IPO - Zantat Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 12 Mar 2024, 09:37 AM

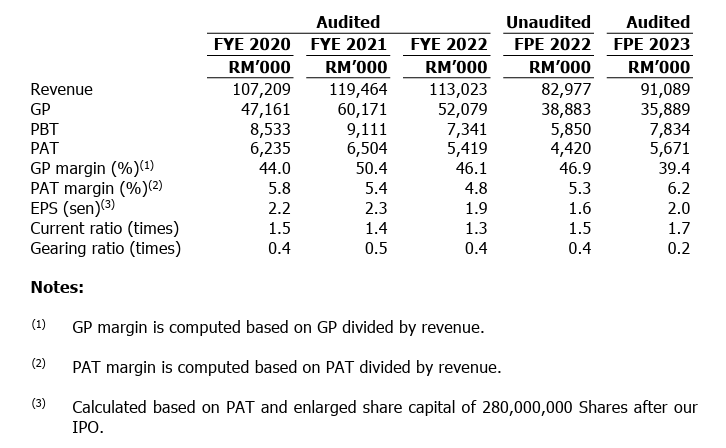

Financial Highlights

The following table sets out the financial highlights based on the combined and consolidated statements of comprehensive income for FYE 2020 to 2022 and FPE 2022 to 2023:

- The revenue range is between $107 million (FYE 2020) and $119 million (FYE 2020). The limited revenue growth indicates that the company's market share has stopped growing. According to the LPD, management disclosed the reasons for the slow revenue growth: In 2020, the revenue was impacted by the Movement Control Order (MCO); in 2021, the revenue was impacted by the COVID-19 outbreak in India and the increased sea freight rates; in 2022, the impact was due to increased sea freight rates.

- The gross profit margin increased from 44% in FYE 2020 to 50.4% in FYE 2021 and declined to 46.1% in FYE 2022. The decrease in GP margin from the production of Ground Calcium Carbonate (GCC) was mainly due to the increase in chemical costs, particularly stearic acid. The decrease in GP from the production of Calcium Carbonate (CC) was primarily due to the lower sales volume from rubber glove manufacturers. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin decreased from 5.8% in FYE 2020 to 4.8% in FYE 2023.

- The gearing ratio is 0.4 in FYE 2022. The company's gearing ratio is within the benchmark, reflecting a good balance between debt and equity. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Customers

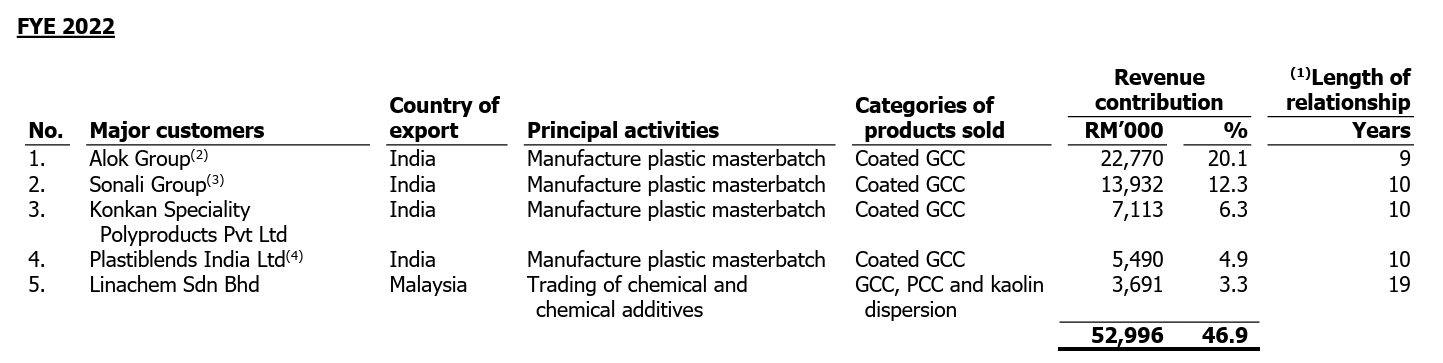

The Group’s revenue from customers varies from year to year depending on the units of products sold to its customers. The top 5 major customers for FYE 2022.

The top 5 customers contribute 46.9% of the company's revenue, with the leading customer accounting for 20.1%, approximately 1/5 of the total revenue. The management has mentioned their dependency on the top 2 clients, Alok Group and Sonali Group. However, the company aims to diversify its product portfolio by initiating bioplastic compounding activities and conducting R&D to develop new applications for calcium carbonate products, thereby reducing customer dependency. This strategy will enable the company to expand its target market and customer base, ultimately reducing reliance on specific customers.

