IPO - ES Sunlogy Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 04 Feb 2025, 05:11 PM

Tentative Date(s):

- Opening of application - 27 January 2025

- Closing of application - 05 February 2025

- Balloting of applications - 10 February 2025

- Allotment of IPO shares to successful applicants - 18 February 2025

- Tentative listing date - 20 February 2025

Company Background

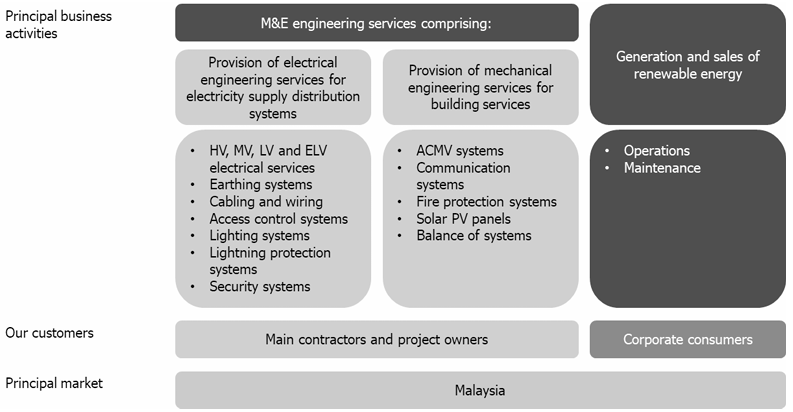

The company was incorporated in Malaysia under the Act on 23 November 2023 as a public limited company under the name of ES Sunlogy Berhad. The company provides M&E engineering services for various types of properties such as industrial, commercial, and residential as well as solar facilities. The company is principally involved in the following:

- provision of electrical engineering services for electricity supply distribution systems;

- provision of mechanical engineering services for building services; and

- generation and sales of renewable energy.

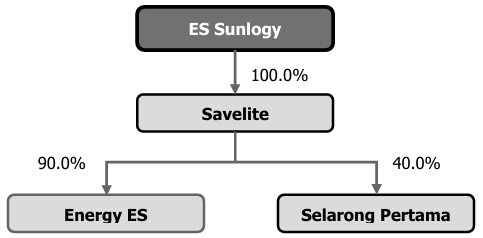

The company Group structure as at LPD is as follows:

Use of proceeds

- Development and construction of Selarong LSSPV Plant - 33.60% (within 12 months)

- Repayment of borrowings - 33.30% (within 6 months)

- General working capital - 21.90% (within 24 months)

- Purchase of ERP system - 1.70% (within 24 months)

- Estimated listing expenses - 9.50% (within 1 month)

Development and construction of Selarong LSSPV Plant - 33.60% (within 12 months)

The company intends to expand the generation and sales of renewable energy business segment, by developing Selarong LSSPV Plant. The company has allocated RM14.10 million or 33.6% of its proceeds from the Public Issue to part finance the development and construction of the Selarong LSSPV Plant with a built-up area of approximately 5,880,600 sq ft, on the Selarong Land.

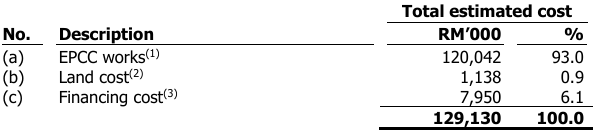

The capital expenditures and operating expenditures for the development, construction, and operation of the Selarong LSSPV Plant are as follows:

- Capital expenditures

The capital expenditures to be incurred for the development and construction of the Selarong LSSPV Plant shall be funded via the following:

The development and construction cost of the Selarong LSSPV Plant was estimated based on quotations received. In the event there is any excess available from the above development and construction cost, such excess proceeds will be allocated for the company’s general working capital requirements. Conversely, if the allocated proceeds are insufficient for the development and construction cost, such shortfall will be funded via internally generated funds. The company has allocated 12 months from its Listing to utilize the allocated proceeds. In the event that the company is unable to complete the development and construction of the Selarong LSSPV Plant within the specified timeline, the company may consider extending the timeframe or reallocate the proceeds for other purposes, and in such an event, the company will seek shareholders’ approval, if required under the Listing Requirements, for such variation.

