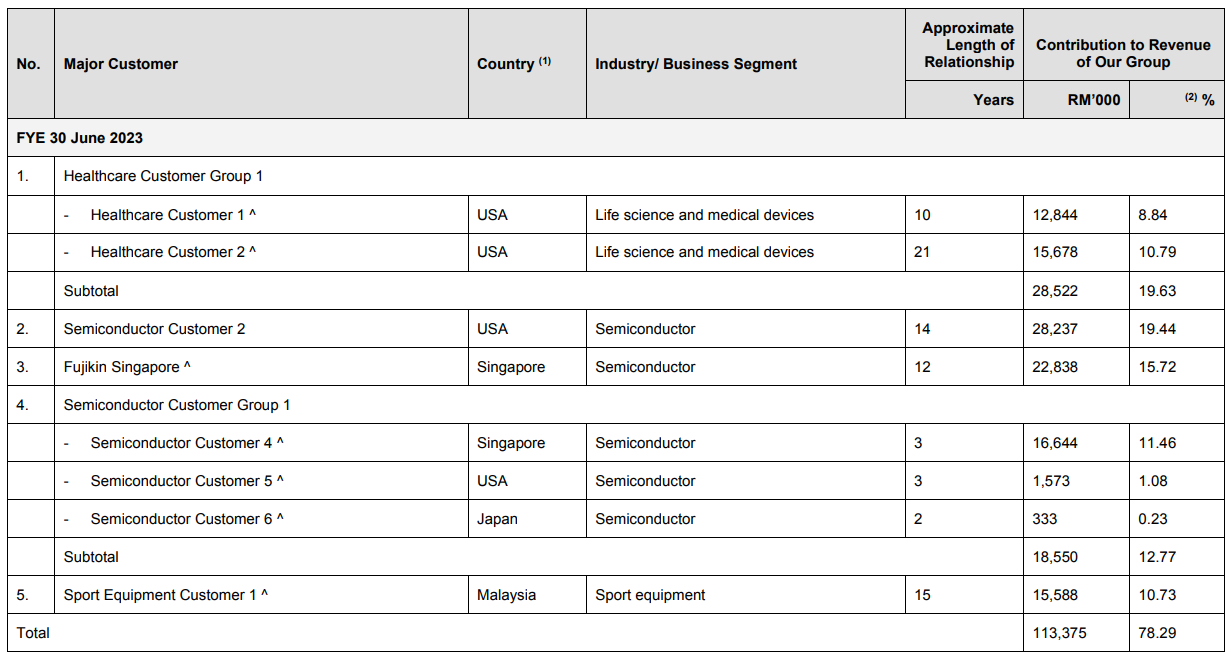

Major Clients

The top 5 major customers for the Period Under Review are as stated in the table below.

According to the table, the top 5 customers contribute 78.29% of the company's revenue. This highlights the company's significant dependence on these top 5 customers, leading to a high customer concentration risk. If any customer within this top 5 decides to terminate their corporate involvement, it could significantly impact the company's financial results.

Major Suppliers

The top 5 major suppliers for the Period Under Review are as stated in the table below.

The total purchases from the top 5 suppliers account for 66.08% of the purchases. The management has mentioned that the company is not dependent on any of its major suppliers as the raw materials are common and can be sourced from other suppliers.

