IPO - KTI Landmark Bhd (Part 1)

MQTrader Jesse

Publish date: Fri, 31 May 2024, 09:24 AM

Company Background

The Company was incorporated in Malaysia under the Companies Act 1965 on 10 March 2016 as a public limited company under the name of KTI Property Berhad and is deemed registered under the Act. Subsequently on 14 July 2022, the Company changed its name to KTI Landmark Berhad.

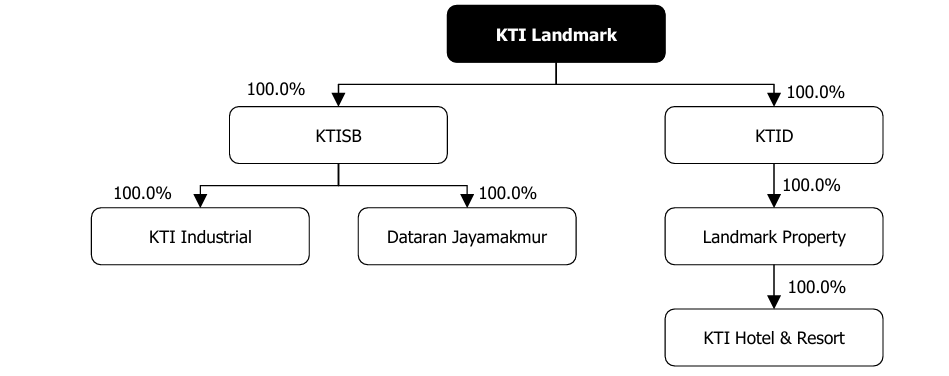

The Company was incorporated to facilitate the Listing and the principal activities is that of an investment holding company. The Group’s structure as at LPD is as follows:

Through its subsidiaries, the company is a property developer, principally involved in the provision of design and build construction services and property development.

Use of proceeds

- Acquisition of land for development - 37.5% (within 12 months)

- Upgrading existing / expansion of the casting yard / IBS facility for the building division - 4.5% (within 24 months)

- Upgrading software and systems - 0.7% (within 6 months)

- Working capital for project development - 43.1% (within 12 months)

- Repayment of bank borrowings - 6.3% (within 6 months)

- Estimated listing expenses - 7.9% (within 1 month)

Acquisition of land for development - 37.5% (within 12 months)

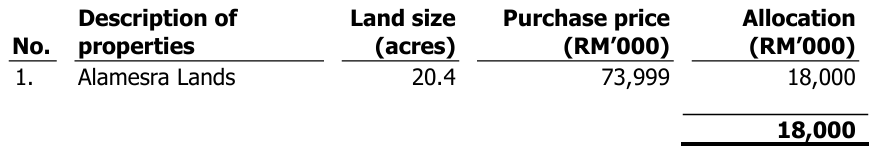

The company has allocated RM18.0 million for the acquisition of a landbank in Sabah within the vicinity of the existing landbank for its development in Alamesra, Kota Kinabalu. The Company has on 9 January 2023, entered into a conditional sale and purchase agreement with Millennium Amber Sdn Bhd (non-related party) for the acquisition of Alamesra Lands, which is earmarked for the Ayuria Place project in Alamesra, Kota Kinabalu as set out in Section 7.3.2.3, for a cash consideration of RM74.0 million. The details of the lands are as follows:

Upgrading existing / expansion of the casting yard / IBS facility for the building division - 4.5% (within 24 months)

