Thong Guan - Unwrapping An Undervalued Gem

kiasutrader

Publish date: Tue, 02 Sep 2014, 11:09 AM

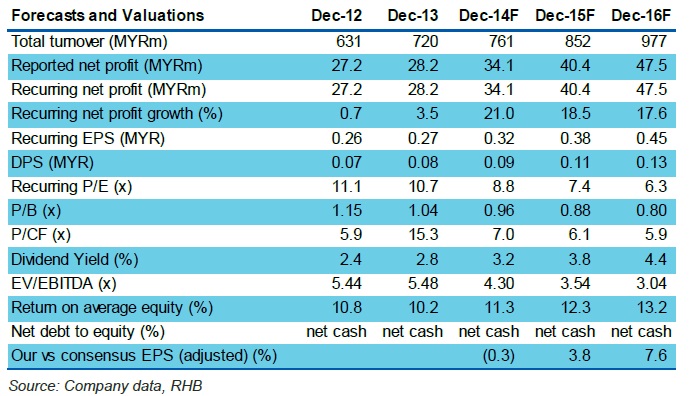

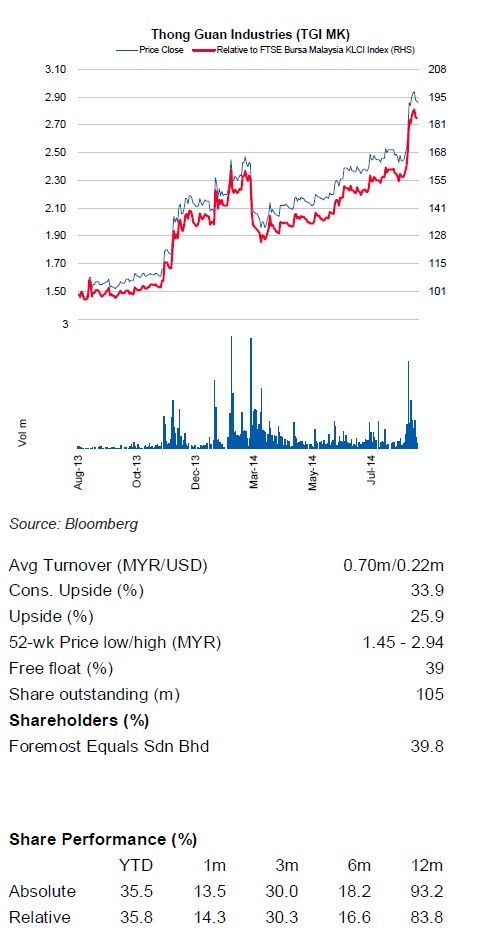

We initiate coverage on TGI with a MYR3.60 FV which represents a 25% upside return and recommend BUY. Its expansion into high-end plastic packaging and the PVC food wrap business is expected to derive a 3-year earnings CAGR of 19% in 2013-2016F. Our MYR3.60 FV is based on 11x FY15F P/E, ie broadly in line with target valuations of its peers. Currently TGI trades at an undemanding 7.4x FY15F P/E valuation relative to prospective earnings growth.

Capitalising on rising global demand for stretch film and plastic packaging materials. In recent quarters, plastic packaging manufacturers have delivered strong performances as evident in their latest financial results. This is on rising demand from the exports market amid the recovery seen in the global economy since 2H13. To cater for this increasing demand – together with its target of becoming a major player in the polyvinyl chloride (PVC) food wrap industry – Thong Guan Industries (TGI) plans to invest MYR100m in capex to gear up.

High-end films and PVC food wrap to drive margins expansion. With a new thin stretch film production line – and its first nano-layered line – coming in gradually, we expect to see margins expansion in this typically low-margin division. The PVC food wrap business, which yields the highest margins, is expected to see a 3-year production output CAGR of 38.7% for 2013-2016F.

Leveraging on its exposure to the Japanese market. TGI has been producing garbage bags for the Japanese market since the 1980s and Japan remains one of its major markets till today. This is due to the group’s consistent quality and product delivery. TGI is now eyeing further expansion in Japan in other areas of business, namely in food wrap, given the huge Japanese food and beverage (F&B) industry.

Initiate BUY with a MYR3.60 FV. Driven by the expansion of TGI’s high-end plastic packaging materials and PVC food wrap divisions, we are upbeat on TGI’s growth prospects moving forward and forecast a 3-year earnings CAGR of 19% (2013-2016F). Our FV is derived from pegging its fully-diluted FY15 EPS to a 11x P/E multiple, broadly in line with average peer target valuations of 12x. TGI is currently trading at an undemanding FY15 P/E of 7.4x.

Source: RHB

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on RHB Research

Created by kiasutrader | Jun 14, 2016

Created by kiasutrader | May 05, 2016

.png)