IPO - KTI Landmark Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 31 May 2024, 09:24 AM

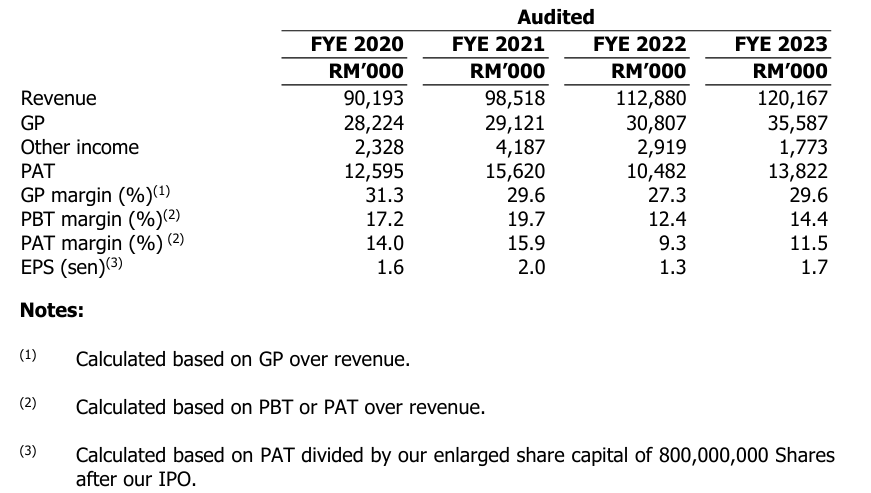

Financial Highlights

The following table sets out the financial highlights based on the combined statements of comprehensive income for FYE 2020 to 2023:

- The revenue grew from RM 90 million in FYE 2020 to RM 120 million in FYE 2023. This shows that the company is expanding its market share in the industry.

- The gross profit margin was maintained at around 30%. The highest gross profit margin was 31.3% in FYE 2020, while the latest gross profit margin stood at 29.6% in FYE 2023. Most of the time, the gross profit margin was impacted by the rebate package promotions offered to buyers. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 14% in FYE 2020 to 15.9% in FYE 2021. After that, the PAT margin declined to 9.3% in FYE 2022 and then increased to 11.5% in FYE 2023.

- The gearing ratio was 1.3 times in FYE 2023, which is above the benchmark. This high gearing ratio was mainly due to the drawdown of a term loan, a bridging loan, and revolving credit for working capital requirements for The Logg and the purchase consideration of the Alamesra Lands. Although the purpose is to expand the business, this situation puts the company in a high-risk scenario, which could directly impact the company if it faces a financial crisis in the future.(A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

Major Customers

Due to the nature of the Group’s business in property development, the customers are individual end buyers or companies who generally purchase one or a small number of units. The company was not dependent on any single customer during FYE 2020 to 2023.

However, a majority of the projects which contributed to its Group’s revenue during FYE 2020 to 2023 were design and build construction services contracts awarded by LPPB. In addition, on-going and future projects slated up to 2025 amounting to RM1.4 billion GDV are also projects awarded by/in participation with LPPB, save and except for Ayuria Place project, which is an acquisition of land from a third party, amounting RM 74.0 million.

In this regard, the Group is dependent on LPPB to sustain its pipeline of projects. However, LPPB as the state property developer does not undertake development projects on its own. It therefore places reliance on existing property developers in Sabah to do so, and selects them through a tender process. Hence, the dependency on LPPB is mitigated as there is a mutual reliance on each other’s strengths.

