IPO - Zantat Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 12 Mar 2024, 09:37 AM

Company Background

The Company was incorporated in Malaysia under the Act on 30 November 2021 as a private limited company under the name of Zantat Holdings Sdn Bhd. On 25 May 2023, the company converted into a public limited company and adopted its present name.

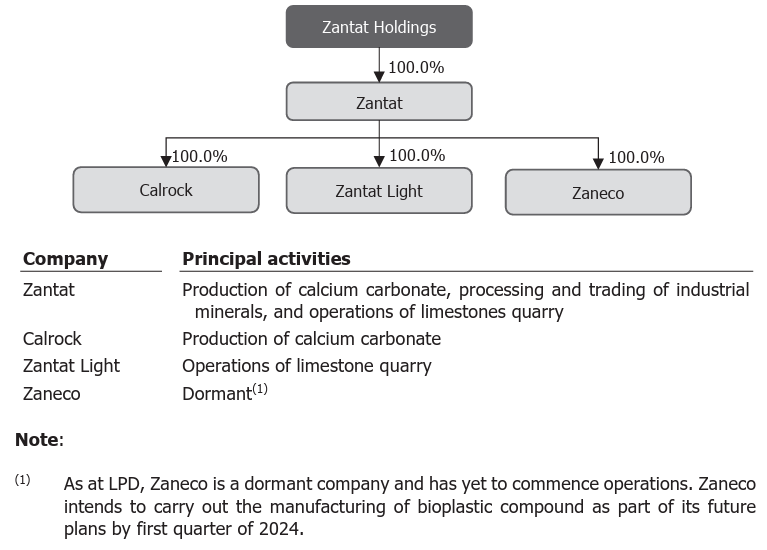

The Company is an investment holding company. The Group structure as at LPD is as follows:

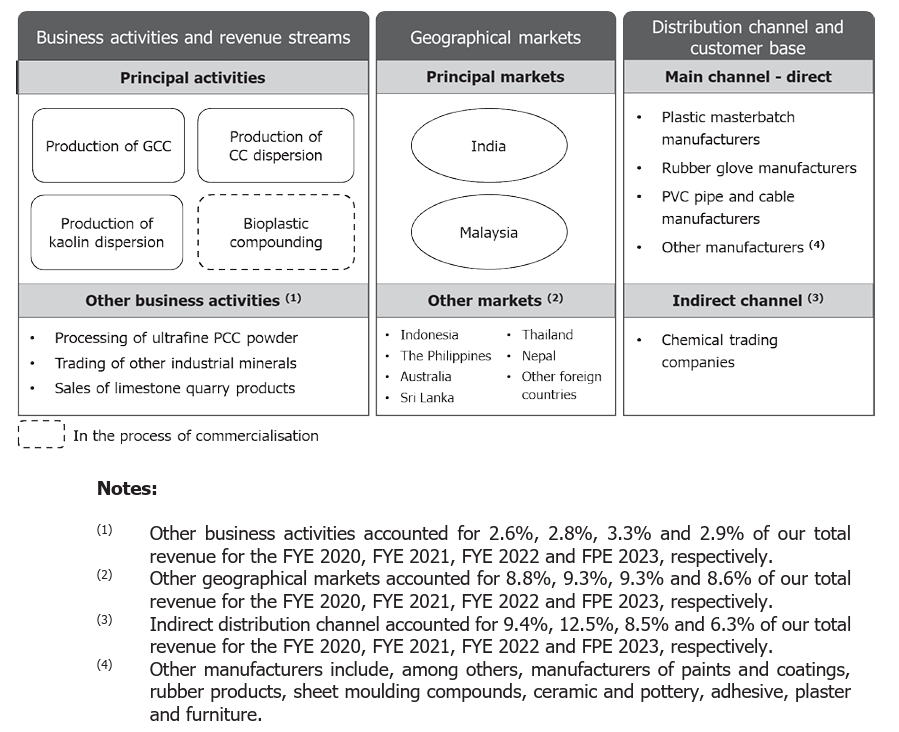

Through its subsidiaries, the company has principally been involved in the production of calcium carbonate namely GCC and CC dispersions. The company is also involved in the production of kaolin dispersion, processing of ultrafine PCC powder, trading of other industrial minerals (mainly talcum powder and limestone chips), and sales of limestone quarry products. The company also operates its limestone quarry mainly for internal use of limestone.