Major Suppliers

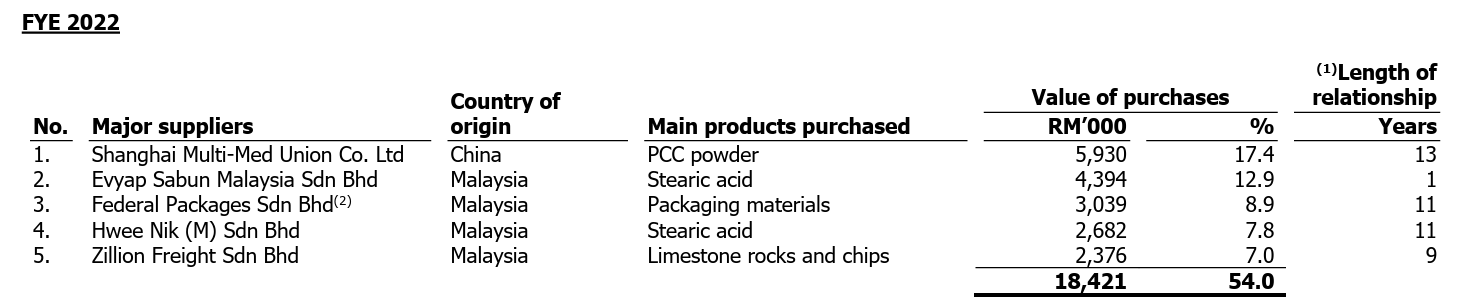

The top five major suppliers for Financial Periods Under Review are as follows:

The total purchases from the top 5 suppliers account for 54.0%. Although the management mentioned that they are not dependent on any specific suppliers, the choice of the current supplier for PPC powder is attributed to its quality and consistent supply over the past 14 years. Additionally, other materials such as limestone rocks and chips, chemicals, and packaging materials can also be sourced from alternative suppliers.

Industry Overview

According to research from Vital Factor Consulting, the performance of the calcium carbonate industry in Malaysia depends on various factors, including economic conditions as well as demand for calcium carbonate in Malaysia and India. India is a major export market accounting for the largest proportion of Malaysia’s calcium carbonate export volume in 2022. Zantat Group mainly serves customers in India and Malaysia. In 2023, the real GDP of Malaysia moderated to 3.7% amid a challenging external environment. This was mainly due to slower global trade, the global technology downcycle, geopolitical tensions and tighter monetary policies. As for the manufacturing industry, real GDP moderated to 0.7% in 2023 mainly attributed to the weaker electrical and electronics product (E&E) segment (Source: Bank Negara Malaysia (BNM)). In 2023, the manufacturing industry accounted for 23.4% of Malaysia’s real GDP, while the manufacture of non-metallic mineral products contributed 3.3% to the real GDP of the manufacturing industry (Source: DOSM). In 2023, the real GDP of non-metallic mineral products grew by 4.3%.

Demand for calcium carbonate in Malaysia and India.

The demand for calcium carbonate in Malaysia is represented by export and domestic consumption. Between 2020 and 2022, the export volume of calcium carbonate declined at an average annual rate of 4.8%, mainly attributed to lower export volume to India. In 2022, India accounted for the largest proportion of Malaysia’s calcium carbonate exports with 40.9% of the total export volume, followed by Indonesia (14.4%) and Bangladesh (9.0%). The remaining 35.7% include several other countries with each country representing less than 9.0% of the total export volume of calcium carbonate in Malaysia (Source: Vital Factor analysis). Between 2020 and 2022, the export value of calcium carbonate in Malaysia grew at a CAGR of 1.4%. As for domestic consumption, the volume declined by 3.4% in 2022. In 2023, the export value of calcium carbonate in Malaysia grew by 2.4% compared to a decline of 4.8% in 2022. In 2023, the export value of calcium carbonate in Malaysia grew by 2.4% compared to a decline of 4.8% in 2022.

India is one of the main importers of Malaysia’s calcium carbonate. Similarly, for Zantat Group, India is a major export market for its calcium carbonate products. As such, the demand for calcium carbonate in India has an impact on Malaysia as well as Zantat Group. In India, statistics are commonly reported based on the government’s fiscal year, which is the period between 1 April and 31 March. The real GDP of India grew by 7.2% in 2022/23 and is estimated to grow by 7.3% in 2023/24 (Source: Ministry of Statistics and Programme Implementation (MOSPI), India). In 2021/22, being the latest available information, the consumption volume of calcium carbonate in India grew by 12.1% following a decline of 23.1% in 2020/21, indicating a recovery from the COVID-19 pandemic. Nevertheless, it has not reached its pre-COVID-19 level in 2019/20. In 2021/22, domestically produced calcium carbonate represented 20.2% of India’s consumption of calcium carbonate in terms of volume. As such, India relies on the import of calcium carbonate from overseas to meet the demand for calcium carbonate. This augurs well for operators involved in the manufacture of calcium carbonate in Malaysia that exports to India. In 2022/23, the import of calcium carbonate from Malaysia represented 26.1% of the total import volume of calcium carbonate in India. (Source: Ministry of Commerce and Industry, India)

