IPO - Master Tec Group Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 05 Jan 2024, 12:32 PM

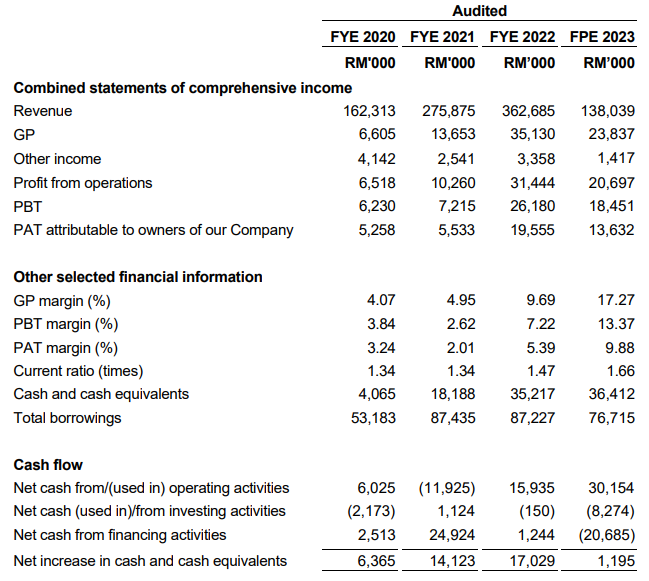

Financial Highlights

The following table sets out a summary of the combined financial information for the FYE Under Review and FPE 2023:

- The revenue increased from RM 162 million in FYE 2020 to RM 362 million in FYE 2022. This shows that the company is still growing due to an increase in market share.

- The gross profit margin increased from 4.07% in FYE 2020 to 9.69% in FYE 2020. The rise in the gross profit margin was primarily due to a higher GP margin from the sales of aluminum-cored LV power. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin declined from 3.45 in FYE 2020 to 2.01% in FYE 2021 and increased to 5.39 in FYE 2022.

- The gearing ratio was 1.01 in FYE 2022, which is above the healthy range. This will weaken the company's ability to face financial crises and may damage its foundation in case of unexpected events. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

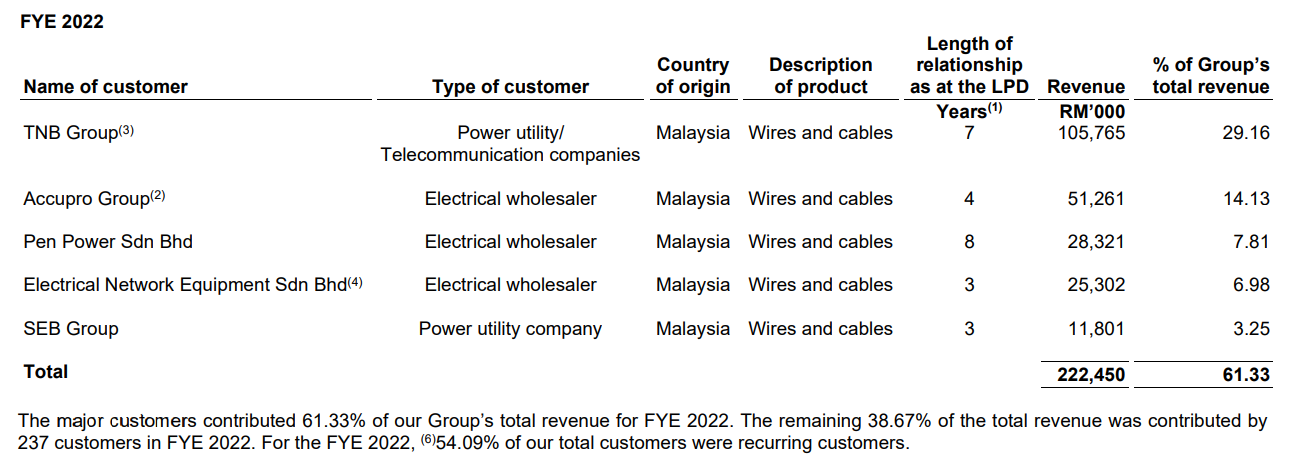

Major Customers

The major customers and their respective contributions to the Group’s revenue in terms of amount and percentage for FYE 202:

According to the table, the top 5 customers contribute 61.33% of the company's revenue. The company is dependent on its top 3 customers, who contribute over half of its revenue. The majority of revenue coming from concentrated customers will expose the company to concentrated customer risk. If any of these customers terminate their service with the company, it will immediately impact the financial results.