Use of proceeds

- Upgrading of R&D facilities - 27.4% (within 12 months)

- Upgrading of Calrock Perak Plant’s infrastructure - 7.2% (within 12 months)

- Investment in high efficiency machine components and industrial automation - 9.6% (within 6 months)

- Repayment of bank borrowings - 24.2% (within 12 months)

- Working Capital - 10.2% (within 12 months)

- Estimated listing expenses - 21.4% (Immediately)

Upgrading of R&D facilities - 27.4% (within 12 months)

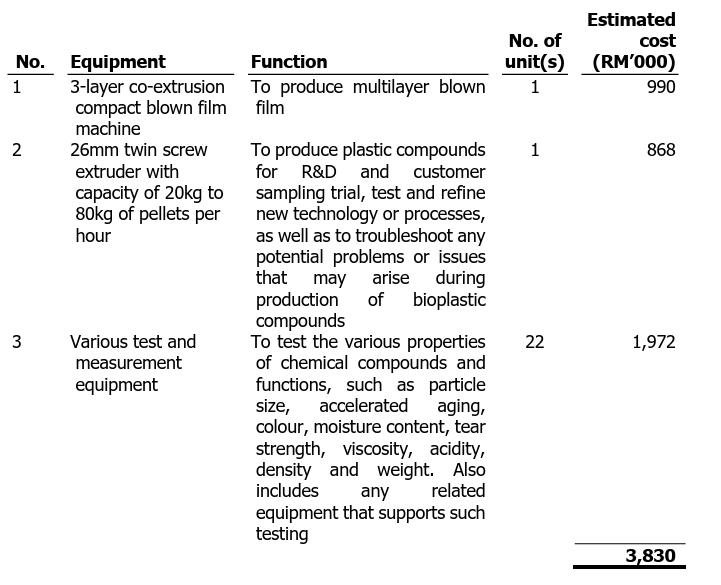

The company plans to upgrade its existing R&D centre within the Zantat Perak Plant 1 as well as purchase additional test and product development equipment by 2024.

As at LPD, the company has 4 R&D personnel supported by 4 quality assurance personnel. Part of its strategy is to expand the team by hiring additional 2 R&D personnel and 1 quality assurance personnel. This will require additional working capital for the expansion of the R&D team which will be funded from the proceeds of the Public Issue.

The company plans to purchase additional test and product development equipment to conduct this additional testing in-house to shorten the product trials to under a month. The following sets out the testing and product development equipment that its plans to purchase, which will be fully funded through the proceeds of the Public Issue:

Upgrading of Calrock Perak Plant’s infrastructure - 7.2% (within 12 months)

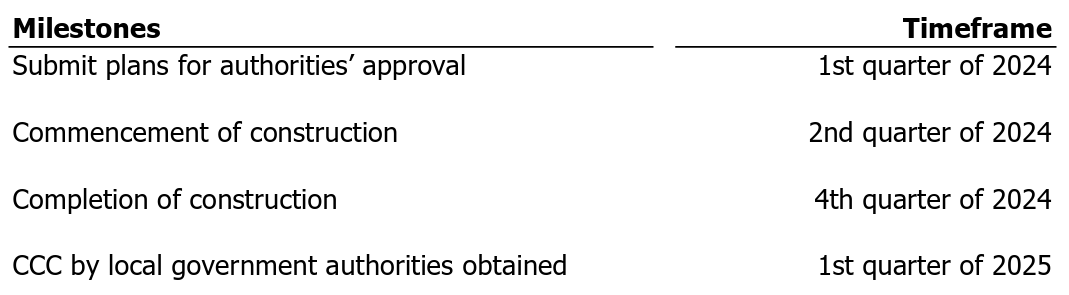

The upgrading of Calrock Perak Plant entails the construction works for a new 3,000 sq ft office and warehouse (including electrical works, fixtures and fittings, and professional fees), which will cost a total of RM1.0 million to be funded from proceeds raised from the Public Issue.

