Hang Seng Index Futures - the Buying Momentum Resumes

rhboskres

Publish date: Tue, 29 Oct 2019, 09:03 AM

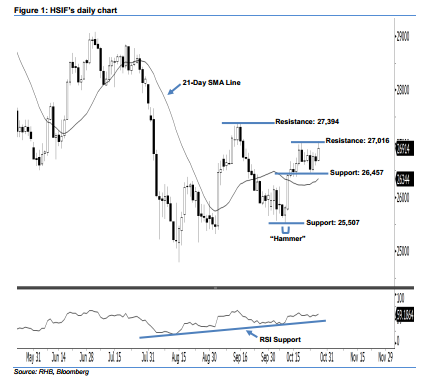

Rebound is likely to persist; stay long. The upward momentum of the HSIF continued as expected, as a white candle was formed yesterday. It closed at 26,914 pts, off its high of 27,041 pts and low of 26,671 pts. We believe the buying momentum is still present, as the index has recouped the previous session’s losses and hit its 1-week high. As the 21-day SMA line is now likely to turn upwards, it would appear that the bullish sentiment has been enhanced. Overall, we expect the market to rise further if the immediate 27,016-pt resistance – mentioned previously – is taken out decisively in the coming sessions.

Judging from the current outlook, we are eyeing the immediate support level at 26,457 pts, which was determined from the low of 23 Oct. If a decisive breakdown arises, look to 25,507 pts – ie the low of 10 Oct’s “Hammer” pattern – as the next support. On the other hand, the immediate resistance level is seen at 27,016 pts, which was 18 Oct’s high. The next resistance is maintained at 27,394 pts, or situated at the high of 16 Sep.

Hence, we advise traders to stay long, following our recommendation of initiating long above the 26,150-pt level on 16 Oct. For now, a new trailing-stop can be set below the 26,457-pt threshold to limit the downside risk.

Source: RHB Securities Research - 29 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024