IPO - Master Tec Group Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 05 Jan 2024, 12:32 PM

Company Background

The Company was incorporated in Malaysia under the Act on 3 November 2022 as a private limited company under the name of Master Tec Group Sdn Bhd. On 15 June 2023, the Company was converted into a public limited company under the present name.

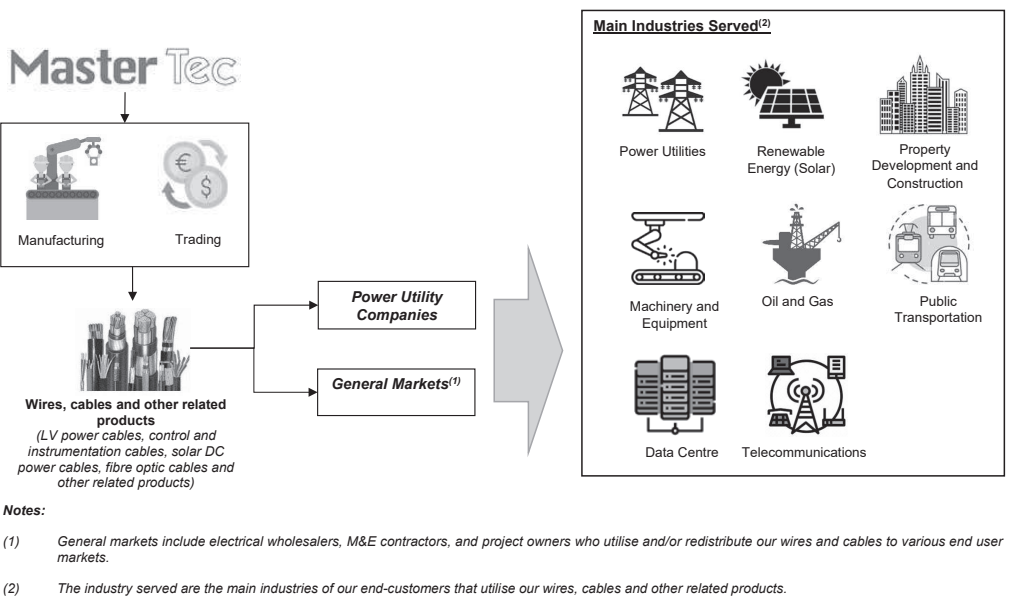

The company is an investment holding company, while MTWC, the sole subsidiary, is principally involved in the manufacturing and distribution of power cables, control and instrumentation cables, and other related products, and the trading of power cables, fibre optic cables, and other related products.

Use of proceeds

- Capital expenditure for the following: - 66.77% (within 15 months)

- Construction of new MV power cable manufacturing plants - 27.22% (within 15 months)

- Purchase of new machineries and equipment - 39.55% (within 15 months)

- General working capital - 26.42% (within 15 months)

- Defray fees and expenses relating to the Listing - 6.81% (within 3 months)

Capital expenditure for construction of new manufacturing plants and purchase of new machineries and equipment - 66.77% (within 15 months)

The use of the gross proceeds for capital expenditure for the construction of new manufacturing plants and purchase of new machineries and equipment is part of its strategy to venture into the manufacturing of MV power cables, which will further drive the growth of the business operations and financial performance.

The company has earmarked RM41.17 million, representing approximately 66.77% of the proceeds from its Public Issue, of which RM16.78 million will be allocated for the construction of two new manufacturing plants at Lot 1297 and Lot 1304, and RM24.39 million will be allocated for the purchase of new machineries and equipment.

