Hang Seng Index Futures - Moving Higher

rhboskres

Publish date: Thu, 17 Oct 2019, 04:37 PM

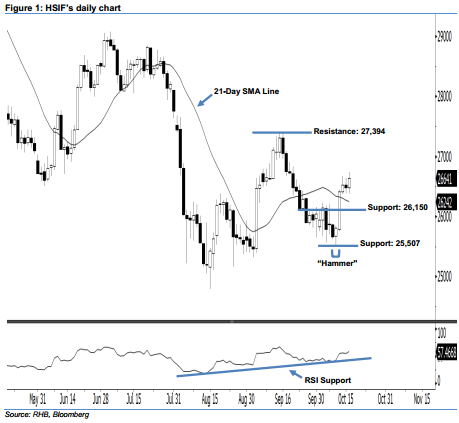

Positive sentiment remains unchanged; stay long. The upward movement of the HSIF continued as expected, as a white candle was formed yesterday. It rose to a high of 26,739 pts during the intraday session, before ending at 26,641 pts for the day. On a technical basis, the market sentiment remains bullish, as the index has recouped the previous day’s losses and hit nearly a one-month high. This may also further extend the rebound that started with 10 Oct’s “Hammer” pattern. Overall, we remain upbeat on the HSIF’s outlook.

According to the daily chart, the immediate support level is seen at 26,150 pts, ie near the midpoint of 11 Oct’s long white candle. If this level is taken out, look to 25,507 pts – which was the low of 10 Oct’s “Hammer” pattern – as the next support. To the upside, we maintain the immediate resistance level at the 27,000-pt psychological mark. The next resistance will likely be at 27,394 pts, ie the high of 16 Sep.

Therefore, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,150-pt level on 16 Oct. In the meantime, a stop-loss can be set below the 25,507-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 17 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024