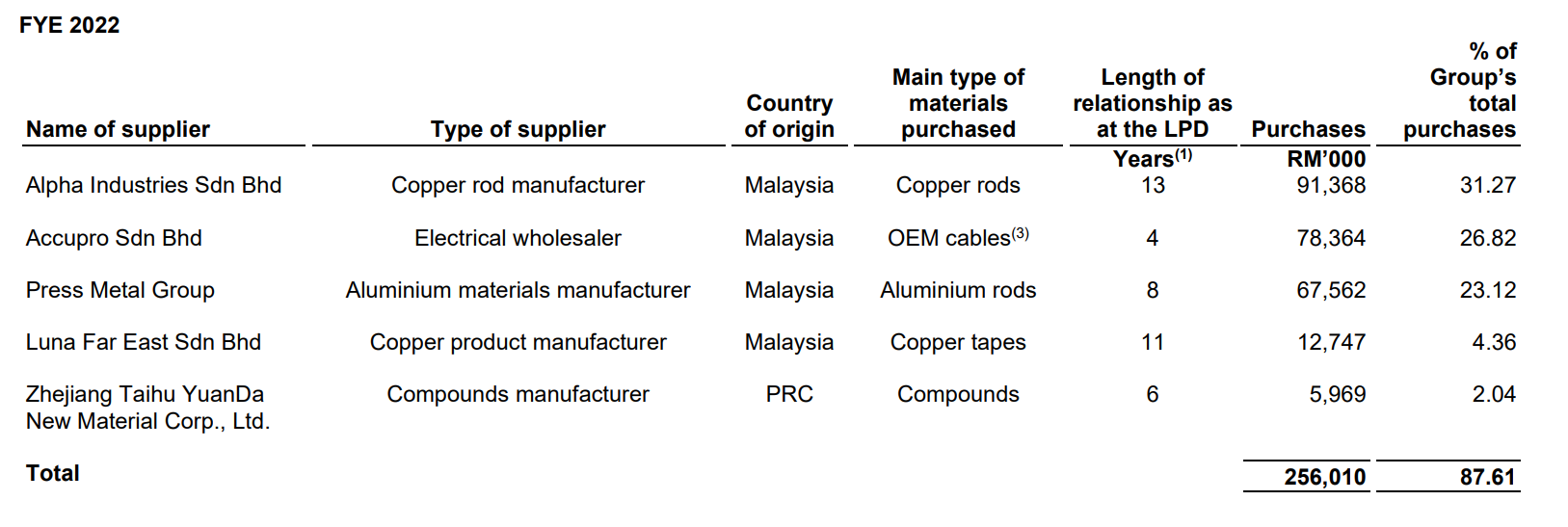

Major Suppliers

The major suppliers and its respective contributions to the Group’s purchases in terms of amount and percentage for the FYE 2022:

The total purchases from the top 5 suppliers account for 87.61%. The management mentioned that the company is dependent on the suppliers which contributions of more than 10% of its Group’s total purchases during the respective financial year/period ended:

- Accupro Group (FYE 2020, FYE 2021, FYE 2022)

- Alpha Industries Sdn Bhd (FYE 2021, FYE 2022)

- Press Metal Group (FYE 2021, FYE 2022)

- Toyota Tsusho Asia Pacific Pte Ltd (FYE 2020, FYE 2021)

- Metrod Copper Product Sdn Bhd (FPE 2023)

Industry Overview

The ex-factory sales of wires and cables in Malaysia are expected to increase from RM9,610.0 million in 2022 to RM11,205.0 million in 2025, yielding a CAGR of 5.25% (source: Infobusiness). The demand for power cables is closely related to industrialisation and infrastructure spending. In turn, this is greatly dependent on the gross fixed capital formation in the country. Another major factor behind the expanding demand for wires and cables is rising urbanisation. Mass transits such as electric buses and electric trains, which require a network of electricity lines, are encouraged by the Malaysian government for public mobility, to reduce traffic congestion on the road and to mitigate greenhouse gas emissions. As both electric buses and electric trains operate on electric power only, there are requirements for power cables to be installed in their power networks to support the electrical transportation systems. In turn, this is expected to generate further demand for wires and cables.

