IPO - Sin-Kung Logistics Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 23 Apr 2024, 03:00 PM

Company Background

The company was incorporated in Malaysia under the Act on 25 October 1994 as a private limited company under the name of Sin-Kung Logistics Sdn Bhd. On 1 August 2022, they converted into a public limited company and adopted the present name.

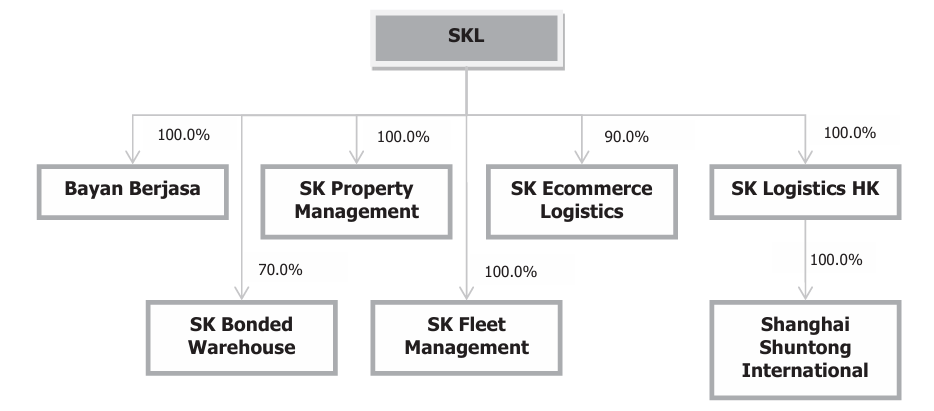

The company is an integrated logistics service provider principally involved in the provision of trucking services with a focus on airport-to-airport road feeder services. Additionally, they also provide container haulage services, warehousing and distribution services and other logistics-related services to the customers. The group structure as at LPD is as follows:

Use of proceeds

- Expansion of warehousing and distribution services - 38.60% (within 36 months)

- Repayment of bank borrowings - 37.0% (within 12 months)

- Purchase of commercial vehicles - 7.7% (within 24 months)

- Working capital - 4.0% (within 12 months)

- Estimated listing expenses - 12.7% (within 1 month)

Expansion of warehousing and distribution services - 38.60% (within 36 months)

As part of the business strategy, the Group had on 27 June 2023 entered into a sale and purchase agreement with Merbau Sejati Sdn Bhd for the purchase of Valdor Office and Warehouse, and a down payment amounting to RM4.0 million has been paid for the industrial property. For information purposes, the industrial property has a total built-up area of approximately 164,000 sq ft.

The total purchase consideration of the Valdor Office and Warehouse is RM70.6 million (including incidental expenses such as legal costs, stamp duty and memorandum of transfer of RM3.0 million) whereby RM4.0 million has been funded internally by the Group. The company intends to allocate RM3.0 million from the proceeds to defray the incidental expenses. The balance purchase price of RM63.6 million will be funded via bank borrowings which they have obtained from Hong Leong Islamic Bank Berhad.

Repayment of bank borrowings - 37.0% (within 12 months)

