IPO - Sin-Kung Logistics Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 23 Apr 2024, 03:00 PM

Financial Highlights

The following table sets out the financial highlights based on the consolidated statements of comprehensive income for FYE 2020 to 2023:

- The revenue grew from RM 43 million in FYE 2020 to RM 56 million in FYE 2022 and declined to RM 51 million in FYE 2023. The decrease in FYE 2023 is mainly attributed to: (1) lower revenue from the trucking services segment, and (2) decreased revenue from other logistics-related services segments.

- The gross profit margin was maintained within the range of 44% to 49.5%. However, the overall GP margin decreased from 49.4% for FYE 2022 to 46.2% for FYE 2023, attributable to a decrease in GP margin from all business segments other than the container haulage services segment. (Generally, a GP margin of 20% is considered high/ good).

- The company had the highest PAT at 27.8% in FYE 2021 and the lowest at 12.3% in FYE 2023.

- The gearing ratio was 1.2 times in FYE 2023, which is more than double the benchmark. This indicator suggests that the company is holding too much debt and might be exposed to liquidity risk. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Customers

The top 5 major customers for FYE 2023 are as follows:

The top 5 customers contribute 51% of the company's revenue. The management disclosed that they are dependent on Customers A and C, who contribute 16.9% and 12.7% of its Group’s total revenue, respectively. However, both of these customers have had very long working relationships with the company.

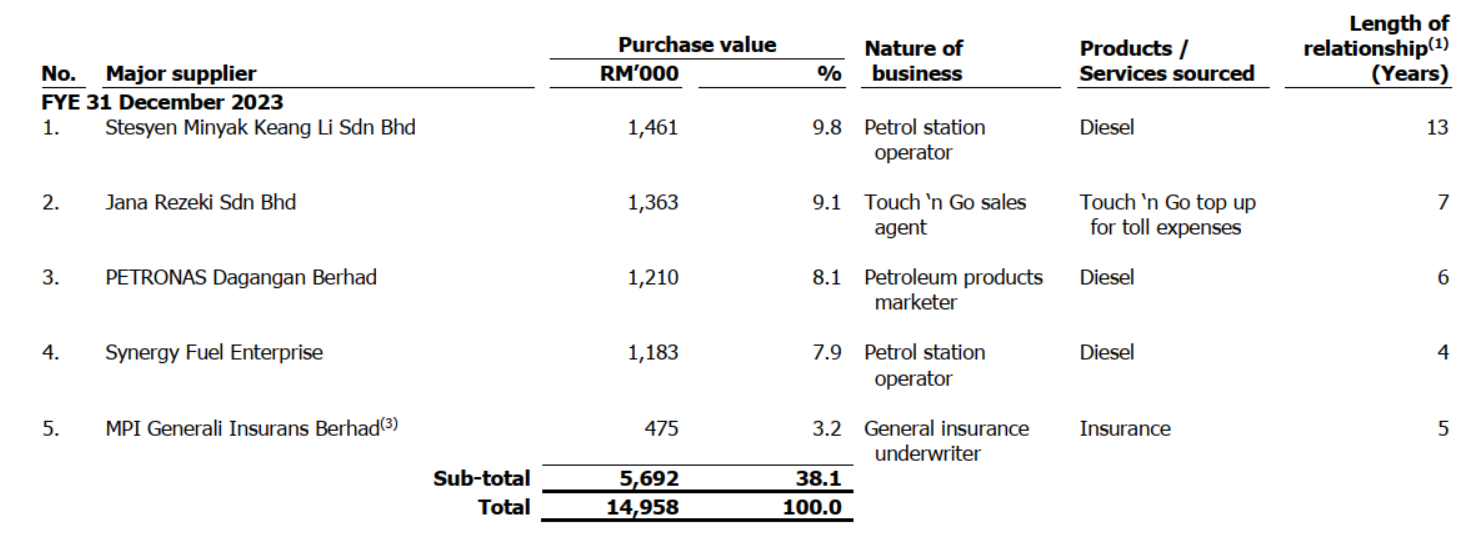

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 38.1% of the purchases. Due to the nature of the business, the major supplier is not related to raw materials. The costs primarily involve diesel or toll expenses. Therefore, the company is not dependent on diesel supply, as they are able to source diesel from other suppliers in the market.