- Operating expenditures (per annum basis)

Following the commencement of operations of Selarong LSSPV Plant, the company expects to incur the following operating expenditure annually, which will be funded via the company Group’s internally generated funds (contributions will be based on the respective shareholdings of shareholders, with the company Group contributing 40.0%):

Repayment of borrowings - 33.30% (within 6 months)

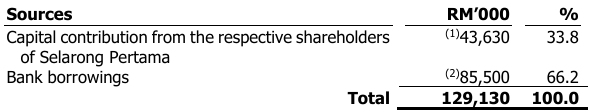

The company intends to allocate RM14.00 million or 33.3% from the Public Issue proceeds to partially repay its borrowings, details of which are as follows:

The selection of the type of financing facilities to be repaid via utilization of IPO proceeds was determined after taking into account the following factors:

- interest cost of such financing facilities; and

- outstanding loan amount.

As at LPD, the company’s outstanding total borrowings stood at RM97.51 million. The proposed repayment of borrowings above will reduce the company’s overall gearing level from 1.36 times as at 31 July 2024 to a pro forma gearing level of 0.67 times after the IPO and utilization of proceeds. This will result in an expected total interest savings of approximately RM0.74 million based on the interest rate of 5.13% to 5.47% per annum as tabulated above. However, the actual interest savings may vary depending on the applicable interest rates. In addition, the company Group will not incur any early settlement fees and/ or penalties for the early repayment of the above bank borrowings.

In the event that there is any excess available from the above repayment of borrowings, such excess proceeds will be allocated for the company's general working capital requirements.

General working capital - 21.90% (within 24 months)

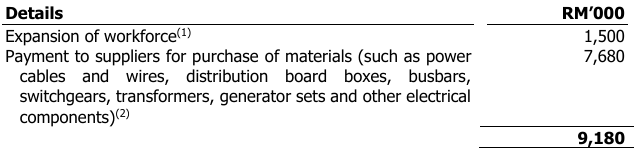

A total of RM9.18 million or 21.9% of the Public Issue proceeds will be used to finance the company's general working capital requirements in tandem with the expected growth in the company’s business and operations. The following is a breakdown of the utilization of proceeds for the company’s working capital requirements:

The allocation of proceeds for the company’s general working capital requirements will reduce its dependency on external financing and allow the company to undertake more projects for M&E engineering services concurrently.

Purchase of ERP system - 1.70% (within 24 months)

The company intends to utilize approximately RM0.72 million or 1.7% of the Public Issue proceeds to purchase an ERP system known as “Speedbrick”, a cloud-based construction cost management software, which is able to integrate with the company’s existing AutoCount accounting system and purchasing system. The integrated ERP system namely, Speedbrick will support the company Group in the following:

- Streamlining the company Group’s business operations - integrates the company Group’s purchasing process on a single platform, automatically linking project site and office team activities. It automates manual tasks, reduces tedious work, removes manual entries, and ensures smooth integrated operations with real-time data synchronization.

- Empowering data-driven decision-making - delivers the right data to the right people at the right time, enabling the company Group to make informed, data-driven decisions. This capability improves resource allocation, financial management and enhances the company Group's ability to deliver projects on time and within budget.

- Enhancing business analytics - offers advanced business analytics capabilities, where it automatically builds the company Group's costing database, tracks material price trends, predicts future purchases, generates up-to-date real-time project-level costs and profit forecast, and generates valuable insights for improved and confident decision-making. These features aid in identifying trends, forecasting needs, and improving overall business performance.

By integrating with Speedbrick, the company Group aims to enhance its operational efficiency, make better-informed decisions, leverage advanced analytics, and improve financial management for its continuous business growth.

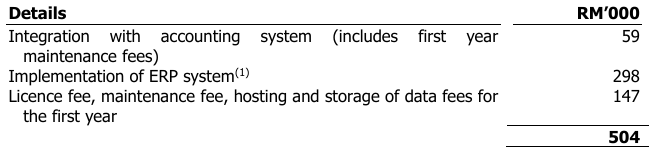

The ERP system cost was estimated based on quotations received. Such an amount is expected to be utilized over a period of 24 months. Out of the RM0.72 million allocated, RM0.50 million will be utilized for the acquisition of the ERP and the first-year implementation cost, the breakdown of which is as follows:

The remaining RM0.22 million will be utilized for the licenses, services, and maintenance costs for the following year.

If the actual cost of purchasing the ERP system exceeds the amount allocated, the deficit will be funded from the company’s internally generated funds and/ or bank borrowings. Conversely, if there is excess available from the purchase of the abovementioned ERP system, such excess will be reallocated for the company’s general working capital.

Business Model

The company Group’s business model is as follows:

Click here to continue the IPO - ES Sunlogy Berhad (Part 2)

Looking for flat 0.05% brokerage?

Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)