Hang Seng Index Futures: Outlook Stays Negative

rhboskres

Publish date: Thu, 03 Oct 2019, 09:11 AM

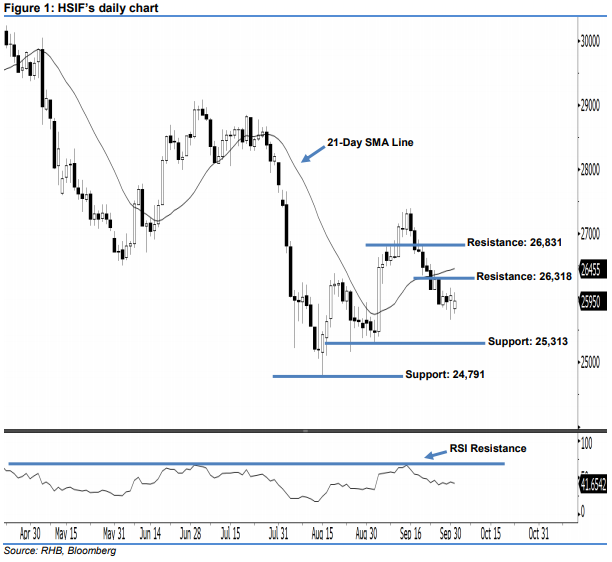

Maintain short positions, with a stop-loss set above the 26,831-pt level. The HSIF formed another positive candle yesterday. It closed at 25,950 pts, off its high of 26,087 pts and low of 25,750 pts. Still, we believe the downside move is not over yet, as the index continues to hover below the 21-day SMA line. Yesterday’s positive candle was the result of bargain-hunting activities after the recent losses, in our view. Technically, the 14-day RSI indicator deteriorated to a weaker reading at 41.65 pts, this has enhanced the bearish sentiment. Overall, the market trend remains bearish.

Based on the daily chart, the immediate resistance level is seen at 26,318 pts, defined from 25 Sep’s high. If the price breaks above this level, look to 26,831 pts – which was the high of 19 Sep’s black candle – as the next resistance. Towards the downside, we maintain the near-term support level at 25,313 pts, ie 3 Sep’s low. This is followed by 24,791 pts, obtained from the previous low of 15 Aug.

Thus, we advise traders to stay short, following our recommendation of initiating short below the 26,318-pt level on 2 Oct. Meanwhile, a stop-loss is preferably set above the 26,831-pt mark in order to limit the risk per trade.

Source: RHB Securities Research - 3 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024