Industry Overview

According to a Smith Zander research report, the economic fluctuations in Malaysia's transport and freight sectors from 2019 to 2023 were significantly influenced by the COVID-19 pandemic and subsequent recovery phases.

- Land Transport Subsector:

- 2020: GDP from land transport (including road and rail) plunged by 26.97% due to severe movement restrictions initiated on March 18, 2020, to control the COVID-19 spread. This decline reflected decreased demands in trade and manufacturing, affecting the need for goods transportation.

- 2021-2022: There was a marginal GDP increase of 1.93% in 2021 and a substantial rise of 36.23% in 2022, reaching RM13.65 billion as restrictions eased and economic activities resumed in the 'Endemic Phase' from April 1, 2022.

- Air Freight Industry:

- The total air cargo handled fell by 15.96% in 2020, primarily due to a 20% drop in international cargo from halted passenger services and a loss of belly cargo capacity.

- Recovery followed with cargo increases in 2021 (27.85% YOY) and 2022 (3.96% YOY), but a decline again in 2023 by 10.48% owing to slower global demand and geopolitical issues.

- Major airports like KUL, PEN, and SZB consistently handled most of the air cargo in Malaysia, although their collective contribution varied slightly from year to year.

- Sea Freight Industry:

- 2020: The total container throughput decreased slightly by 1.31% to 9.07 million TEUs, affected by global disruptions like container shortages and port congestion.

- 2023: A recovery to 10.22 million TEUs represented a CAGR of 4.06% from 2020, indicating a gradual economic rebound.

- Port Klang remained the dominant seaport for container throughput, contributing between 54.73% and 60.27% of Malaysia's total container throughput from 2019 to 2023.

Key Industry Drivers:

- Continued growth in the Malaysian economy creates continuous demand for logistics and warehousing services

- Growth in the trade and manufacturing sectors will drive the demand for logistics and warehousing services

- Continuous growth in the e-commerce industry boosts the demand for logistics and warehousing services

- Implementation of government initiatives to spur the logistics and warehousing industry

Key Industry Risks and Challenges:

- Reliance on diesel to operate trucks leads to exposure to the volatility of global fuel prices

- Reliance on local skilled drivers

Source: Smith Zander

Future plans and strategies for SIN-KUNG LOGISTICS BERHAD.

The company's business objectives are to maintain sustainable growth and create long-term shareholder value. To achieve the business objectives, the company will implement the following business strategies over the period of 36 months from the date of the Listing:

- The company intends to expand the warehousing and distribution business through the establishment of a new warehouse.

- The company intends to grow its trucking and container haulage business through the expansion of the fleet of commercial vehicles

MQ Trader View

Opportunities

- The company has extensive airport coverage across Peninsular Malaysia, Singapore, and Thailand for the provision of airport-to-airport road feeder services. The Group covers an extensive network of airports for the provision of airport-to-airport road feeder services across Peninsular Malaysia, Singapore, and Thailand. This supports cargo airlines and passenger airlines in transporting cargo to airports when there are no timely connections or limited cargo space on flights, so that the cargo can be transferred faster to the final destination airport or to the next transit airport for its connecting flight to the final destination airport, bringing greater connectivity to the customers.

Risk

- The company's financial stability is vulnerable to changes in global fuel prices, particularly diesel, which is a significant part of its operating expenses. Diesel prices are influenced by various factors including global crude oil prices and local government policies on subsidies. A reduction or removal of government subsidies on diesel could raise costs and negatively impact profitability.

- The company is involved with a high gearing ratio, which could affect daily operations if the company faces any debt issues. The company’s gearing ratio in FYE 2023 is 1.2, while the standard benchmark should be between 0.25 and 0.5. The higher the gearing ratio, the weaker the company's ability to withstand risks.

Click here to refer the IPO - Sin-Kung Logistic Berhad (Part 1)

Eager to explore more trading opportunities?Apply margin account now! https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)