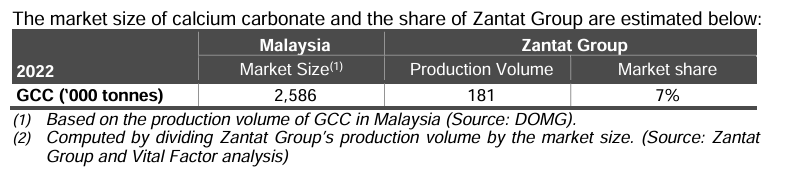

Market Size and Share

Source: Vital Factor Consulting

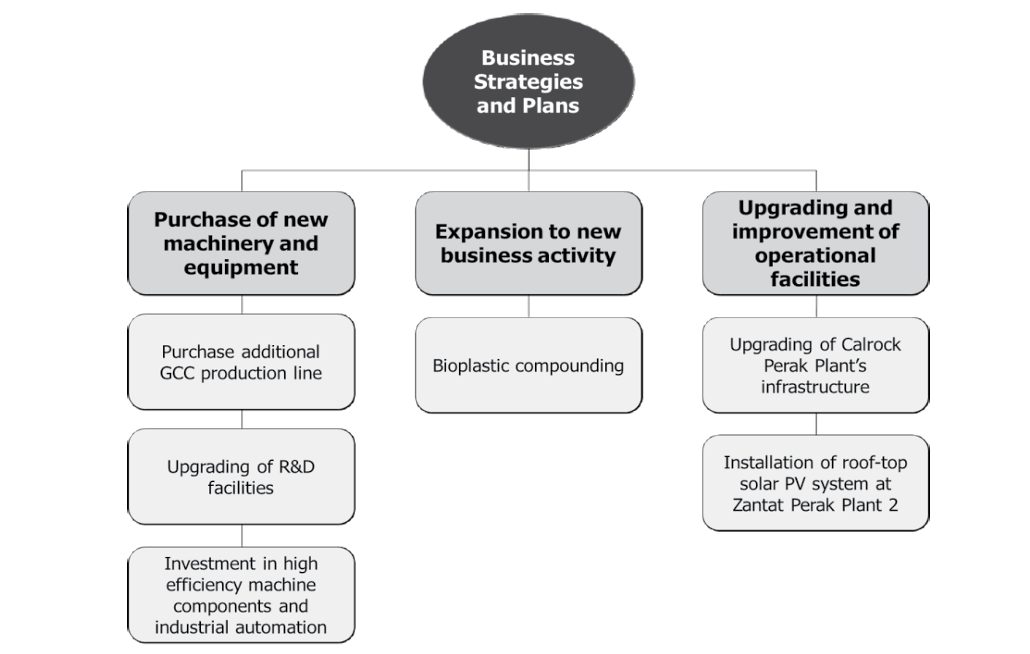

Future plans and strategies for ZANTAT HOLDINGS BERHAD.

The business strategies and plans are summarised in the following diagram:

MQ Trader View

Opportunities

- The company possesses two pieces of leasehold land with limestone reserves in Keramat Pulai, Perak, set to expire in 2068 and 2070, respectively. The combined size of these two limestone reserves encompasses an approximate land area of 25 acres, with a total above-ground limestone volume estimated at 19 million tonnes based on geological reports conducted in 2022. These reserves are projected to last through the remaining tenure of the leasehold lands. Additionally, there are limestones beneath the ground level that have not been assessed yet.

- The diverse functions and uses of calcium carbonate provide the company with a potentially wide addressable market to sustain and grow its business. In addition, management has observed that manufacturers worldwide, especially those in plastic manufacturing, are gradually moving towards a more environmentally responsible approach to production due to increasing pressures of sustainability requirements. Thus, these manufacturers have been adopting calcium carbonate fillers in their formulations to partly replace plastic and also to reduce greenhouse gas emissions.

Risk

- The company is dependent on its customers from India, which constituted the largest export market, accounting for 59.5% of the total revenue. The company has 41 customers in India. As India serves as the primary export market, the business's performance is reliant on various factors related to the customers' industry, specifically plastic masterbatch manufacturing. This includes considerations such as the general economy, laws and regulations, political stability, as well as social factors such as disease outbreaks in India.

- The company is sensitive to logistic and raw material costs. From the financial results, we know that any increases in costs will eventually require the company to raise selling prices, potentially reducing its competitiveness. This could impact its ability to retain existing customers and/or secure new orders. If the company is unable to remain competitive, it may adversely affect revenue and financial performance.

Click here to refer the IPO - Zantat Holdings Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)