Under the Twelfth Malaysia Plan 2021-2025, investments in generation capacity and reinforcement of transmission and distribution networks will be continued to ensure the efficiency and reliability of electricity supply in Malaysia. The reinforcement of generation, transmission and distribution systems will be further undertaken to strengthen the power utility industry. Initiatives such as creating a resilient power utility industry, strengthening the Sabah electricity supply system, enhancing the grid system, expanding rural electricity coverage and increasing the installed capacity of renewable energy are expected to improve the sustainability of the power utility industry. Similarly, the distribution network will be expanded and upgraded to improve coverage, reliability and customer services. This also includes the replacement of old cables which were subjected to wear and tear. In addition, the construction of 500 kV and 275 kV transmission lines will be undertaken in Peninsular Malaysia and Sarawak, which will support future load growth. Also, the existing Lao-Thailand-Malaysia power transfer initiative under the ASEAN Power Grid and new transboundary interconnections will be explored to ensure better connectivity.

The imports of wires and cables into Thailand and Singapore increased from RM5.65 billion and RM5.92 billion, respectively, in 2018 to RM6.32 billion and RM6.36 billion, respectively, in 2022, yielding CAGRs of 2.85% and 1.78%, respectively. In Brunei's case, wires and cables' imports had declined by a CAGR of 27.14%, from RM235.69 million in 2018 to RM66.42 million in 2022. In 2023, between 10,000 and 12,000 residential units are planned to be launched in Singapore, while approximately 35,000 residential units are forecasted to be launched in Thailand. These buildings form a market for wires and cables.

Source: infobusiness research

Future plans and strategies for MASTER TEC GROUP BERHAD.

The objective is to further grow the position as an established wires and cables solutions provider in the markets which the company operates. The business and growth strategies include the following:

- Venture into the manufacturing of MV power cables

- Expand the market coverage through export sales

MQ Trader View

Opportunities

- The industry is currently at a strategic opportunity stage, and the expected surge in product demand is significant. The prospects of the wire and cable industry are predominantly influenced by national policies:

- Malaysia is actively promoting the development of green energy.

- The widespread adoption of electric vehicles will significantly increase the demand for charging stations, consequently boosting the demand for wires and cables.

- Government initiatives driving large-scale infrastructure projects will further propel the utilization of wires and cables.

Risk

- The fluctuations in the prices of its major raw materials, such as copper and aluminum, may adversely affect its profitability. Copper and aluminum are the main raw materials the company uses to manufacture its wires and cables, contributing to the majority of its cost of sales. Both copper and aluminum are actively traded commodities in the international metals market and are mainly priced in USD. The prices of copper and aluminum are affected by numerous factors beyond its control, including global economic and political conditions, supply and demand, inventory levels maintained by suppliers, potential disruptions in the supply chains, and currency exchange rates.

- The company faces a high concentration risk due to its reliance on a few customers. It is heavily dependent on its top 3 customers, and if any of these customers were to terminate their services, it could significantly impact the company's financial results.

- From the company's financial perspective, two points should be noted: (1) Industry margins are low, and (2) the gearing ratio is too high. The industry is experiencing intense competition, leading to consistently low margins. However, the company's management has stated that their future focus won't solely be revenue but will prioritize margin. Consequently, there might be a decline in revenue but an increase in margin. As for the elevated gearing ratio, it primarily stems from a deliberate move to convert letters of credit to invoice financing, aimed at ensuring swift payments to suppliers.

Click here to refer the IPO - Master Tec Group Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)