The indicative timeline for the upgrading of the Calrock Perak Plant is as follows:

Investment in high efficiency machine components and industrial automation - 9.6% (within 6 months)

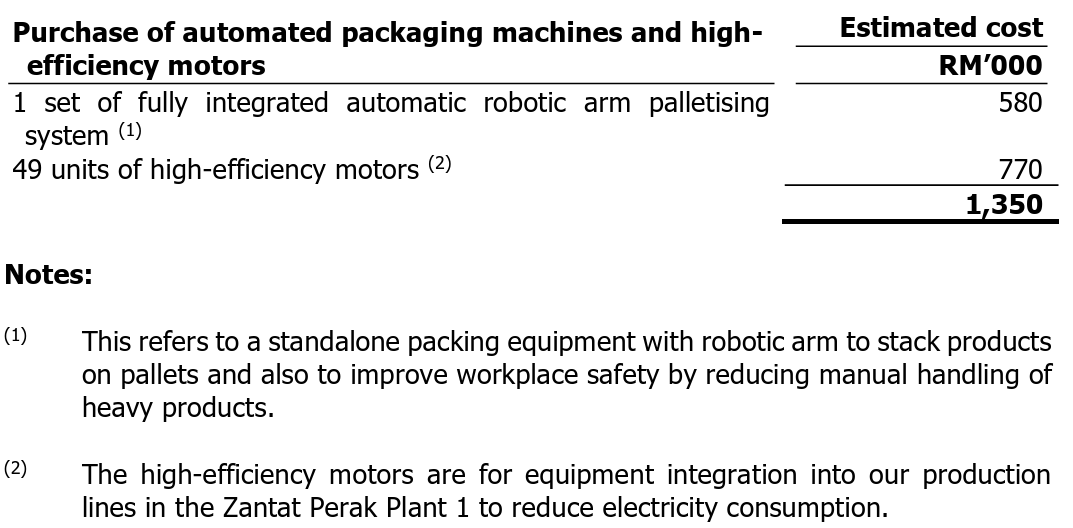

The company plans to purchase and install automated packaging machines and high-efficiency motors for the production lines in Zantat Perak Plant 1 by 2024.

The total estimated cost for the purchase of automated packaging machines and high-efficiency motors is RM1.3 million which will be fully funded by proceeds from Public Issues as follows:

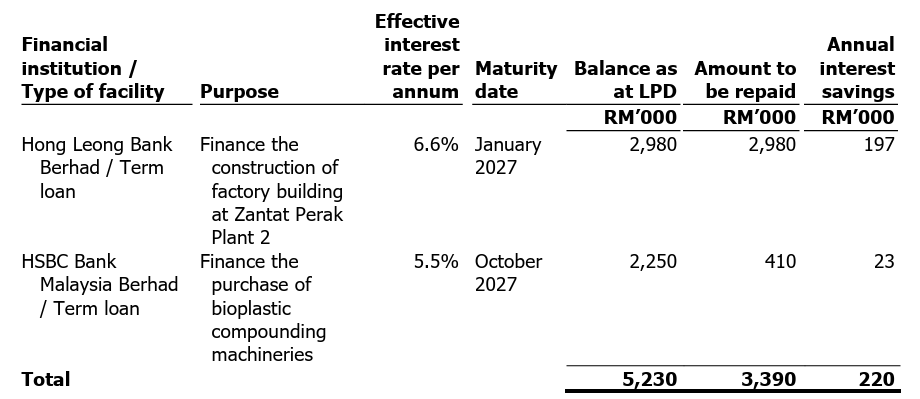

Repayment of bank borrowings - 24.2% (within 12 months)

The company has allocated RM3.4 million to partially repay the term loan which was mainly drawn down to finance the construction of a factory building at Zantat Perak Plant 2.

The company has decided to prioritise the repayment of the term loans from Hong Leong Bank Berhad and HSBC Bank Malaysia Berhad as they carry a higher effective interest rate of 6.6% and 5.5% respectively for FPE 2023 compared to the other bank borrowings which carry interest rates of 4.1% to 5.5%.

For illustrative purposes, the details of the borrowings as at LPD are set out as follows, among which the company has indicated which facility the RM3.4 million repayment will be made to:

The expected annual interest savings from the repayment of the bank borrowing is approximately RM0.2 million based on the effective interest rate of 6.6% and 5.5% per annum respectively, as tabulated above.

