WTI Crude Futures: Further Below the 200-Day SMA

rhboskres

Publish date: Tue, 01 Oct 2019, 08:43 AM

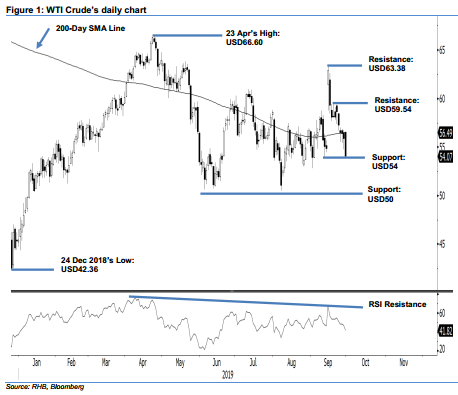

Maintain short positions as the retracement is still not showing signs of ending. The WTI Crude performed weakly in the latest trade. At one point, it tested the immediate support of USD54 with an intraday low of USD53.98, before closing at USD54.07 – a decline of USD1.84. The weak closing also placed the commodity further below the 200-day SMA line. Recap that the black gold has been struggling to overcome the said SMA in recent months. In the absence of a price reversal signal, we are keeping our negative trading bias.

On the observation that the bears still have good control over the price trend, traders are advised to stay in short positions. We initiated these at USD56.49, the closing level of 25 Sep. For risk-management purposes, a stop loss can now be placed at the breakeven level.

We are keeping the immediate support target at USD54, the low of 12 Sep. This is followed by USD50, a round figure. On the other hand, immediate resistance is now expected at USD59.54, the high of 19 Sep. This is followed by USD63.38, the high of 16 Sep.

Source: RHB Securities Research - 1 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024