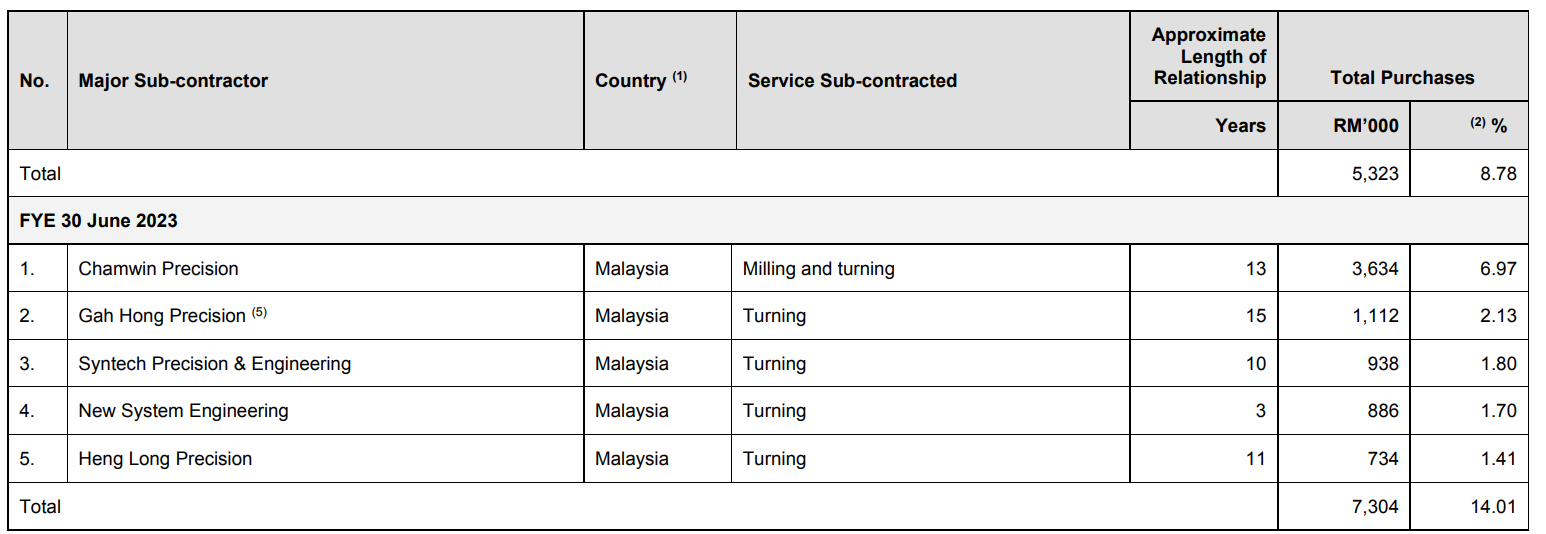

Major Sub - Contractors

The top 5 major sub-contractors for the Period Under Review are as stated in the table below.

The total purchases from the top 5 major subcontractors account for 14.01% of the purchases. The company will engage subcontractors for the primary processes and secondary processes when the capacity is full based on the schedule of the workers as well as for the secondary processes that are not performed by them.

The management mentioned the company is not dependent on any of the major subcontractors as the sub-contractors as the sub-contracting services are common and can be sourced from other sub-contractors.

Industry Overview

According to the research report from Protégé Associates, the market size (measured by sales value of manufactured products in Malaysia) of the ESI in Malaysia was valued at RM9.37 billion in 2022, which was a double-digit expansion from RM7.62 billion in the previous year. The local ESI is forecast to reach RM9.98 billion in 2023 and expand by a CAGR of 8.2% to reach RM13.88 billion in 2027, supported by the advancement in technology as well as expansion in end-user markets. In the short term, the growth of the Malaysian ESI may be affected by the global economic slowdown, heightened inflation rates, and subdued consumer spending. The semiconductor industry, in particular, is expected to experience a decline, especially within consumer-led markets. Nevertheless, the increasing demand for engineering supporting services from other end-user industries, namely the life science and medical technology industry, is likely to offset the decline in the semiconductor industry and support the Malaysian ESI. Growth in the industry is expected to be underpinned by an increasing number of electronic components being incorporated into both emerging and traditional industries, thus spurring demand for more semiconductors in the long-term. At the same time, the global semiconductor industry is also expected to be driven by the advancement in telecommunication technology such as the rollout of 5G technology and the increasing adoption of IoT and IoMT, in which both will boost demand for semiconductors. The ESI is also set to benefit from the expansion of its other end-user markets such as the life sciences and medical technology, instrumentation and sport equipment industries, all of which rely on the ESI to supply parts, components and services to them.

Closer to home, the local ESI is poised to benefit from the growth of the local M&E industry which serves as an important supporting industry for the broader manufacturing sector. As manufacturing activities intensify, there's an anticipated uptick in investments, especially those that focus on enhancing and expanding production capacities, which would translate to increased demand for the M&E solutions in Malaysia. Manufacturers are also adopting the "just-in-time" method for its advantages such as reduced warehousing and inventory costs, greater control over inventory turnover and prevention of overproduction as well as unsold product accumulation. The need for swift production in response to orders from customers would require manufacturers to increase their manufacturing capacity. These developments will continue to support the local M&E industry and translate to higher demand for engineering supporting services.

Source: Protégé Associates

Future plans and strategies for CPE TECHNOLOGY BERHAD.

The group aims to grow the business by implementing the following business strategies.

- Construction of New Plants

- Purchase of New Machinery and Equipment

- Purchase of Raw Materials

MQ Trader View

Opportunities

- The company has a wide geographical coverage across various industry segments. Its customers hail from the USA, Singapore, Malaysia, Germany, Japan, and Thailand. Additionally, the company covers sectors such as semiconductors, life sciences, medical devices, sports equipment, sensor equipment, and security. The diversified customer base across different geographic locations and industry segments can help the company mitigate risks stemming from any single source. For instance, this diversity can offset risks related to government tax laws or a contraction in any specific business sector due to the business cycle.

- The company has demonstrated strong financial performance. Consistent revenue growth indicates an increase in the company's market share. Despite its large scale, the company has managed to maintain a gross profit margin of around 30%. Furthermore, its low gearing ratio ensures higher liquidity, enabling the company to better manage financial risks.

Risk

- The company is exposed to high customer concentration risk. This implies that if any of these five companies terminate their partnership with the company, it will significantly impact the company's finances. Hence, the company needs to make every effort to secure new orders, reducing overreliance on a single customer and preventing potential loss of pricing power in the future.

- The company is exposed to foreign currency exchange risk because of its diverse customer base from different geographical regions. The company's financial results might be affected by the appreciation or depreciation of foreign currencies against the Malaysian currency.

Click here to refer the IPO - CPE Technology Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)