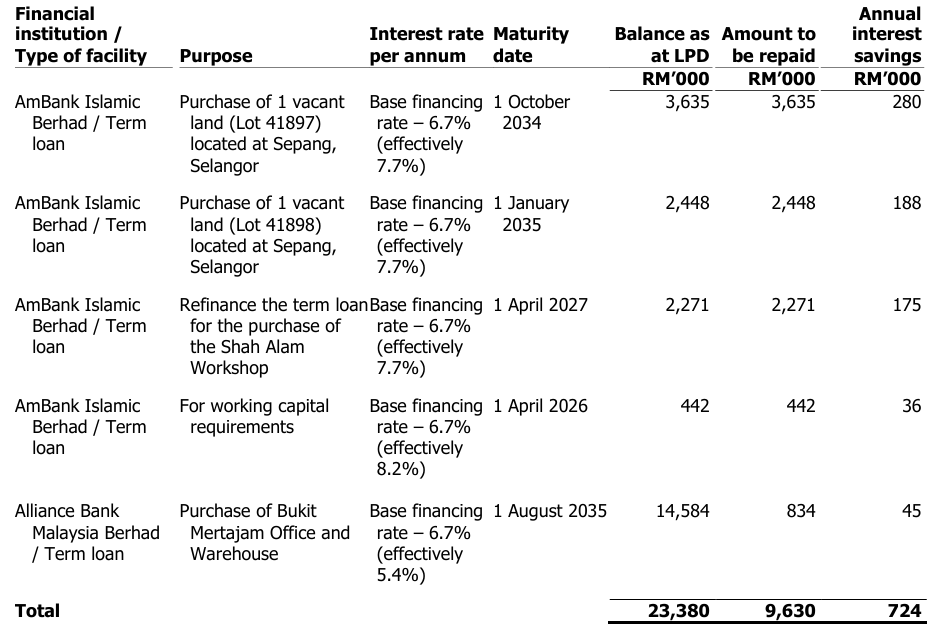

The Group has allocated RM9.6 million to fully repay the company’s term loans which were mainly drawn down to finance the purchase of 2 vacant lands located at Sepang, Selangor, refinance the term loan used for the acquisition of Shah Alam Workshop and for working capital purposes as well as to partially repay our term loan which was obtained for the purchase of Bukit Mertajam Office and Warehouse. For avoidance of doubt, the company prioritise the repayment of the term loans from AmBank Islamic Berhad as they carry higher effective interest rate of 7.7% for FYE 2023 compared to Alliance Bank Malaysia Berhad’s borrowings which carry effective interest rates of 5.4% for FYE 2023.

For illustrative purpose, the details of the borrowings as at LPD are set out as follows, among which they have indicated where the RM9.6 million repayment will be made to:

In this respect, the company has allocated RM9.6 million for repayment of the term loans following completion of the IPO. The repayment of the term loans is expected to result in interest saving of RM0.7 million per annum based on the interest rates as stated above. Following the repayment of bank borrowings, the Group's pro forma gearing ratio is still expected to rise to 1.4 times as compared to 1.2 times as at 31 December 2023. This is because, despite allocating RM9.6 million for the repayment of term loans, the Group will still incur additional borrowings to finance the acquisition of Valdor Office and Warehouse, as detailed in Section 4.9.1(a). Nonetheless, the proceeds channeled towards the repayment of bank borrowings will allow the Group to be better positioned to undertake more sizeable borrowings for future expansion.

The early repayment of the term loans from AmBank Islamic Berhad will attract a one-off early settlement fee of approximately RM0.3 million. Nonetheless, the expected annual interest savings from the repayment of the bank borrowings are approximately RM0.7 million based on the interest rate of 6.7% (effectively 7.7%) per annum as tabulated above. However, the actual interest savings may vary depending on the then-applicable interest rates.

Purchase of commercial vehicles - 7.7% (within 24 months)

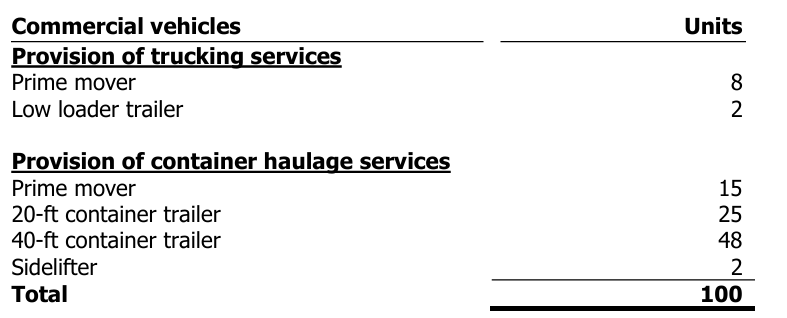

As part of the strategy to continue growing our trucking and container haulage businesses, the company will need more commercial vehicles in order to increase its capacity for the transportation of more cargo and containers. For avoidance of doubt, these commercial vehicles are similar to the ones that they currently own and operate to provide the trucking and container haulage services.

As at LPD, the company owns and operates a total of 461 commercial vehicles comprising trucks, prime movers, trailers, delivery vans and cargo escort vehicles for the business operations.

The Group intends to purchase 100 commercial vehicles by 2025 based on the Group’s estimated requirements. Details of the 100 commercial vehicles are as follows:

The total cost of the 100 commercial vehicles are estimated to be RM8.0 million which was arrived based on quotations by suppliers.

Working capital - 4.0% (within 12 months)

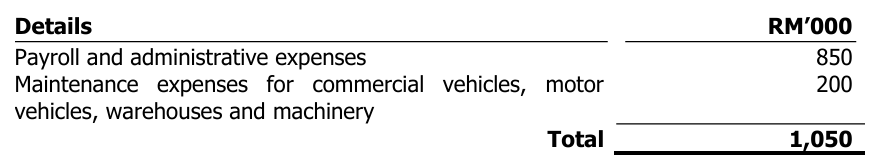

The Group’s working capital requirements are expected to increase in line with the growth in the business operations. The company has allocated RM1.1 million to be used to supplement its working capital requirements mainly used for day-to-day operations of the logistics services business as well as warehousing including but not limited to maintenance expenses for commercial vehicles, motor vehicles, warehouses and machinery and payroll and administrative expenses. The breakdown are as follows:

Business model

The Group’s business model, by business activities, is as illustrated below:

Click here to continue the IPO - Sin-Kung Logistics Berhad (Part 2)

Eager to explore more trading opportunities?Apply margin account now! https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)