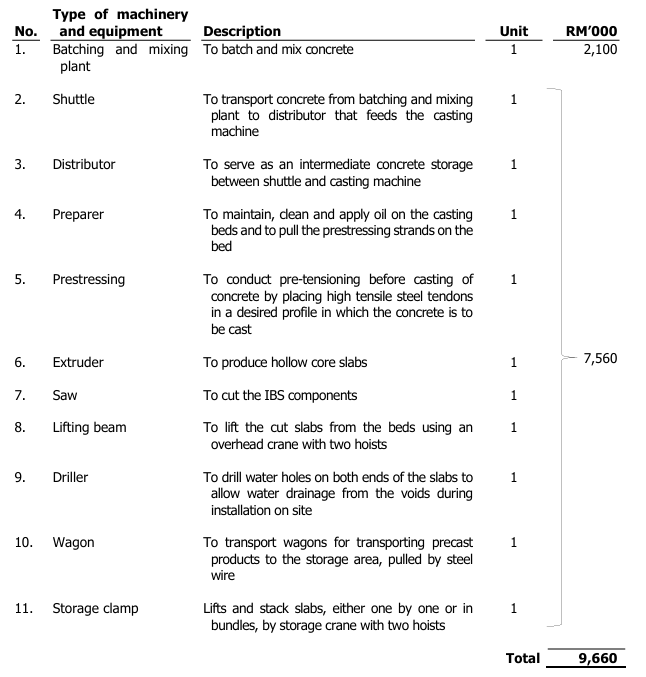

The company has allocated RM2.15 million from the proceeds raised from its Public Issue to purchase the new IBS production line (including a batching and mixing plant to support the operations of the IBS production line) which they plan to install at the Kinarut casting yard. The new IBS production line is estimated to be able to achieve an annual manufacturing capacity of 16,100 m3 in a year (i.e. derived based on the assumption that 24,180 m3 of IBS components are manufactured in Kinarut in 2019 and an approximate 261,000 sq ft of land area was utilised to cater to the manufactured volume. This gives a calculation of 0.0926 m3 of IBS components manufactured per sq ft. As a start, the company intends to utilise an approximately 174,000 sq ft of the casting yard in Kinarut for the new IBS production line. Based on the calculation of 0.0926 m3 of IBS component manufactured per sq ft, the company will be able to achieve an estimated annual manufacturing capacity of 16,100 m3).

The breakdown of the estimated purchase cost for each type of machinery and equipment for the new IBS production line (including a new batching and mixing plant), all of which will be acquired from local suppliers, are as follows:

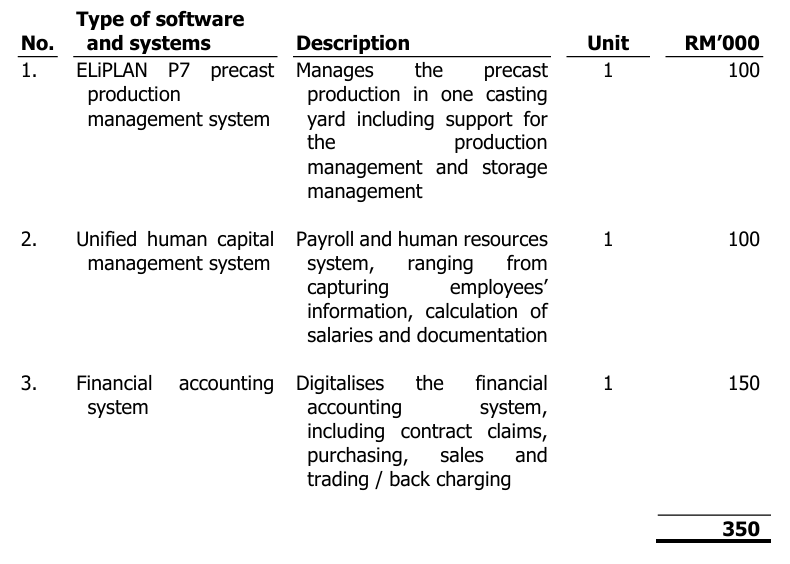

Upgrading software and systems - 0.7% (within 6 months)

The company has allocated RM0.4 million of the proceeds raised from its Public Issue to upgrade the software and systems. The company intends to upgrade to an integrated resource planning system to facilitate its business expansion. The integrated resource planning system will enable the company to streamline the processes, eliminate redundant processes through automation, centralise the data and improve planning and reporting works. The company has taken into consideration the scope of works for its on-going projects as well as the order books and tender books in determining the following software and systems to be purchased.

The details of the software and systems, all of which will be purchased from local supplier(s), are as follows:

Working capital for project development - 43.1% (within 12 months)

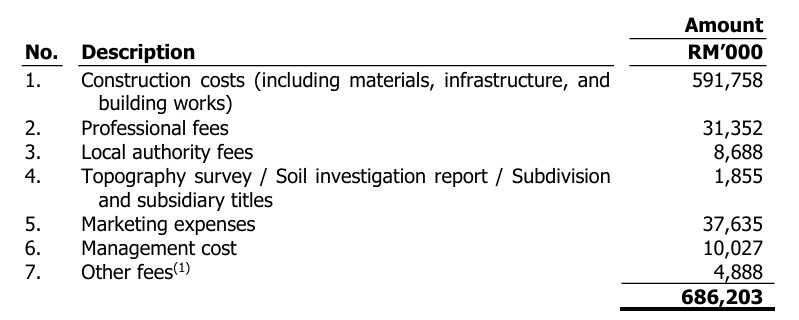

A total of RM20.7 million of the proceeds raised from the Public Issue will be used to supplement the general working capital requirements for The Logg’s project, which include construction costs (building and infrastructure cost), consultants’ and professional fees, and local authority fees for the on-going projects. The Logg’s project commenced in July 2019 and has an estimated GDC (excluding land cost) of RM686.2 million, as detailed below. The proposed allocations of the proceeds are for the following components of GDC:

Repayment of bank borrowings - 6.3% (within 6 months)

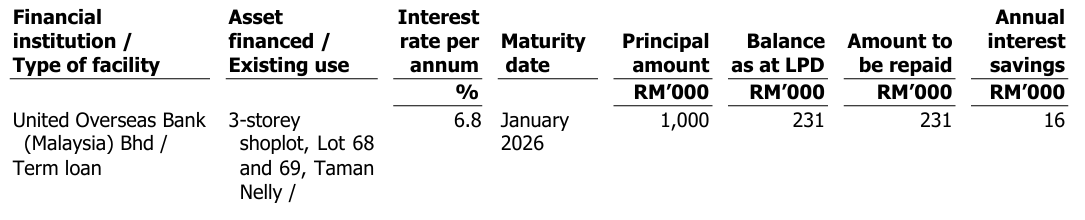

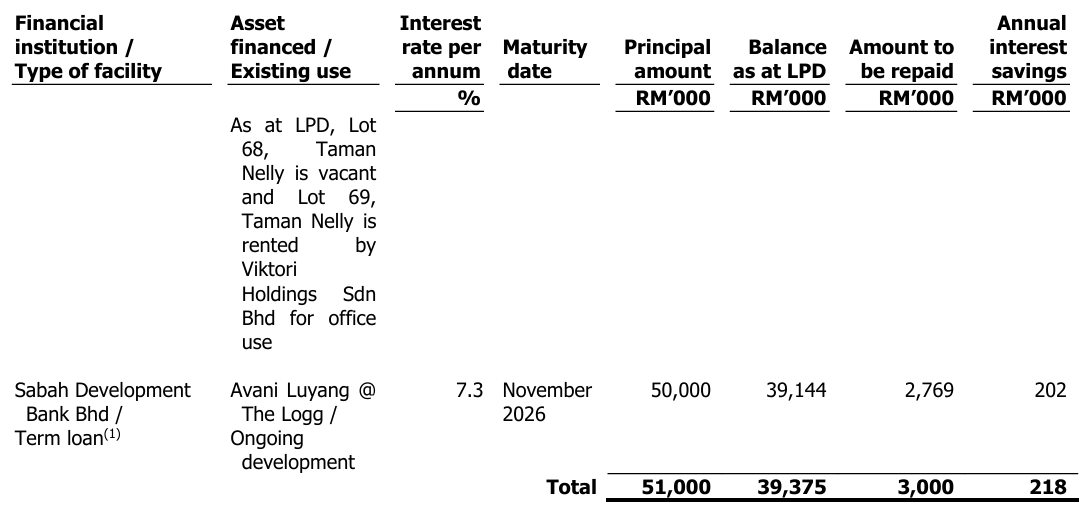

An amount of RM3.0 million is allocated to fully settle the existing term loan financing for the following assets. For illustrative purposes, the details of the borrowings in relation to these assets as at LPD are set out as follows, among which they have indicated which facilities that the RM3.0 million repayment will be made to:

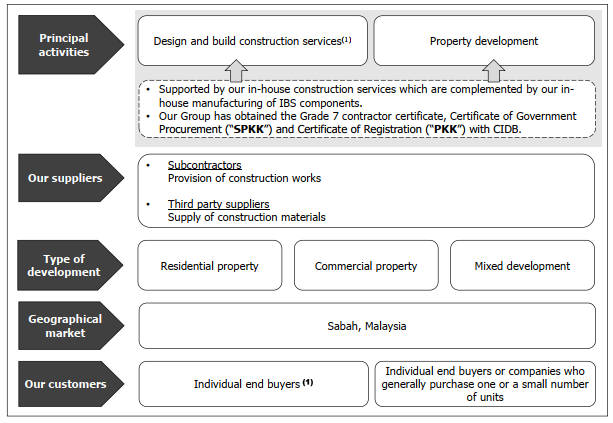

Business model

The business model can be summarised as follows:

The company is a property developer, principally involved in the provision of design and build construction services and property development. The Group is involved in all aspects of property development activities comprising site selection, project design, submission of building plans to relevant authorities, sales and marketing of its projects and delivery of vacant possession to end buyers as well as in construction activities.

The design and build construction services and property development activities are supported by its in-house construction services, which is complemented by our in-house manufacturing of IBS components. The company utilise the IBS construction technique for most of the design and build construction projects and property development projects.

Click here to continue the IPO - KTI Landmark Bhd (Part 2)

Eager to explore more trading opportunities?Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)