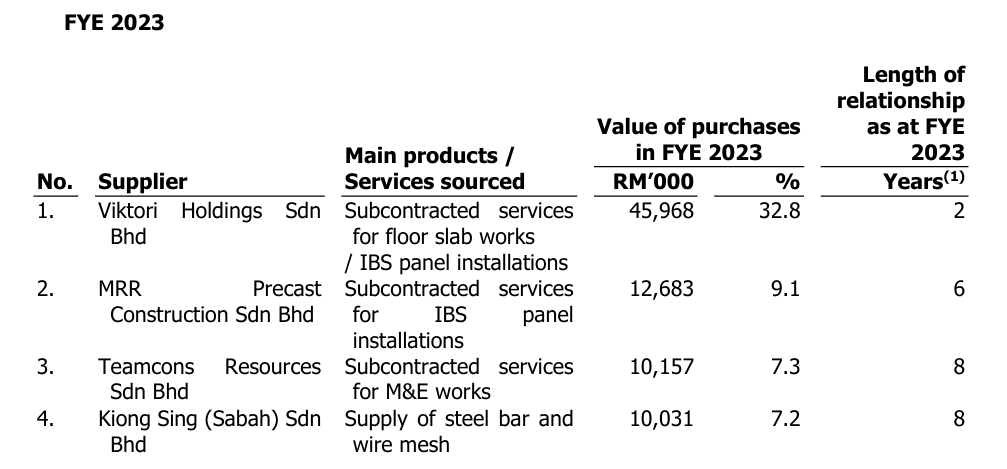

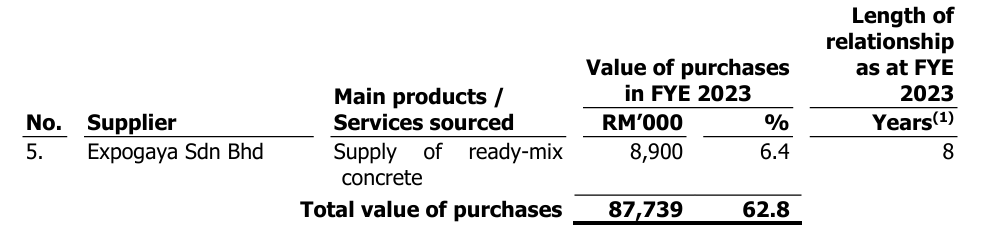

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 62.8% of the purchases. The management mentioned they are not dependent on any of its top 5 major suppliers as they are able to source the same products and services from alternative suppliers locally. Nevertheless, the company is dependent on its suppliers for the purchase of cement due to the limited cement manufacturers available in Sabah.

Industry Overview

According to Smith Zander's research, the property development market is driven by the development of other economic sectors in the country, such as the construction, manufacturing, services, agriculture, mining and quarrying sectors. The property market is broadly categorised into residential, commercial and industrial properties

The performance of the residential property market in Sabah, measured in terms of total value of property transactions, increased from RM1.84 billion in 2018 to RM2.39 billion in 2023, at a CAGR of 5.37%. In terms of total volume of property transactions, the performance of the residential property market in Sabah increased from 4,993 units in 2018 to 5,724 units in 2023, at a CAGR of 2.77%. The performance of the shop market in Sabah, measured in terms of total value of property transactions, increased from RM0.64 billion in 2018 to RM0.85 billion in 2023, at a CAGR of 5.84%. In terms of total volume of property transactions, the performance of the shop market in Sabah increased from 1,026 units in 2018 to 1,315 units in 2023, at a CAGR of 5.09%.

Key Demand Drivers

- Economic growth and rising disposable income signify growth opportunities in the property market in Sabah.

- Increase in investments drives demand for residential properties and shops.

- Government-driven initiatives to drive demand for residential properties, including affordable housing.

Key Market Risks and Challenges

- Adverse economic conditions may negatively impact the demand for properties.

- Unfavorable changes in Government policies may affect property sales.

Source: Smith Zander

Future plans and strategies for KTI LANDMARK BERHAD

The business objectives are to maintain sustainable growth in its business and create long term shareholder value. To achieve its business objectives, the company will implement the following business strategies over the period of 24 months from the date of the Listing:

- The company intends to expand the Group’s property development business through the acquisition of landbank for future projects in Sabah.

- The company intends to further strengthen the market presence as an established property developer in Sabah.

- The company intends to expand the production capability of the casting activities with the addition of a new IBS production line to produce hollow core slabs to supplement the existing range of IBS components manufactured.

- The company intends to upgrade the software and systems to further enhance its operational efficiency.

MQ Trader View

Opportunities

- The company has a well-established history of 40 years and a proven track record as a property developer. The company has a well-established history and track record of 40 years since the commencement of its business operations in 1984. The benefits and advantages that the Group derives from its proven track record include the following:

- The company's reputation in the property market and construction industry over the past 40 years translates into market visibility and brand awareness to attract prospective buyers for the properties that we develop;

- The company’s in-depth experience as a property developer is expected to provide prospective buyers with confidence in its ability to complete and deliver the properties; and

- The company’s track record provides prospective partners with assurance that we are able to successfully complete design and build construction projects and joint venture projects.

- The company manufactures IBS components and adopts IBS construction techniques in its construction activities to optimise the project efficiencies and manage the construction cost. The Group has 25 years of experience in adopting IBS construction techniques in the construction activities. The experience and expertise that stretches across construction activities and IBS components manufacturing enables them to better understand the practical challenges in construction processes and design a more efficient construction methodology, including the appropriate use of IBS components and proper production planning to manage its overall construction cost.

Risk

- The group is dependent on LPPB to sustain its pipeline of projects. Since 2010 and up to LPD, the company has been providing its design and build construction services primarily to LPPB whereby LPPB is the state authority in Sabah involved in overseeing housing and township development, as well as the development of affordable housing in Sabah. Through the provision of such services, LPPB is the land and project owner of the development. This is different from the Group’s property development activities where the company is the land and project owner of the development.

- The company has a high gearing ratio of 1.3 times, indicating a substantial level of debt. This poses a significant risk to the company in the event of any financial difficulties.

Click here to refer the IPO - KIT Landmark Berhad (Part 1)

Eager to explore more trading opportunities?Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)