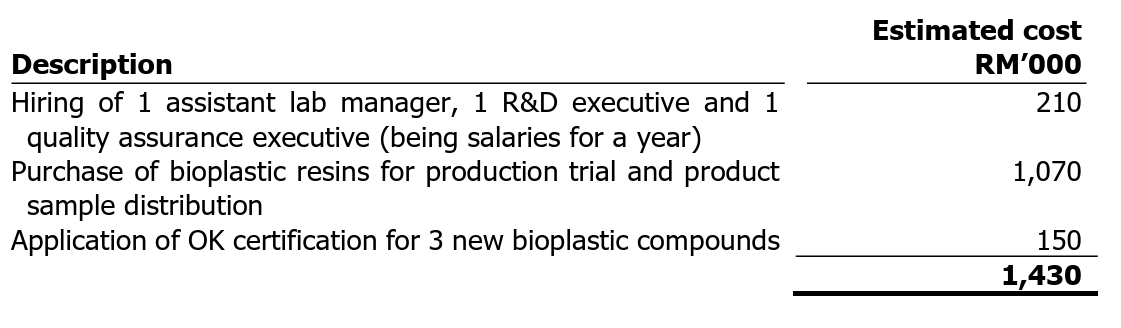

Working Capital - 10.2% (within 12 months)

The Group’s working capital requirements are expected to increase in line with the venture into the bioplastic compounding business. The company has allocated RM1.4 million to be used to supplement the working capital requirements for a bioplastic business venture once it commercialised.

The proposed allocations of the proceeds are set out as follows:

Business model

The business model is depicted in the following diagram:

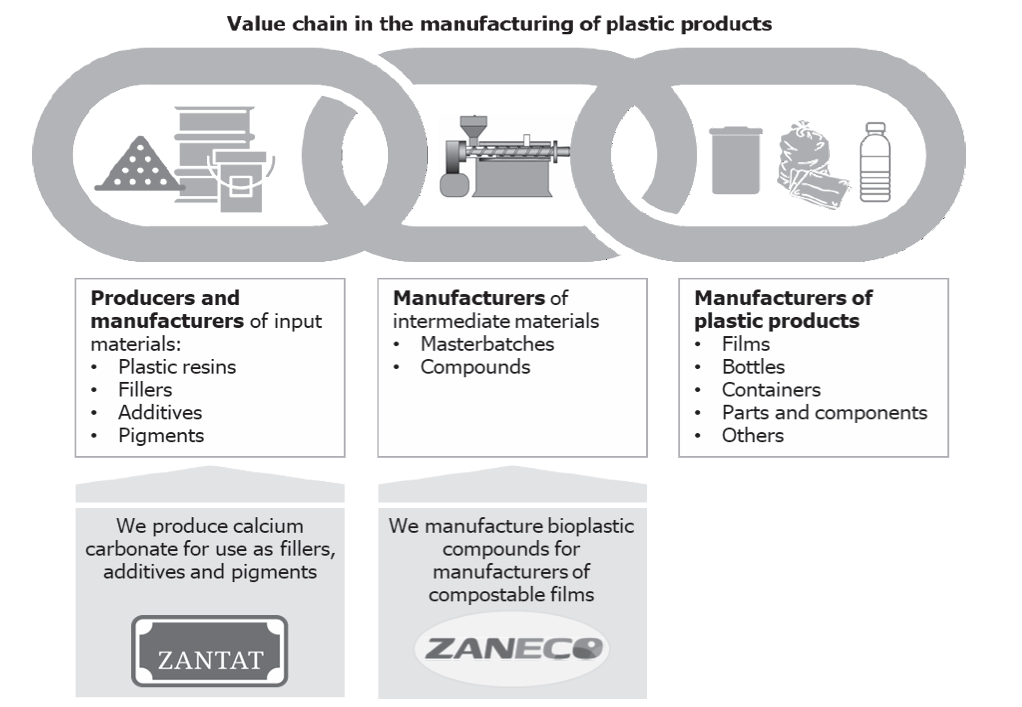

The company’s position in the value chain of manufacturing of plastic products is depicted in the diagram below:

The company produces calcium carbonate which serves as fillers, additives and/or pigments which are combined with the key ingredient, namely plastic resins, to serve as input materials in the manufacturing of plastic products.

Click here to continue the IPO - Zantat Holdings Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)