(a) Construction of manufacturing plants

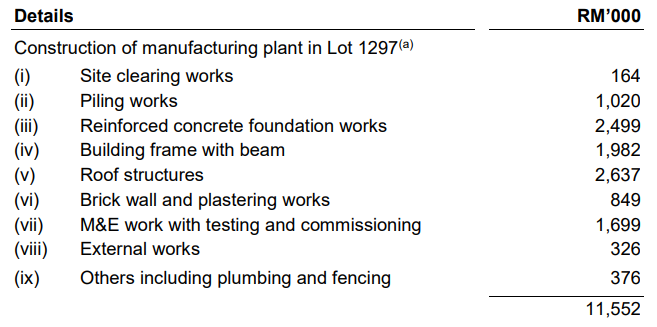

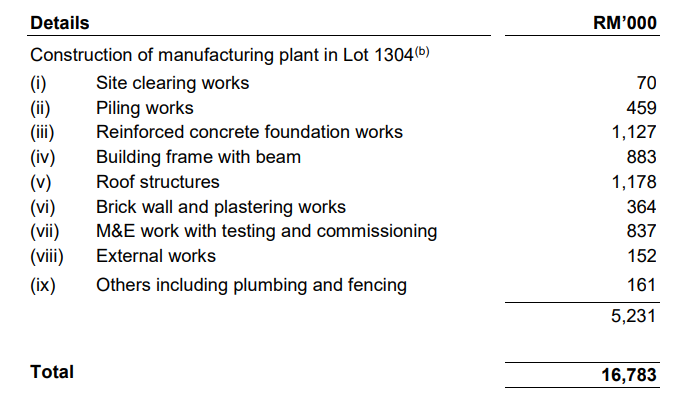

The estimated total construction costs for Plant 4 and Plant 5 on Lot 1297 and Lot 1304 respectively of RM16.78 million will be fully funded by the proceeds from the Public Issue.

The breakdown for the estimated total construction costs is as follows:

(b) Purchase of machineries and equipment

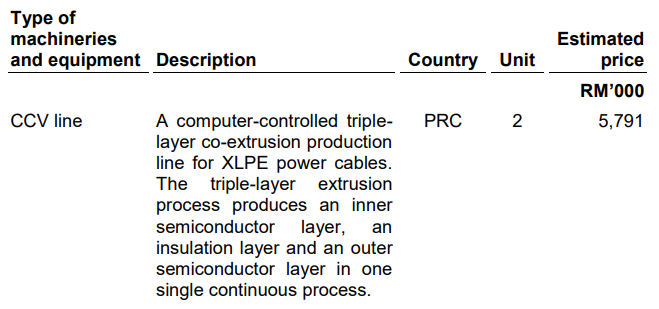

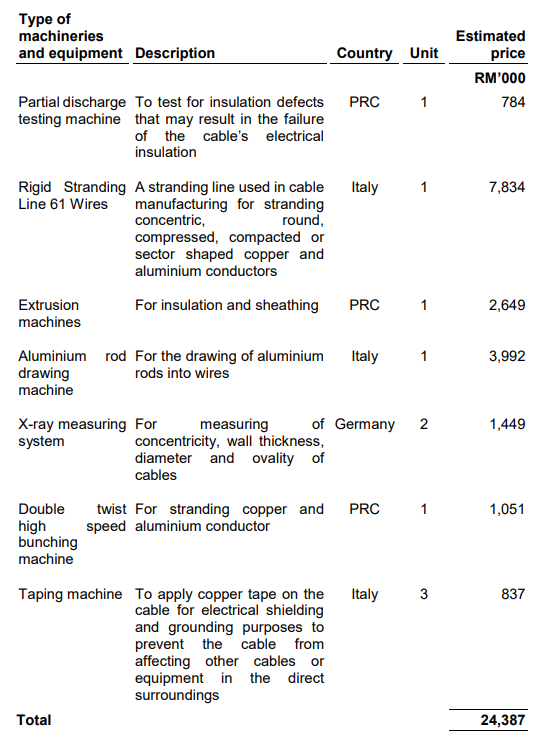

The estimated total cost of new machineries and equipment of RM24.39 million will be fully funded by the proceeds from the Public Issue.

The details of the machineries and equipment as well as breakdown of the estimated costs are as follows:

General working capital - 26.42% (within 15 months)

The Group’s working capital requirement will increase in tandem with its plan to venture into the manufacturing of MV power cables. Over the FYE Under Review, the Group has registered significant revenue growth at a CAGR of 49.48%. The company will allocate RM16.29 million, representing approximately 26.42% of the proceeds from its Public Issue, for working capital which will be used to finance the purchase of raw materials for the manufacturing of MV power cables. The main raw materials used for the manufacturing of MV power cables include aluminium rods and compounds.

The construction of Plant 4 and Plant 5 are expected to be completed by the 4th quarter of 2024 and the production of MV power cables at Plant 4 and Plant 5 are also expected to commence by the 4th quarter of 2024. Taking into consideration the delivery timing for its main raw materials, the company intends to purchase the main raw materials up to 2 months in advance prior to the commencement of the production of MV power cables.

For the FYE Under Review, the company has recorded increasing sales of MV power cables to customers via its trading arm at a CAGR of 135.89%. In addition, the sales of MV power cables had increased by 107.49% in FPE 2023 as compared to FPE 2022. Moving forward, the company intends to fulfil such orders for MV power cables through the new MV power cable manufacturing capabilities.

Given that most of the suppliers are based locally and have shorter lead times coupled with its JIT inventory management policy, the company generally maintains one month’s quantity of raw materials in its storage to ensure uninterrupted production.

Business model

The business model for the company’s principal business activities is as follows:

Click here to continue the IPO - Master Tec Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)