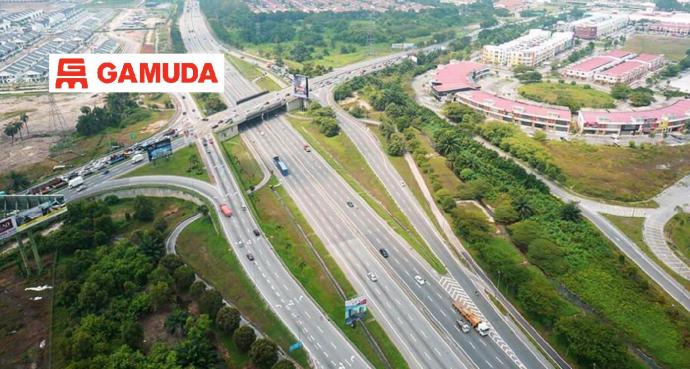

【行家论股/视频】金务大 脱售大道料进账23亿

Tan KW

Publish date: Tue, 05 Apr 2022, 10:37 PM

https://youtu.be/fOHWzHAnGG4

分析:联昌国际投资研究

目标价:4.25令吉

最新进展

金务大(GAMUDA,5398,主板建筑股)接获人民大道信托公司(ALR)收购大道资产献议。ALR对4条大道开出的总收购价为55亿令吉。

行家建议

金务大在政府最新的大道收购献议中,可获23亿令吉脱售金,与之前得出的23.5亿令吉稍低。

同时,这笔金额相当于金务大每股91仙,或市值的26%左右,料可大幅改善截至1月底的净负债18%,并转为净现金6.11亿令吉;净脱售收益料约10亿令吉。

代价是金务大需要放弃大道资产未来贡献,即经常净收入的20%到25%,约每年1.7亿令吉。

不过,这可进一步强化金务大实力,并有充足余力重新部署资金,发展捷运3(MRT3)项目110亿令吉隧道部分工程,或造价50亿令吉槟城南岛项目等。

另外,不排除有特别股息的可能。假设23亿令吉脱售金中的10%到30%用来派息,将可派发高达每股18仙到27仙的特别股息,等同介于5.2%到7.9%周息率。

我们相信献议很可能被接受,毕竟可结束耗时已久的大道脱售计划,且信托管理模式长期对金务大、政府和路面使用者是双赢局面。

我们维持目标价4.25令吉,和“增持”评级。

https://www.enanyang.my/行家论股/【行家论股视频】金务大-脱售大道料进账23亿

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-10

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-09

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-08

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-07

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-06

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-03

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-02

GAMUDA2025-01-01

GAMUDA2025-01-01

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA2024-12-31

GAMUDA